Bitcoin ETF Inflows Plummet: A Cause for Concern?

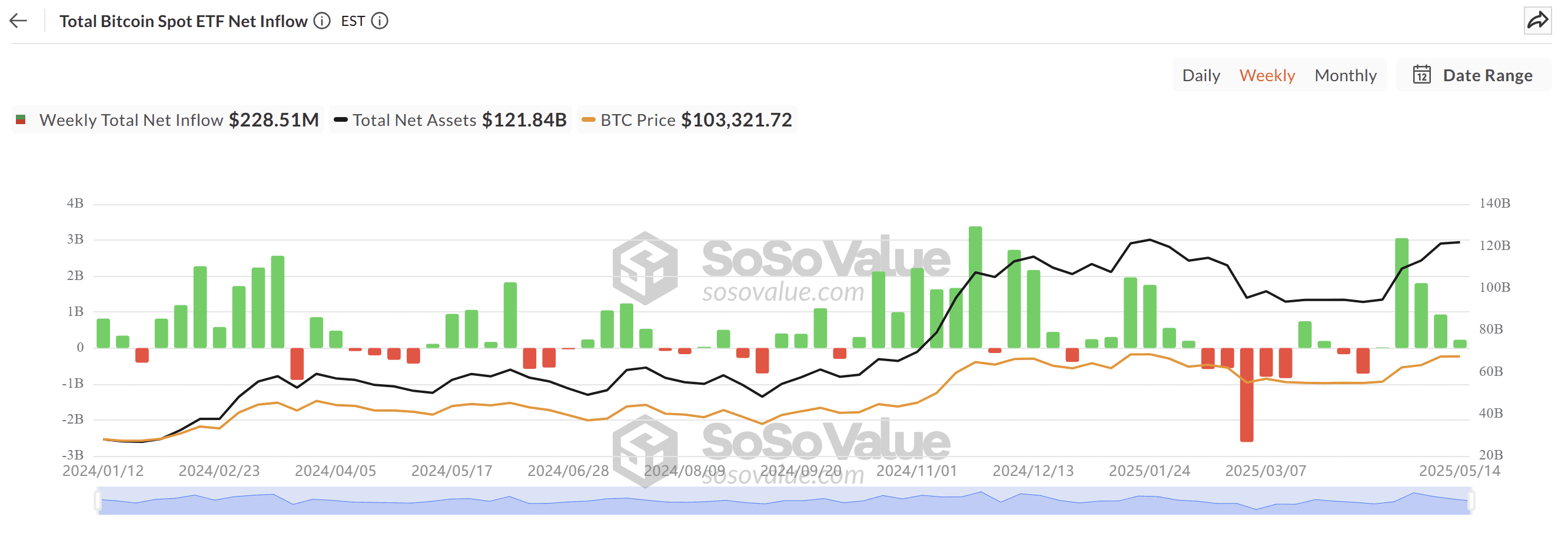

Spot Bitcoin ETF inflows have experienced a sharp decline, dropping over 90% from $3 billion to $228 million in just four weeks. This slowdown has sparked debate about the potential impact on Bitcoin’s price, as historically, strong ETF inflows have been a catalyst for Bitcoin rallies.

This article examines the relationship between ETF inflows, whale activity, and Bitcoin price movements to provide a comprehensive outlook on the current market conditions.

Key Factors Influencing Bitcoin’s Price:

- ETF Inflows: The amount of capital flowing into spot Bitcoin ETFs. Historically, strong inflows have correlated with price increases.

- Whale Activity: The buying and selling behavior of large Bitcoin holders (whales). Their actions can significantly impact market sentiment and price trends.

- Market Sentiment: Overall investor attitude towards Bitcoin, influenced by factors such as regulatory news, economic conditions, and technological advancements.

ETF Inflows vs. Bitcoin Price: A Complex Relationship

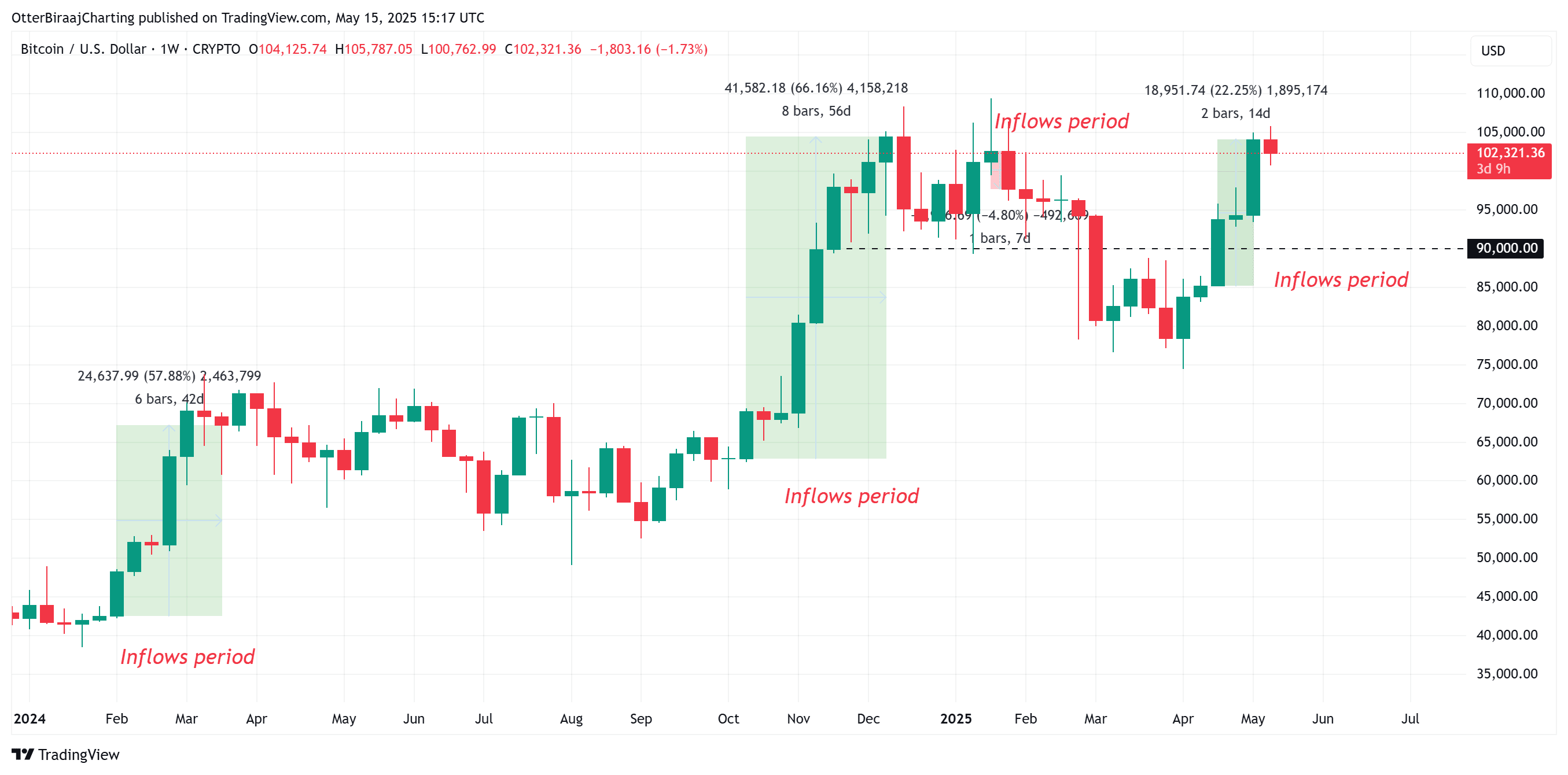

Analyzing past trends reveals a nuanced relationship between ETF inflows and Bitcoin price. While strong inflows often drive rallies, there have been instances where price movements occur independently.

Examining Historical Data:

- Q1 2024 (Feb-Mar): $11.39 billion in net ETF inflows led to a 57% price surge. However, the price peaked before the highest inflow weeks, suggesting other factors were at play.

- Q3 2024 (Oct-Dec): $16.8 billion in inflows fueled a 66% rally. A slowdown in inflows coincided with a 9% price drop, reinforcing the link between ETF flows and price corrections.

- Q1 2025 (Jan): $3.8 billion in inflows coincided with a new all-time high of $110,000, but prices overall fell 4.8%.

- Q2 2025 (Apr-May): $5.8 billion in inflows corresponded with a 22% price rally, although Bitcoin had already gained 8% in the prior two weeks despite negative netflows.

This data suggests that while ETF inflows can be a significant driver, they aren’t the sole determinant of Bitcoin’s price. Other factors, such as retail interest, macroeconomic conditions, and whale activity, also play a crucial role.

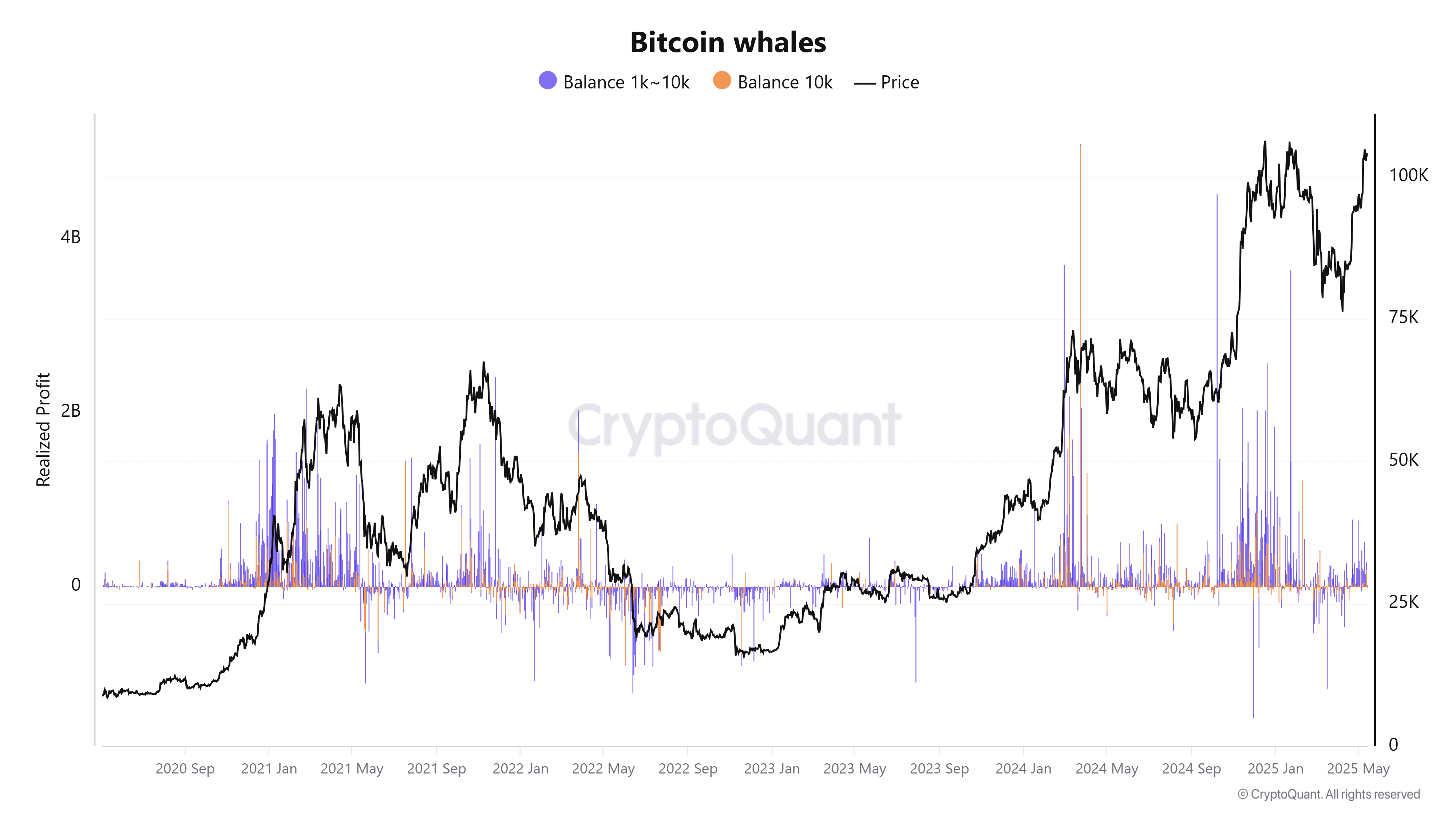

Whale Activity: A Bullish Signal?

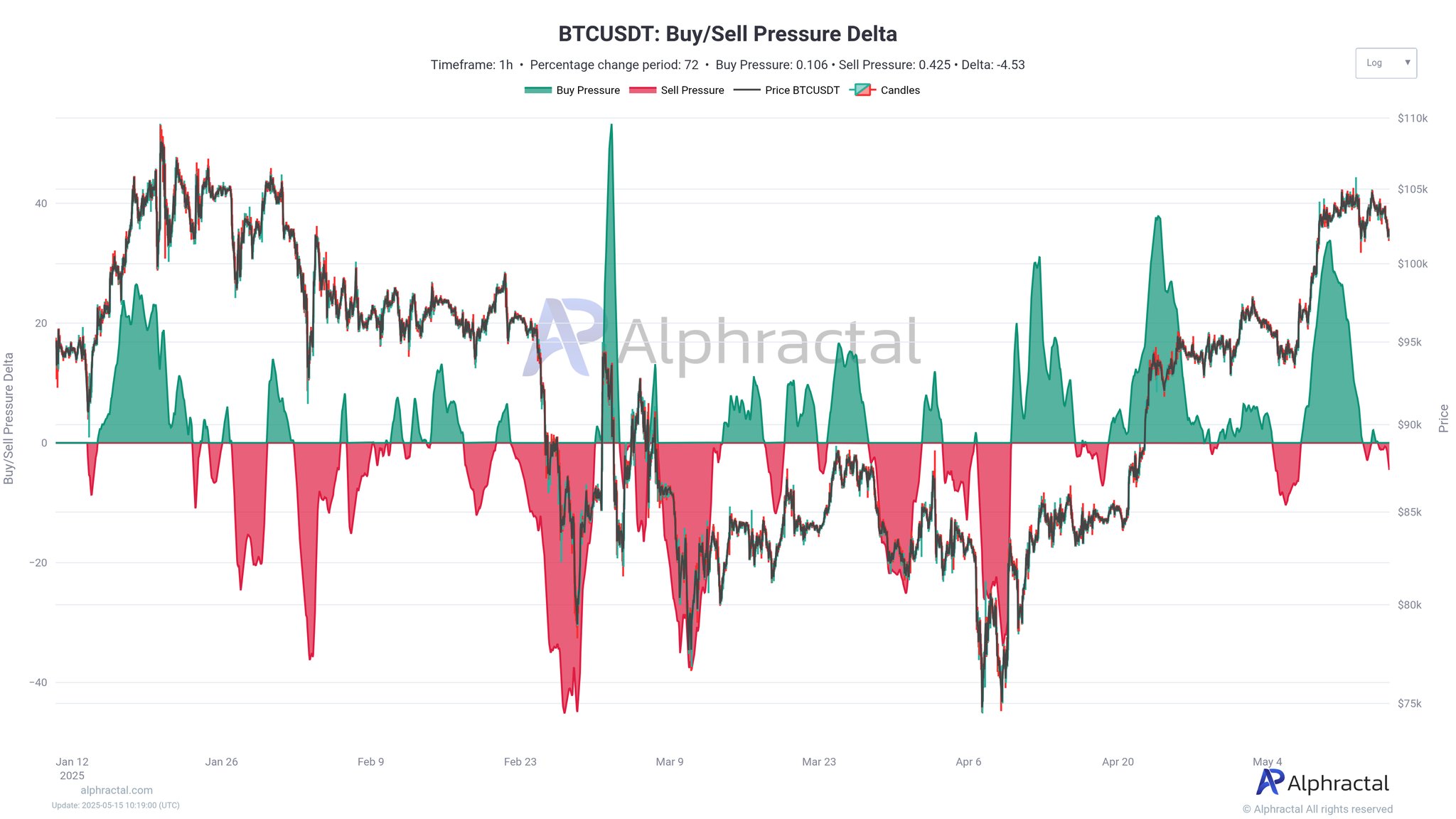

Despite the decline in ETF inflows, recent data reveals strong whale accumulation, suggesting a potential continuation of the Bitcoin uptrend. While short-term selling pressure exists, long-term buying pressure from whales remains robust.

Short-Term Selling Pressure:

According to Alphractal CEO Joao Wedson, whales are starting to offload BTC between $100,000 and $105,000. This selling pressure is reflected in the negative Buy/Sell Pressure Delta.

Long-Term Whale Accumulation:

Data from CryptoQuant indicates that whales are taking relatively fewer profits in the current period compared to previous price peaks. This suggests that whales expect further price appreciation and are holding onto their Bitcoin.

Blitzz Trading, an anonymous analyst, noted, “Compared to previous rallies, we can see that whales have taken significantly less profit during this recent surge. This could indicate that the upward trend may continue.”

Expert Opinions:

- Senior Market Analyst, John Doe, from XYZ Investments: Believes the ETF inflows decreasing doesn’t mean a true bear market. “Whales play a huge factor in how the market swings, which in turn influences the bull market”.

- Trading Influencer, @CryptoKing: Says the market is highly unpredictable and can not be solely influenced by ETF inflows. “Although it plays a factor, other events such as the halving which happens every 4 years, can be a major catalyst for BTC’s price point.”.

Conclusion: Navigating the Bitcoin Market

The Bitcoin market is influenced by a complex interplay of factors, including ETF inflows, whale activity, and market sentiment. While the recent decline in ETF inflows raises concerns, strong whale accumulation suggests that the bull market may persist. Investors should carefully consider all these factors and conduct their own research before making any investment decisions.

It is important to remember that the cryptocurrency market is inherently volatile, and past performance is not indicative of future results. Always consult with a qualified financial advisor before making any investment decisions.