Introduction: Bitcoin’s Evolving Market Dynamics

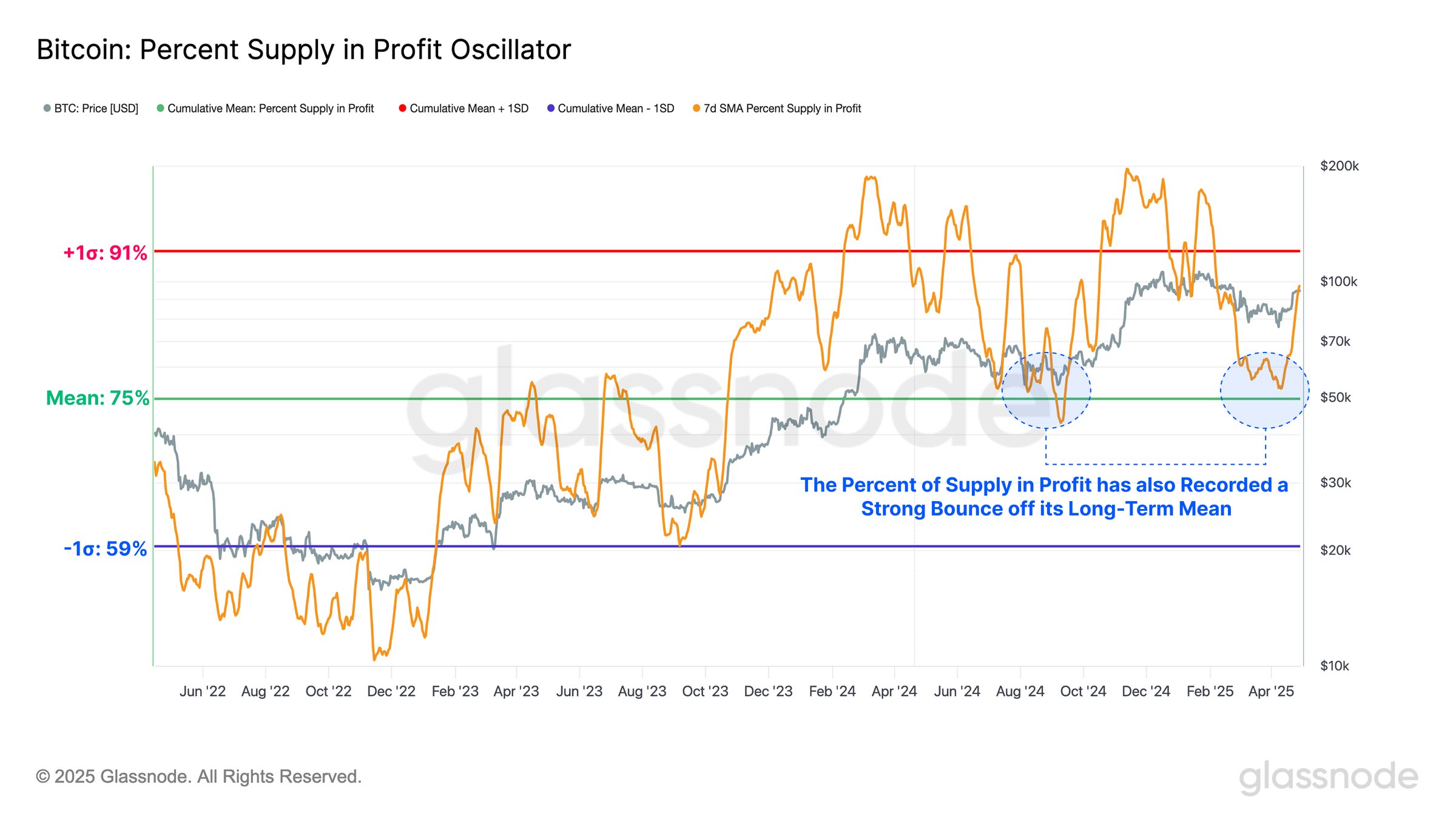

Bitcoin’s market is currently exhibiting interesting dynamics, with on-chain data indicating a significant shift in investor sentiment and profitability. According to recent analysis, 88% of the Bitcoin supply is now in profit, specifically for those who acquired BTC below $95,000. This article delves into the key factors influencing this shift, exploring potential market bottoms, exchange flows, and critical indicators like the Market Value to Realized Value (MVRV) ratio. We’ll examine how these elements collectively paint a picture of a maturing Bitcoin market with potentially reduced selling pressure and a more stable foundation for future growth.

Key Takeaways:

-

High Profitability: 88% of Bitcoin’s supply is in profit below $95,000, signaling a reset in investor expectations and confidence.

-

Potential Market Bottom: The $75,000–$95,000 price range may represent a structural bottom, aligning with market conditions observed earlier in the year.

-

Cooling Unrealized Gains: The Market Value to Realized Value (MVRV) Ratio at 1.74 acts as a historical support zone, indicating a cooling of unrealized gains and a potential base for future growth.

- Reduced Exchange Inflows: Decreased exchange inflows suggest diminished selling pressure from holders, reinforcing a more stable market environment.

Profitability and Investor Expectations

Data reveals that a significant portion of the Bitcoin supply is currently in profit. This profitability contrasts sharply with periods where losses were concentrated among buyers in higher price ranges (e.g., $95,000 – $100,000). The rebound from a long-term profitability mean of 75% indicates a notable shift in investor expectations. This suggests that investors who bought below $95,000 are likely holding onto their assets, anticipating further price appreciation.

$75,000 – $95,000: A Potential Structural Bottom?

Bitcoin’s price has shown resilience in the $75,000 to $95,000 range. The fact that Bitcoin retested the 75% mean in profit percentage around $60,000 earlier suggests this range could be a structural bottom, aligning with the market conditions observed during Q3 2024. This level acts as a psychological support, where buyers are more likely to step in and prevent further price declines.

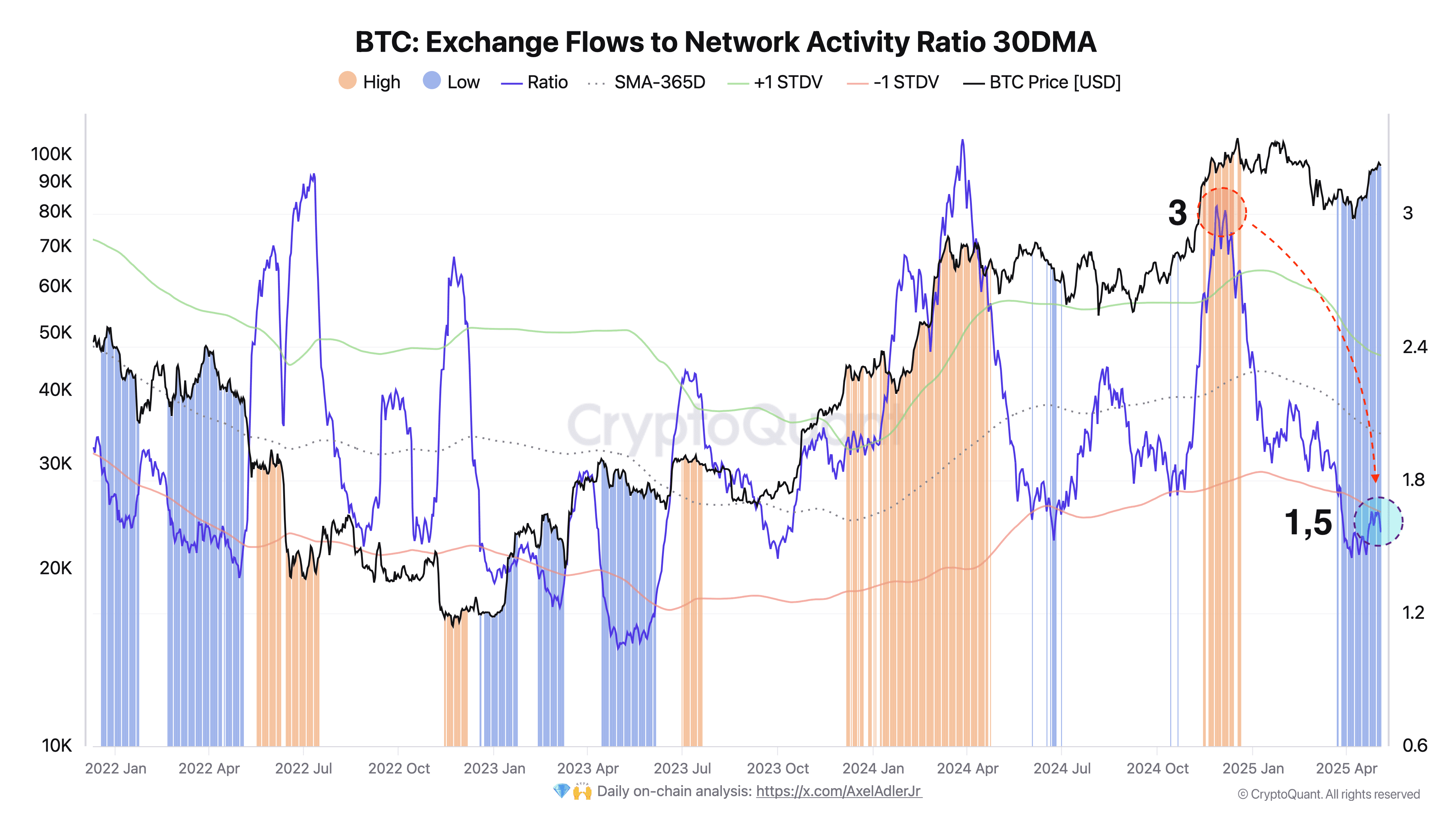

Exchange Flows and Organic Growth

Analyzing exchange flows (both inflows and outflows) relative to network activity provides valuable insights into holder behavior. A decrease in the ratio of exchange flow to network activity suggests that the current market growth is more organic, driven by genuine demand rather than speculative trading or heavy selling. Less selling pressure from long-term holders is a very bullish signal.

The decrease in holder sales through exchanges confirms a growing sentiment that investors view BTC as undervalued in the $75,000 to $95,000 range. This mindset shift reinforces a stable market environment, where holders are less inclined to sell at these levels, further reducing the selling pressure.

MVRV Ratio: Cooling Unrealized Gains

The Market Value to Realized Value (MVRV) Ratio is a critical indicator of market sentiment. A return to the long-term mean of 1.74 suggests a cooling of unrealized gains. Historically, this level has acted as a support zone during consolidation phases, signaling a potential base for future growth. When the MVRV ratio is at its long-term mean, it is a sign that Bitcoin is fairly valued by the market, not over or undervalued.

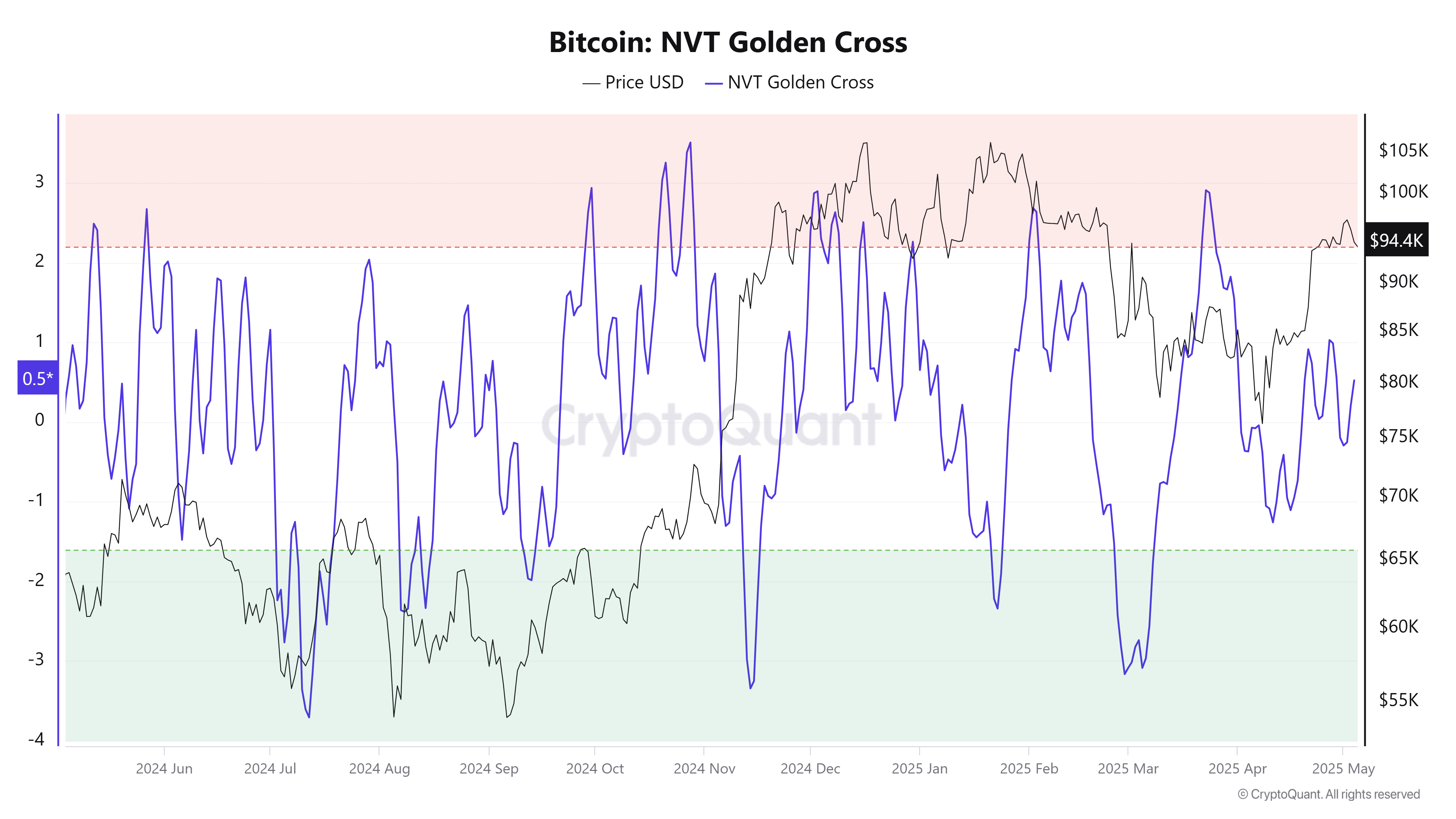

Network Value to Transactions (NVT) Ratio

The Network Value to Transactions (NVT) ratio is another helpful indicator when determining the current state of the market. When Bitcoin was previously priced at a similar level, the NVT ratio showed an overbought signal. However, it has now returned to a neutral level, which suggests that the current growth is more sustainable than previous rallies.

Broader Implications and Future Outlook

The shift in market dynamics, coupled with evolving holder behavior, suggests that the current cohort of profitable investors may be less inclined to sell. This reinforces a more bullish case for the present market structure. As Bitcoin’s adoption continues to grow and institutional interest increases, these indicators provide valuable insights into the long-term health and stability of the market.

In conclusion, the analysis of on-chain data reveals a maturing Bitcoin market with several key factors supporting potential future growth. The high percentage of supply in profit, the potential structural bottom in the $75,000 – $95,000 range, the cooling of unrealized gains as indicated by the MVRV ratio, and reduced exchange inflows all contribute to a more stable and sustainable market environment. Investors are keenly watching these developments, as they could pave the way for the next phase of Bitcoin’s evolution.

Disclaimer: This article is for informational purposes only and should not be construed as investment advice. Cryptocurrency investments are highly speculative and involve substantial risk of loss. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.