Key points:

- Bitcoin profit-taking is in full swing, but analysts suggest this could sustain the bull market.

- Coins are spending less time in wallets, indicating healthy market activity, not just short-term speculation.

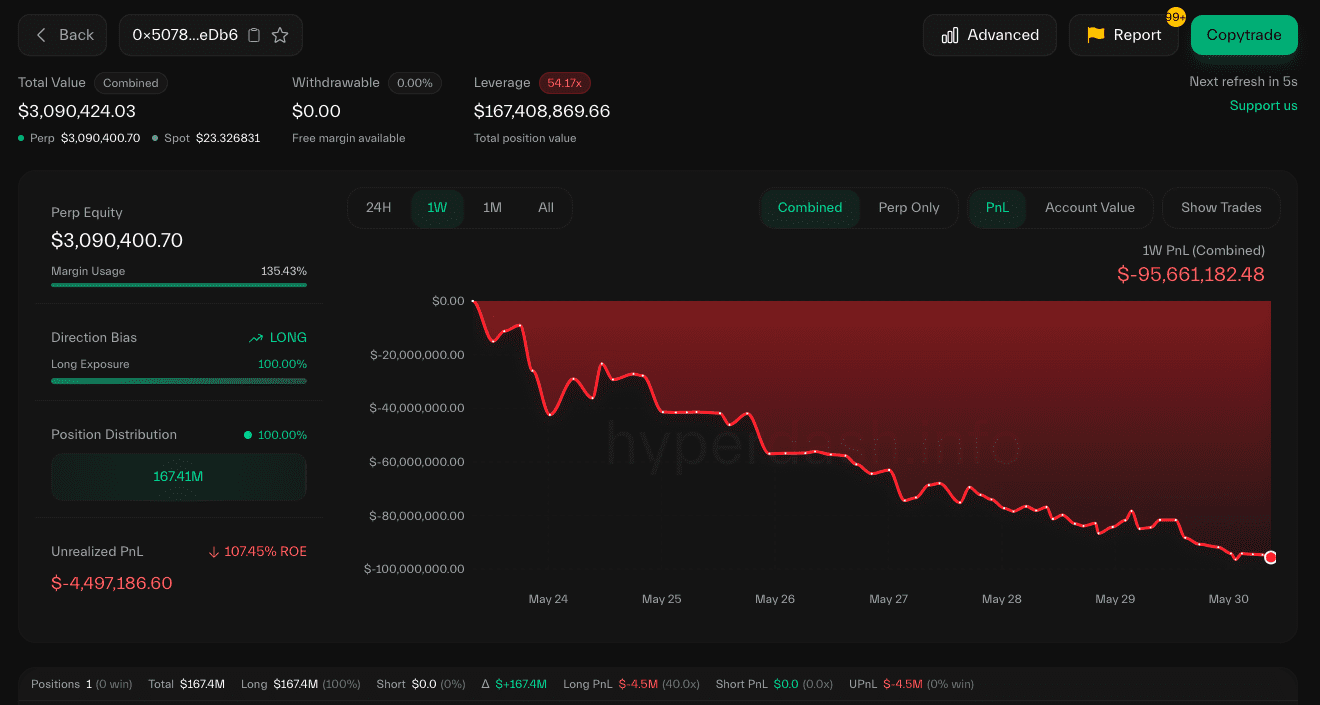

- Hyperliquid’s James Wynn faced a significant $99 million liquidation.

Bitcoin (BTC) is poised for further gains despite investors cashing in on their holdings, according to recent analysis.

Santiment’s Biweekly Report on May 29 maintains a bullish outlook, even as BTC/USD experienced a 10% dip.

Bitcoin Profit-Taking Could Fuel the Rally

Santiment argues that profit-taking isn’t necessarily a sign of the bull market’s end.

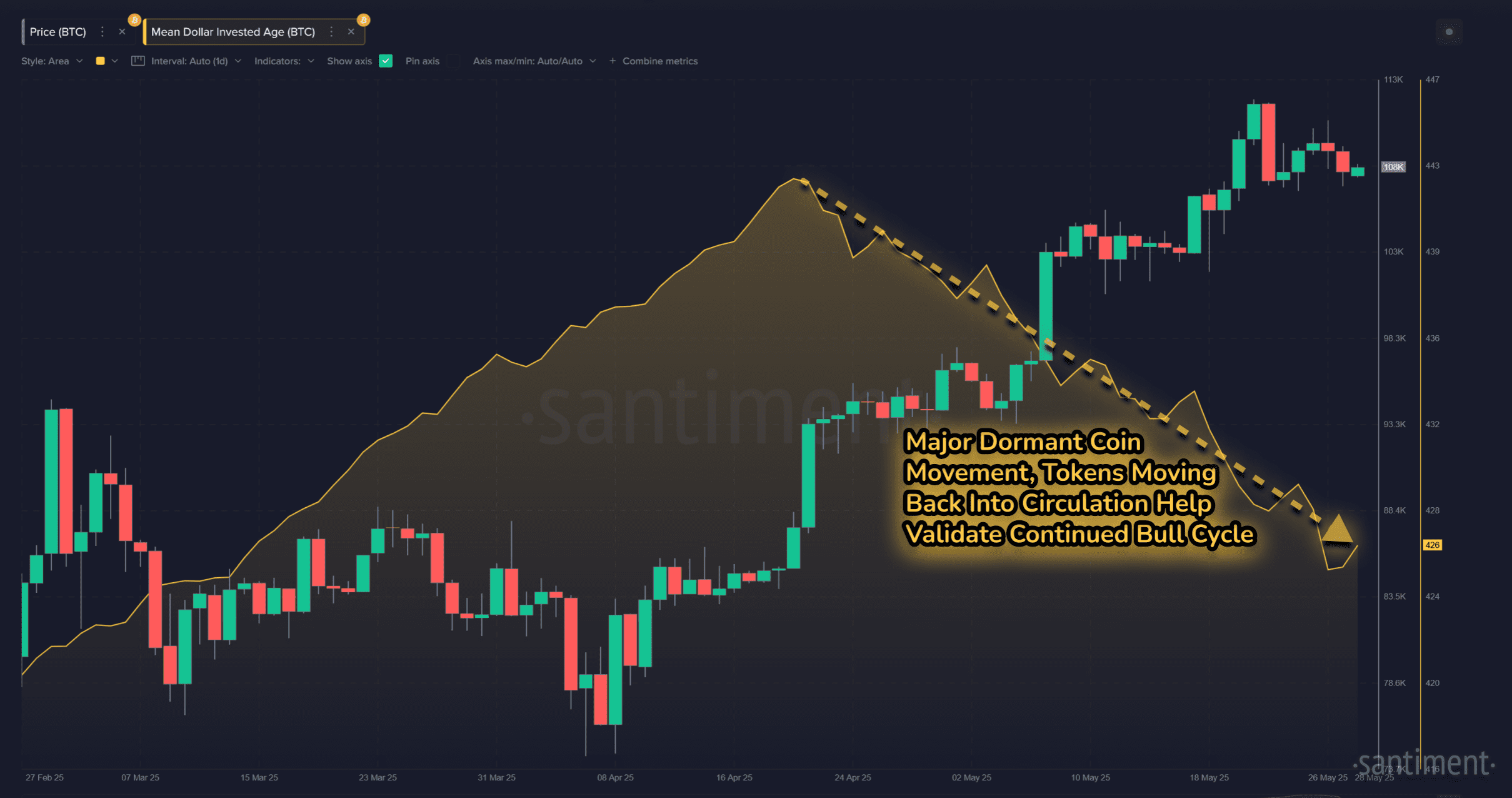

Analyzing the Mean Dollar-Invested Age (MDIA) – the duration coins remain unmoved in wallets – reveals increased activity since mid-April.

“During most bull cycles, a falling MDIA (meaning average holding wallets are getting younger) is a strong indicator that bullish momentum will continue,” the report states.

“More technically, a falling line indicates that old coins are being brought back into circulation, allowing utility to rise and an asset’s network to grow and flourish. Since mid-April, Bitcoin’s MDIA has been dropping steadily.”

The average holding time has decreased modestly over the past six weeks, from 443 days to 426.

While this suggests owners are securing profits, Santiment believes such behavior is “necessary to help keep a rally alive.”

“This adds weight to the argument that the market is in an active phase, and not just being driven by short-term speculation,” they added.

Whale Liquidation: A $100 Million Lesson

BTC price consolidated below $105,000 after the May 29 daily close, a 10% correction from recent all-time highs.

Despite this, sentiment remains largely bullish, with many anticipating a “healthy” support retest before the uptrend continues.

Bitcoin – imagine being bearish on this bullish retest

— Mags (@thescalpingpro) May 30, 2025

Observations also show significant BTC outflows from exchanges, including a 7,000 BTC transaction on May 30, attributed to a single whale entity.

Santiment highlighted Hyperliquid’s James Wynn, whose long BTC position was liquidated for $99 million as the price dipped below $105,000.

“When major longs get liquidated, prices typically move down sharply because the major capital is no longer propping up price,” they warned before the event.