The Changing Landscape of Bitcoin Mining Finance

The Bitcoin mining industry is undergoing a significant transformation. Following the crypto winter of 2022, which saw many miners burdened by unsustainable debt levels, a strategic shift towards equity financing is underway. This transition, coupled with diversification into high-performance computing (HPC) and artificial intelligence (AI), is reshaping the financial landscape for these companies.

Debt-to-Equity Shift: A Necessary Correction

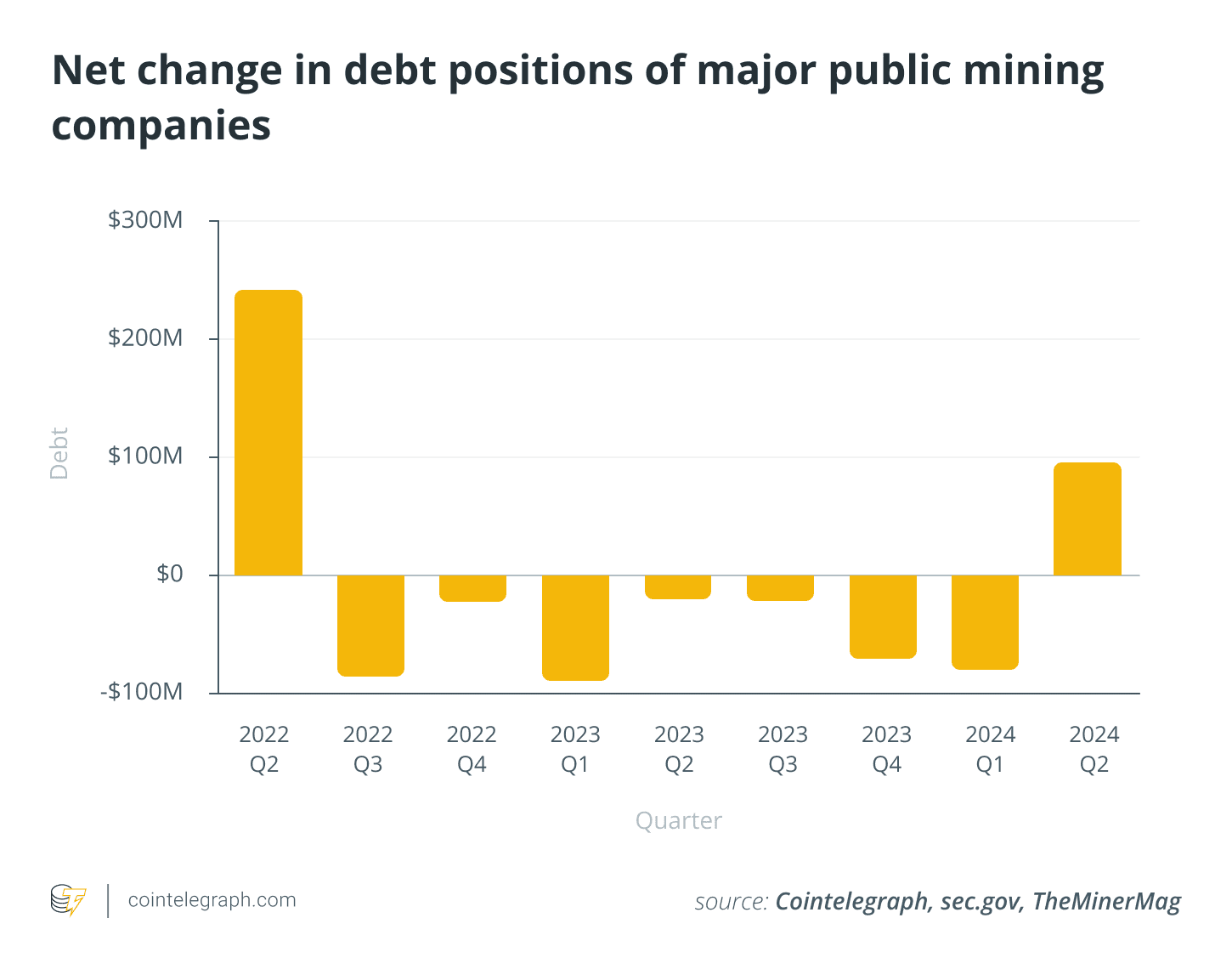

The excessive reliance on debt financing proved detrimental to many Bitcoin miners during the market downturn. High debt-to-equity ratios, often exceeding sustainable levels, led to bankruptcies. Since then, the industry has been actively deleveraging, reducing its reliance on loans and seeking alternative funding methods. The exception was Q2 2024 when Hut 8 made a significant investment in AI.

This deleveraging offers several benefits:

- Reduced debt-servicing costs, particularly crucial in a high-interest rate environment.

- Improved creditworthiness, making it easier to secure future financing under more favorable terms.

- Greater focus on strategic development, including diversification into new revenue streams.

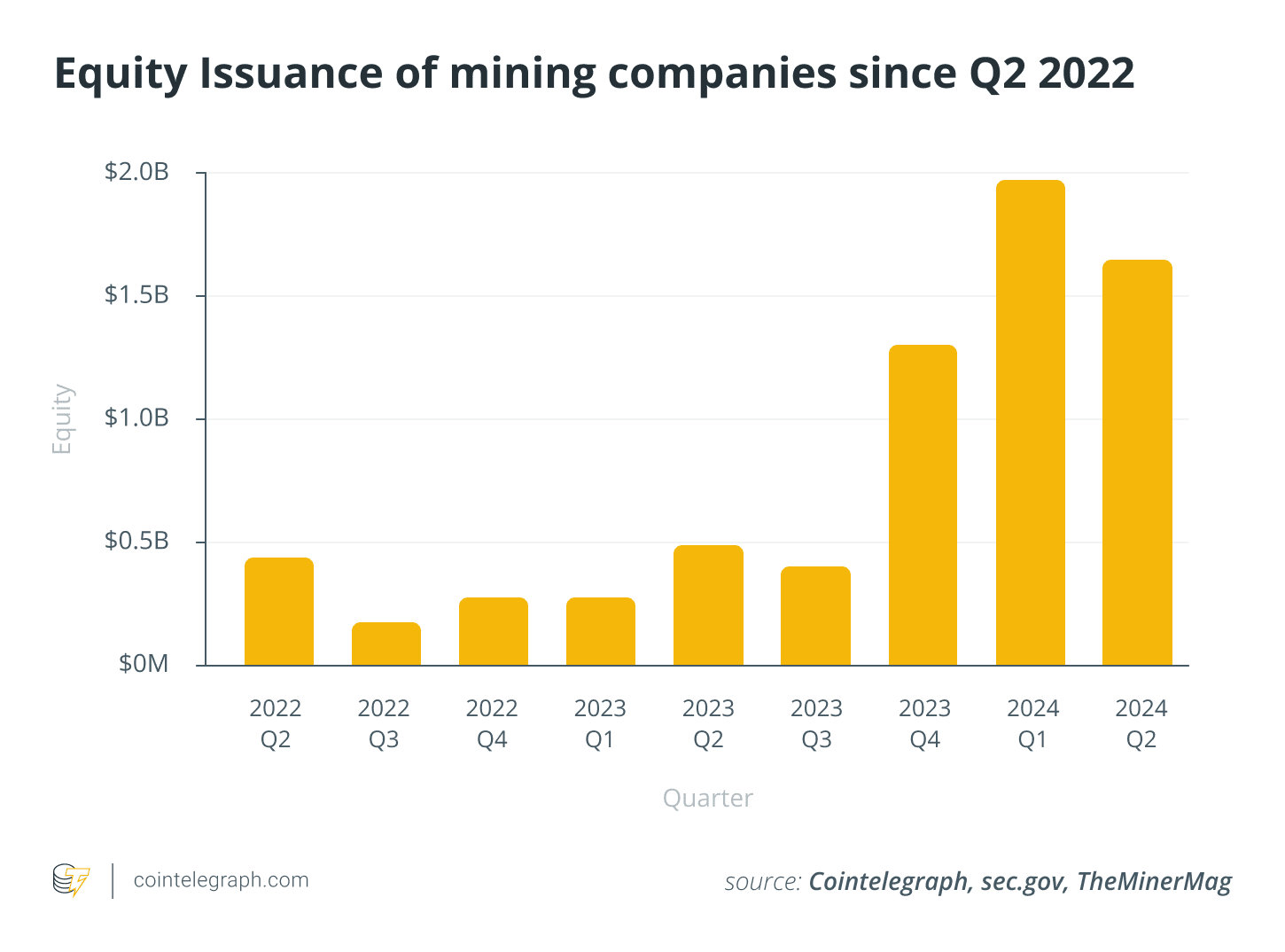

Since Q4 2023, miners have increasingly turned to equity issuance to fund their operations, raising over $4.9 billion between Q3 2023 and Q2 2024, dwarfing the preceding quarters. This influx of equity capital provides miners with the financial flexibility to invest in critical infrastructure upgrades and explore new avenues for growth.

The Halving and the Need for Upgrades

A primary driver for this shift towards equity financing is the need to upgrade hardware in response to the Bitcoin halving. The halving events reduce the rewards miners receive for validating transactions, squeezing margins and necessitating the adoption of more efficient mining equipment to maintain profitability.

Diversification into AI and HPC: A Strategic Imperative

Beyond hardware upgrades, Bitcoin miners are increasingly diversifying their operations into the realm of HPC and AI. This strategic move offers several advantages:

- New Revenue Streams: HPC and AI provide alternative revenue streams, reducing reliance on Bitcoin mining alone.

- Access to Capital: Investors are more willing to provide equity capital to miners with diversified operations.

- Competitive Advantage: Bitcoin miners often have existing infrastructure and access to the power grid, giving them a head start in the HPC space.

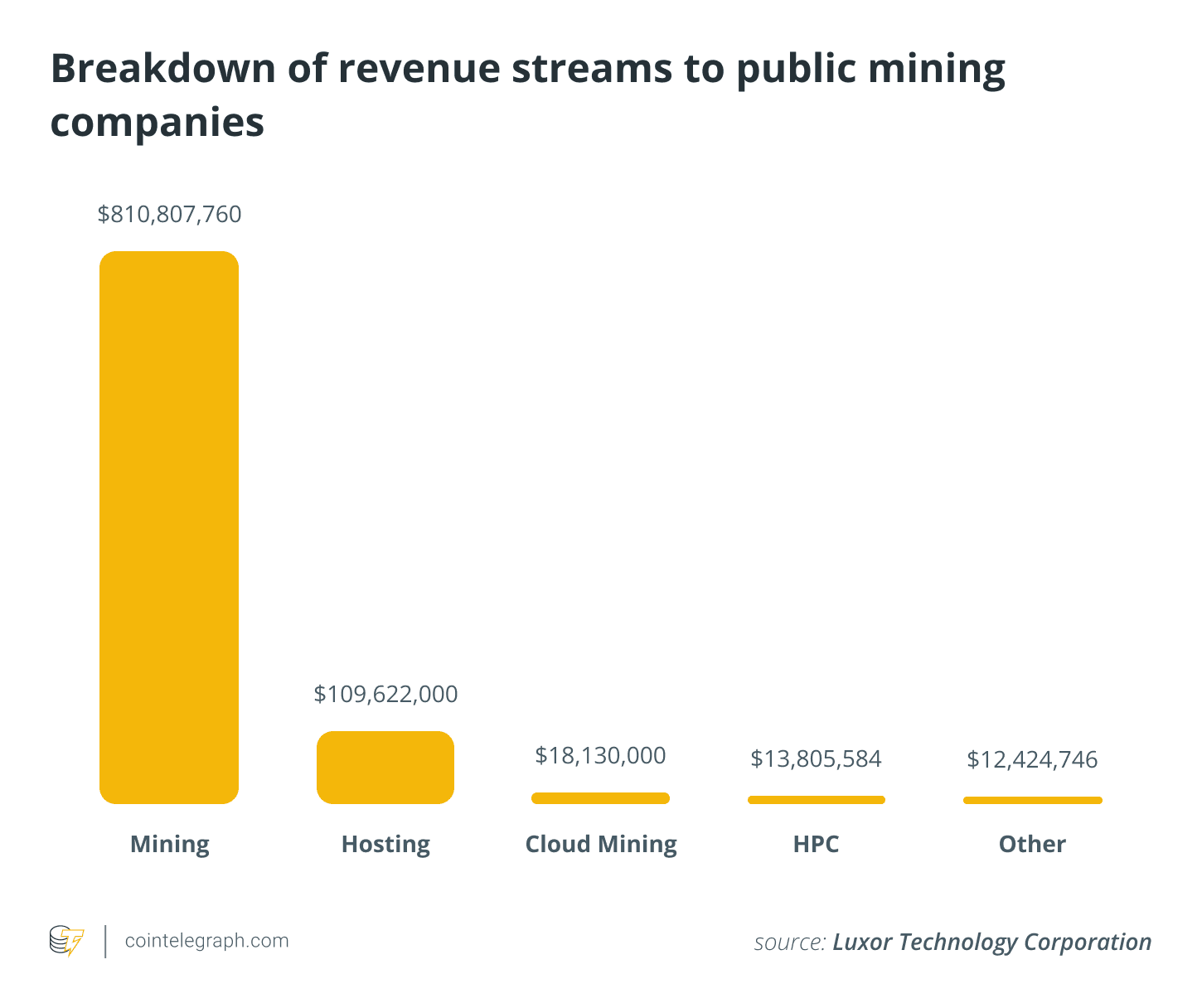

Several prominent mining companies, including TeraWulf, Iris Energy, Hut 8, Core Scientific, and Hive, have already made significant strides in integrating HPC and AI into their business models. While revenue from these sectors currently represents a small portion of their overall earnings (around 1.43%), it is poised for substantial growth as the demand for AI computing continues to surge.

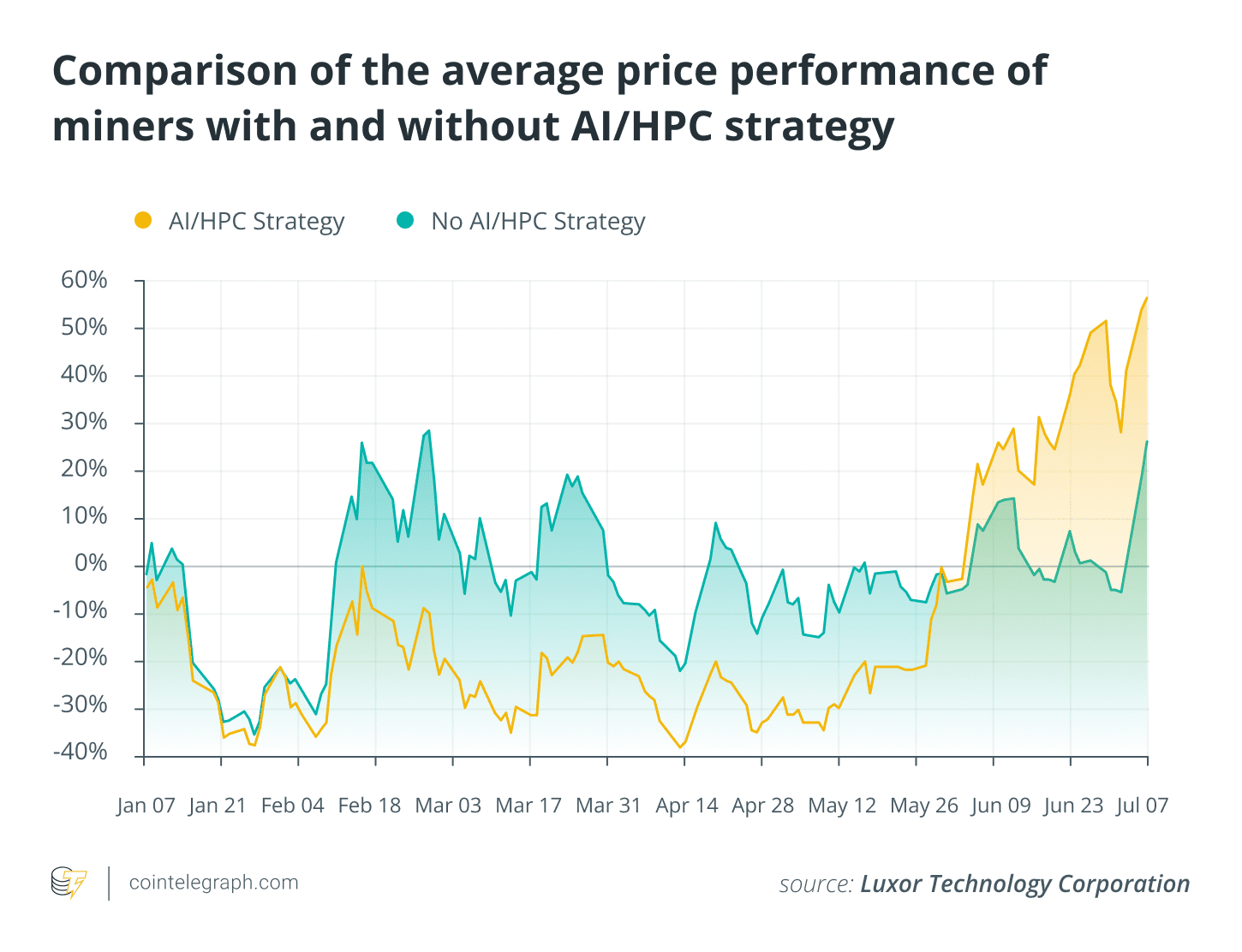

Companies embracing the AI/HPC strategy have seen positive results. By Q2, stock values of involved miners increased by 25% year-to-date, contrasting with a 3% decline for traditional miners.

Challenges and Competition

While the diversification into HPC and AI presents significant opportunities, Bitcoin miners face stiff competition from established players like Amazon Web Services, Microsoft Azure, and Google Cloud, who dominate the market. Successfully carving out a significant market share will require strategic partnerships, technological innovation, and a keen understanding of the evolving needs of the AI computing industry.

Marathon Digital’s Contrarian Hodl Strategy

While most miners are focused on infrastructure upgrades and diversification, Marathon Digital is pursuing a different strategy: accumulating more Bitcoin. The company announced a $100 million Bitcoin purchase and a shift to a full hodl strategy, signaling its strong belief in the long-term value of the cryptocurrency.

However, this approach has been met with skepticism from some investors. Marathon’s plans to issue $250 million in convertible debt led to a drop in stock value, reflecting concerns about the company’s growing dependence on Bitcoin price fluctuations and the potential dilution of equity if the debt is converted.

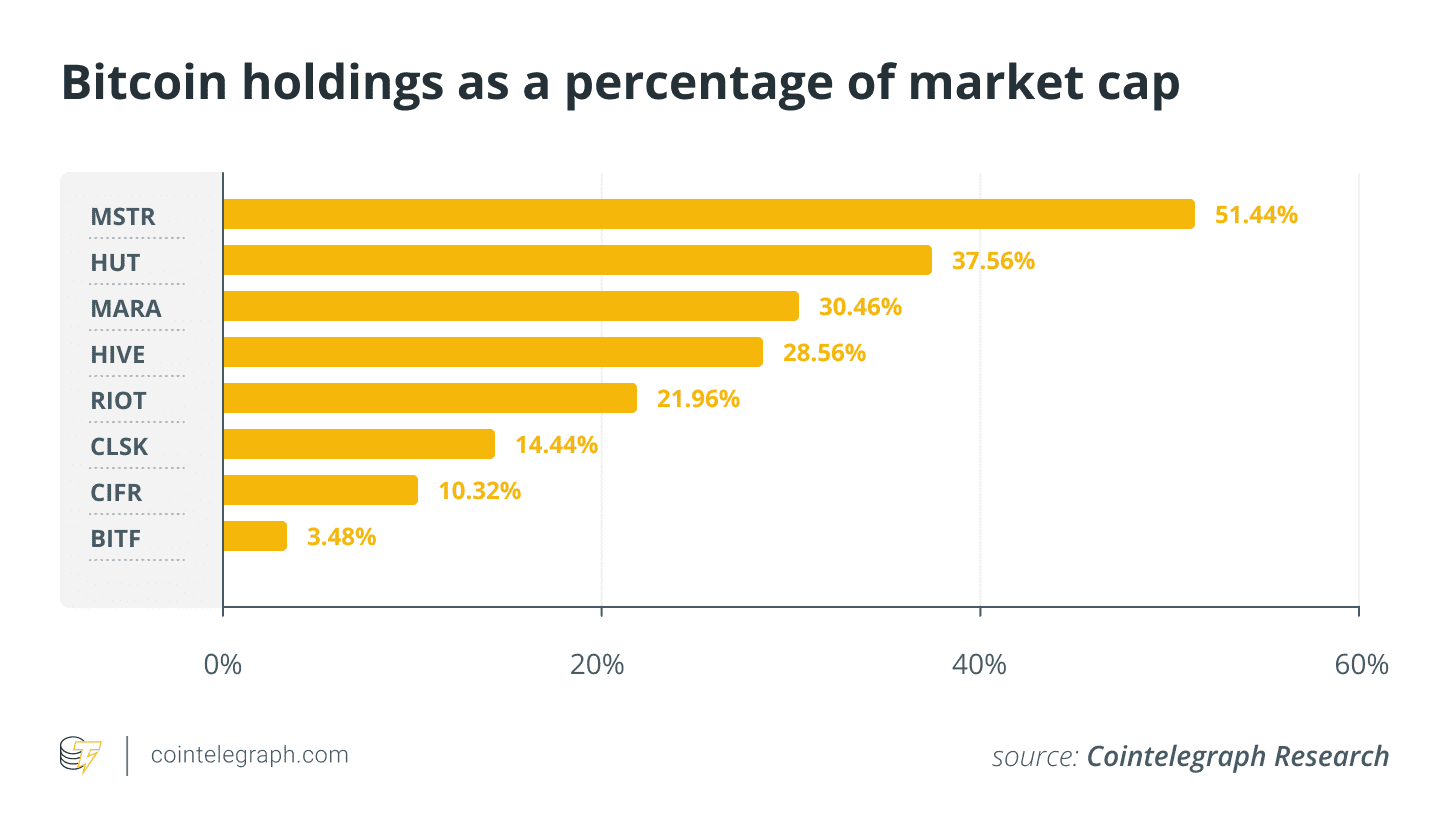

Compared to MicroStrategy, Marathon’s Bitcoin holdings represent a smaller percentage of its market capitalization. MicroStrategy’s consistent use of equity funding to acquire Bitcoin has proven successful, with the company holding over 226,000 BTC as of Q2 2024.

Conclusion: A More Resilient and Diversified Future

The Bitcoin mining industry is evolving rapidly. The shift from debt to equity financing, coupled with diversification into AI and HPC, represents a strategic effort to build more resilient and sustainable businesses. While challenges remain, these changes position Bitcoin miners for long-term success in an increasingly competitive and dynamic technological landscape.

Key Takeaways:

- Debt Reduction: Bitcoin miners are actively reducing debt to improve financial stability.

- Equity Financing: Increased reliance on equity issuance to fund operations.

- Halving Impact: Hardware upgrades are crucial to mitigate the impact of Bitcoin halvings.

- AI/HPC Diversification: Miners are expanding into AI and HPC for new revenue streams and capital access.

- Competitive Landscape: Significant competition from established cloud providers in the AI/HPC market.

- Marathon Digital: Unique strategy of accumulating Bitcoin, but facing investor skepticism.