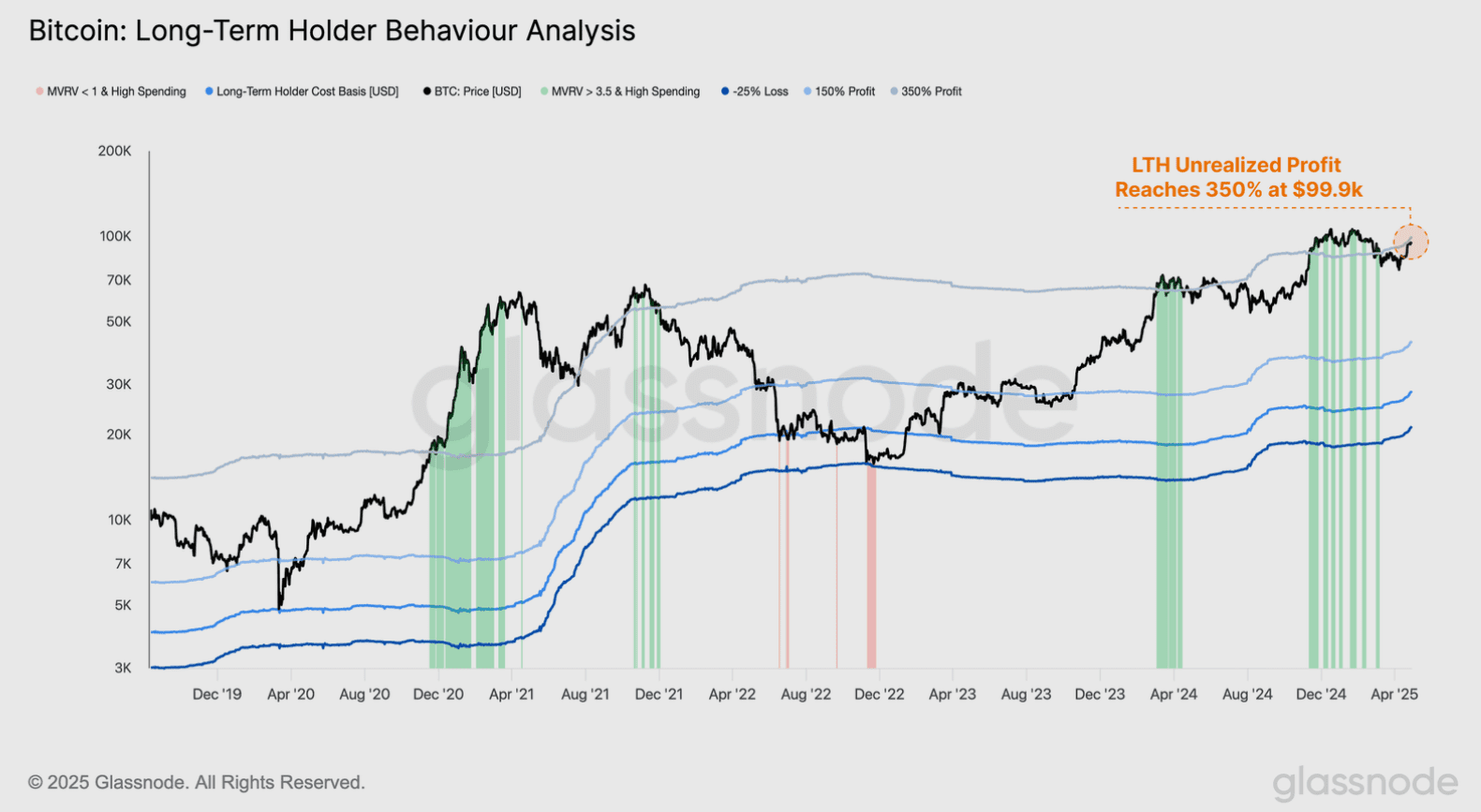

Bitcoin (BTC) is approaching a critical juncture where long-term holders (LTHs) may trigger a significant sell-off, according to on-chain analytics firm Glassnode. Their analysis suggests that as LTH unrealized profits near 350%, historically a level that prompts selling, the market could face increased downward pressure. This threshold coincides with Bitcoin potentially reaching the $100,000 price point.

Key Takeaways:

- LTH Profitability: Long-term Bitcoin holders are nearing a 350% unrealized profit margin, a level historically associated with increased selling activity.

- $100K Price Point: This profit level aligns with a potential return to a six-figure Bitcoin price, making it a crucial area to watch.

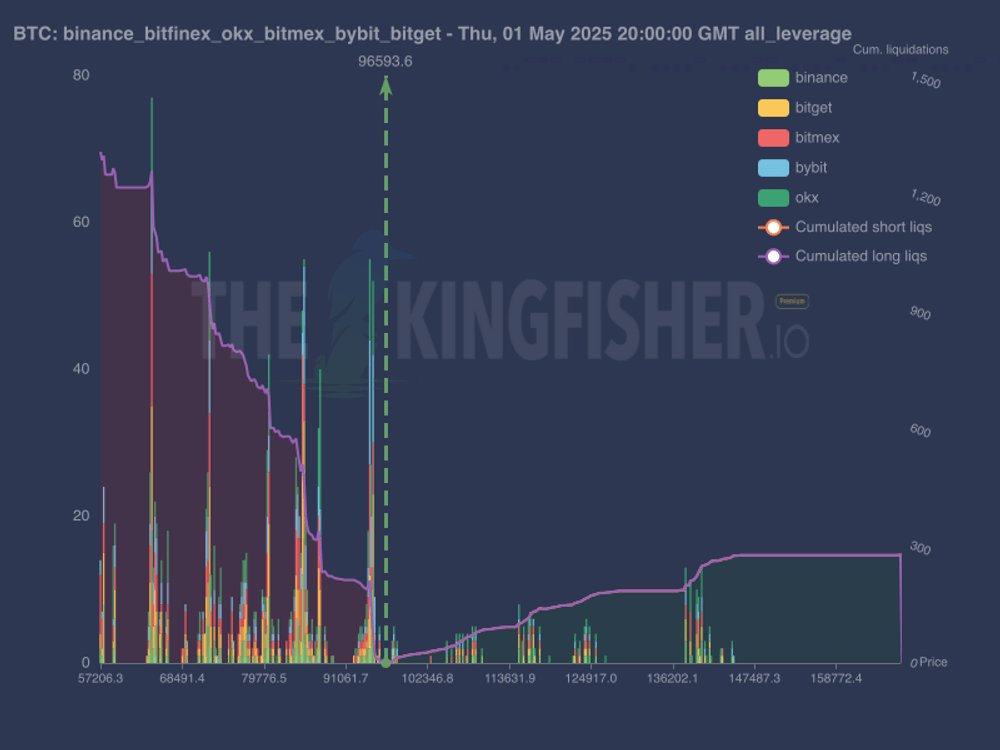

- Order Book Data: Analysis of order book data suggests that bulls may face challenges in maintaining the current upward trajectory.

Analyzing Long-Term Holder Behavior

Glassnode’s “The Week Onchain” newsletter highlights the potential for increased selling pressure as Bitcoin reaches multi-month highs. The firm uses various metrics to track investor profitability and observes that aggregate LTH unrealized profits are approaching the 350% mark. This level has historically prompted profit-taking, even among so-called “diamond hands.”

“Having established that the LTH cohort is expressing a preference to hold onto their supply, we can attempt to quantify the potential price levels required to entice them to part with their coins, and commence the next wave of profit taking,” Glassnode explains.

LTHs are defined as entities holding BTC for more than six months. The $100,000 price zone is identified as a critical level to monitor for changes in LTH behavior.

“Historically speaking, the Long-Term Holder cohort typically ramps up their spending pressure when the average member is holding a +350% unrealized profit margin,” the report states.

“Reconciling this information with the spot price, the average LTH is expected to hit a 350% profit margin at the $99.9k level. As such, we can anticipate an uptick in sell-side pressure as the market approaches this zone, making it an area that will likely require substantial buy-side demand to absorb the distribution, and sustain upwards momentum.”

Order Book Liquidity and Potential Downside

Despite reaching $97,500 this week, Bitcoin’s upside potential is being questioned by some traders. TheKingfisher, a popular trader, points to order book liquidity as a sign that sellers may capitalize on the recovery.

In an X post, TheKingfisher notes a significant concentration of long liquidations stacked up under ~$91k, while short positions above the current price ($96.6k) are relatively insignificant. This imbalance suggests a potential downside magnet is strong, posing a high risk for longs near current levels. The upside fuel appears thin for now.

“Huge imbalance suggests potential downside magnet is strong. High risk for longs near current levels. Upside fuel looks thin for now.”

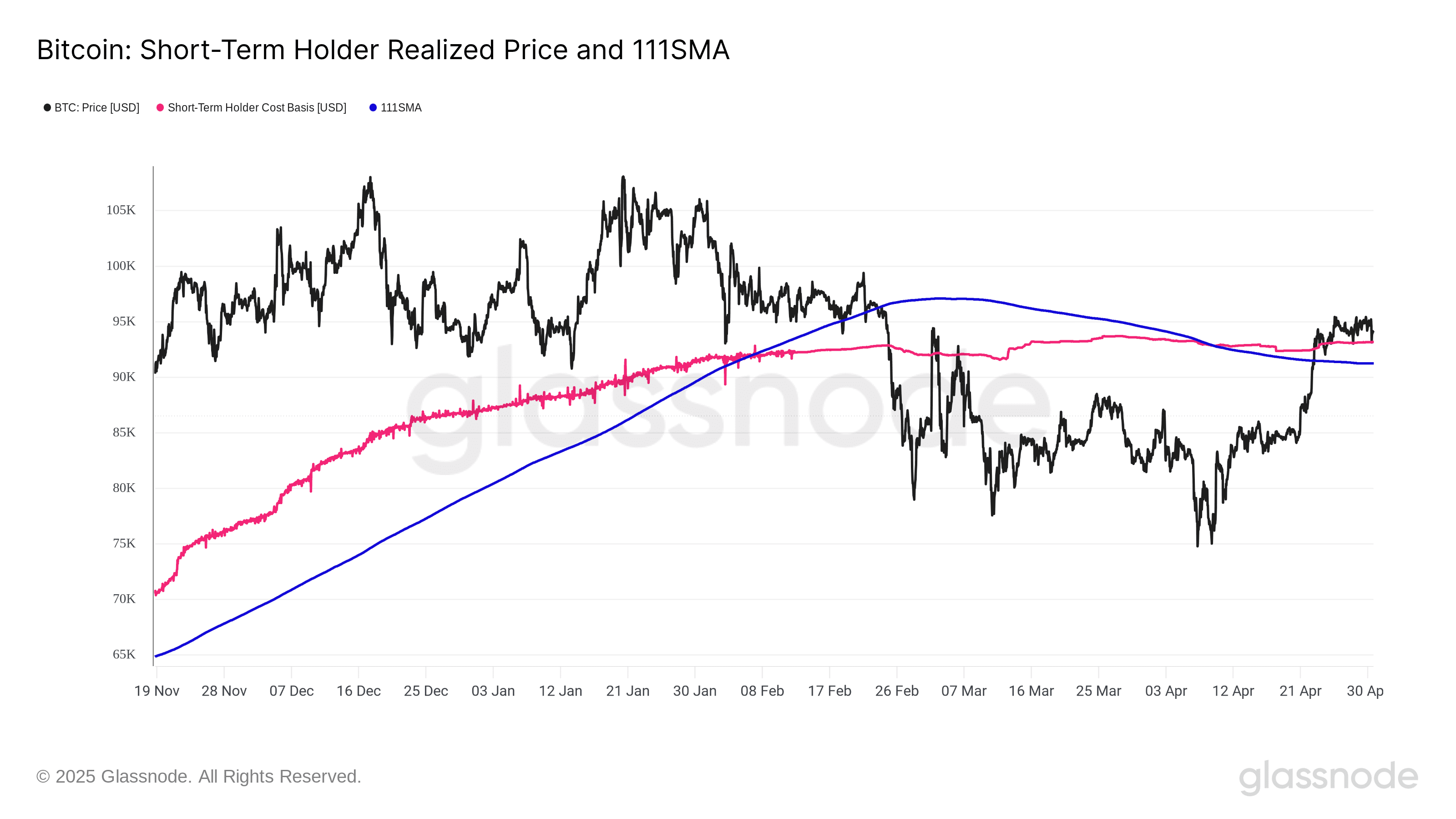

Analyzing Key Resistance and Support Levels

Glassnode also emphasizes the importance of breaking and holding key resistance/support levels, specifically referencing the 111-day simple moving average (SMA) and the aggregate cost basis of short-term holders (STHs).

“The price has recently surged above both of these pricing models and is now attempting to consolidate within this zone. This highlights a noteworthy degree of strength behind this upwards swing,” Glassnode comments.

However, they caution that these levels must be broken and held for further price appreciation. A rejection at this level could push the price back into bearish territory and return many investors to a state of significant unrealized loss.

“However, these are levels that must be broken and held for further price appreciation, as a rejection of this level would push the price back into bearish territory, and return many investors to a state of meaningful unrealized loss.”

Additional Factors Influencing Bitcoin Price

Beyond the analysis of LTH behavior and order book data, several other factors could influence Bitcoin’s price trajectory in the coming weeks:

- Macroeconomic Conditions: Inflation data, interest rate decisions by central banks, and overall economic growth can significantly impact investor sentiment and risk appetite.

- Regulatory Developments: Any regulatory changes related to cryptocurrency, either positive or negative, can have a substantial impact on market prices.

- Adoption by Institutional Investors: Increased adoption of Bitcoin by institutional investors, such as pension funds or hedge funds, could provide a significant boost to demand and price.

- Technological Advancements: Developments in Bitcoin technology, such as the implementation of the Lightning Network or other scalability solutions, could enhance its utility and drive adoption.

- Geopolitical Events: Global events, such as political instability or economic crises, can impact Bitcoin’s perceived value as a safe-haven asset.

Conclusion

Bitcoin’s price is currently navigating a complex landscape with potential for both significant gains and substantial losses. The looming threat of LTH sell-offs at the $100,000 mark, coupled with order book imbalances and the need to break through key resistance levels, suggests a cautious approach is warranted. Investors should carefully monitor these factors, along with broader macroeconomic conditions and regulatory developments, to make informed decisions. While the allure of a six-figure Bitcoin price is strong, the market remains vulnerable to potential downside risks.