Key points:

-

Bitcoin is trading back below its recent all-time highs, testing support at levels it first encountered in late 2024.

-

A “deeper pullback” may occur before bulls find the momentum to return to price discovery.

-

Profit-taking is a significant factor behind the current resistance.

Bitcoin (BTC) risks a “deeper correction” as the next phase of its bull market faces a temporary setback.

Bitcoin profit-taking causes bull run hiatus

Analysis warns of sub-$100,000 prices as BTC/USD drops 8%.

Bitcoin returned below its old all-time highs on May 31 as the latest correction nears $9,000 below its latest record peak.

After bulls encountered resistance from multiple sources, onchain indicators soon began to forecast a slowdown in bullish momentum.

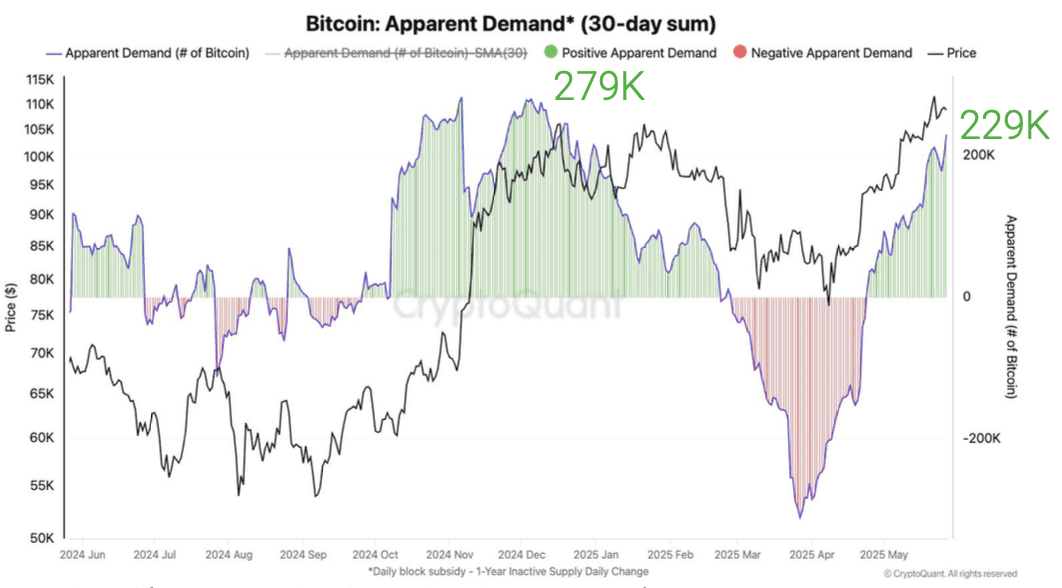

In its latest research report, onchain analytics platform CryptoQuant noted that “some of Bitcoin’s demand metrics may be reaching a short-term top, which could imply a pause in the current rally.”

“CryptoQuant’s estimate of Bitcoin’s demand growth in the last 30 days is at 229K, which is near the previous demand growth top of 279K Bitcoin reached in December 2024,” its authors wrote.

“Additionally, whale-held Bitcoin balances have increased by 2.8% over the past month, a pace that often precedes a slowdown in whale accumulation.”

CryptoQuant added that unrealized profits were, on average, over 30% at $111,000, likewise hinting at an imminent pause.

BTC price “deeper pullback” expected

Market participants, while remaining bullish on a return to price discovery, anticipate lower levels first.

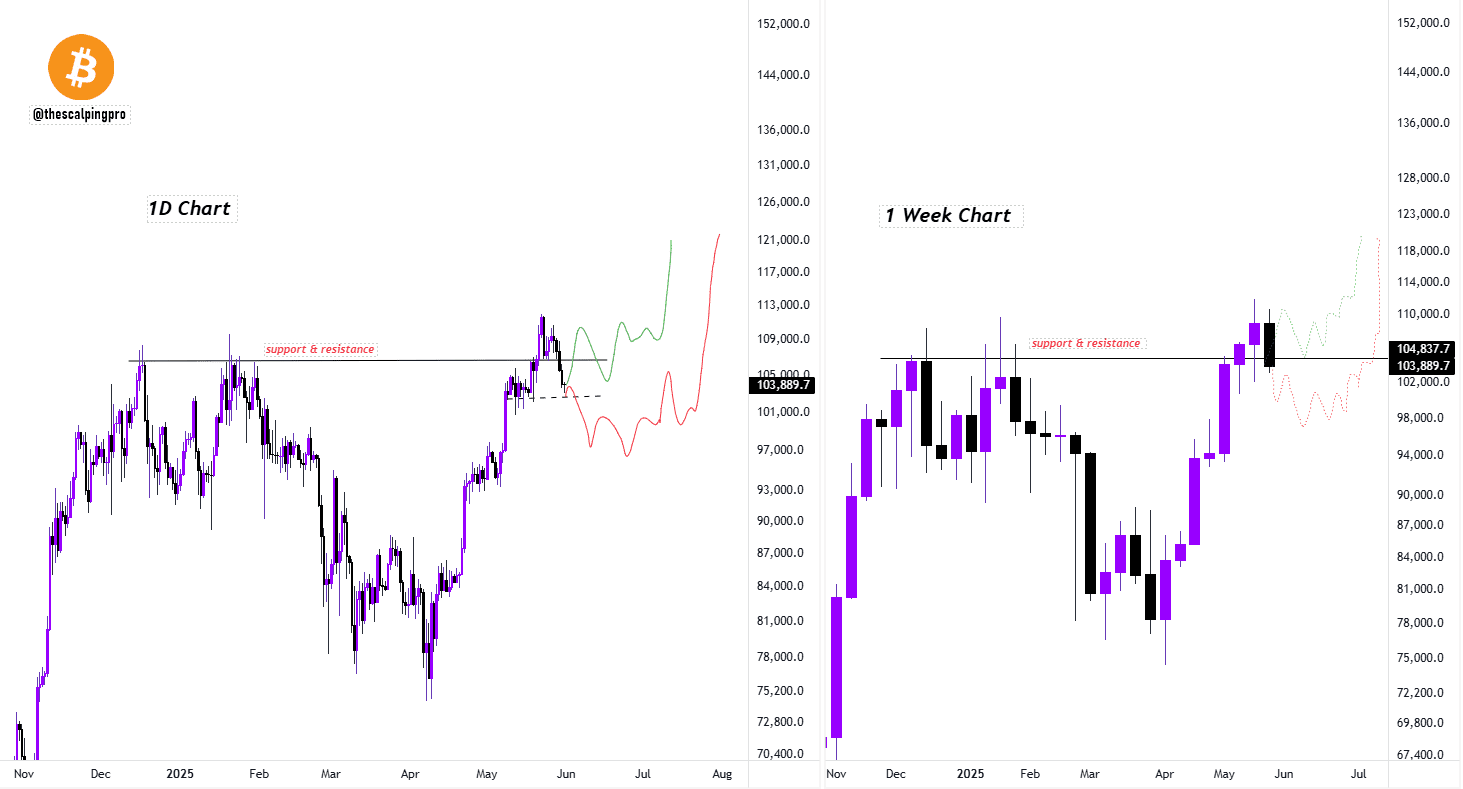

“On the daily chart, BTC has broken below the previous all-time high and is facing rejection at that same level,” trader Mags wrote in his latest X analysis.

“This might look like the start of a deeper correction.”

Mags focused on the upcoming weekly candle close as a key test of bulls’ strength, with the price still able to retake the old record close at $104,450 from December 2024 on weekly timeframes.

“If BTC closes below the horizontal support and resistance line on the weekly, we could see a deeper pullback possibly forming an inverse Head and Shoulders before the next leg up,” he concluded.

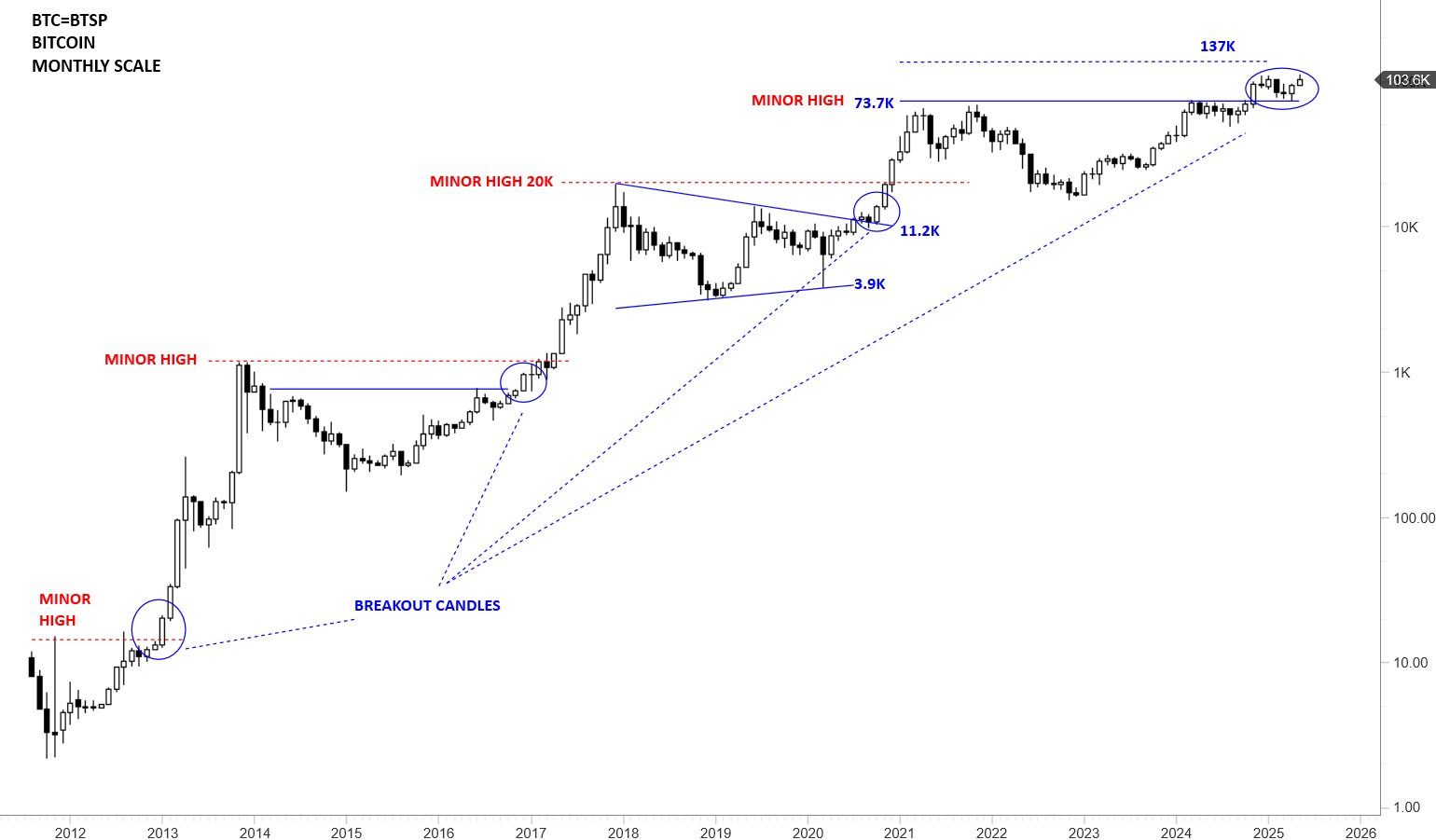

Trader and analyst Aksel Kibar agreed that the bull market comeback “might be delayed.”

“Bullish interpretation intact as long as price holds above 73.7K,” he told X followers about the monthly BTC/USD chart.

Kibar retained his midterm target of $137,000, one in play throughout 2025.

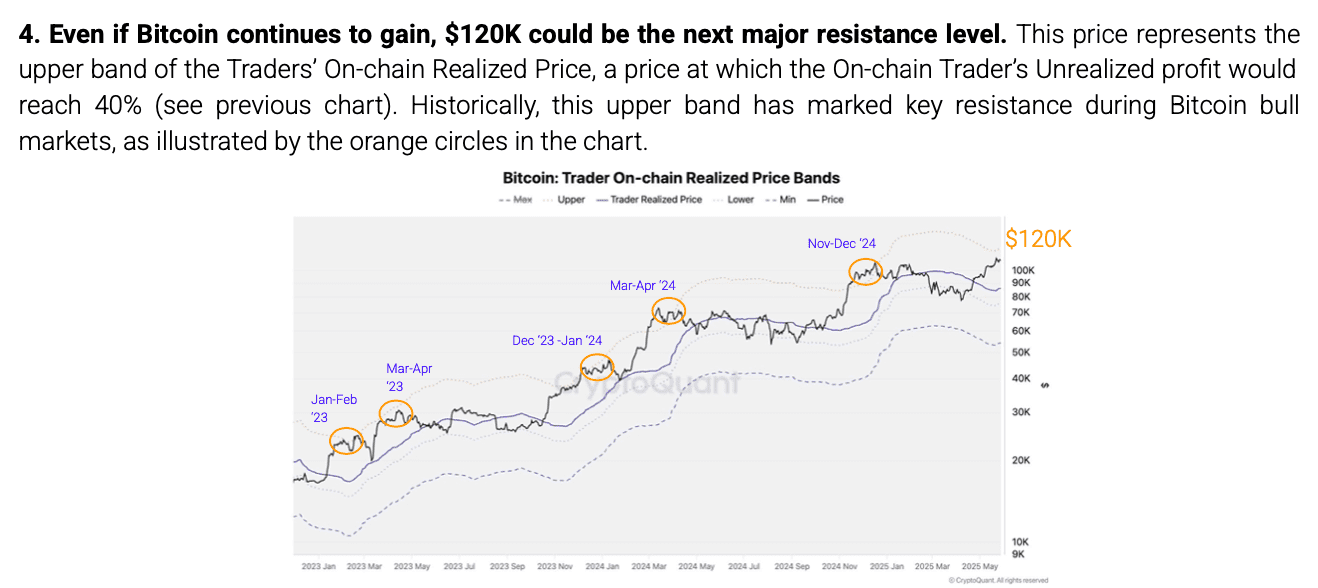

CryptoQuant meanwhile sees price stopping off sooner, with $120,000 on the radar as a key profit-taking station.