Is Bitcoin a safe haven asset, or primarily a portfolio diversifier? Recent analysis highlights Bitcoin’s role in the financial landscape, particularly concerning its correlation with traditional assets like US equities. While it exhibits characteristics of a diversifier, it hasn’t fully matured into a safe-haven asset akin to gold or government bonds.

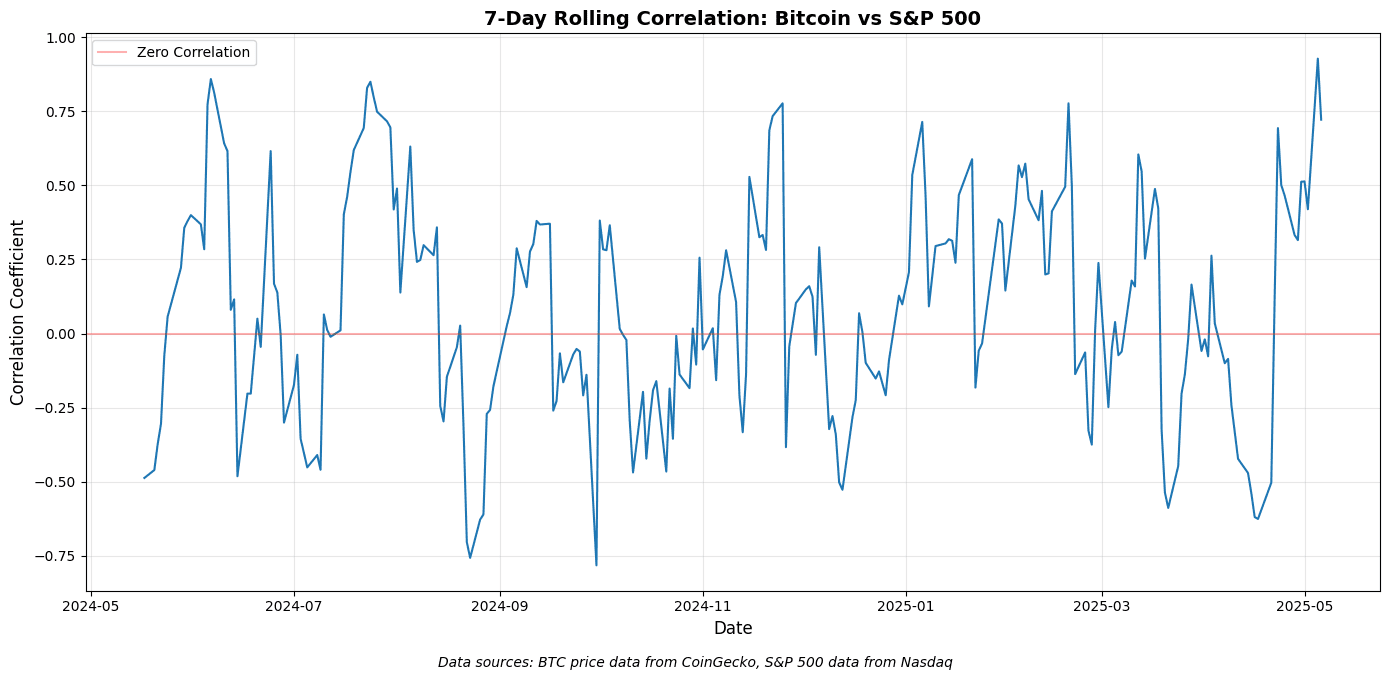

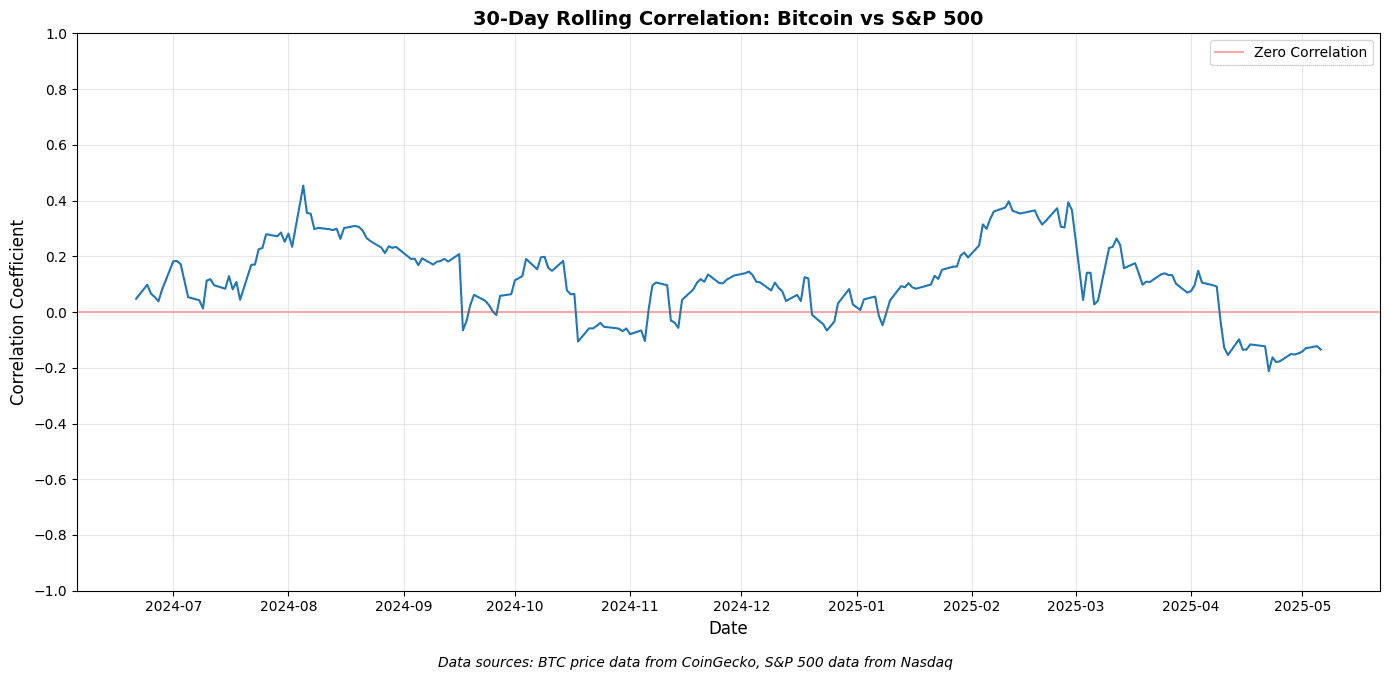

According to research from RedStone Oracles, Bitcoin’s correlation with the S&P 500 has fluctuated significantly. Short-term (7-day) correlations have sometimes shown a negative relationship, while longer-term (30-day) correlations have varied between -0.2 and 0.4. This inconsistency suggests that Bitcoin’s price doesn’t always move in opposition to the stock market, a key characteristic of a true hedge.

A safe-haven asset should ideally exhibit a strong negative correlation (below -0.3) during market stress, providing a reliable counter-movement. Bitcoin hasn’t consistently demonstrated this, leading to the conclusion that it’s not yet a dependable hedge against equity market declines.

Bitcoin as a Portfolio Diversifier

Despite not being a perfect hedge, Bitcoin offers substantial value as a portfolio diversifier. Its often-independent movement from other assets can provide additional returns when other investments are underperforming. This can enhance a portfolio’s overall risk-adjusted returns.

Key benefits of Bitcoin as a diversifier:

- Independent Movement: Bitcoin’s price isn’t always tied to traditional markets.

- Potential for High Returns: Historically, Bitcoin has delivered significant returns, outperforming stocks and traditional safe havens.

- Enhanced Risk-Adjusted Returns: Even a small allocation to Bitcoin can improve a portfolio’s overall performance.

The Maturation of Bitcoin

According to Marcin Kazmierczak, co-founder and COO at RedStone, Bitcoin needs further maturation before it can fully decouple from stock markets and function as a true safe-haven asset. This maturation process involves increased institutional adoption, which can reduce Bitcoin’s volatility and enhance its stability.

Factors contributing to Bitcoin’s maturation:

- Institutional Adoption: Increased investment from institutions like corporate treasuries and asset managers.

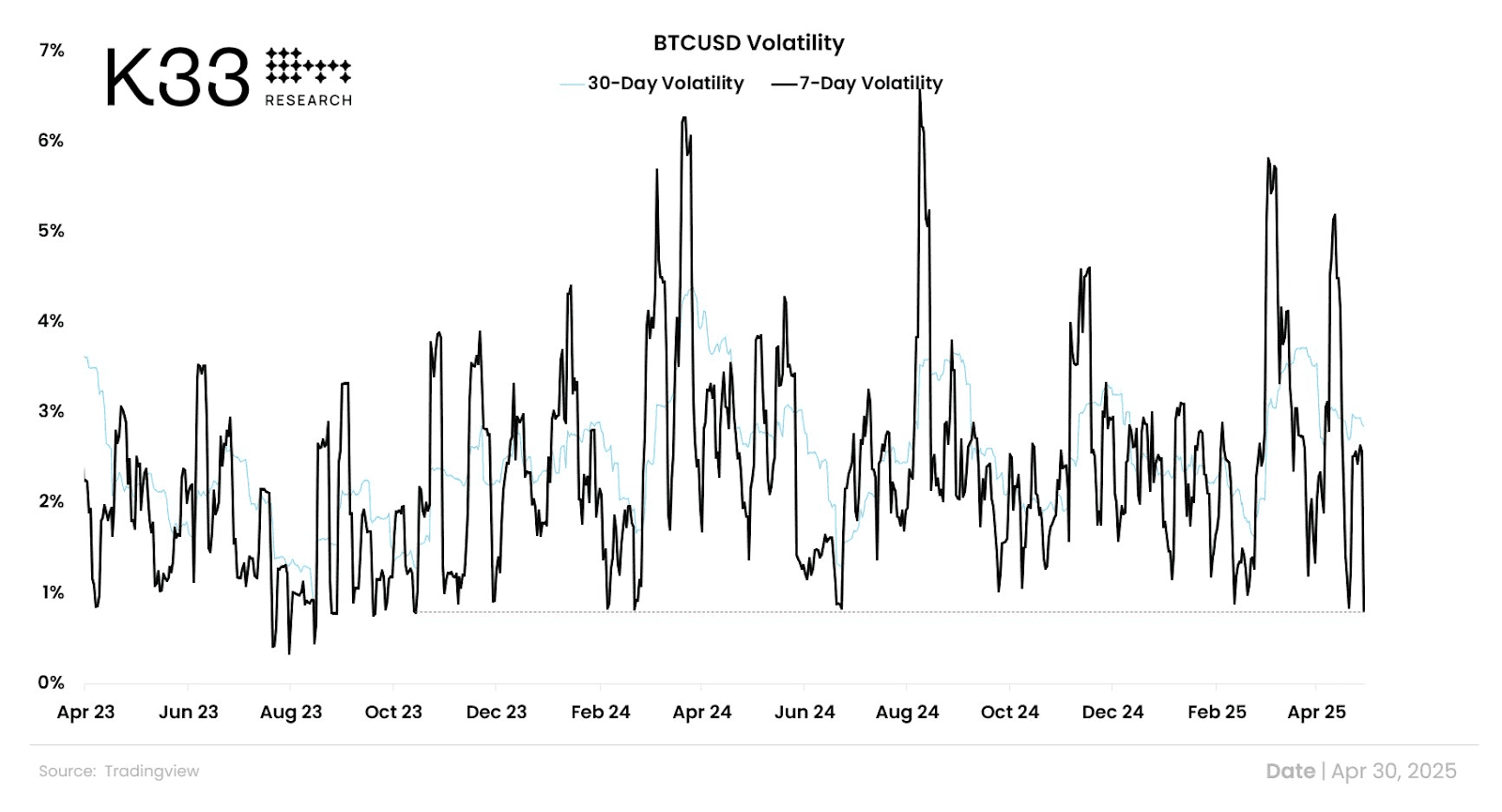

- Decreasing Volatility: As Bitcoin becomes more established, its price fluctuations tend to decrease.

- Growing Recognition: More investors are recognizing Bitcoin as a legitimate asset class.

Bitcoin’s Declining Volatility

Bitcoin’s declining volatility is a key indicator of its growing maturity. Recently, Bitcoin’s weekly volatility hit a multi-year low, suggesting more stable price action. In fact, Bitcoin’s price volatility has even fallen below that of the S&P 500 and the Nasdaq 100, indicating that investors are increasingly treating it as a long-term investment.

The Future of Bitcoin as a Safe Haven

While Bitcoin isn’t currently a perfect safe haven, its potential for future growth and adoption is significant. As institutional interest continues to rise and its volatility decreases, Bitcoin may eventually evolve into a more reliable hedge against market downturns. For now, it remains a valuable tool for portfolio diversification, offering the potential for high returns and independent movement from traditional assets.

Understanding Safe Haven Assets

To fully appreciate Bitcoin’s role, it’s helpful to understand what defines a traditional safe haven asset. These assets typically maintain or increase their value during economic uncertainty or market downturns. Common examples include:

- Gold: A classic safe haven, often seen as a store of value during times of crisis.

- Government Bonds: Considered low-risk investments, as they are backed by the government.

- The US Dollar: Often sought after during global uncertainty.

- The Swiss Franc: Another currency known for its stability.

These assets tend to have a low or negative correlation with riskier assets like stocks, making them valuable for protecting wealth during market volatility.

Conclusion

In conclusion, while Bitcoin may not yet be a perfect safe-haven asset, its role as a portfolio diversifier is undeniable. Its independent movement, potential for high returns, and declining volatility make it a valuable addition to a well-rounded investment portfolio. As Bitcoin continues to mature and gain wider acceptance, its potential to become a true safe haven asset in the future remains strong.