Bitcoin ETFs See Dramatic $912M Inflows: Investor Confidence Surges

Investments in Bitcoin exchange-traded funds (ETFs) have rebounded strongly, reaching levels not seen since January. This surge indicates a renewed confidence among investors, alleviating earlier concerns about global trade tariff escalations.

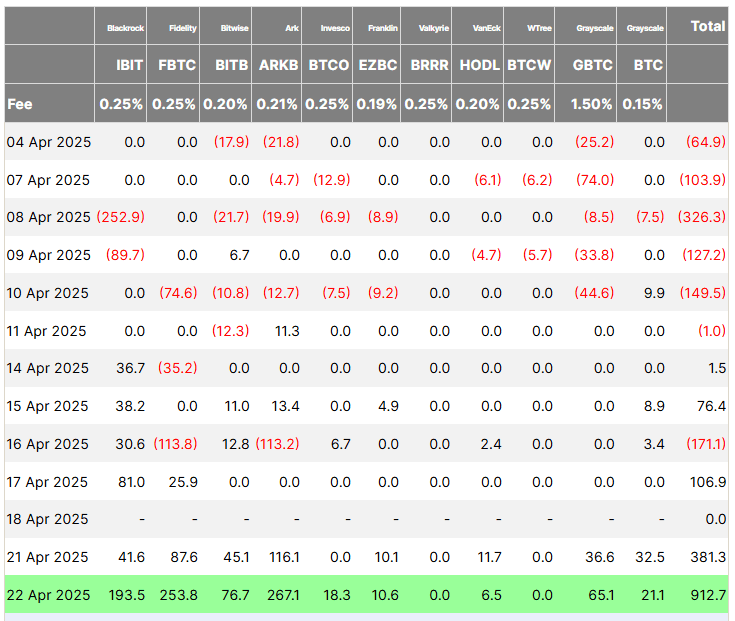

On April 22nd, US spot Bitcoin ETFs recorded over $912 million in cumulative net inflows. This marks the highest single-day investment in over three months, according to data from Farside Investors.

James Butterfill, head of research at CoinShares, noted this dramatic shift in sentiment, stating that Bitcoin ETPs had experienced their largest daily inflows since January 21st.

Factors Driving the Bitcoin ETF Inflow Surge

Several factors are contributing to this resurgence in Bitcoin ETF investments:

- Easing Trade War Tensions: Investor sentiment improved after US President Donald Trump signaled a potential reduction in import tariffs on Chinese goods. This less confrontational approach to trade negotiations has boosted market confidence.

- Bitcoin Price Surge: The growing ETF inflows and easing trade tensions pushed Bitcoin’s price above $93,000, a seven-week high as reported on April 23rd.

- Institutional Adoption: The increasing institutional presence and investment through ETFs are potentially accelerating Bitcoin’s historical four-year cycle. Analysts suggest this could lead to new all-time highs before the end of 2025.

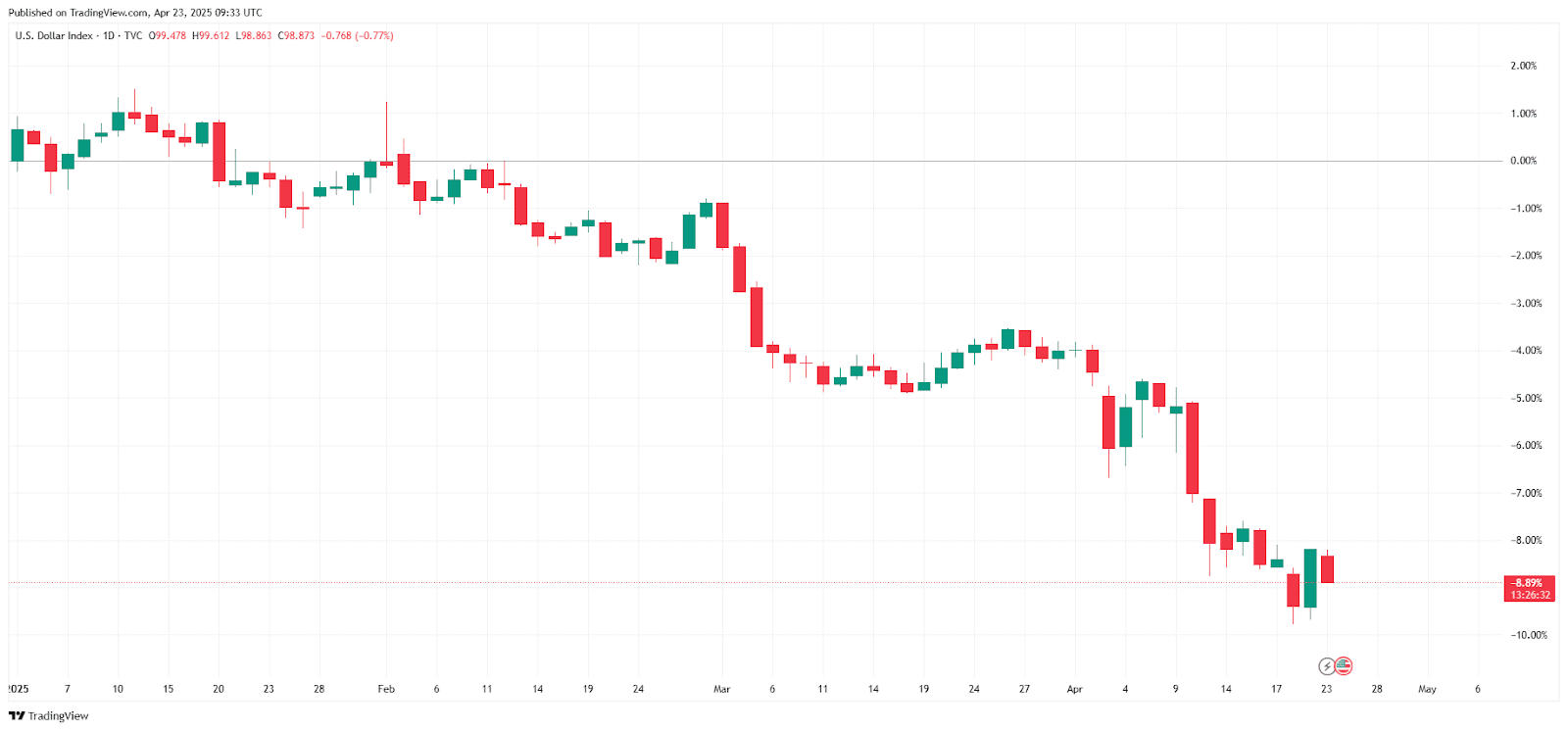

- Weakening US Dollar: The declining value of the US dollar is also playing a role. As the dollar weakens, investors are increasingly seeking alternative assets like Bitcoin.

The US Dollar’s Weakness and Bitcoin’s Safe-Haven Appeal

The US Dollar Index (DXY), which measures the dollar’s strength against other major currencies, has fallen significantly since the start of 2025. This decline has led investors to consider Bitcoin as a hedge against economic uncertainty.

Ryan Lee, chief analyst at Bitget Research, highlighted the role of macro factors such as a weakening dollar and rising gold correlation in reinforcing Bitcoin’s appeal as a safe-haven asset.

Bitcoin’s Maturing Role in the Financial Landscape

Analysts suggest that Bitcoin is increasingly decoupling from traditional tech stocks and solidifying its position as a macro asset. According to Nexo dispatch analyst Iliya Kalchev, Bitcoin is no longer trading in the shadows of tech but has become a lens through which macro uncertainty is priced.

Nansen CEO Alex Svanevik observed that Bitcoin has become less like the Nasdaq and more like gold, acting as a safe-haven asset amidst economic turmoil.

Expert Predictions and Market Outlook

BitMEX co-founder Arthur Hayes predicted on April 21st that the incoming US Treasury buybacks might be the next catalyst for Bitcoin’s price. He speculated that this could be the last chance to buy Bitcoin below $100,000.

Potential Impacts of Bitcoin ETF Inflows

- Increased Market Liquidity: Larger ETF inflows provide more liquidity for Bitcoin markets, improving trading efficiency.

- Price Stability: Institutional investment through ETFs may reduce price volatility by introducing more stable, long-term holdings.

- Wider Adoption: ETFs can broaden Bitcoin’s accessibility, allowing traditional investors to gain exposure without directly owning the cryptocurrency.

- Market Sentiment: Significant inflows boost overall market sentiment, attracting additional investment and confidence.

In conclusion, the recent surge in Bitcoin ETF inflows reflects a significant shift in investor sentiment. Factors such as easing trade war concerns, a weakening US dollar, and growing institutional adoption are driving this resurgence, positioning Bitcoin as a resilient and increasingly important asset in the global financial landscape.