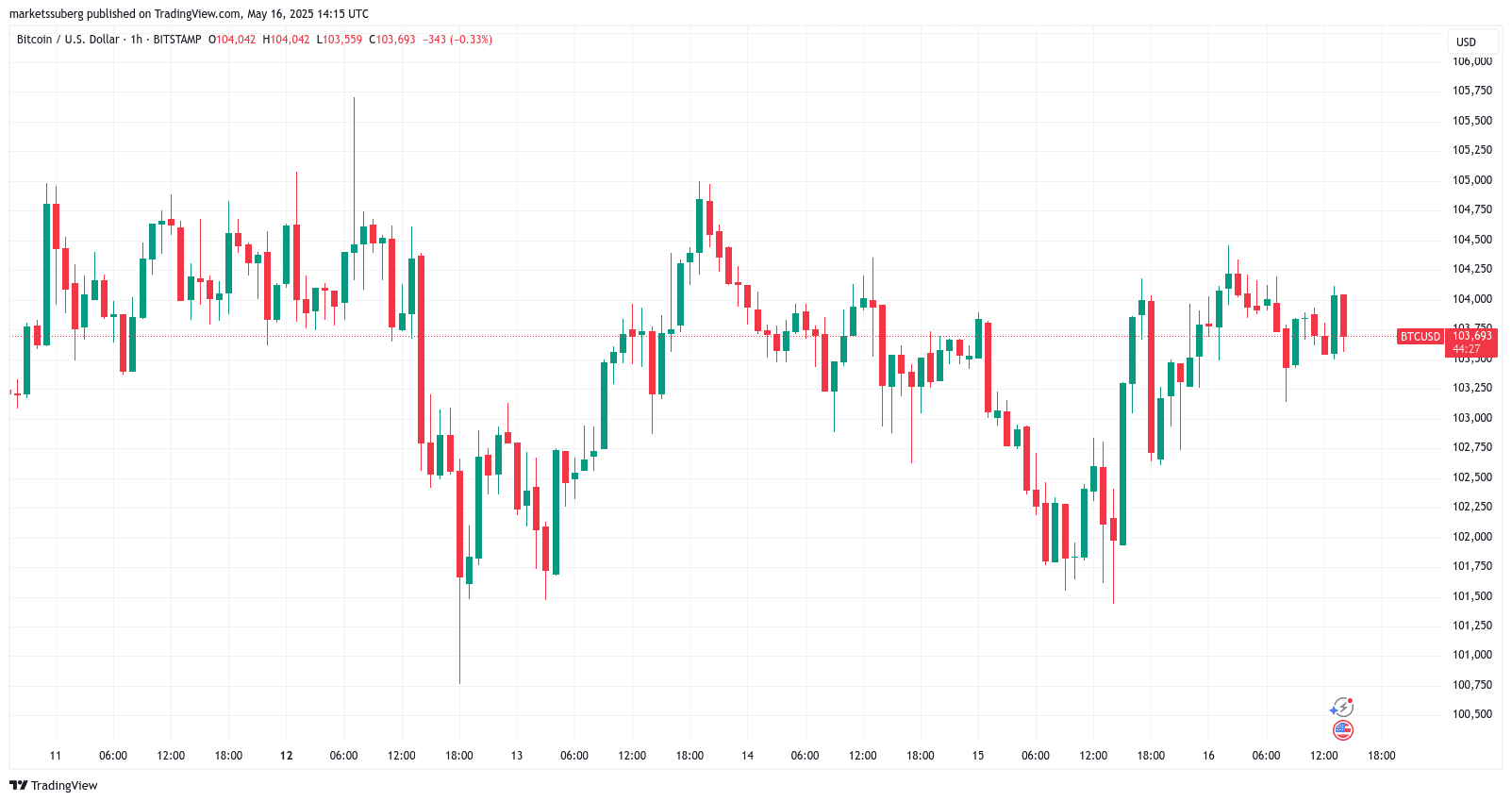

Bitcoin (BTC) is currently in a consolidation phase, hovering between $103,000 and $104,000, leading to uncertainty among traders regarding its next move. This article delves into the potential breakout scenarios, examining both bullish and bearish perspectives, while considering key price levels and expert analysis.

Key Takeaways:

- Bitcoin is consolidating near all-time highs, creating uncertainty about its next price direction.

- Analysts are closely watching for a breakout above $105,000-$106,000, which could lead to new highs.

- A potential rejection at current levels could trigger a pullback towards $90,000.

- Liquidity levels around $102,800-$103,000 could act as a magnet or trigger cascading liquidations if the price drops.

- Some analysts predict a target of $115,000 if the current uptrend continues.

Current Market Sentiment

Despite positive macroeconomic data, such as the Consumer Price Index (CPI) and Producer Price Index (PPI), Bitcoin’s price remains range-bound. Traders are focusing on Bitcoin’s consolidation phase, which is less than 10% away from its all-time high.

Daan Crypto Trades noted that Bitcoin has been following a pattern of “move up, tight consolidation, new leg up” since the April lows. He advises traders to monitor the current range and await a breakout in either direction.

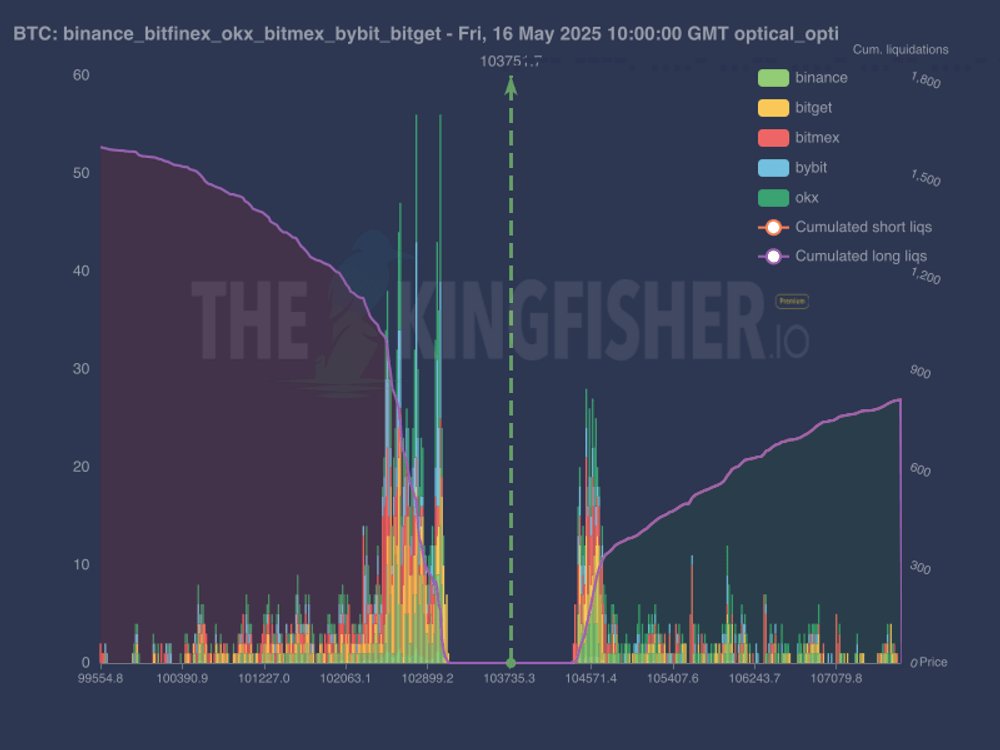

Liquidity Analysis

Analysis of the Bitcoin liquidation map reveals significant liquidity clusters at $105,000-$106,000 and between $99,000-$103,000. These levels represent the highs and lows of the current consolidation range. The concentration of long liquidations just below the current price, particularly around $102,800-$103,000, could act as a price magnet or a trigger for cascading liquidations if the price moves down, according to TheKingfisher.

Potential Breakout Scenarios

Crypto Caesar suggests that a breakout above the current range could lead to new highs, referencing a bullish crossover on the weekly moving average convergence/divergence (MACD) indicator. However, he also warns that a rejection at current levels could lead to a pullback towards $90,000.

Kevin Svenson anticipates a continuation of the stop-start rebound since April. Analyzing 4-hour timeframes, he projects an upside target of $115,000 if the current trend continues. He notes that the measured move extrapolations of each leg up in this run have been accurate so far.

Expert Predictions and Long-Term Outlook

Cointelegraph has reported on various BTC price predictions, with most commentators favoring upside potential. Some analysts, like former BitMEX CEO Arthur Hayes, predict that Bitcoin could reach $1 million per coin in three years or even sooner.

Factors Influencing Bitcoin’s Price

Several factors could influence Bitcoin’s price in the short and long term:

- Macroeconomic conditions: Inflation, interest rates, and other economic indicators can impact investor sentiment and Bitcoin’s price.

- Regulatory developments: Government regulations regarding cryptocurrencies can significantly affect market dynamics.

- Institutional adoption: Increased adoption by institutional investors could drive demand and push prices higher.

- Technological advancements: Improvements to the Bitcoin network, such as scaling solutions and enhanced security, could boost its value.

- Geopolitical events: Global events, such as political instability or economic crises, can influence Bitcoin’s safe-haven appeal.

Conclusion

Bitcoin’s current consolidation phase presents traders with a challenging situation. While a breakout above $105,000-$106,000 could trigger a rally towards new highs, a rejection at current levels could lead to a significant pullback. Monitoring key liquidity levels and expert analysis is crucial for making informed trading decisions. As always, investors should conduct their own research and consider their risk tolerance before investing in Bitcoin or any other cryptocurrency.