Key Takeaways:

- Bitcoin’s year-over-year (YoY) return and realized price suggest robust long-term support and undervaluation.

- Standard Chartered predicts Bitcoin could reach $120,000 by Q2 2025.

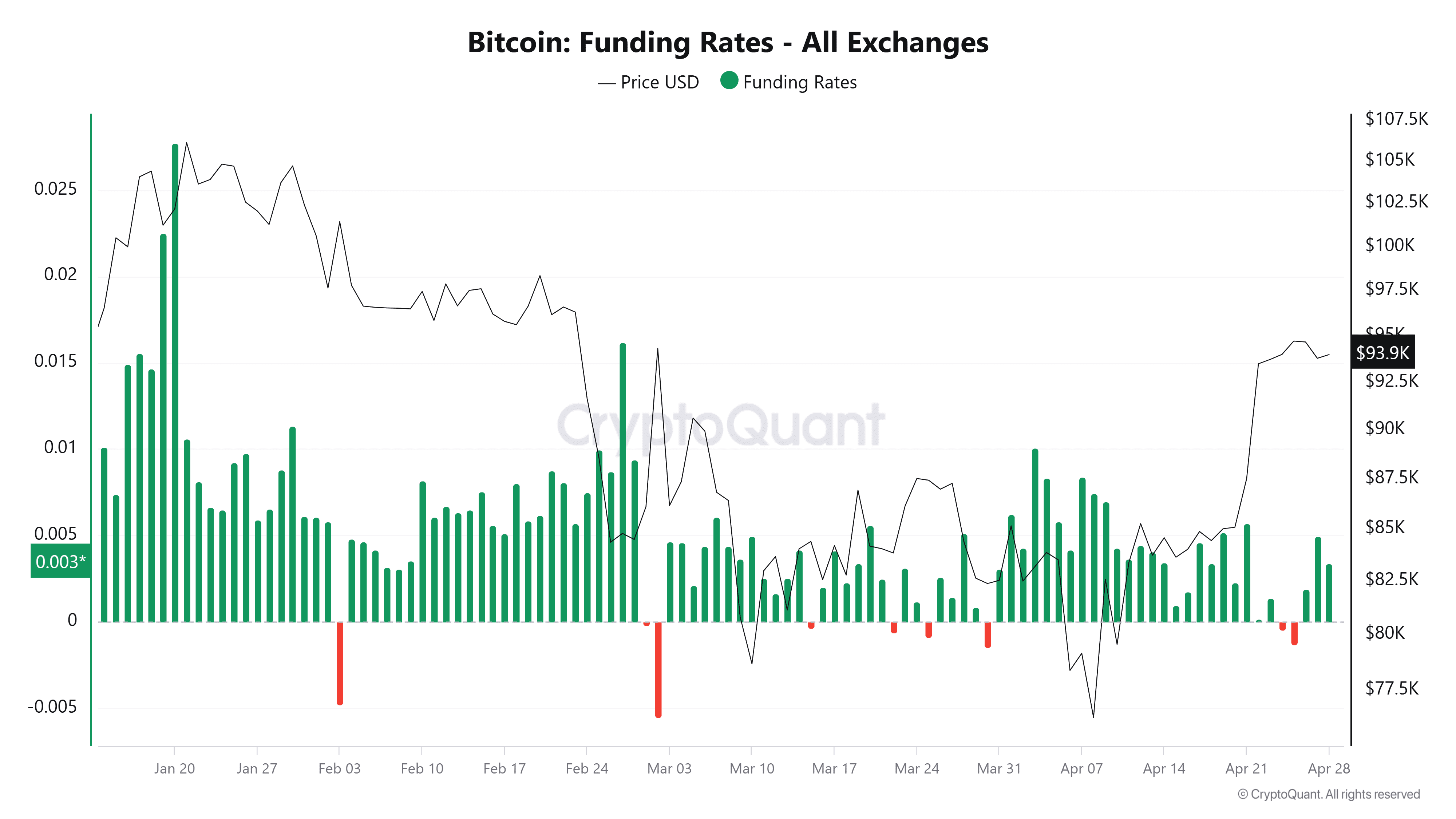

- Positive funding rates hint at a potential long squeeze towards $90,500.

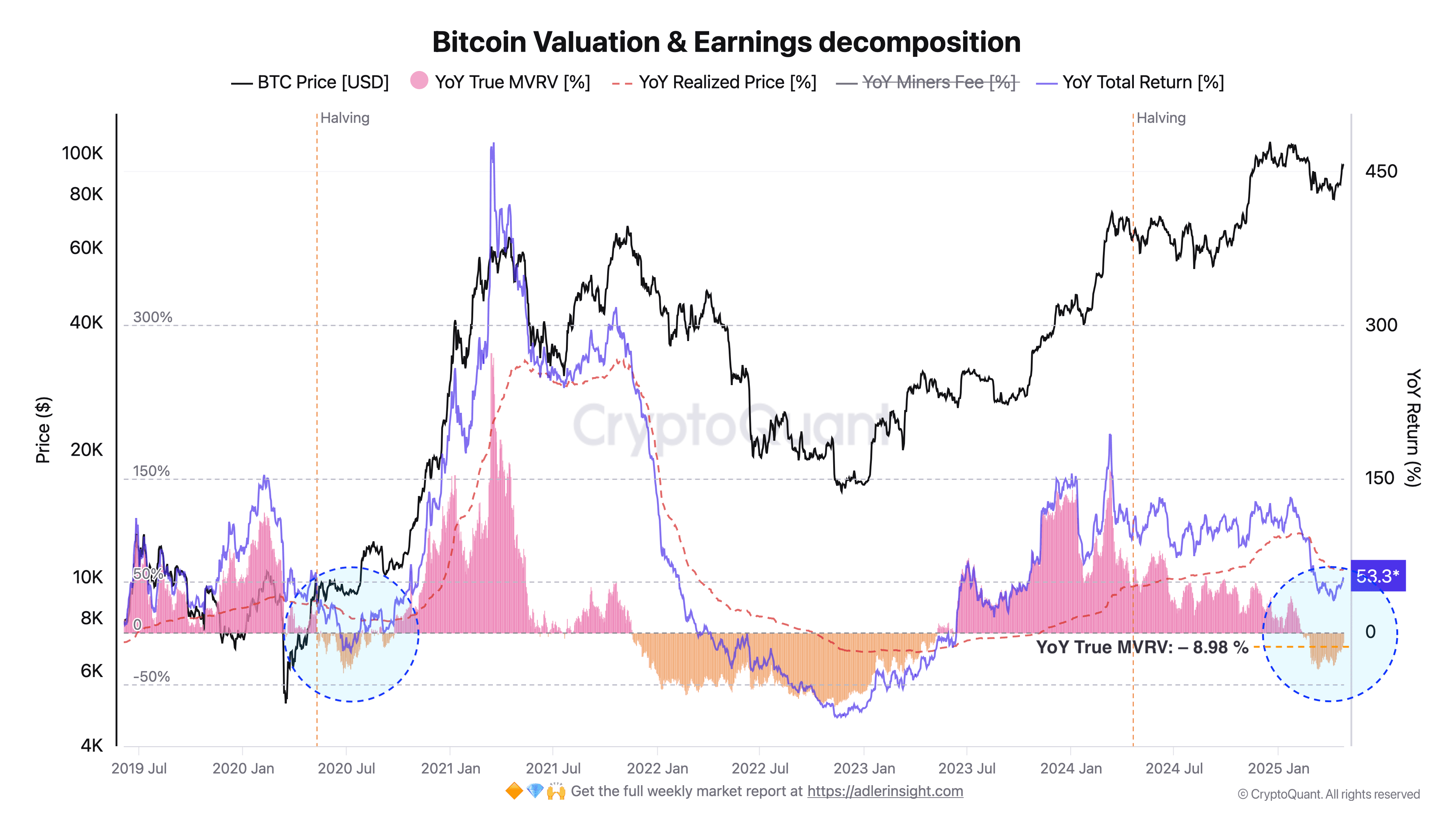

Bitcoin (BTC) has demonstrated significant growth, closing the week near $94,000 and achieving a 53.61% year-over-year total return. This performance indicates a shift from the speculative market frenzy of early 2024 to a more sustainable “mature bull trend,” driven by onchain growth and strong market fundamentals.

Bitcoin Fundamentals and Market Dynamics

Bitcoin researcher Axel Adler Jr. highlights that the YoY realized price has increased by 61.82%, outpacing the market value to realized value (MVRV) decline of 8.98%. This disparity suggests that long-term holders are establishing a higher base price, indicative of a healthy market cycle. The negative MVRV implies that Bitcoin is currently undervalued compared to its fundamental value from a year ago, which historically precedes significant rallies.

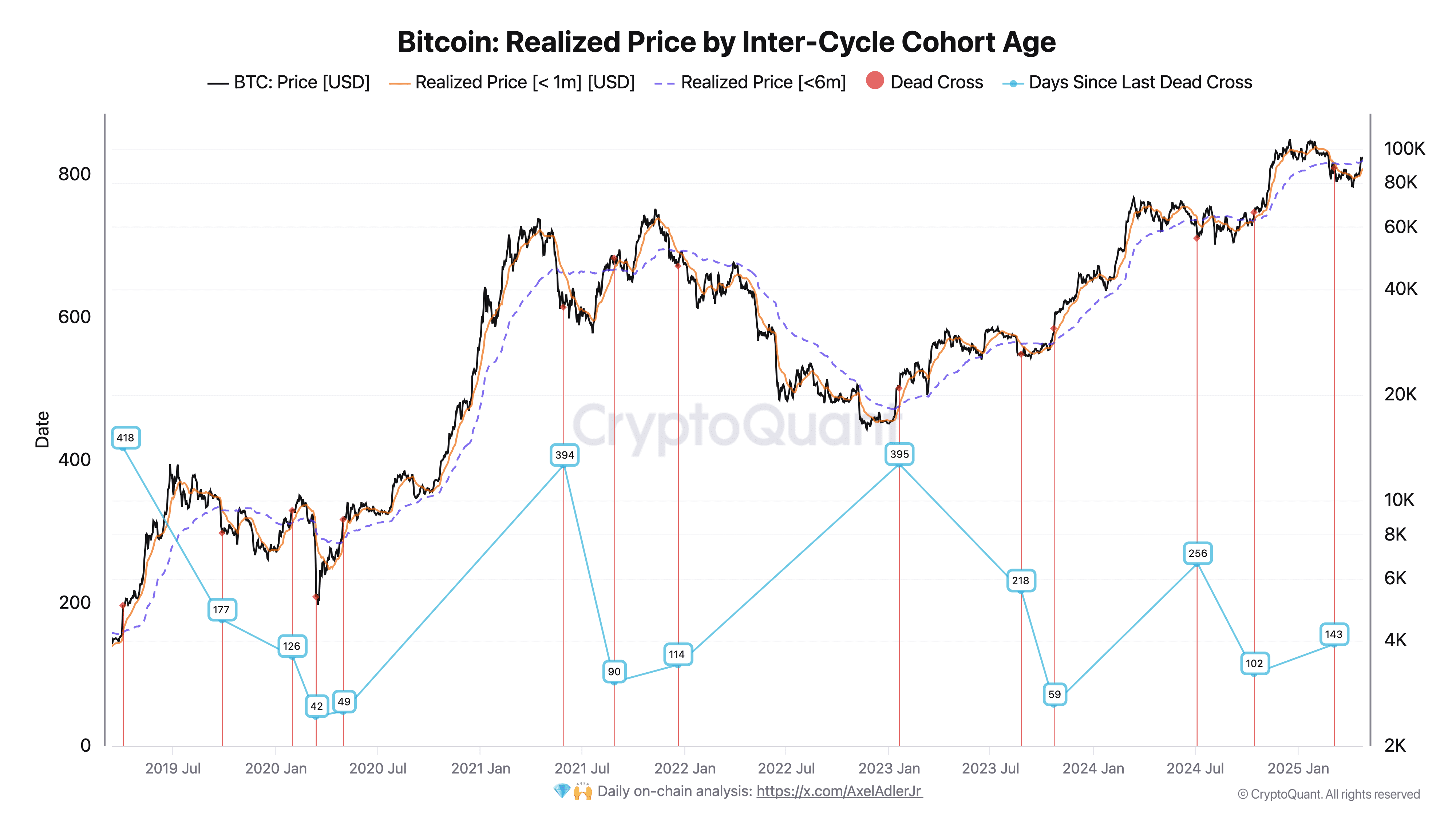

The cooling speculative premium, reflected in the cost basis of one-month holders being 5% below the six-month cohort, mirrors past accumulation phases. Such patterns suggest that momentum could accelerate within the next five to six weeks.

Expert Predictions and Market Sentiment

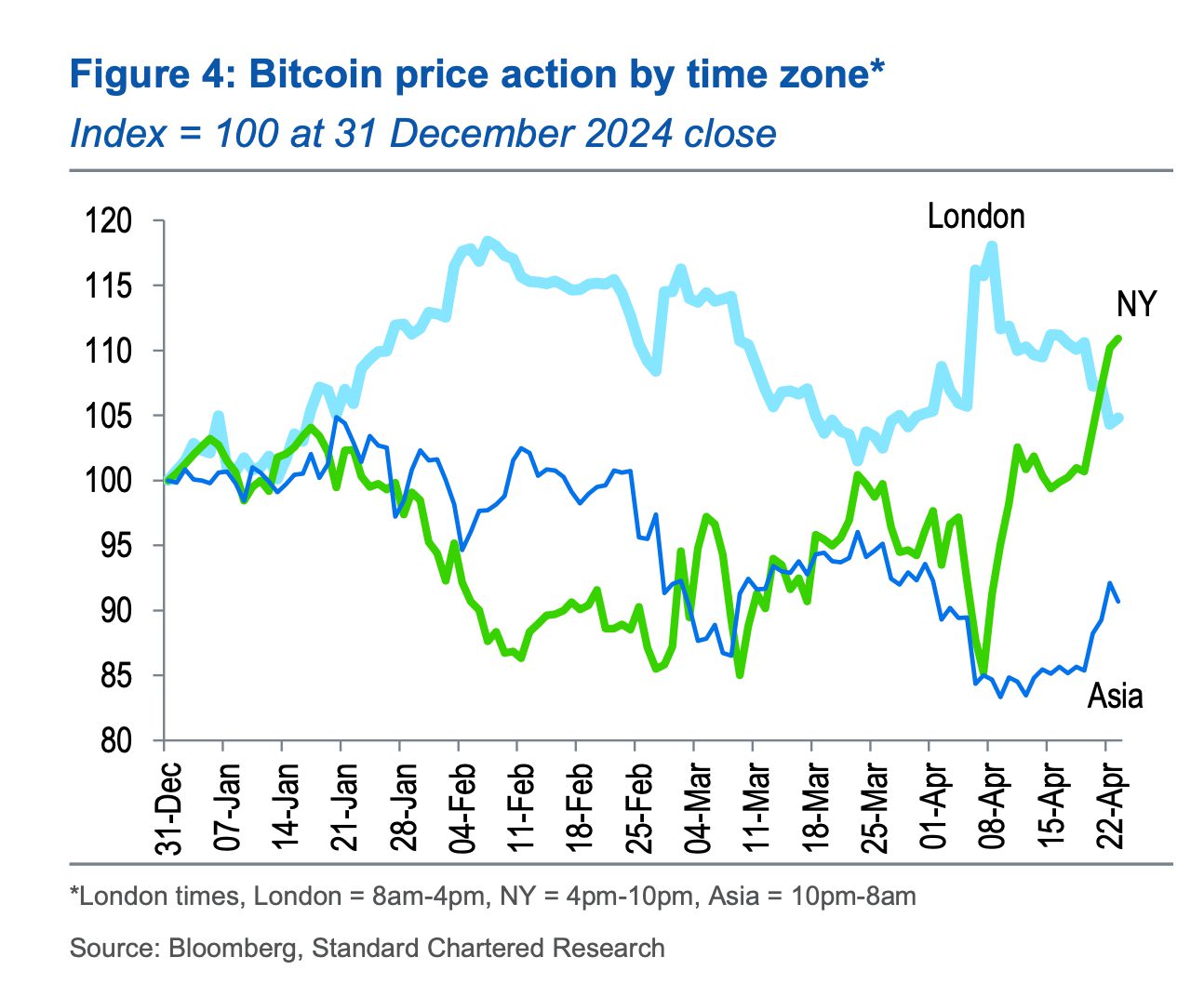

Standard Chartered’s Geoffrey Kendrick forecasts a new all-time high of $120,000 for Bitcoin in Q2 2025. This prediction is based on strategic asset reallocation from US assets, influenced by factors such as a high US Treasury term premium and time-of-day trading patterns that suggest US investors are diversifying into non-US assets.

Furthermore, the Bitcoin futures market indicates a potential “long squeeze” below $91,000. Positive funding rates signal a dominance of long positions, reflecting traders’ bets on price increases above $90,000. A brief negative funding rate between April 24 and April 25 led to discussions of a potential long squeeze toward $97,000. However, with the funding rate turning positive, the possibility of a long squeeze remains.

Potential Pullback and Market Analysis

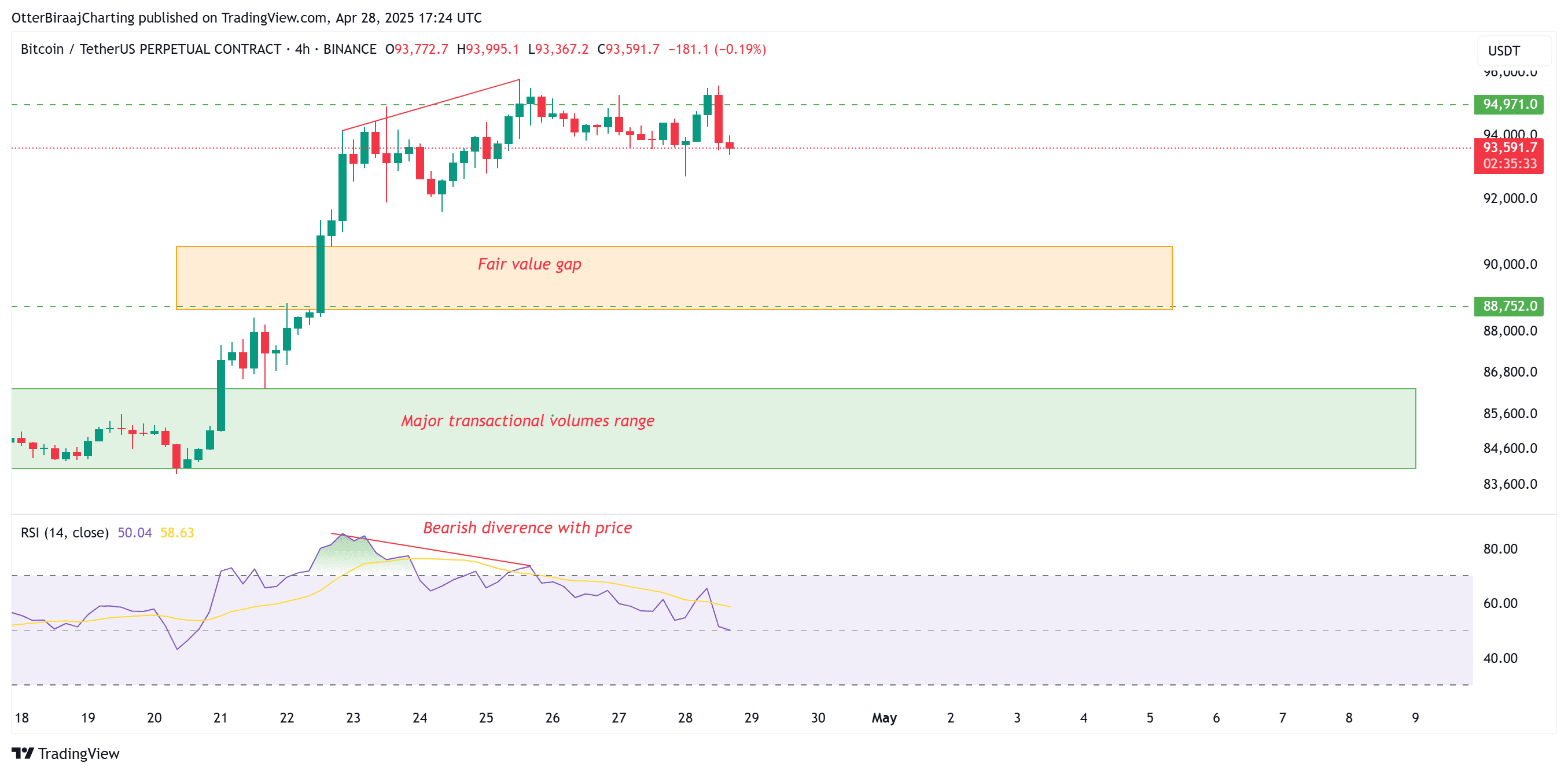

Bitcoin prices have seen a 1.58% decrease following the New York market session opening on April 28, potentially leading to a drop as low as $90,500 in the coming days. The fading bullish momentum suggests a possible re-test of the fair-value gap (FVG) between $90,500 and $88,750 on the 4-hour chart.

Additionally, a bearish divergence with the relative strength index (RSI) has formed after the price failed to maintain a position above $95,000. This suggests a weakening bullish trend.

What is a Long Squeeze? A long squeeze occurs when a sudden price decrease forces over-leveraged traders to sell, which amplifies the downward price movement through mass liquidations.

Bitcoin’s Current Valuation

As of late April 2025, Bitcoin’s price hovers around $94,000, representing a significant increase year-to-date. While analysts suggest potential short-term pullbacks, the overall sentiment remains bullish. Factors contributing to this positive outlook include:

- Halving Event: The 2024 halving continues to impact supply dynamics, potentially driving prices upward.

- Institutional Adoption: Increased institutional interest and investment in Bitcoin contribute to its legitimacy and stability.

- Global Economic Factors: Economic uncertainty and inflation concerns in traditional markets drive some investors to Bitcoin as a hedge.

Factors to Watch in the Bitcoin Market:

- Regulatory Developments: Changes in regulations can significantly impact Bitcoin’s price.

- Macroeconomic Events: Interest rate hikes, inflation data, and other macroeconomic indicators can influence investor sentiment.

- Technological Advancements: Innovations in blockchain technology and the broader crypto ecosystem can impact Bitcoin’s value proposition.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.