Key Takeaways:

- Bitcoin’s long-term holders (LTHs) experienced a significant $26 billion increase in their realized market cap as the price recovered to $94,900.

- Short-term holders (STHs) showed a tendency to sell at a loss during the early April drawdown, demonstrating differing investment strategies.

- Bitcoin’s 30% price correction aligns with historical patterns, suggesting a potentially healthy market cycle. Support levels are anticipated around $88,750 and $91,000.

Bitcoin (BTC) has recently shown resilience, with long-term holders (LTHs) benefiting substantially from its price recovery. This analysis delves into the factors contributing to this trend, examining the behavior of both LTHs and short-term holders (STHs), as well as potential future price movements.

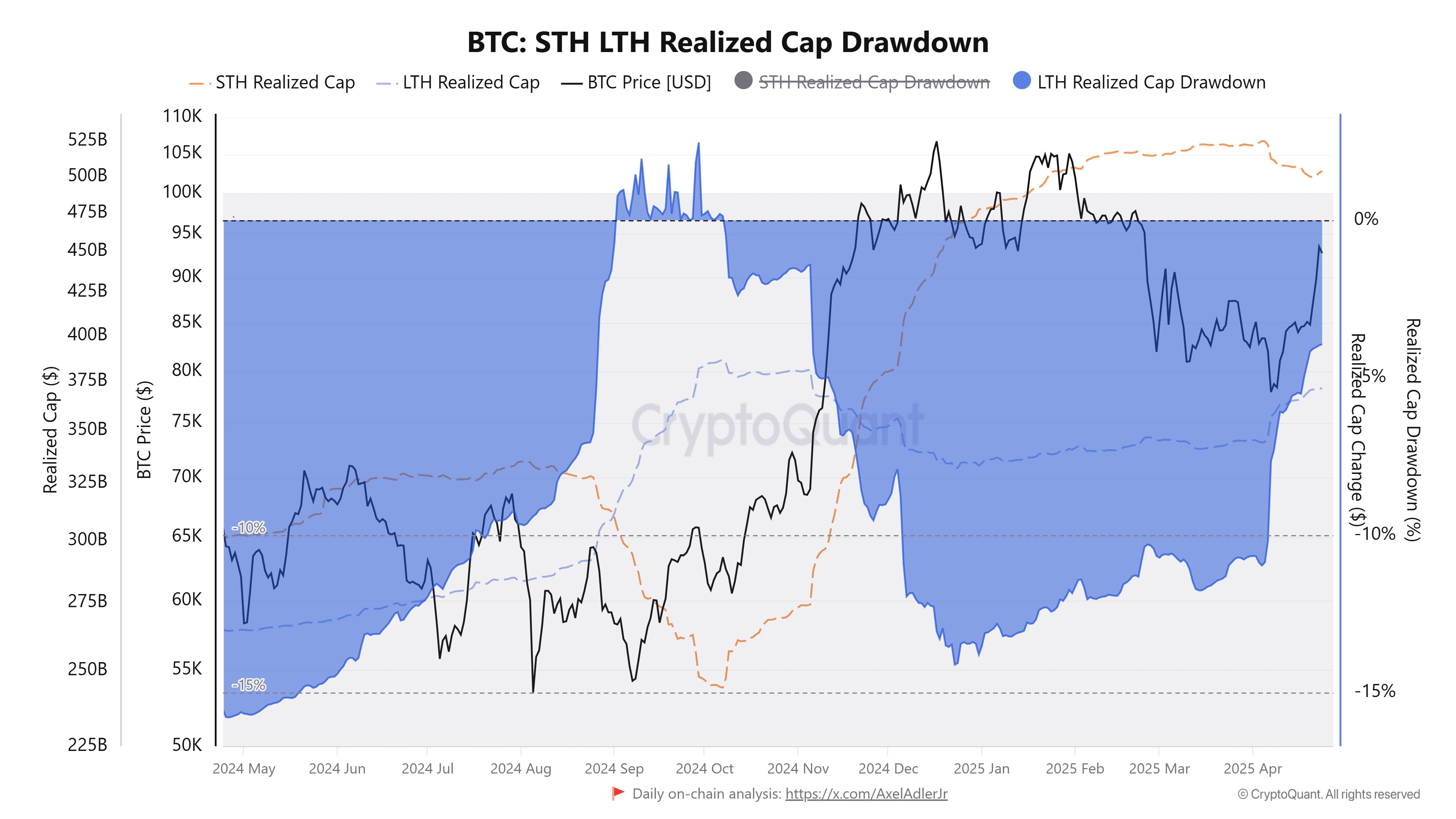

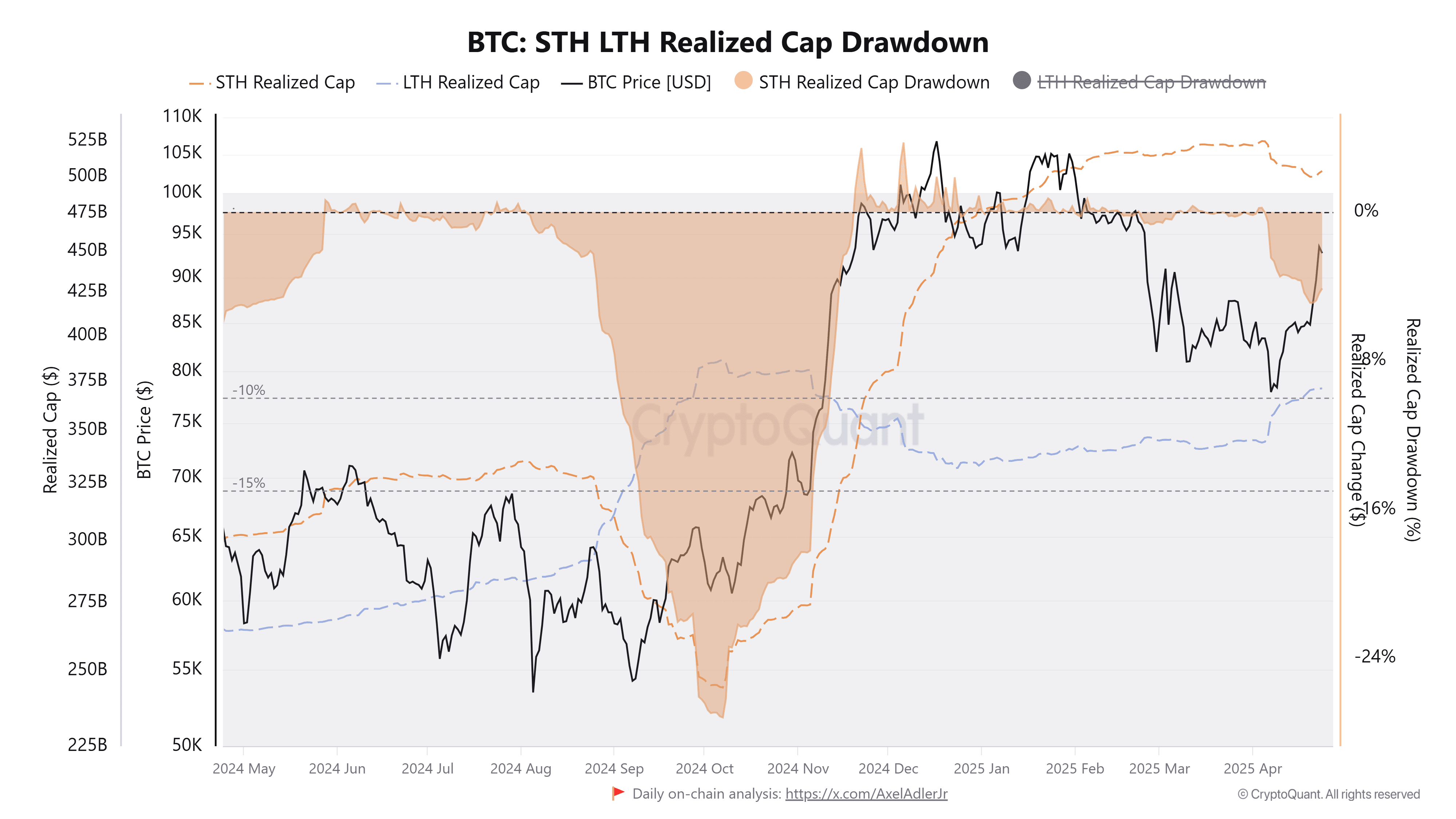

Long-Term Holders and Realized Gains:

Data indicates a notable increase in the realized market cap of LTHs between April 1st and April 23rd. This $26 billion surge signifies the rewards reaped by long-term investors who maintained their positions during market fluctuations.

Historical Context: Bitcoin’s Cyclical Nature:

The recent 30%+ correction in Bitcoin’s price isn’t an anomaly. Historical data from 2013, 2017, and 2021 demonstrates that such drawdowns are common after Bitcoin reaches new all-time highs. These corrections often serve to weed out weaker hands before the price resumes its upward trajectory. This aligns with the common phrase in crypto market cycles which is ‘shake out before breakout’.

Bitcoin Decoupling from Traditional Markets:

Bitcoin’s increasing independence from traditional financial markets, particularly as US equities face headwinds, strengthens its appeal as an investment. While stocks struggle, assets like gold surge, reflecting investor demand for non-correlated holdings. This bolsters confidence in Bitcoin’s potential as a store of value.

Short-Term Holder Behavior:

In contrast to LTHs, short-term holders (STHs) often react differently to market volatility. Many STHs sold at a loss during the recent drawdown, highlighting their tendency to rotate positions under pressure. This pattern of STHs selling to LTHs during corrections has been observed throughout 2024.

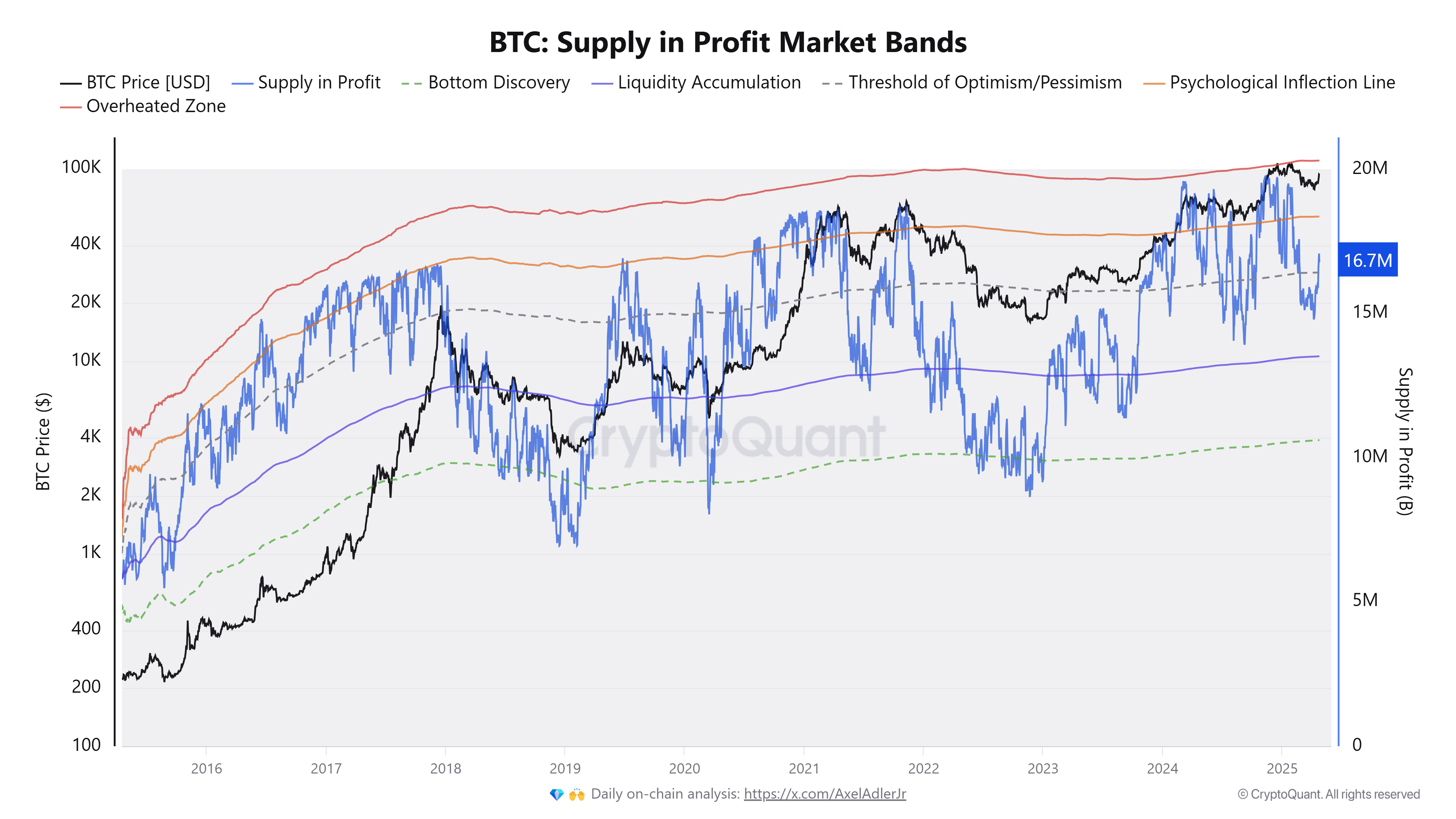

Bitcoin Supply in Profit: A Bullish Signal?

The total Bitcoin supply in profit has risen above a key threshold, potentially signaling a bullish outlook. Currently, 16.7 million BTC across various addresses are in profit. Historically, when Bitcoin consistently holds above this zone, significant bull runs have followed, driving prices to new highs within months.

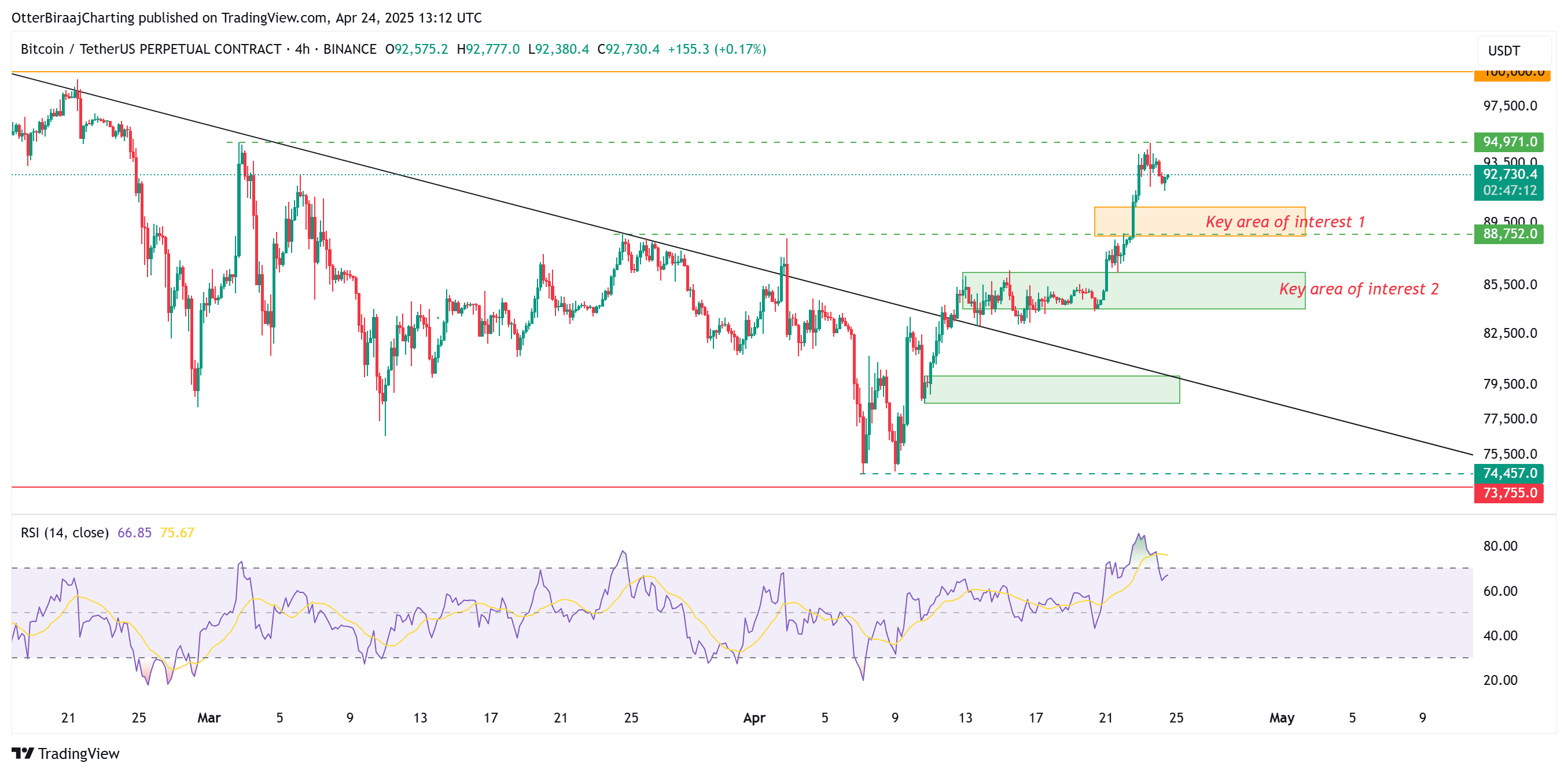

Potential Price Consolidation and Support Levels:

Analysts anticipate a potential cooldown period following Bitcoin’s rise to $94,900. Experts suggest that such corrections are normal after significant breakouts. From a technical standpoint, Bitcoin might consolidate between $94,900 and $88,750 in the near term.

Key support levels to watch lie between $90,500 and $88,750. A breach below this range could weaken the bullish structure, potentially pushing prices towards the next support area between $84,000 and $86,300.

Factors Influencing Bitcoin’s Price: Further Insights

Beyond the dynamics of long-term vs. short-term holders and technical analysis, several broader factors influence Bitcoin’s price. These include:

- Macroeconomic Conditions: Inflation rates, interest rate decisions by central banks, and overall economic stability all impact investor sentiment and risk appetite, influencing Bitcoin’s attractiveness as an alternative asset.

- Regulatory Developments: Regulations surrounding Bitcoin and other cryptocurrencies can have a significant impact on adoption and investor confidence. Positive regulatory clarity can drive prices up, while negative or uncertain regulations can create downward pressure.

- Institutional Adoption: Increased investment from institutional investors (e.g., hedge funds, pension funds, corporations) can inject significant capital into the Bitcoin market and validate its long-term viability.

- Technological Advancements: Developments in Bitcoin’s underlying technology, such as improvements in scalability, security, and privacy, can enhance its appeal and drive adoption. The development of the Lightning Network, for example, aims to improve transaction speeds and reduce fees.

- Geopolitical Events: Political instability, conflicts, and economic sanctions can lead investors to seek safe-haven assets like Bitcoin.

Conclusion:

Bitcoin’s recent price recovery has benefited long-term holders, while short-term holders exhibited a more reactive approach. A deeper understanding of these dynamics, combined with careful consideration of technical indicators and broader market factors, is essential for navigating the complexities of the Bitcoin market. While short-term volatility is expected, the long-term outlook for Bitcoin remains tied to its ongoing adoption and its evolving role in the global financial landscape.

This analysis is for informational purposes only and does not constitute financial advice. Investing in Bitcoin and other cryptocurrencies carries inherent risks. Readers should conduct their own thorough research and consult with a qualified financial advisor before making any investment decisions.