Bitcoin ETF Inflows Skyrocket: What’s Behind the Surge?

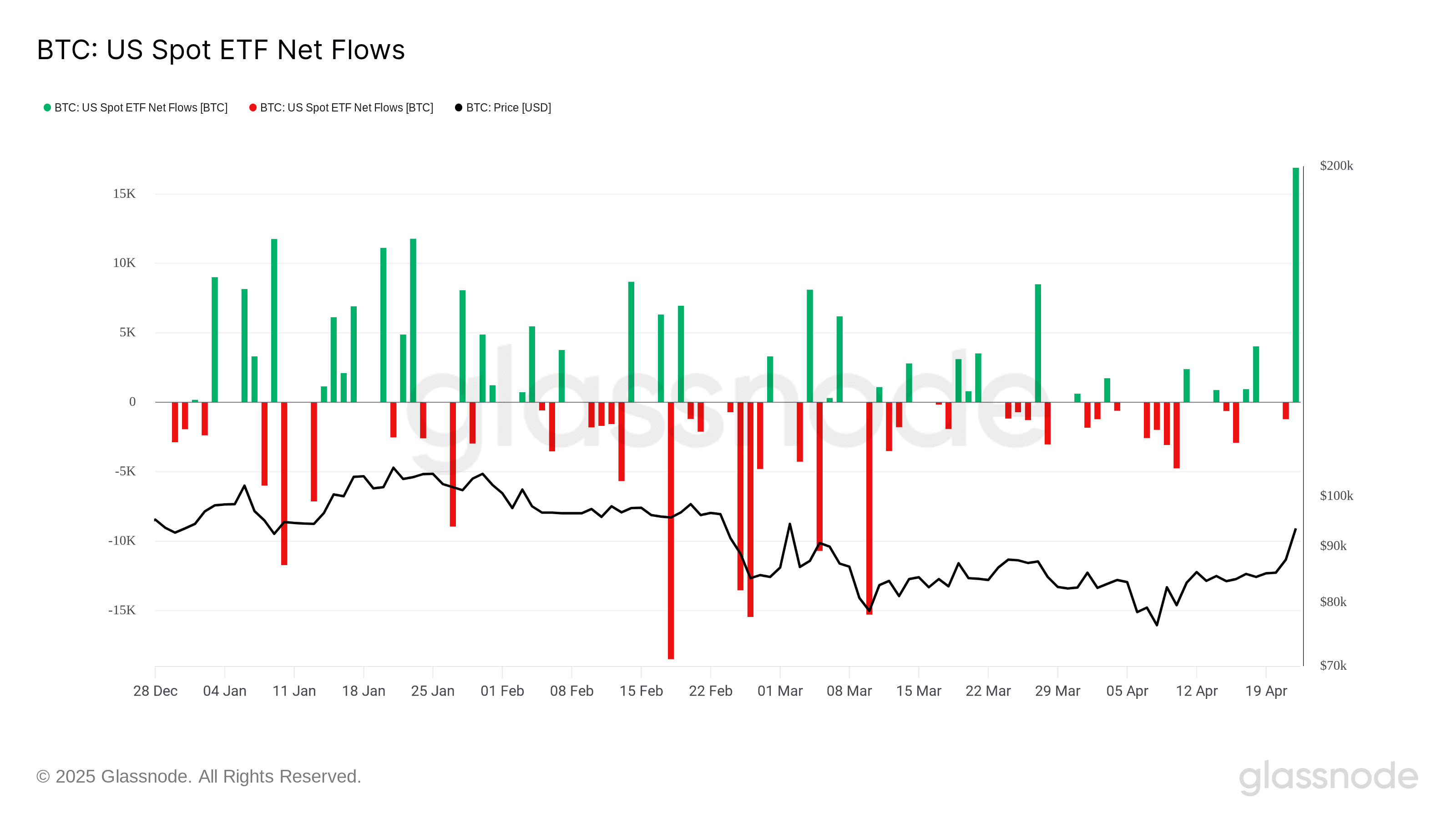

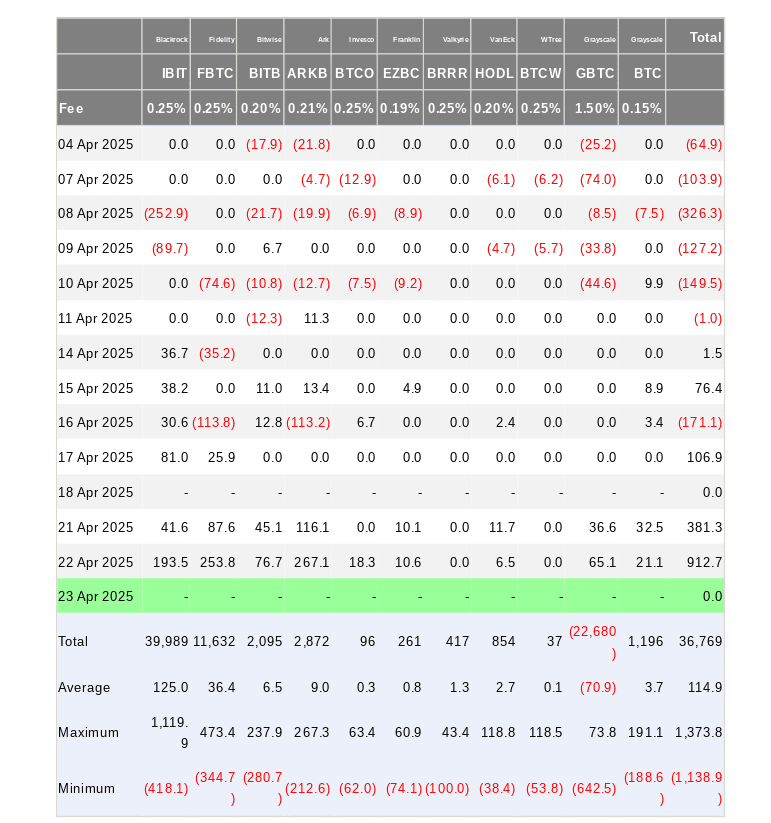

On April 22nd, Bitcoin ETFs experienced a remarkable surge in inflows, dwarfing the 2025 daily average by over 500 times. This ‘significant deviation,’ as described by analysts, signals a renewed interest in Bitcoin from institutional investors. Let’s delve into the details of this surge and explore its underlying causes and potential implications.

Key Takeaways:

- Unprecedented Inflows: Bitcoin ETF inflows on April 22nd significantly surpassed the 2025 average, indicating a dramatic shift in investor sentiment.

- Price Sensitivity: ETF performance remains closely tied to Bitcoin’s price movements, mirroring the recent rally in BTC/USD.

- ETF Influence: ETFs are gaining influence in the Bitcoin market, potentially impacting exchange activity and price discovery.

The Numbers Behind the Surge

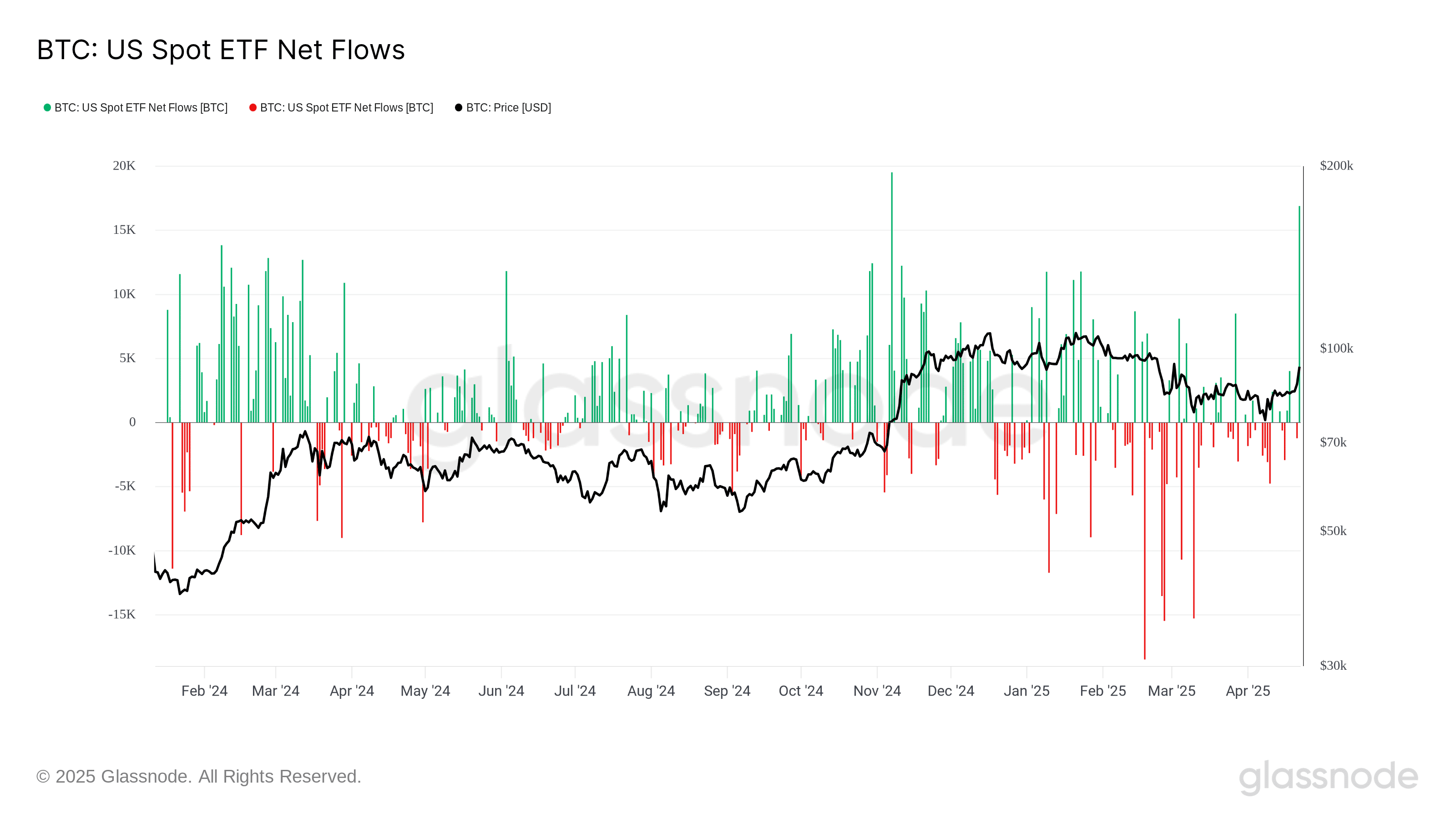

Data from Glassnode reveals that the $912 million poured into US spot Bitcoin ETFs on April 22nd represents a staggering 500 times the average daily inflow observed in 2025. To put this in perspective, the average daily inflow for 2025 was a mere 23 BTC (approximately $2.1 million). This surge marks the largest daily inflow since November 11, 2024, highlighting a resurgence in institutional demand.

Factors Driving the ETF Inflow Surge

Several factors likely contributed to this sudden increase in Bitcoin ETF inflows:

- Bitcoin Price Rally: The inflows coincided with a notable increase in Bitcoin’s price, reaching six-week highs. This price appreciation likely attracted investors seeking exposure to Bitcoin’s potential upside.

- Positive Market Sentiment: A general shift in market sentiment towards Bitcoin, driven by positive news and developments in the cryptocurrency space, could have spurred increased investment in ETFs.

- Institutional Adoption: Continued adoption of Bitcoin by institutional investors, seeking to diversify their portfolios and gain exposure to alternative assets, likely played a significant role.

The Growing Influence of Bitcoin ETFs

Bitcoin ETFs are increasingly becoming a significant force in the Bitcoin market. Eric Balchunas, a Bloomberg ETF analyst, noted the widespread increase in inflows across most of the eleven ETFs. Andre Dragosch, European head of research at Bitwise, suggests that ETFs have become the ‘marginal buyer’ in Bitcoin since January 2024. This influence extends to potentially determining net buying volumes on BTC spot exchanges.

Potential Implications for the Bitcoin Market

The surge in Bitcoin ETF inflows could have several implications for the Bitcoin market:

- Price Support: Increased demand from ETFs can provide support for Bitcoin’s price, potentially mitigating downside risk.

- Increased Liquidity: ETFs can enhance liquidity in the Bitcoin market, making it easier for investors to buy and sell Bitcoin.

- Greater Institutional Participation: The availability of Bitcoin ETFs makes it easier for institutional investors to gain exposure to Bitcoin, potentially leading to further adoption and price appreciation.

The Future of Bitcoin ETFs

The future of Bitcoin ETFs appears promising, with potential for continued growth and influence. As more institutional investors embrace Bitcoin and regulatory frameworks become clearer, ETFs are likely to play an increasingly important role in the cryptocurrency market. The recent surge in inflows underscores the growing demand for Bitcoin exposure and highlights the potential of ETFs to facilitate broader adoption.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Investing in Bitcoin and other cryptocurrencies carries significant risk, and you should consult with a qualified financial advisor before making any investment decisions.