The 2024 Bitcoin halving, which reduced block rewards from 6.25 BTC to 3.125 BTC, has significantly impacted the Bitcoin mining landscape. Miners are now intensely focused on optimizing efficiency, reducing energy costs, and upgrading their hardware to maintain profitability. This article explores the key trends shaping Bitcoin mining in 2025, focusing on the industry’s response to rising hashrate, shrinking margins, and the global shift toward low-cost energy.

The Impact of the Halving on Bitcoin Mining

The Bitcoin halving events, occurring roughly every four years, are designed to control the supply of new Bitcoins entering the market. While beneficial for the long-term value of Bitcoin, halvings present immediate challenges for miners. Reduced block rewards directly impact revenue, forcing miners to become more efficient to remain competitive.

Key challenges and adaptations include:

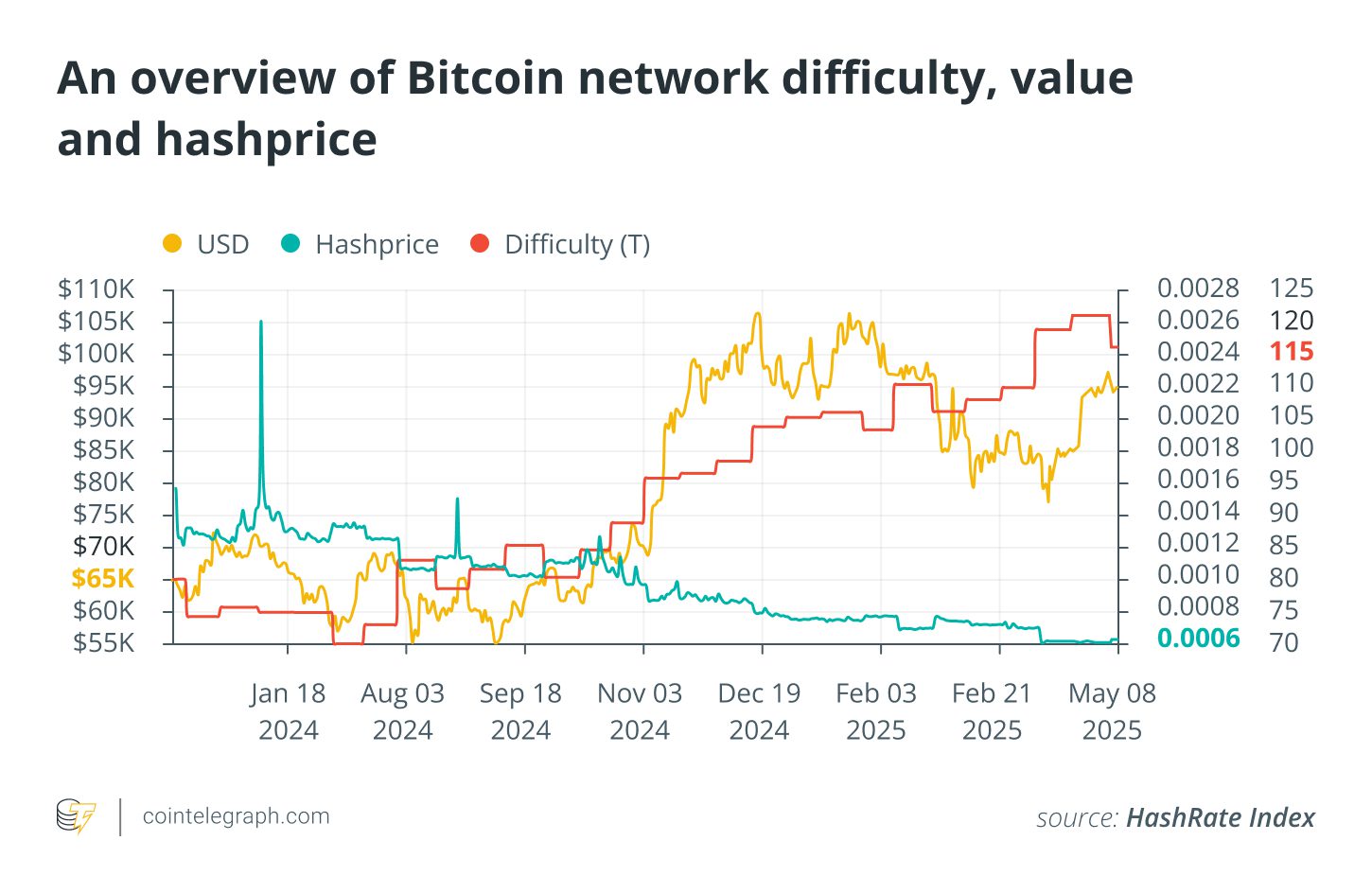

- Increased Hashrate: Despite reduced rewards, the network hashrate continues to climb, reaching 831 EH/s as of May 1, 2025. This indicates a continued investment in mining infrastructure, as miners compete for a smaller piece of the pie.

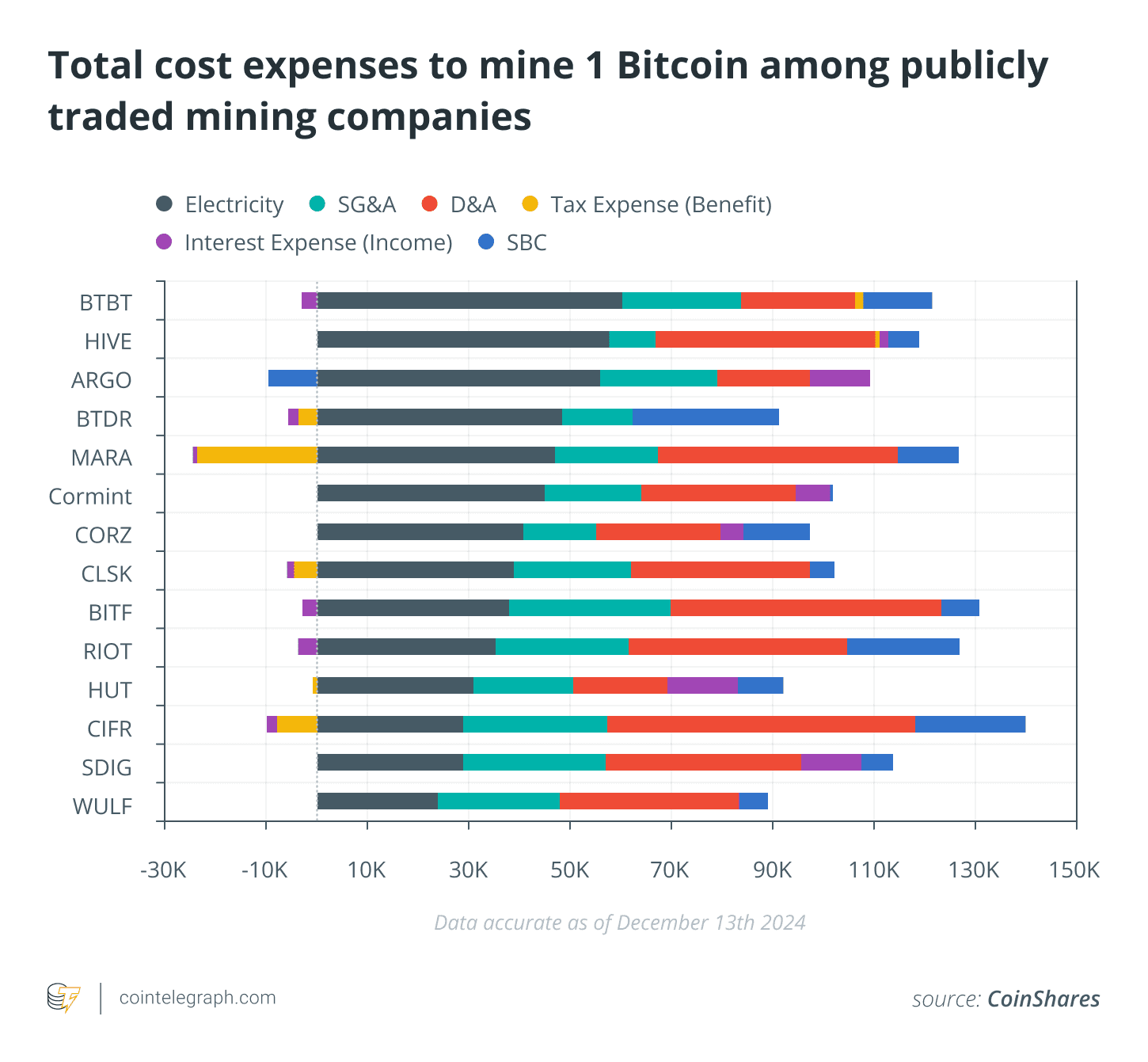

- Shrinking Margins: The daily revenue per terahash per second (hashprice) has decreased significantly, while network difficulty has surged to an all-time high. This necessitates squeezing maximum value from every watt of power consumed.

- Hardware Upgrades: Miners are investing in the latest ASIC models to improve power efficiency.

Hardware Innovations Driving Efficiency

The mining industry is engaged in a continuous arms race centered on power efficiency. The latest ASIC models from leading manufacturers like Bitmain, MicroBT, and Canaan are designed to minimize the energy required per hash. Notable examples include:

- Bitmain’s Antminer S21+: Delivers 216 TH/s at 16.5 J/TH.

- MicroBT’s WhatsMiner M66S+: Pushes immersion-cooled performance to 17 J/TH.

Furthermore, semiconductor giants like TSMC and Samsung are developing advanced 3-nm and 2-nm chips, promising even greater efficiency gains in the future.

The Global Shift Toward Low-Cost Energy

With profitability squeezed, access to cheap and reliable power has become paramount. This is driving mining operations to relocate to regions with lower energy costs.

Examples of advantageous locations include:

- Oman: Licensed miners benefit from government-backed subsidies, securing electricity at $0.05–$0.07 per kWh.

- UAE: Semi-governmental projects operate at even lower rates of $0.035–$0.045 per kWh.

- Africa, the Middle East, and Central Asia: These regions offer energy arbitrage opportunities, allowing miners to access power at significantly lower prices than in traditional mining hubs like the US.

The Future of Bitcoin Mining

The post-halving era demands efficiency and adaptability. The most successful mining operations will be those that can optimize their energy consumption, leverage the latest hardware, and strategically locate in regions with favorable energy costs. Several factors will continue to shape the industry’s future:

- AI Computing: The increasing demand for AI computing power could compete with Bitcoin mining for energy resources.

- Global Regulatory Shifts: Changes in regulations related to cryptocurrency mining could significantly impact the profitability and location of mining operations.

- Hardware Advancements: Continued innovation in ASIC technology will drive further improvements in energy efficiency.

Beyond Mining: New Revenue Streams for Bitcoin Miners

As Bitcoin mining becomes increasingly competitive, miners are exploring alternative revenue streams to diversify their income and reduce reliance on block rewards. These new revenue models include:

- Transaction Fees: Miners earn fees for including transactions in blocks. Increased network activity and higher transaction fees can supplement block rewards.

- Data Storage and Processing: Leveraging mining infrastructure for data storage and processing services, such as decentralized storage solutions or AI computation, can generate additional revenue.

- Renewable Energy Integration: Mining operations are increasingly focusing on integrating renewable energy sources, such as solar and wind power, to reduce costs and environmental impact. This can also lead to opportunities for selling excess energy back to the grid.

- Financial Services: Some miners are exploring opportunities in decentralized finance (DeFi) by providing liquidity or staking services using their Bitcoin holdings.

The Bitcoin mining industry is facing significant changes in 2025. The companies that adapt and innovate will be the most successful and secure the Bitcoin Network in the future.