Bitcoin Launderer Sentenced to 6 Years for ‘No Questions Asked’ Cash-to-BTC Service

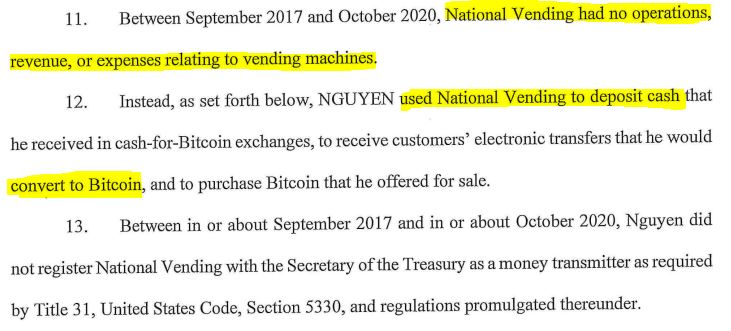

A US man, Trung Nguyen, who ran a ‘no questions asked’ cash-to-Bitcoin conversion service, has been sentenced to six years in prison and ordered to forfeit $1.5 million. The Boston federal court Judge Richard Stearns handed down the sentence, followed by three years of supervised release, as announced by the Boston US Attorney’s Office on May 22. Nguyen, from Danvers, Massachusetts, operated an unlicensed money-transmitting business called National Vending between September 2017 and October 2020.

The ‘National Vending’ Scheme

Prosecutors revealed that Nguyen learned techniques from an online course on how to evade authorities. The course taught him to conceal his actual business activities from banks, crypto exchanges, and state authorities. He masqueraded as a vending machine company accepting cash deposits, maintained a list of fictional suppliers, and avoided using the term ‘Bitcoin’ whenever possible.

Customers and Transactions

Nguyen’s customer base included scam victims who were tricked into converting cash into Bitcoin by overseas con artists, as well as a drug dealer who sent $250,000 in cash across 10 transactions in 2018. The Justice Department stated that Nguyen converted over $1 million to Bitcoin and ‘purposely failed’ to register with the Treasury’s Financial Crimes Enforcement Network (FinCEN), despite being required to under federal Anti-Money Laundering regulations. He also failed to file Suspicious Activity Reports or Currency Transaction Reports on any transactions, including cash transactions exceeding $10,000.

Undercover Operation and Arrest

Nguyen’s downfall came from meeting clients in person to accept large sums of cash. According to a May 2023 indictment, during several meetings with undercover law enforcement officers, he accepted cash and sent Bitcoin in return, taking just over 5% in commission. He used encrypted messaging apps and technologies to make it more difficult to trace his Bitcoin transactions. Furthermore, he broke up the cash deposits into smaller sums over consecutive days and at different branches of the same bank to evade notice by authorities.

Legal Proceedings and Verdict

Nguyen was charged with operating an unlicensed money transmitting business and two counts of money laundering. He pleaded not guilty to all charges in June 2023. However, a jury convicted him in November on the unlicensed money-transmitting business charge and on one of the money laundering charges, finding him not guilty of the other.

Key Takeaways

- Sentence: Trung Nguyen received a 6-year prison sentence.

- Forfeiture: He was ordered to forfeit $1.5 million.

- Charges: Convicted of operating an unlicensed money-transmitting business and one count of money laundering.

- Scheme: Operated a ‘no questions asked’ cash-to-Bitcoin conversion service, disguising it as a vending machine business.

- Evasion Tactics: Used encrypted messaging apps, broke up cash deposits, and avoided using the term ‘Bitcoin’.

The Broader Implications for Cryptocurrency Regulation

This case underscores the ongoing scrutiny and regulatory challenges surrounding cryptocurrency and its potential use in illicit activities. Law enforcement agencies are increasingly focused on identifying and prosecuting individuals who use cryptocurrency to facilitate money laundering and other financial crimes. The sentencing of Trung Nguyen serves as a warning to those who seek to exploit the anonymity of cryptocurrency for illegal purposes.

Financial institutions and cryptocurrency exchanges are also facing increased pressure to implement robust anti-money laundering (AML) and know-your-customer (KYC) protocols. These measures are designed to prevent criminals from using cryptocurrency platforms to launder money or finance terrorism. Regulators are also exploring ways to improve the transparency and traceability of cryptocurrency transactions.

The Future of Cryptocurrency Regulation

As the cryptocurrency industry continues to evolve, it is likely that regulatory oversight will increase. Governments around the world are grappling with how to balance the need to foster innovation with the imperative to protect consumers and prevent financial crime. The outcome of these debates will have a significant impact on the future of cryptocurrency and its role in the global economy.

The Trung Nguyen case highlights the importance of compliance and the serious consequences that can arise from engaging in illegal activities involving cryptocurrency. As the industry matures, it is essential for all participants to adhere to the highest standards of ethical conduct and regulatory compliance.