Key Takeaways

- Bitcoin miners have reversed their selling trend and are now accumulating BTC, signaling a potential shift in market dynamics.

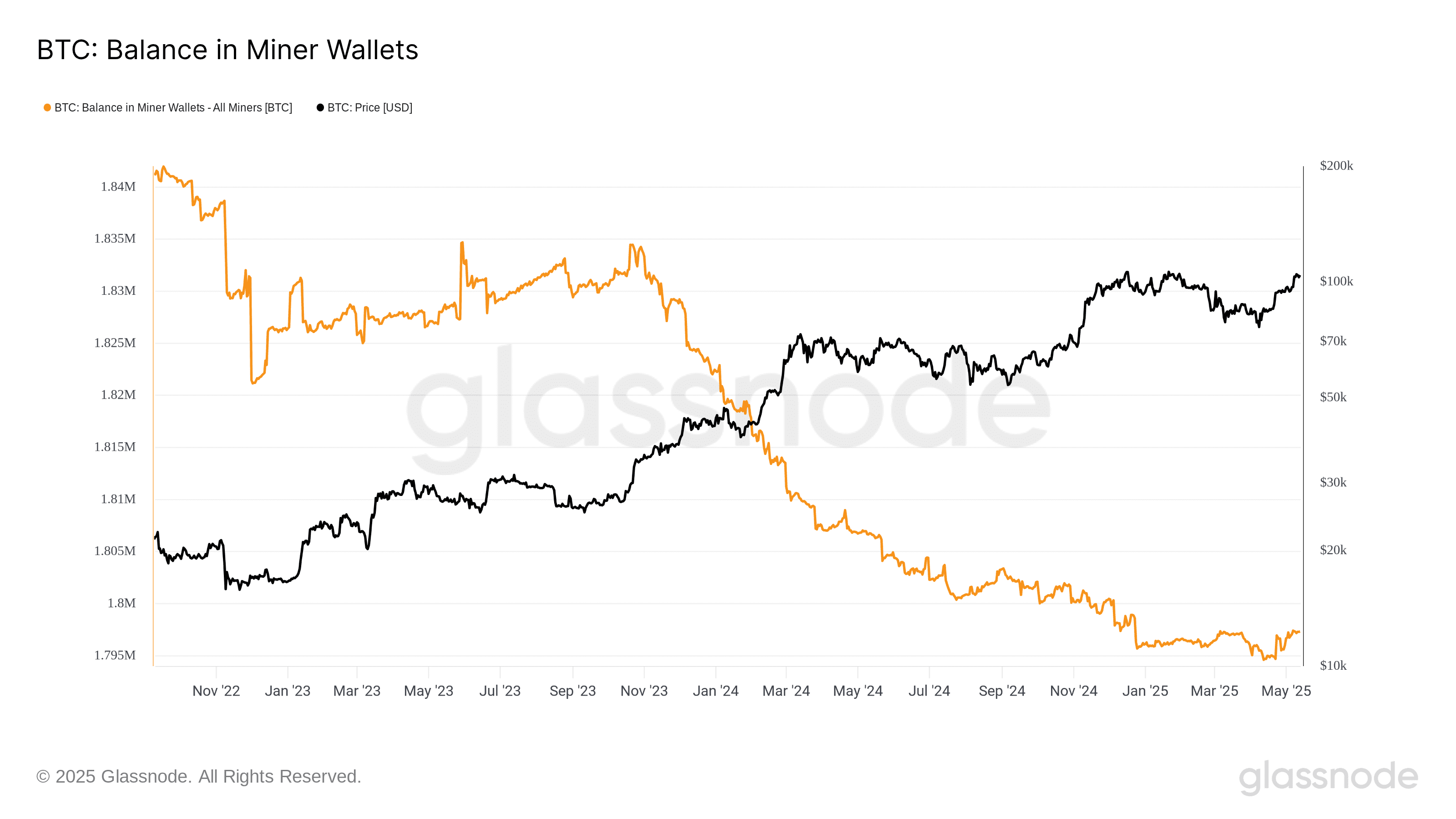

- Miner wallet balances have increased by approximately 2,700 BTC over the past month.

- The Hash Ribbons indicator, a classic metric for miner behavior, continues to show a ‘buy’ signal, suggesting further upside potential for Bitcoin.

Bitcoin (BTC) miners, who play a crucial role in maintaining the network’s integrity, are showing signs of renewed confidence as they transition from sellers to holders of the cryptocurrency. This shift coincides with a notable price rebound and positive signals from key on-chain metrics, indicating a potentially bullish outlook for Bitcoin.

Miners Turn Accumulators

After months of selling pressure, data from Glassnode reveals that Bitcoin miners have begun accumulating BTC in their wallets. This reversal occurred around the time BTC/USD hit multi-month lows near $75,000, suggesting that miners view this level as an attractive entry point. As of May 13, miner wallets held 1,797,330 BTC, an increase of 2,708 BTC from April 12. While this increase may seem small relative to total miner holdings, it represents a significant change in sentiment and behavior.

This accumulation trend has sparked optimism among analysts, with Mister Crypto calling it ‘Extremely bullish for Bitcoin!’ The reduction in miner sell-side pressure has also contributed to positive price trends, as institutional buy volumes have outpaced the amount of newly mined BTC.

Hash Ribbons Signal: A Bullish Indicator

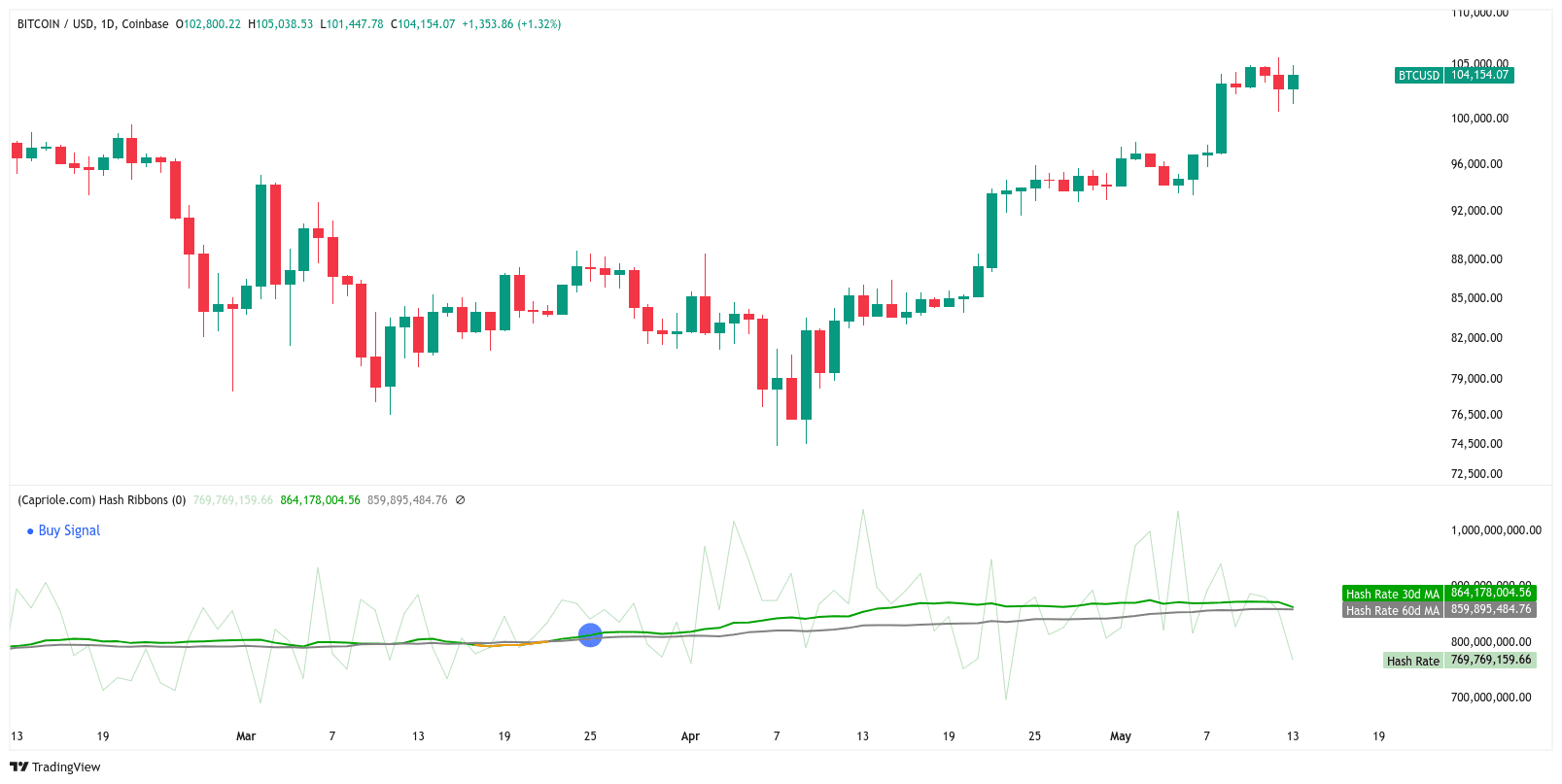

The Hash Ribbons indicator, developed by Capriole Investments, is a widely used tool for identifying periods of miner capitulation and potential buying opportunities. It uses moving averages of hashrate to signal when miners are under stress and may be forced to sell their holdings. When the Hash Ribbons indicator flashes a ‘buy’ signal, it suggests that miner capitulation is ending and that the market may be poised for a recovery.

Since the latest ‘buy’ signal in late March, BTC/USD has gained approximately 20%. This performance aligns with the historical accuracy of the Hash Ribbons indicator in predicting bullish trends.

The Hash Ribbons indicator’s continued ‘buy’ signal suggests that Bitcoin may have further upside potential in the near term. Investors and traders often use this indicator as part of a broader strategy to identify favorable entry points in the market.

Factors Influencing Miner Behavior

Several factors can influence the behavior of Bitcoin miners. These include:

- Bitcoin Price: The price of Bitcoin is a primary driver of miner profitability. Higher prices incentivize miners to hold onto their BTC, while lower prices may force them to sell to cover operating costs.

- Mining Difficulty: The difficulty of mining Bitcoin adjusts periodically to maintain a consistent block creation rate. Higher difficulty increases the computational resources required to mine a block, potentially impacting miner profitability.

- Energy Costs: Bitcoin mining is an energy-intensive process, and electricity costs can significantly impact miner profitability. Miners often seek locations with low energy prices to maximize their earnings.

- Regulatory Environment: Regulatory changes and government policies can also influence miner behavior. For example, crackdowns on mining operations in certain regions may force miners to relocate or reduce their activities.

Conclusion

The recent shift in Bitcoin miner behavior from selling to accumulating BTC, coupled with the ongoing ‘buy’ signal from the Hash Ribbons indicator, suggests a potential bullish outlook for Bitcoin. While various factors can influence miner behavior, the current trends indicate a renewed confidence in the cryptocurrency’s long-term prospects. As always, investors and traders should conduct thorough research and consider their risk tolerance before making any investment decisions.