Key points:

- Bitcoin profit-taking is in full swing, but this can end up sustaining the bull market, Santiment research argued.

- Coins are spending increasingly less time in wallets, but the market is not suffering from “short-term speculation.”

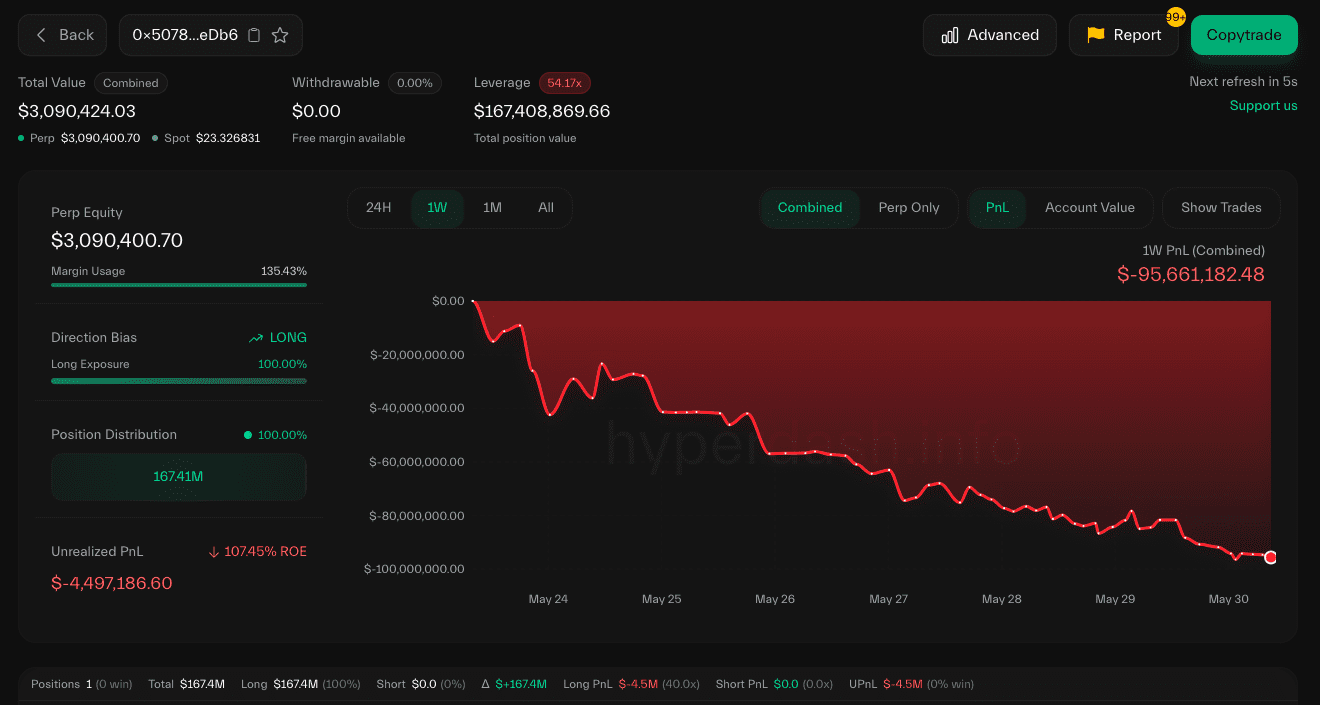

- One whale unable to take profits was Hyperliquid’s James Wynn, liquidated for $99 million.

Bitcoin (BTC) should enjoy continued upside despite hodlers taking profits on their holdings, new research said.

In its latest Biweekly Report on May 29, research firm Santiment stayed bullish on the market outlook as BTC/USD dropped 10%.

Bitcoin profit-taking can “help keep rally alive”

Bitcoin profit-taking need not be a sign that the bull market is nearing its end, Santiment said.

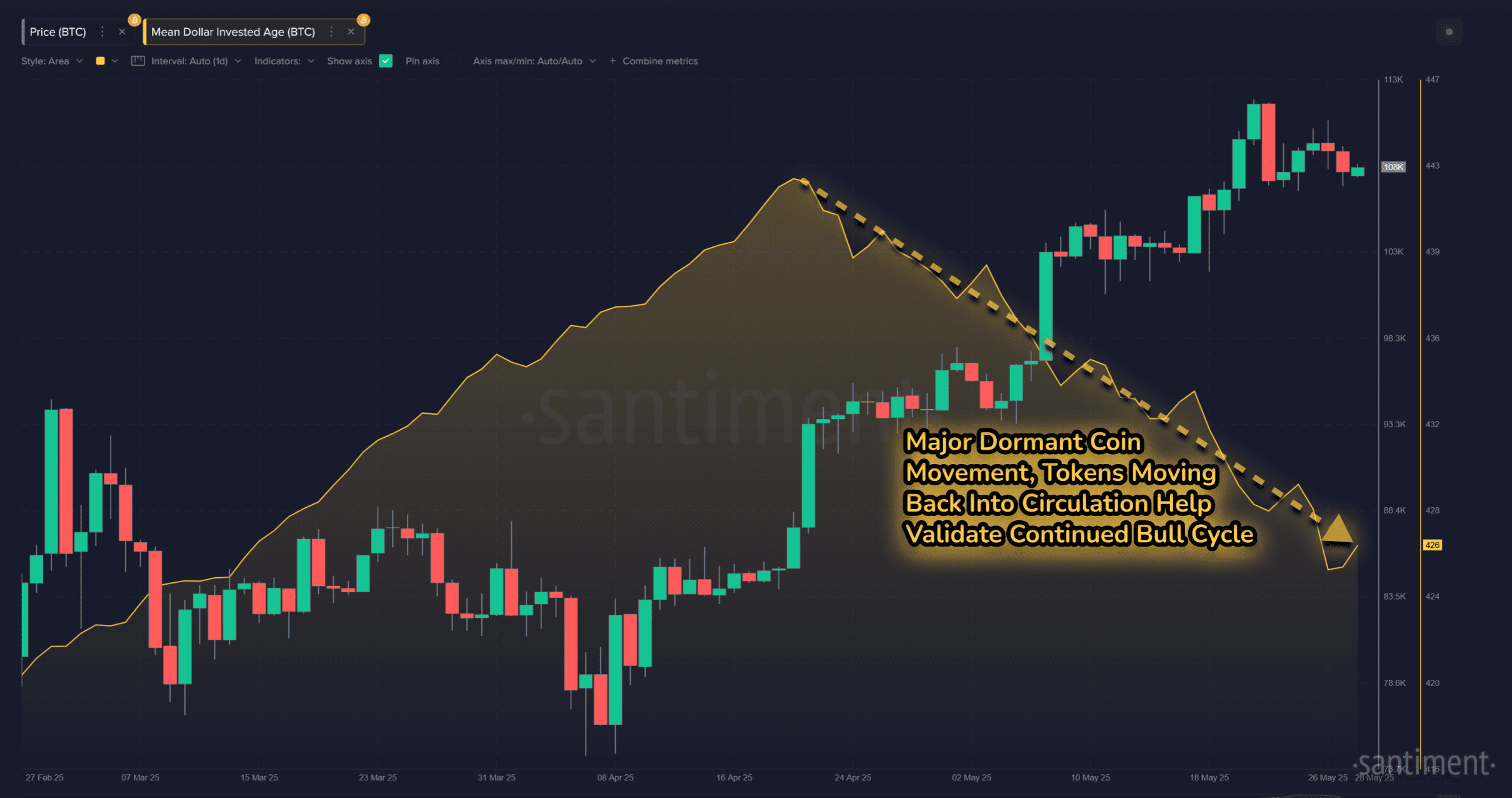

Analyzing the Mean Dollar-Invested Age (MDIA) metric — length of time coins spend in wallets without moving — it revealed that the supply has begun to activate since mid-April.

“During most bull cycles, a falling MDIA (meaning average holding wallets are getting younger) is a great validator that bullish momentum will continue,” it explained.

“More technically, a falling line indicates that old coins are being brought back into circulation, allowing utility to rise and an asset’s network to grow and flourish. Since mid-April, when tensions began to ease over the initial tariff announcements, Bitcoin’s MDIA has been dropping steadily.”

The average time coins are held in a wallet has decreased modestly over the past six weeks, to 426 days from 443.

While this signals that their owners seek to lock in profits, Santiment argued that such behavior is “necessary to help keep a rally alive.”

“This adds weight to the argument that the market is in an active phase, and not just being driven by short-term speculation,” it added.

Hyperliquid whale pays a high price at $105,000

BTC price consolidation saw a return below $105,000 after the May 29 daily close, marking a 10% correction versus its latest all-time highs.

Despite this, sentiment remains conspicuously bullish, with consensus seeing a “healthy” support retest before upside continuation.

“When major longs get liquidated, prices typically move down sharply because the major capital is no longer propping up price,” it warned prior to the event.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.