Key points:

- Bitcoin trades between increasingly thick bands of liquidity as traders await a breakout.

- Above current spot price lies a particularly important area for bulls when it comes to new all-time highs, analysis says.

- Macroeconomic conditions are not yet providing an impetus for risk-asset volatility.

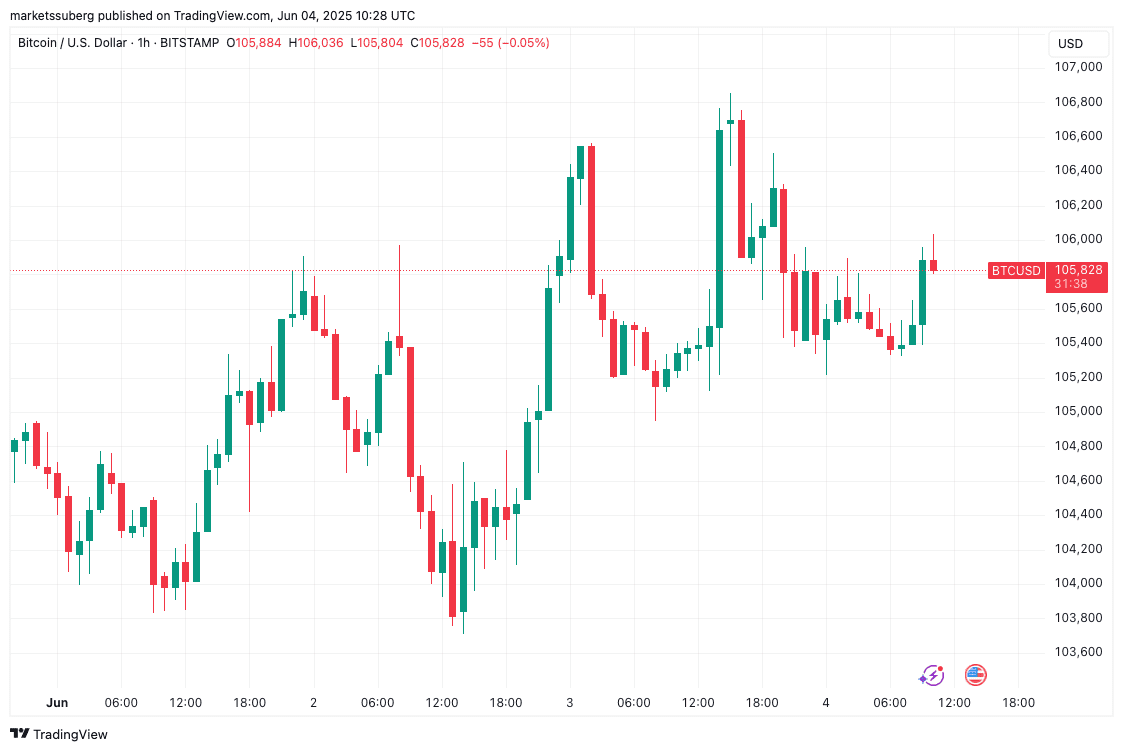

Bitcoin (BTC) continued to target liquidity into the June 4 Wall Street open as $106,000 remained a focus.

Liquidity guard rails up as BTC price ranges

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD fluctuating around the $106,000 mark while “taking out” liquidity on either side.

The day prior had seen a spike to nearly $107,000, which succeeded in neutralizing shorts, with a subsequent dip doing the same to a cloud of bids nearer $105,000.

Traders thus looked for a repeat of that behavior prior to a breakout from the narrow local range.

Let’s clean up those $BTC shorts!

They shall meet their god pic.twitter.com/MbS1T4LRHE— TheKingfisher (@kingfisher_btc) June 4, 2025

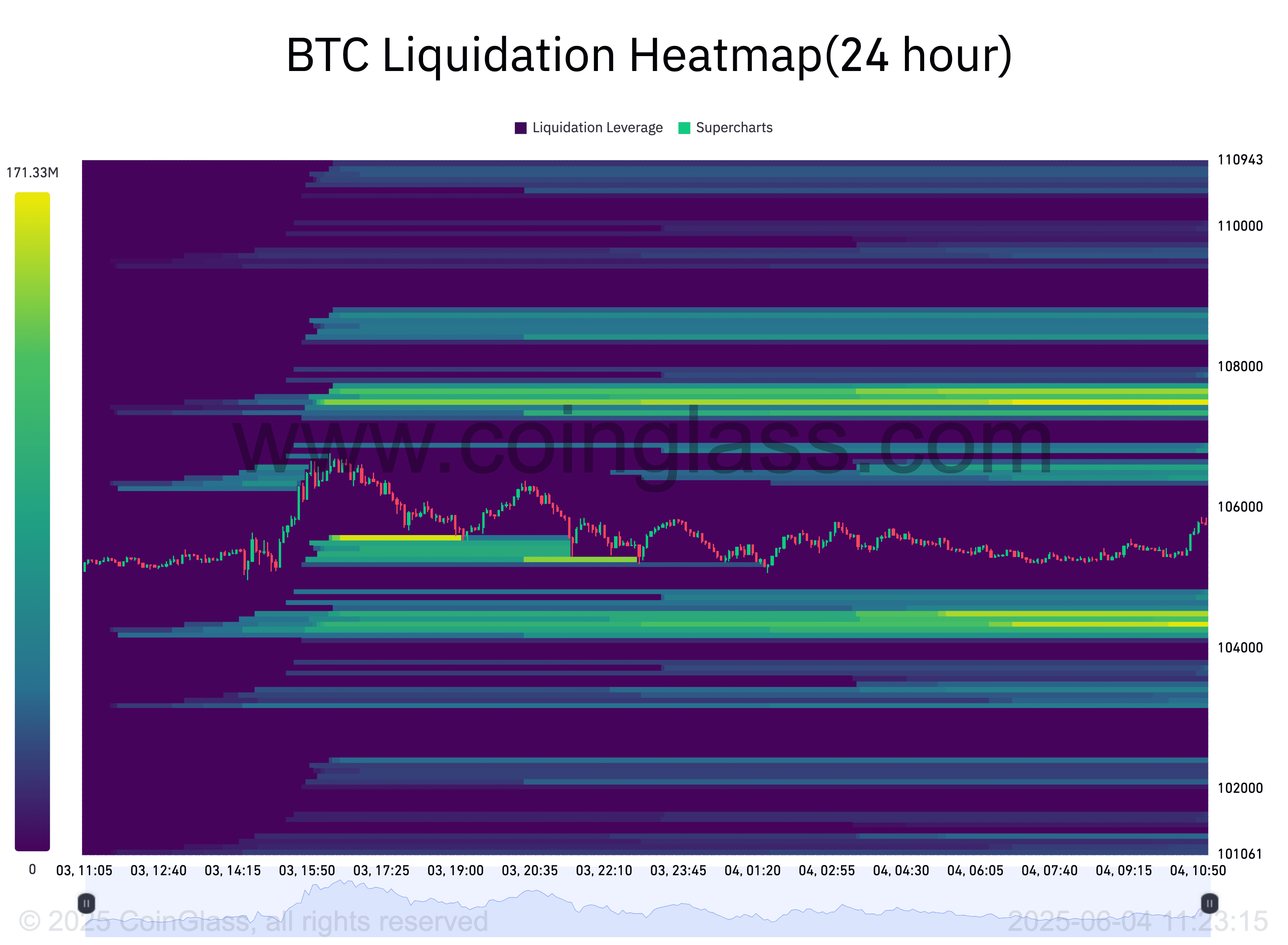

Data from monitoring resource CoinGlass showed liquidity thickening around $104,500 and $107,500 on the day.

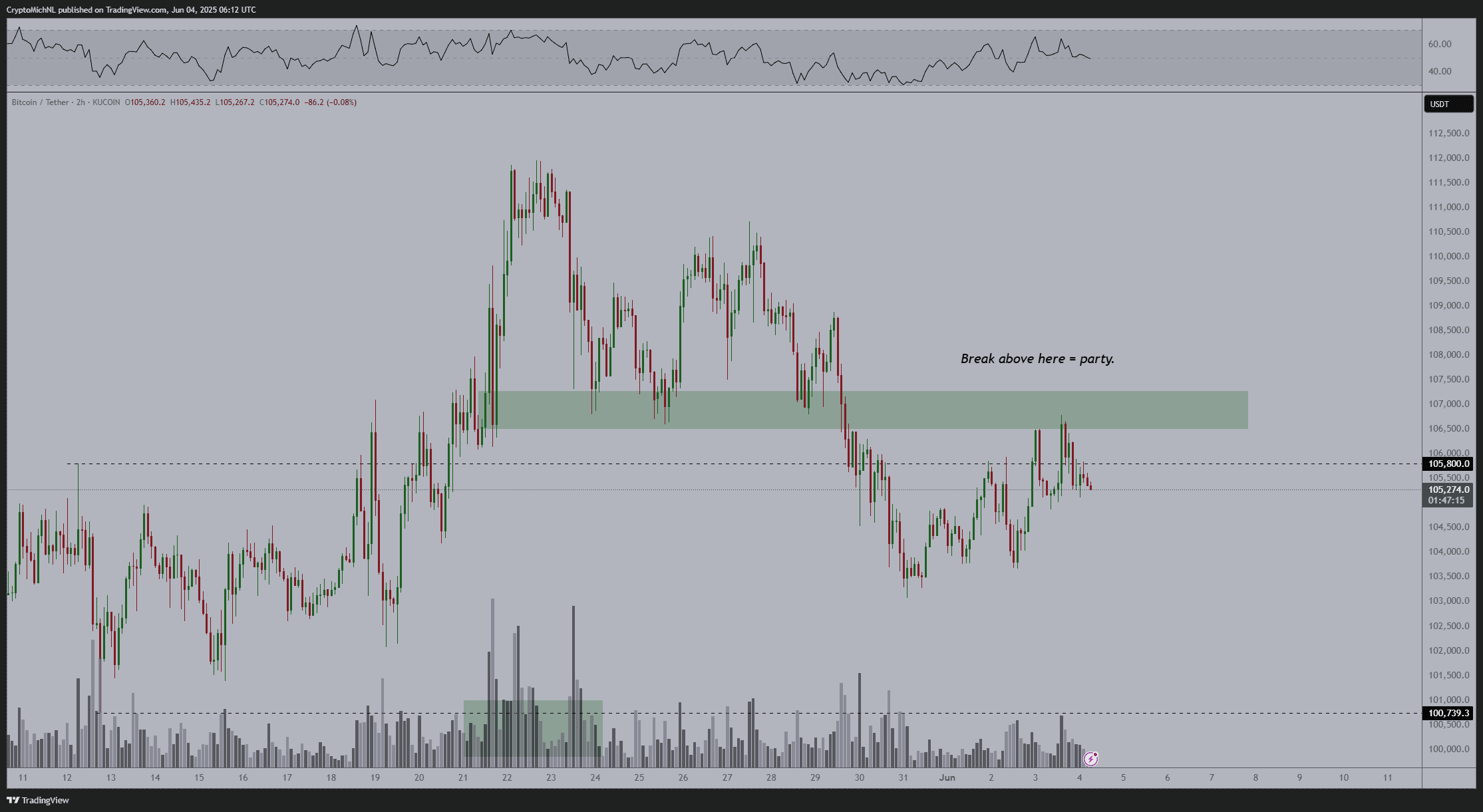

Crypto trader, analyst and entrepreneur Michaël van de Poppe gave the latter area particular significance.

“This is why this level is so vital for Bitcoin,” he told X followers alongside an illustrative chart.

“No breakout above it yet, but if it happens, we’re all the way towards a new ATH and $3,000 per $ETH.”

Bitcoin breakout still “unlikely”

Despite a lack of macroeconomic triggers, some market participants saw range-bound BTC price action continuing despite the local liquidations.

US employment data in the form of nonfarm payroll numbers was due toward the end of the week, providing a potential volatility boost should the result diverge from expectations.

“A steady NFP would cement the Fed’s narrative of a resilient labour market, reinforcing expectations that rates will remain on hold,” QCP added.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.