Bitcoin Eyes $100,000 Amid Trade Deal Speculation

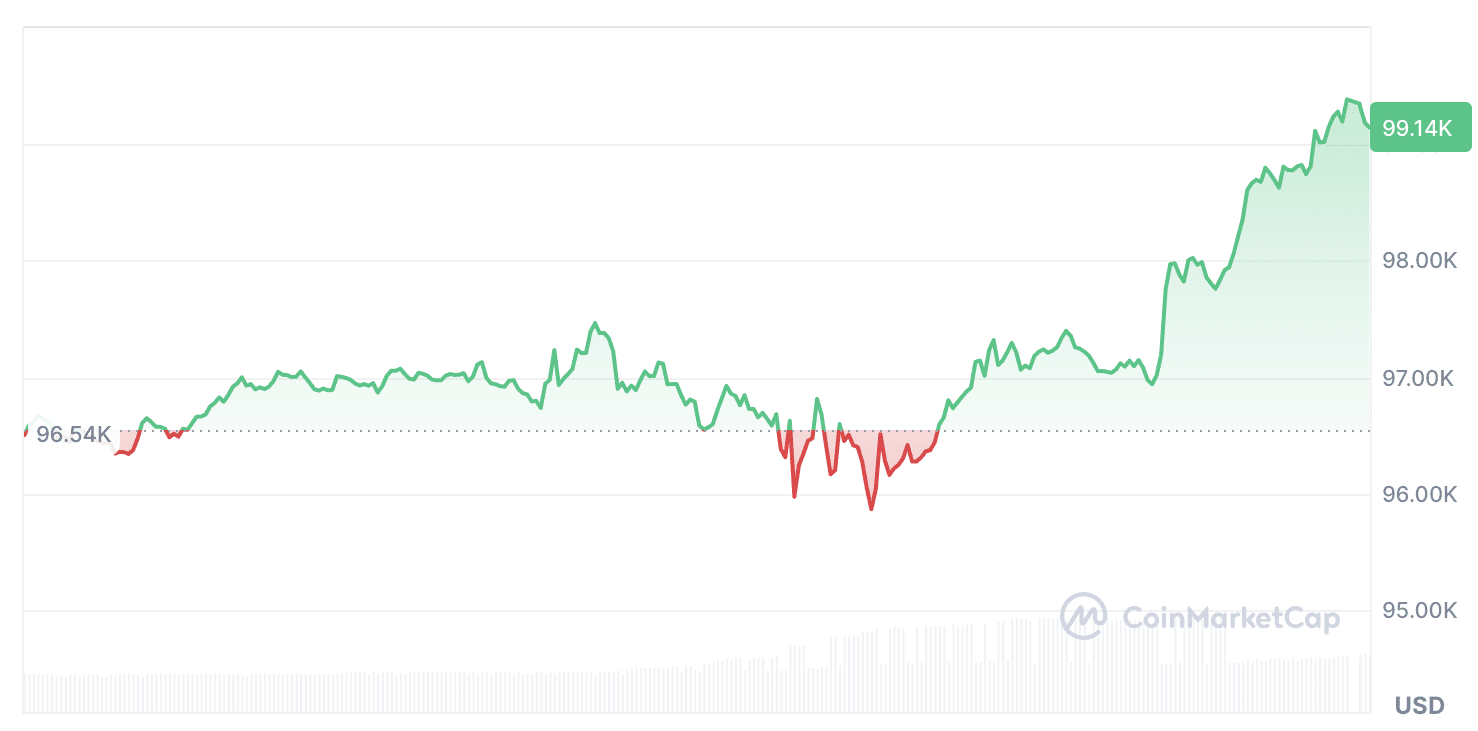

Bitcoin is currently trading around $99,140, inching closer to the $100,000 mark. This surge is attributed to the anticipation of a major trade deal between the United States and the United Kingdom, reportedly set to be announced by former US President Donald Trump.

The announcement has triggered excitement within the cryptocurrency community, with many analysts predicting a potential breakthrough past the psychological resistance of $100,000 and the possibility of new all-time highs for Bitcoin.

Key Factors Driving the Bitcoin Rally:

- Trump’s Trade Deal Announcement: The anticipation surrounding the impending trade deal between the US and the UK is a primary driver.

- Market Sentiment: Increased optimism and bullish sentiment among crypto market participants.

- Liquidations of Short Positions: Bitcoin’s recent price increase has led to the liquidation of a significant amount of short positions.

Expert Opinions and Analysis:

Industry experts share their perspectives on the potential impact of the trade deal on Bitcoin’s price:

- Charlie Sherry (BTC Markets): Suggests the trade deal might already be priced into Bitcoin, anticipating a potential breach of the $100,000 resistance.

- Neil Jacobs (FOMO21): Attributes the Bitcoin rally primarily to Trump’s announcement.

- Anthony Pompliano: Believes the trade deal increases the likelihood of Bitcoin reaching new all-time highs in 2025.

- Sahib Anandsongvit (Pandora CEO): Highlights Bitcoin’s rapid price appreciation.

Historical Context and Previous Market Movements:

Bitcoin previously reached its all-time high of $109,000 in January. However, Trump’s proposed import tariffs led to a price correction. This history highlights the sensitivity of the crypto market to political and economic developments.

Potential Implications of the Trade Deal:

A successful trade deal between the US and the UK could have several positive implications for Bitcoin and the broader cryptocurrency market:

- Increased Investor Confidence: A stable and predictable economic environment can foster greater investor confidence.

- Capital Inflow: Attract capital into the crypto space.

- Mainstream Adoption: Legitimize and promote the adoption of cryptocurrencies.

The Broader Economic Landscape:

It’s also crucial to consider the broader economic landscape when analyzing Bitcoin’s price movements. The US Federal Reserve’s decision to maintain interest rates is a factor influencing market dynamics.

Conclusion:

As Bitcoin approaches $100,000, the anticipation surrounding Trump’s trade deal with the UK is palpable. The potential impact on the crypto market is significant, with experts predicting new all-time highs and increased mainstream adoption. While the market remains volatile, the convergence of political, economic, and technological factors suggests a potentially bullish outlook for Bitcoin.