Key Takeaways:

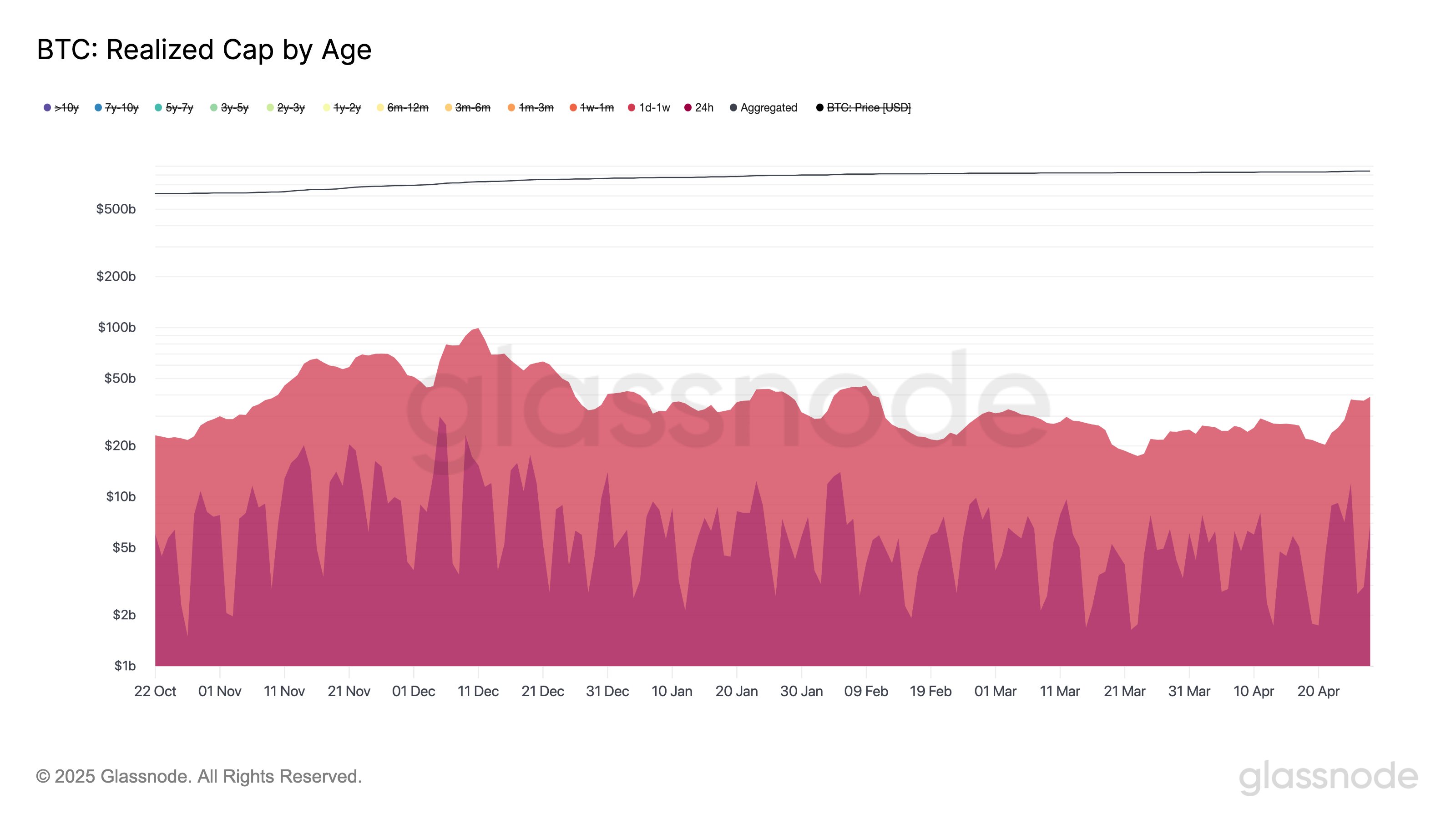

- Bitcoin’s ‘hot supply,’ representing recently-moved coins, is rapidly increasing, indicating new speculative capital entering the market.

- This ‘hot supply’ has doubled in just five weeks, signaling a significant shift in market sentiment since March lows.

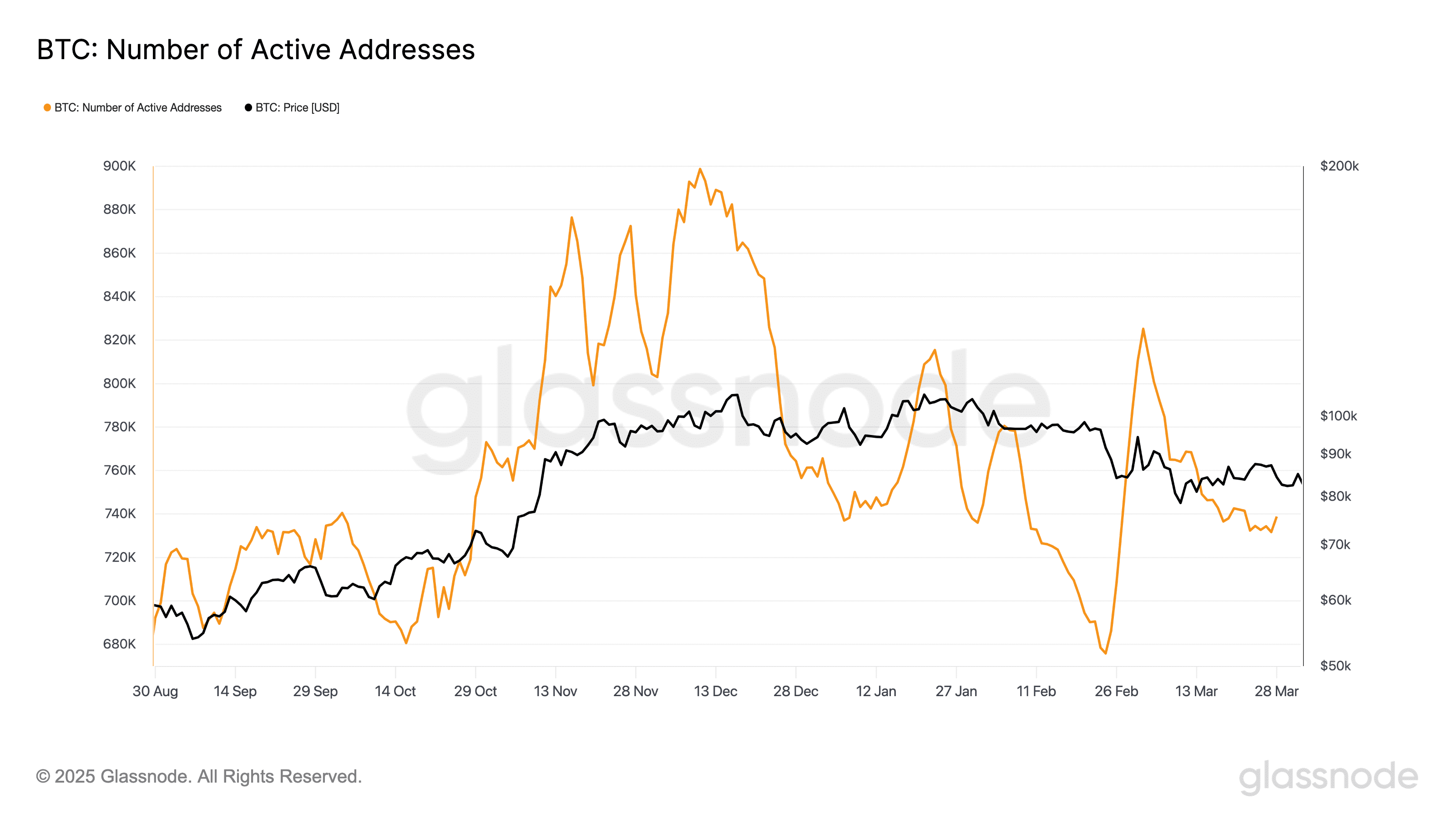

- While on-chain activity is recovering, daily active addresses remain below bull market levels, suggesting the need for further organic network engagement.

Bitcoin (BTC) is experiencing a notable influx of short-term holders (STHs) and speculative capital, reflected in a surge in its ‘hot supply.’ This metric, representing coins that have moved recently, provides insights into the current dynamics of the Bitcoin market.

What is Bitcoin ‘Hot Supply’?

‘Hot supply’ refers to the volume of Bitcoin that has been recently transacted, typically within the past week. It serves as an indicator of speculative activity and the entry of new capital into the market. A rising ‘hot supply’ suggests increased trading and potential price volatility.

Surge in Capital Turnover

According to onchain analytics firm Glassnode, Bitcoin’s ‘hot capital’ has experienced a significant surge. The sum of coins moved within the past week has reached its highest level since early February, indicating a substantial increase in short-term holder activity.

In the past week alone, ‘hot capital’ has surged by over 90%, approaching $40 billion. Since the local lows in late March, it has increased by $21.5 billion. This rapid turnover underscores a significant shift in market sentiment, suggesting a transition from dormancy to speculation among new market entrants.

‘BTC hot capital bottomed at $17.5B on March 23rd, its lowest level since December,’ Glassnode noted. ‘In just 5 weeks, it has added over $21.5B, suggesting a rapid shift from dormancy to speculation among newer market entrants.’

Analyzing the Implications

The increase in ‘hot supply’ has several implications for the Bitcoin market:

- Increased Volatility: Higher levels of speculative capital can lead to increased price volatility as short-term holders are more likely to react to market fluctuations.

- Potential for Price Appreciation: The influx of new capital can drive up demand for Bitcoin, potentially leading to price appreciation.

- Risk of Correction: If speculative fervor subsides, there is a risk of a price correction as short-term holders exit the market.

Bitcoin’s Bull Market Comeback: Is it in Progress?

While the surge in ‘hot supply’ suggests renewed interest in Bitcoin, analyzing overall network participation reveals a more nuanced picture. Short-term holders have recently returned to profitability as the price hovers near $95,000.

However, according to Glassnode, a full bull market comeback has not yet fully materialized. While early signs of FOMO (Fear Of Missing Out) are emerging, with metrics like Percent Supply in Profit and NUPL (Net Unrealized Profit/Loss) expanding, daily active addresses remain suppressed. This indicates that full organic network engagement is still rebuilding.

In their recent ‘Market Pulse’ analysis, Glassnode highlighted that while on-chain activity is recovering, daily active addresses are lagging behind, suggesting that broader user engagement needs to catch up.

Beyond the Numbers: Understanding Market Dynamics

The concept of ‘hot supply’ in Bitcoin provides a valuable lens through which to understand market dynamics. It is essential to consider this metric alongside other indicators, such as active addresses, transaction volumes, and overall market sentiment, to gain a comprehensive view of the Bitcoin ecosystem.

Factors Influencing Bitcoin’s ‘Hot Supply’

Several factors can contribute to fluctuations in Bitcoin’s ‘hot supply’:

- Market Sentiment: Positive news and increasing prices tend to attract new investors, increasing ‘hot supply.’

- Regulatory Developments: Regulatory clarity or favorable policies can encourage institutional investment and increase market activity.

- Technological Advancements: Innovations in Bitcoin technology can attract new users and increase transaction volumes.

- Macroeconomic Conditions: Economic uncertainty or inflation can drive investors towards Bitcoin as a store of value.

Looking Ahead

The surge in Bitcoin’s ‘hot supply’ signals a renewed interest in the cryptocurrency. However, it is crucial to remain vigilant and consider a broad range of indicators before making investment decisions. Monitoring factors like active addresses, on-chain activity, and overall market sentiment can provide a more complete picture of the Bitcoin market’s health and potential trajectory. As new investors enter the market, understanding the nuances of ‘hot supply’ and its implications can help navigate the complexities of the cryptocurrency landscape.