Bitcoin (BTC) is exhibiting robust buyer activity as it reaches new all-time highs, fueled by positive on-chain metrics. Recent data suggests that this bullish momentum could continue, potentially driving the price even higher.

Key Takeaways:

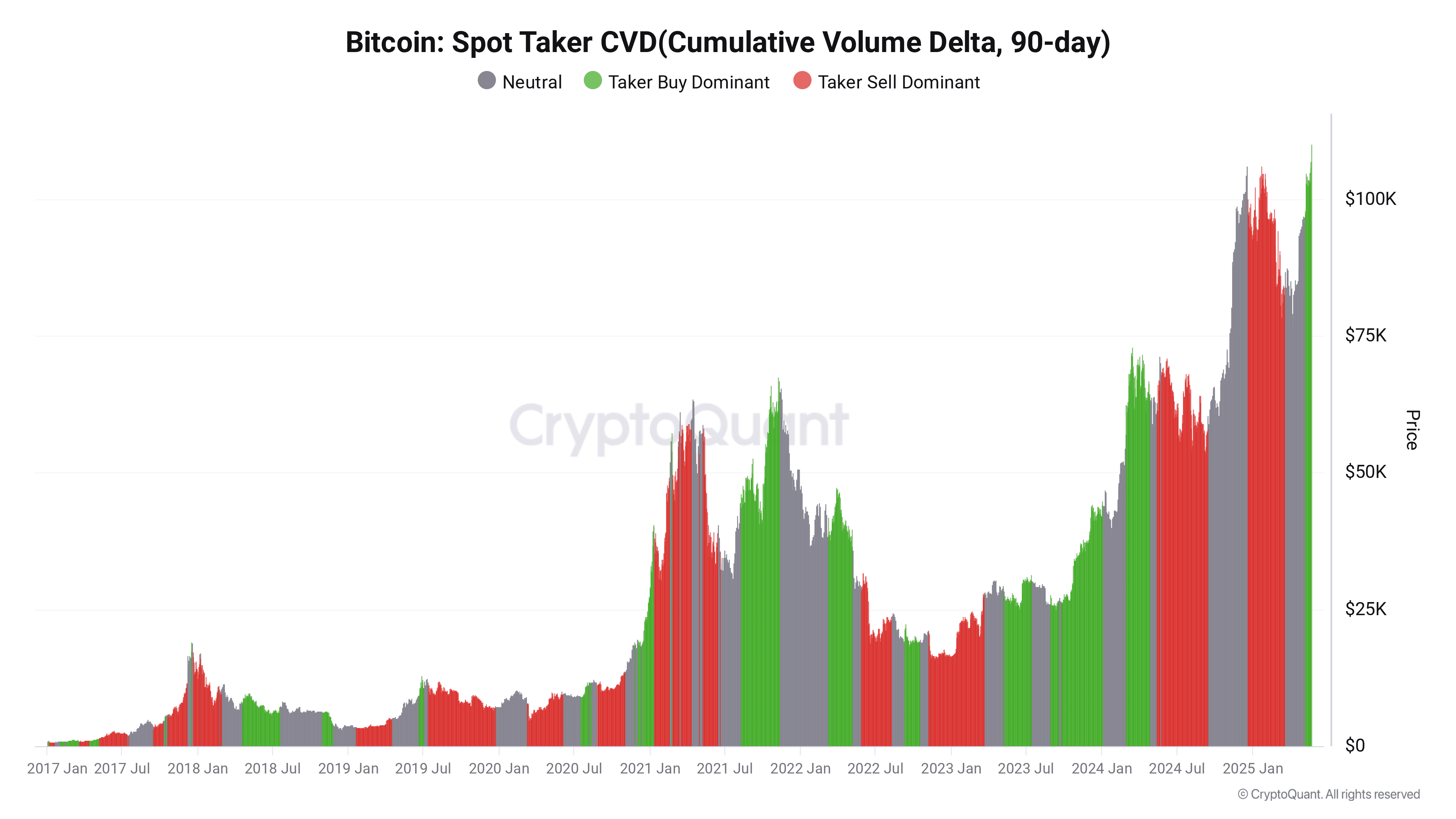

- Sustained Buyer Dominance: Bitcoin’s 90-day cumulative volume delta (CVD) strongly favors buyers, indicating sustained demand.

- Potential Uptrend Continuation: CryptoQuant analysis suggests the strong buyer presence could fuel a continuation of the uptrend.

- Short-Term Holders in Profit: Bitcoin’s short-term holders (STH) are profitable, which reinforces positive market sentiment.

On-Chain Analysis Points to Continued Bullish Momentum

Data from CryptoQuant reveals a significant 90-day cumulative volume delta (CVD) favoring Bitcoin buyers. This metric, which measures the difference between buying and selling volume, demonstrates that buy orders are consistently outpacing sell orders. This trend is particularly noteworthy as Bitcoin has surpassed $110,000, indicating that buyer enthusiasm remains strong even at record price levels.

According to CryptoQuant contributor Ibrahim Cosar, this buyer dominance is a strong signal that the current uptrend may persist. He notes that the continuous placement of buy orders suggests a willingness among investors to acquire Bitcoin at these levels, which supports the overall bullish narrative.

The CVD analysis highlights a shift in market dynamics. Earlier in the year, sell-side pressure was more prevalent, with Bitcoin experiencing a dip below $75,000 in April. However, since May, buyer dominance has reemerged, signaling a renewed confidence in Bitcoin’s potential.

Cosar summarizes the situation, stating, “As the price tests above $110K and reaches a new all-time high (ATH), buyers have not backed down. This could be setting the stage for another wave of upward movement.”

Hodlers Exhibit Strong Holding Behavior

In addition to the CVD data, other on-chain indicators suggest a strong holding behavior among Bitcoin investors. Data indicates that long-term holders are not selling their coins. This is in sharp contrast to the market behavior observed when Bitcoin initially hit $100,000 in December 2024, where profit-taking was significantly higher. This reduced selling pressure supports the current price levels and contributes to market stability.

Glassnode noted in a recent analysis that older coins were much less active this time, signaling stronger holding behavior. This suggests that investors are more confident in Bitcoin’s long-term prospects and are less inclined to sell their holdings, even at record prices.

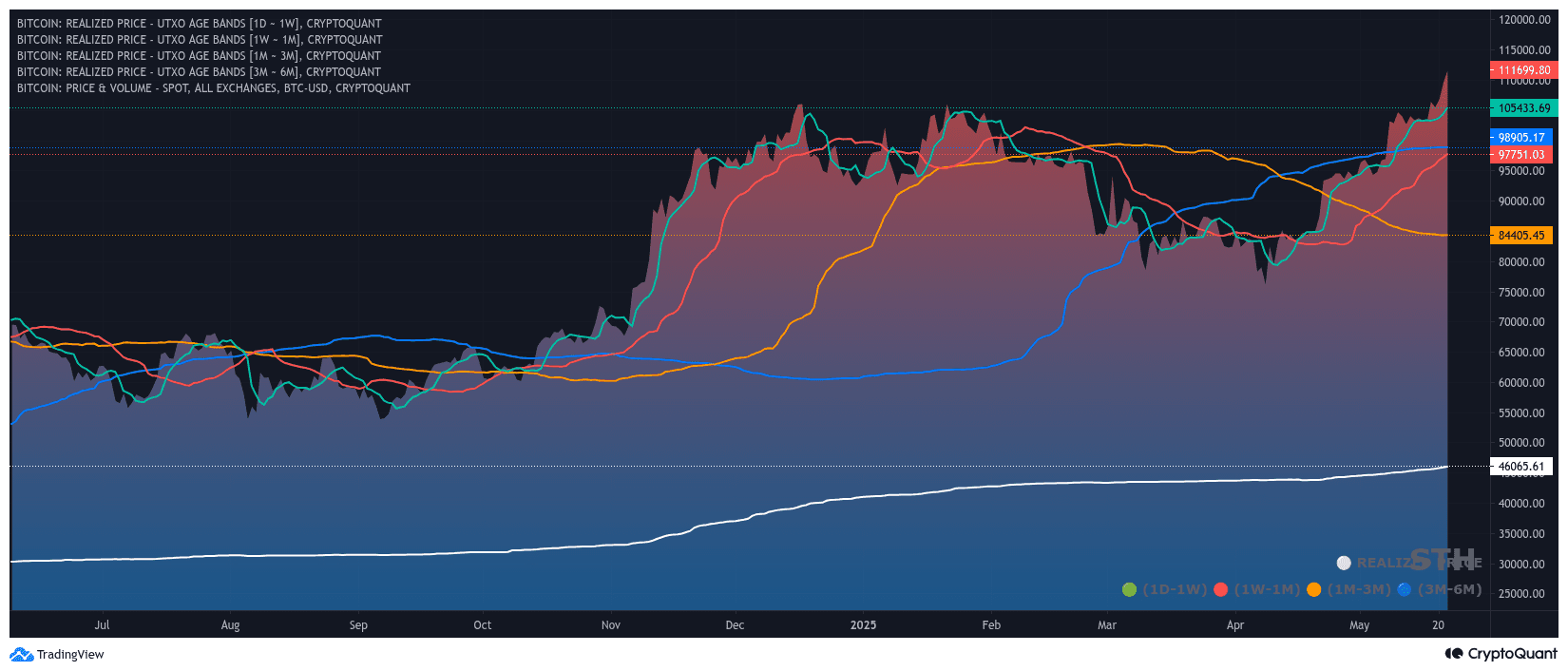

Furthermore, CryptoQuant highlights the importance of the short-term holder (STH) average cost basis. The STH cohort, consisting of entities that have purchased Bitcoin within the last six months, plays a crucial role in market dynamics. When Bitcoin’s price moves above the STH average cost basis, it often acts as a strong buy-the-dip indicator during bull markets.

CryptoQuant notes that Bitcoin’s recent rally occurred after reclaiming the STH average cost basis, which currently sits just under $100,000. This technical indicator further validates the bullish sentiment surrounding Bitcoin.

Potential Catalysts for Further Price Appreciation

Several factors could contribute to a continuation of Bitcoin’s uptrend:

- Institutional Adoption: Growing institutional interest in Bitcoin, including investments from hedge funds, pension funds, and publicly traded companies, could drive demand and push prices higher.

- ETF Inflows: Continued inflows into Bitcoin exchange-traded funds (ETFs) provide a steady source of demand and validate Bitcoin as an investment asset.

- Macroeconomic Factors: A weakening U.S. dollar, rising inflation, or geopolitical instability could increase Bitcoin’s appeal as a safe-haven asset.

- Halving Event: The next Bitcoin halving event, scheduled for early 2028, will reduce the rate at which new Bitcoins are created. This could lead to a supply squeeze and further price appreciation.

In conclusion, the current on-chain data paints a bullish picture for Bitcoin. Strong buyer dominance, coupled with holding behavior among long-term investors, suggests that the current uptrend may continue. Factors such as increasing institutional adoption and favorable macroeconomic conditions could provide further support for Bitcoin’s price appreciation.