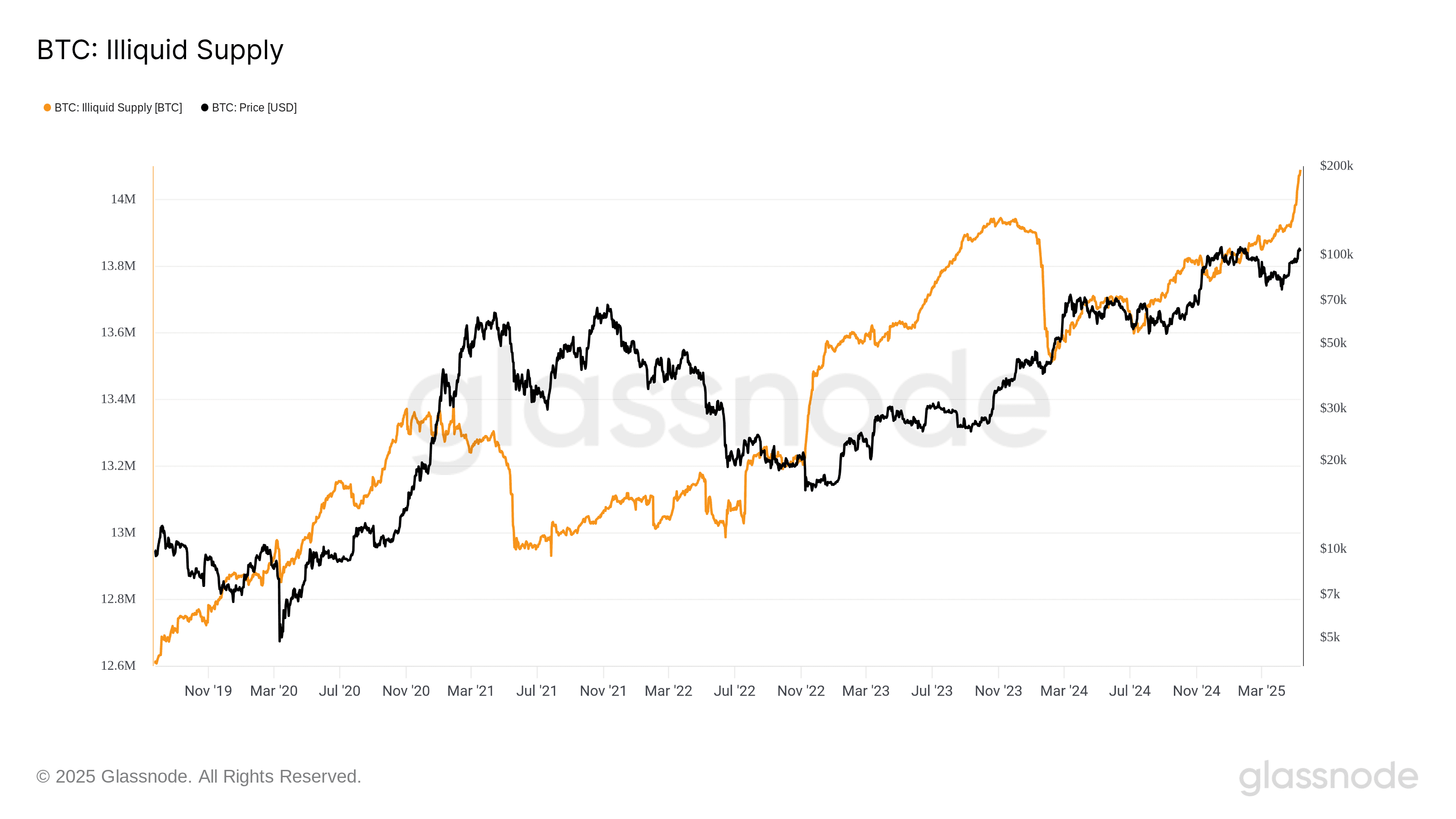

Bitcoin (BTC) is exhibiting a strong bullish signal as its illiquid supply hits a record high, indicating a growing trend of long-term holding among investors. According to data from Glassnode, the illiquid supply has reached 14 million BTC, surpassing previous records and highlighting a significant shift in investor behavior.

What is Illiquid Supply?

Illiquid supply refers to Bitcoin held in wallets with a history of low spending activity. These entities are considered to be accumulating Bitcoin with the intention of holding it for the long term, suggesting a strong belief in its future value. This contrasts with liquid supply, which represents Bitcoin that is actively traded and more readily available for sale.

Glassnode defines an entity as illiquid based on the ratio between its cumulative BTC inflows and outflows. A lower ratio indicates higher liquidity, meaning the entity spends a larger portion of its received assets. Illiquid entities, on the other hand, hoard coins, expecting long-term price appreciation.

Key Takeaways from the Illiquid Supply Increase:

- Record High: The illiquid supply now stands at 14 million BTC, the highest level ever recorded.

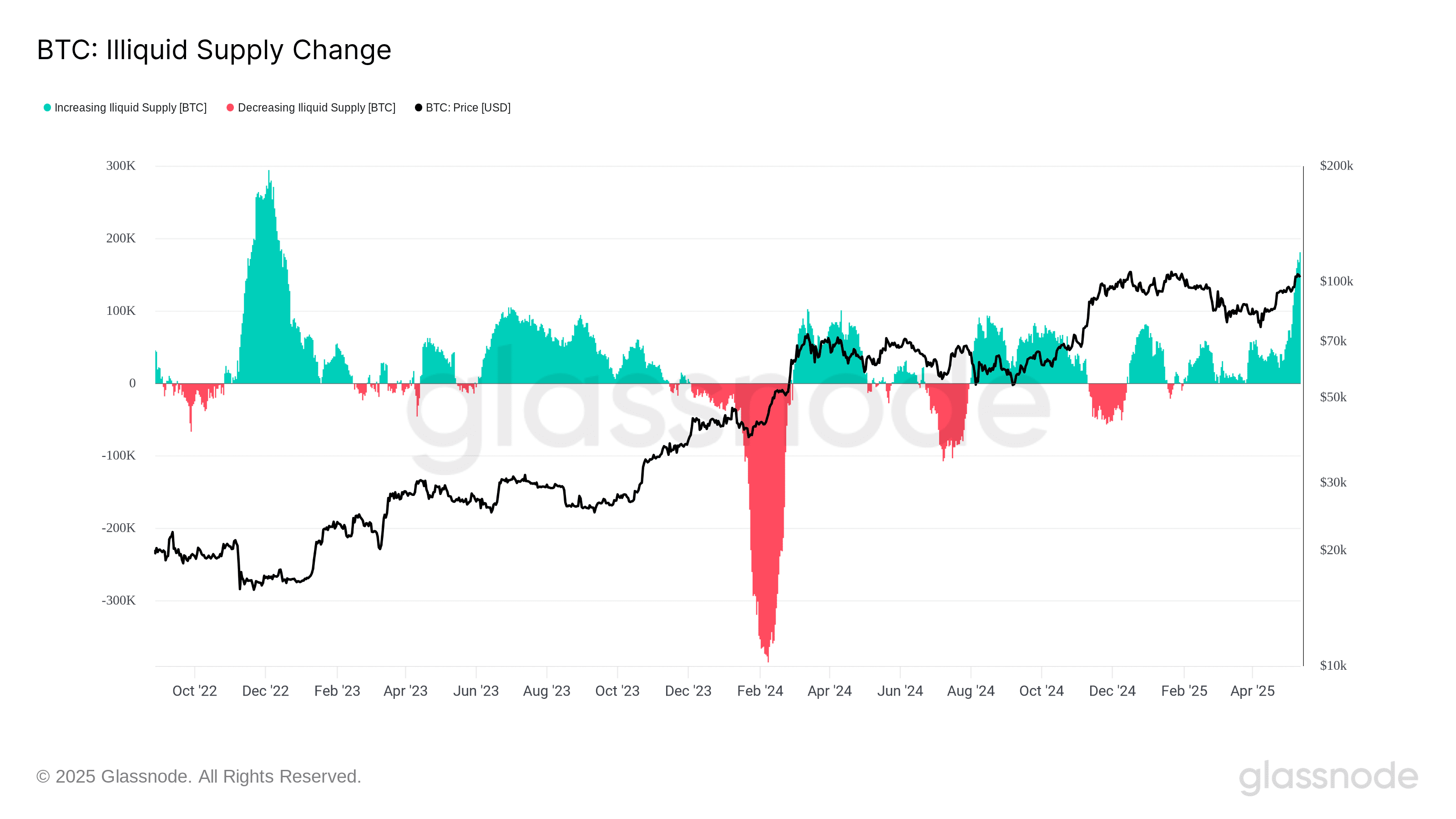

- 30-Day Increase: The 30-day rolling increase in illiquid supply reached 180,000 BTC, the largest jump since December 2022.

- Whale Accumulation: Large Bitcoin holders (whales) are actively accumulating more BTC, further contributing to the illiquid supply.

Whale Activity and Retail Behavior

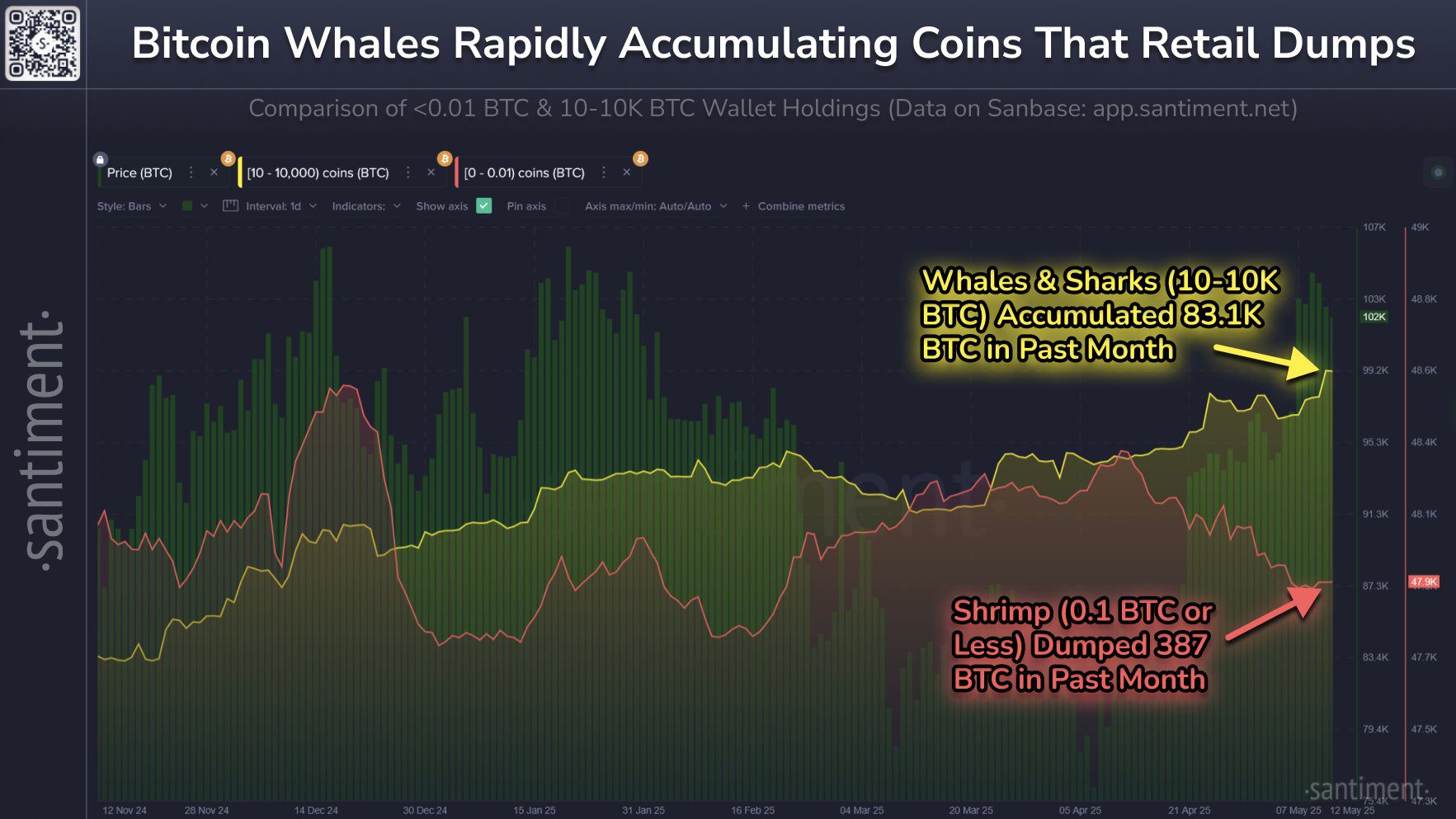

Recent data reveals a divergence in behavior between large Bitcoin holders (whales) and retail investors. Whales, defined as entities holding between 10 and 10,000 BTC, have accumulated over 83,000 BTC in the past month. This indicates strong confidence among large investors in Bitcoin’s long-term prospects.

Conversely, smaller retail holders (those holding less than 0.1 BTC) have been selling off their holdings, dumping approximately 387 BTC during the same period. This suggests that retail investors may be more susceptible to short-term price fluctuations and market volatility.

Implications for the Bitcoin Market

The increase in illiquid supply has several potential implications for the Bitcoin market:

- Reduced Selling Pressure: As more Bitcoin is locked up in illiquid wallets, the available supply for trading decreases, potentially reducing selling pressure and supporting price appreciation.

- Bullish Signal: The accumulation of Bitcoin by long-term holders is generally seen as a bullish signal, indicating a belief in the asset’s future value.

- Increased Scarcity: A shrinking liquid supply can lead to increased scarcity, potentially driving up the price of Bitcoin as demand increases.

Factors Driving Illiquid Supply Growth

Several factors could be contributing to the growth of Bitcoin’s illiquid supply:

- Institutional Adoption: Increased institutional investment in Bitcoin, including through spot ETFs, is driving demand and encouraging long-term holding.

- Corporate Treasuries: Companies like MicroStrategy are adding Bitcoin to their balance sheets, further reducing the available supply.

- Inflation Hedge: Some investors view Bitcoin as a hedge against inflation and are holding it as a store of value.

Conclusion

The surge in Bitcoin’s illiquid supply to a record 14 million BTC is a significant development, signaling a strong long-term holding trend among investors. The continued accumulation by whales, despite recent price volatility, reinforces this bullish outlook. As more Bitcoin is locked up in illiquid wallets, the potential for future price appreciation increases, highlighting the growing scarcity and long-term value proposition of Bitcoin.