Key points:

- US President Donald Trump shifts focus from Elon Musk to Fed Chair Jerome Powell, advocating for interest-rate cuts.

- Bitcoin rebounds despite robust US employment data.

- Concerns arise about a potential BTC price decline due to liquidity issues.

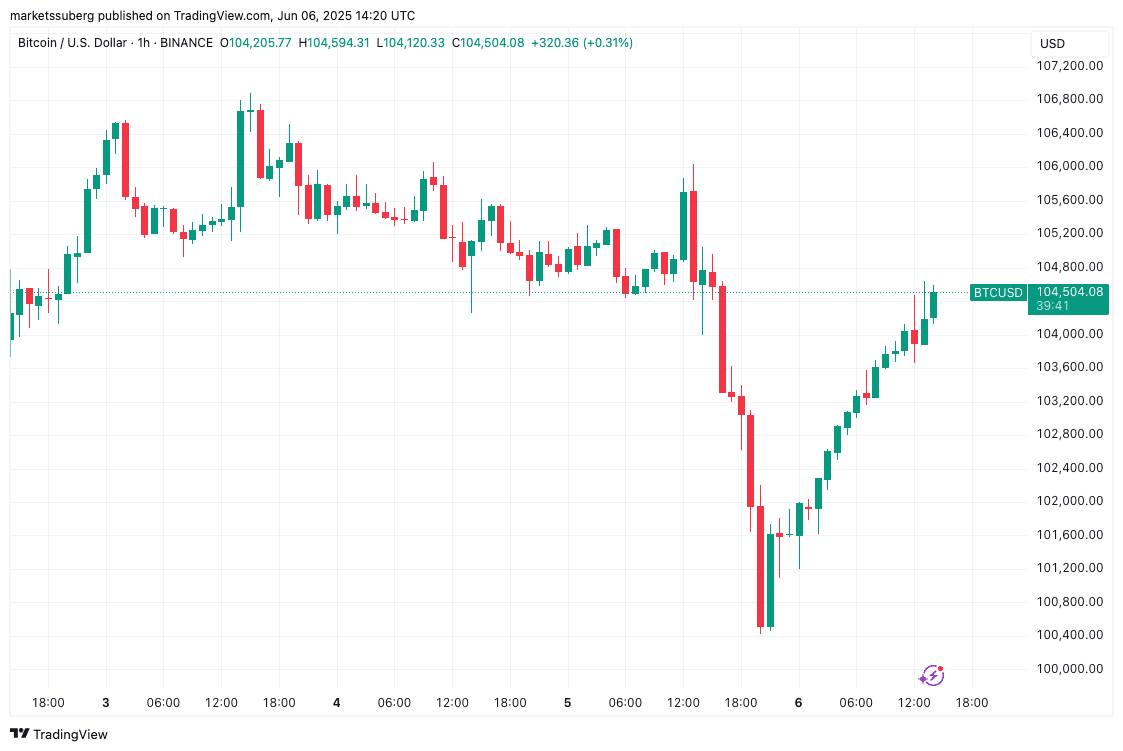

Bitcoin (BTC) surpassed $104,000 during the Wall Street opening on June 6, amidst strong US labor market figures and renewed calls for interest-rate reductions.

Bitcoin Edges Higher as Trump Targets Fed

Data indicates a 2.5% increase in BTC/USD for the day.

Having recovered from recent losses triggered by the Trump-Musk dispute, the market is now assessing fresh inflation signals as Trump redirects his attention to the Federal Reserve.

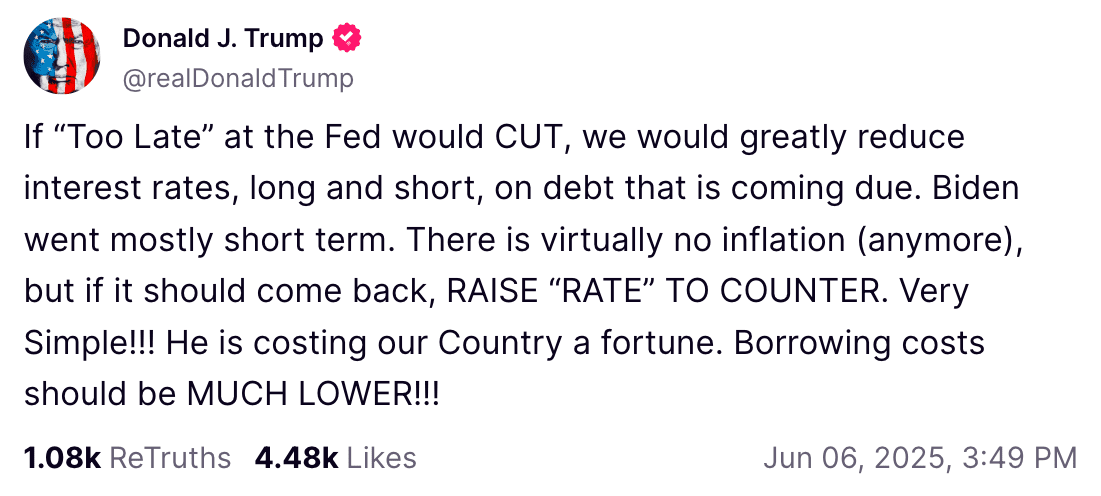

Trump voiced his opinion on Truth Social, stating, “‘Too Late’ at the Fed is a disaster!”

Trump has a history of criticizing Fed policy and Chair Jerome Powell, often pushing for interest-rate cuts in 2025, which would typically benefit risk assets like crypto.

He further added, “Europe has had 10 rate cuts, we have had none. Despite him, our Country is doing great,” referring to Powell.

“Go for a full point, Rocket Fuel!”

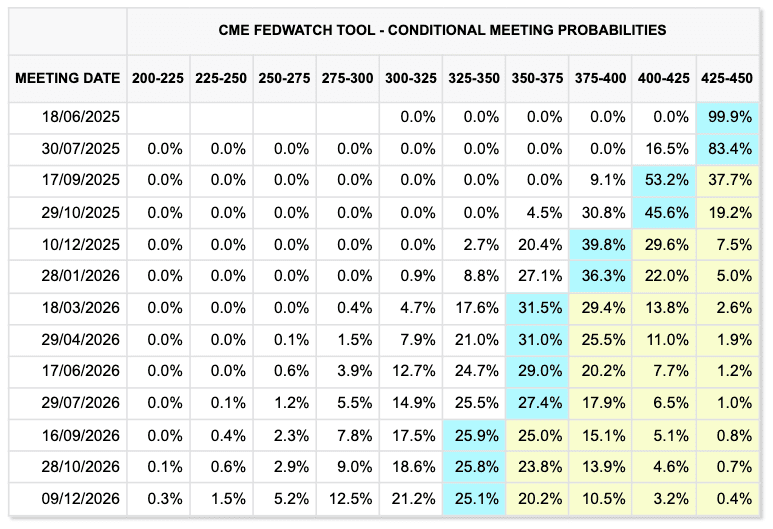

Market expectations for rate cuts before the Fed’s September meeting are low, according to data from CME Group’s FedWatch Tool, effectively pricing out Trump’s call for a full point cut.

The latest nonfarm payrolls data seems to support the Fed’s cautious approach, indicating a strong labor market and reducing the urgency for rate cuts.

An official report from the US Bureau of Labor Statistics (BLS) confirmed a 139,000 increase in total nonfarm payroll employment in May, with the unemployment rate remaining stable at 4.2 percent.

Analysis Warns of Bitcoin “Liquidity Trap”

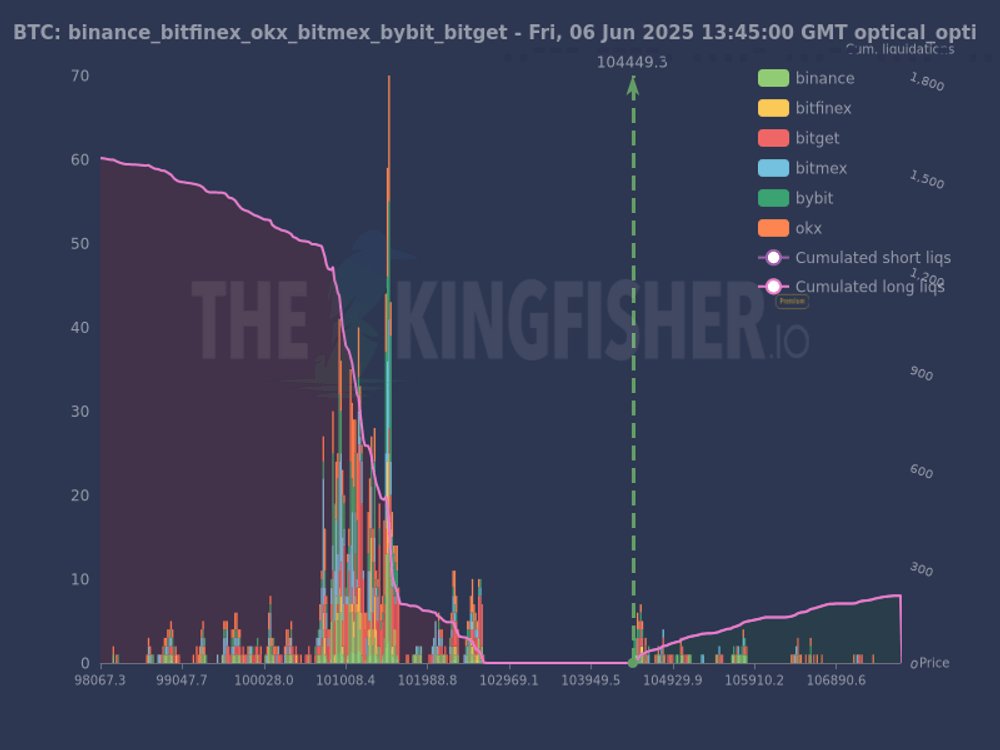

Turning to BTC price action, trader TheKingfisher analyzed order book liquidity for market direction clues.

Earlier reports highlighted potential downside price targets for Bitcoin in the short term, with some analysts suggesting a drop below $100,000.

An X post stated, “This $BTC liquidation map reveals a massive cluster of long liquidations between ~99k and 102k.”

“That’s a huge magnetic zone below current price. In contrast, short liquidations above ~104.5k are minimal.”

TheKingfisher pointed out that the significant imbalance between bid and ask liquidity increases the likelihood of a downward liquidity cascade.

The post concluded, “Normies see support; we see a liquidation trap.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.