Key points:

- Bitcoin is trading back below its recent all-time highs, testing support at levels it first encountered in late 2024.

- A “deeper pullback” may occur before bulls find the momentum to return to price discovery.

- Profit-taking is identified as a primary driver of current resistance.

Bitcoin (BTC) faces the risk of a “deeper correction” as the next phase of its bull market experiences a temporary slowdown.

Bitcoin profit-taking causes bull run hiatus

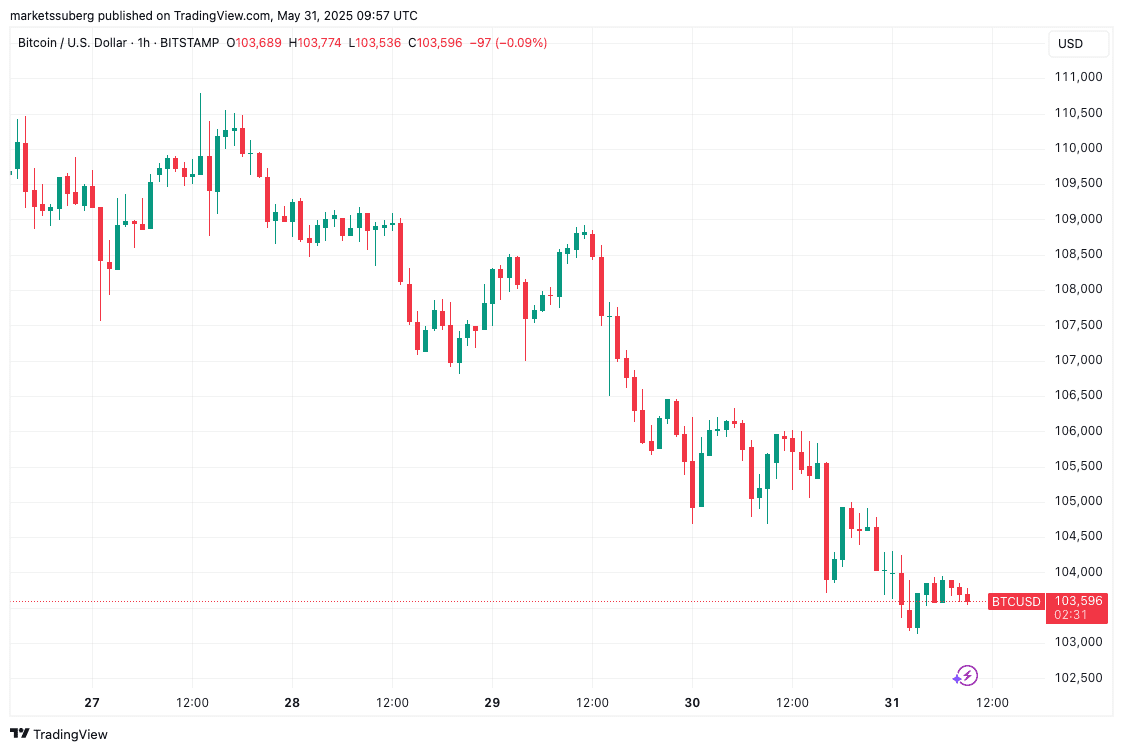

Analysts are warning of potential prices below $100,000 as data shows BTC/USD dropping 8%. Bitcoin fell below its previous all-time highs as the latest correction approaches $9,000 below its recent peak. After encountering resistance, onchain indicators began to forecast a slowdown in bullish momentum.

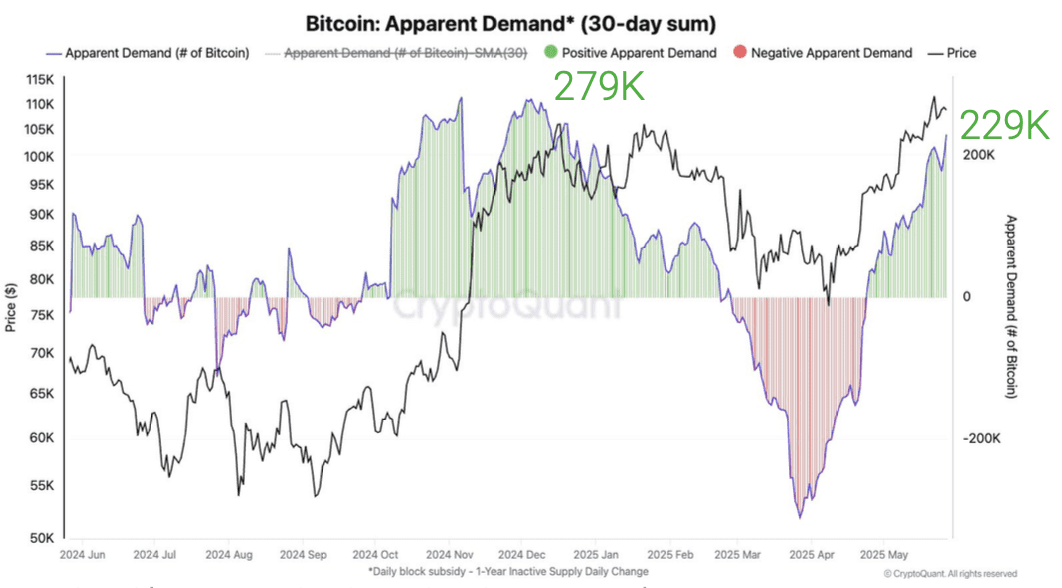

In a recent research report, CryptoQuant noted that “some of Bitcoin’s demand metrics may be reaching a short-term top, which could imply a pause in the current rally.”

“CryptoQuant’s estimate of Bitcoin’s demand growth in the last 30 days is at 229K, which is near the previous demand growth top of 279K Bitcoin reached in December 2024,” its authors stated.

“Additionally, whale-held Bitcoin balances have increased by 2.8% over the past month, a pace that often precedes a slowdown in whale accumulation.”

CryptoQuant also pointed out that unrealized profits were, on average, over 30% at $111,000, suggesting a possible pause.

BTC price “deeper pullback” expected

Market participants anticipate lower levels before a return to price discovery.

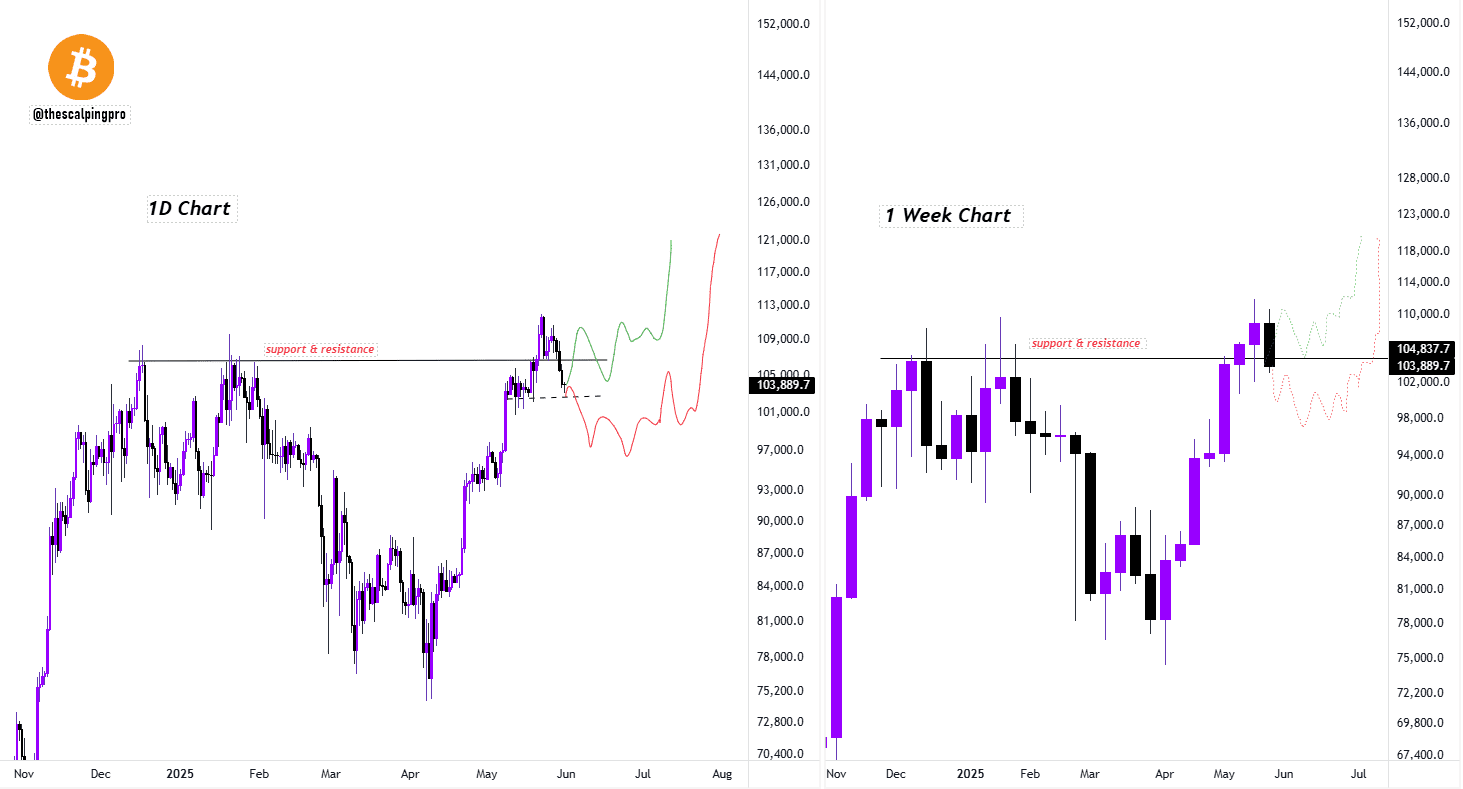

“On the daily chart, BTC has broken below the previous all-time high and is facing rejection at that same level,” trader Mags wrote in a recent analysis.

“This might look like the start of a deeper correction.”

Mags highlighted the importance of the upcoming weekly candle close as a crucial test of bullish strength, emphasizing the price’s ability to reclaim the old record close at $104,450 from December 2024 on weekly timeframes.

“If BTC closes below the horizontal support and resistance line on the weekly, we could see a deeper pullback possibly forming an inverse Head and Shoulders before the next leg up,” he concluded.

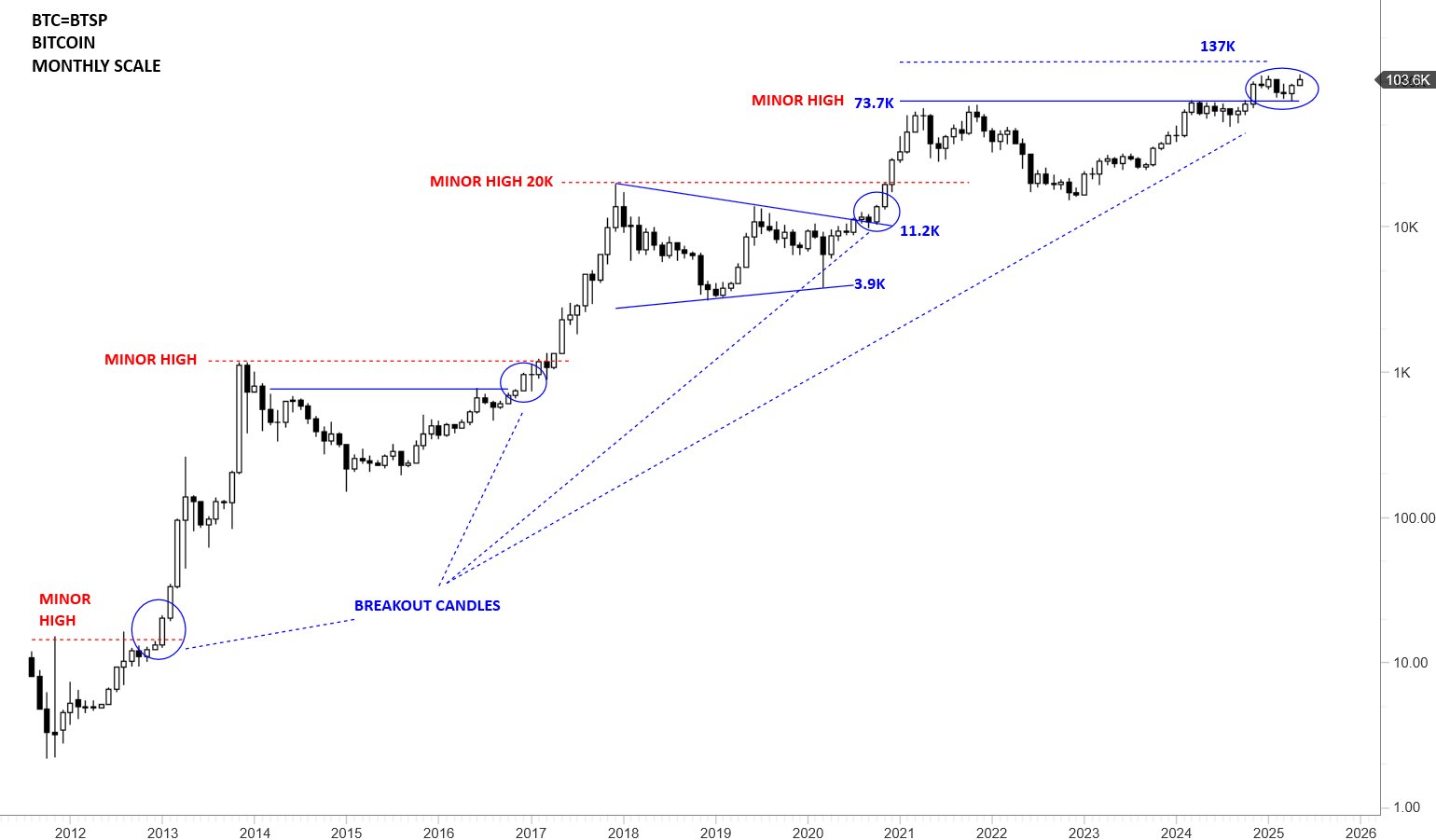

Analyst Aksel Kibar suggested that the bull market’s resurgence “might be delayed.”

“Bullish interpretation intact as long as price holds above 73.7K,” he told followers regarding the monthly BTC/USD chart.

Kibar maintained his midterm target of $137,000, a level anticipated throughout 2025.

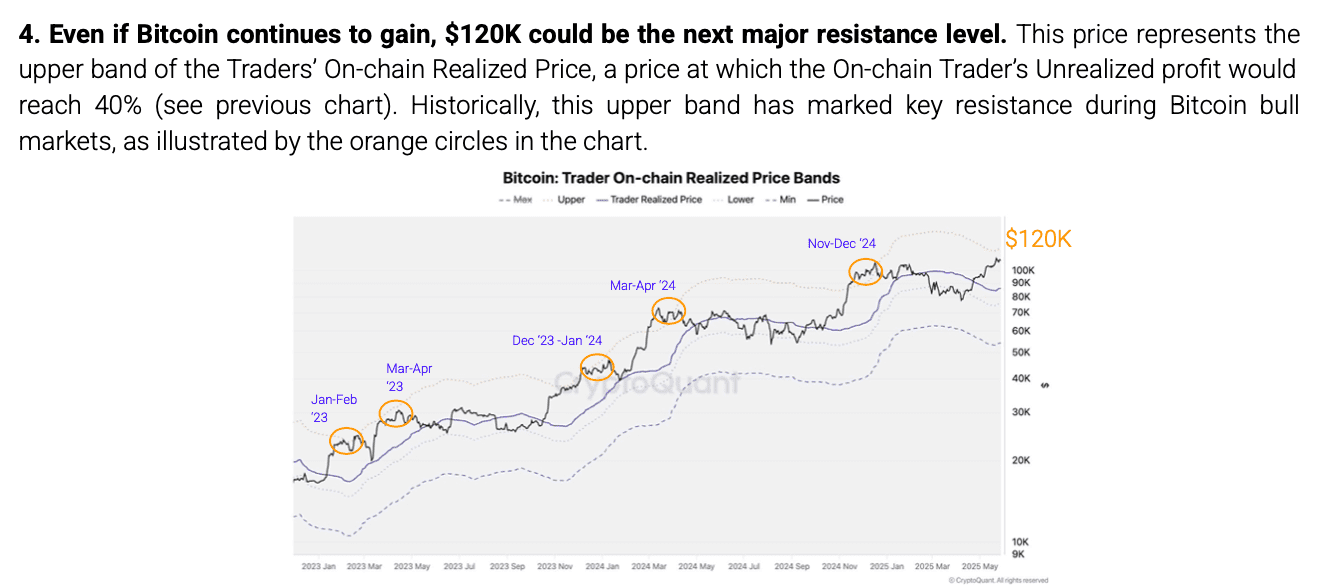

CryptoQuant, on the other hand, anticipates a sooner price target, identifying $120,000 as a key profit-taking area.

Why It Matters

This potential delay in the bull run matters because it impacts short-term trading strategies and overall investor sentiment. A deeper correction could shake out leveraged positions and create uncertainty, while a swift recovery above $104.5K would signal continued bullish momentum. The $104.5k level acts as the line in the sand between a continuation of the bull market and a potential bearish reversal.

Market Impact

The following table illustrates potential Bitcoin price scenarios and their impact:

| Scenario | Likelihood | Potential Impact |

|---|---|---|

| Breaks below $100,000 | Medium | Increased selling pressure, further correction to $90,000 or lower. |

| Consolidates between $100,000 and $104,500 | High | Sideways trading, uncertainty in the market. |

| Breaks and holds above $104,500 | Low | Renewed bullish momentum, potential for new all-time highs. |

Expert Take

While long-term Bitcoin prospects remain strong, I believe a period of consolidation is likely. The market needs to digest recent gains, and profit-taking is a natural part of any bull run. I predict that Bitcoin will trade within the $95,000-$115,000 range for the next few weeks, before attempting another breakout.

Actionable Insight

Traders should closely monitor the $104.5K level. A sustained break above this level would be a bullish signal, while failure to hold above it could indicate further downside. Investors may consider using this period of uncertainty to accumulate Bitcoin at lower prices, employing dollar-cost averaging.

Conclusion

The Bitcoin bull run may be experiencing a temporary delay, but the overall outlook remains positive. Watching key support and resistance levels, particularly the $104.5K weekly close, will be crucial in determining the next phase of the market. Expect volatility and trade cautiously.