Key Takeaways:

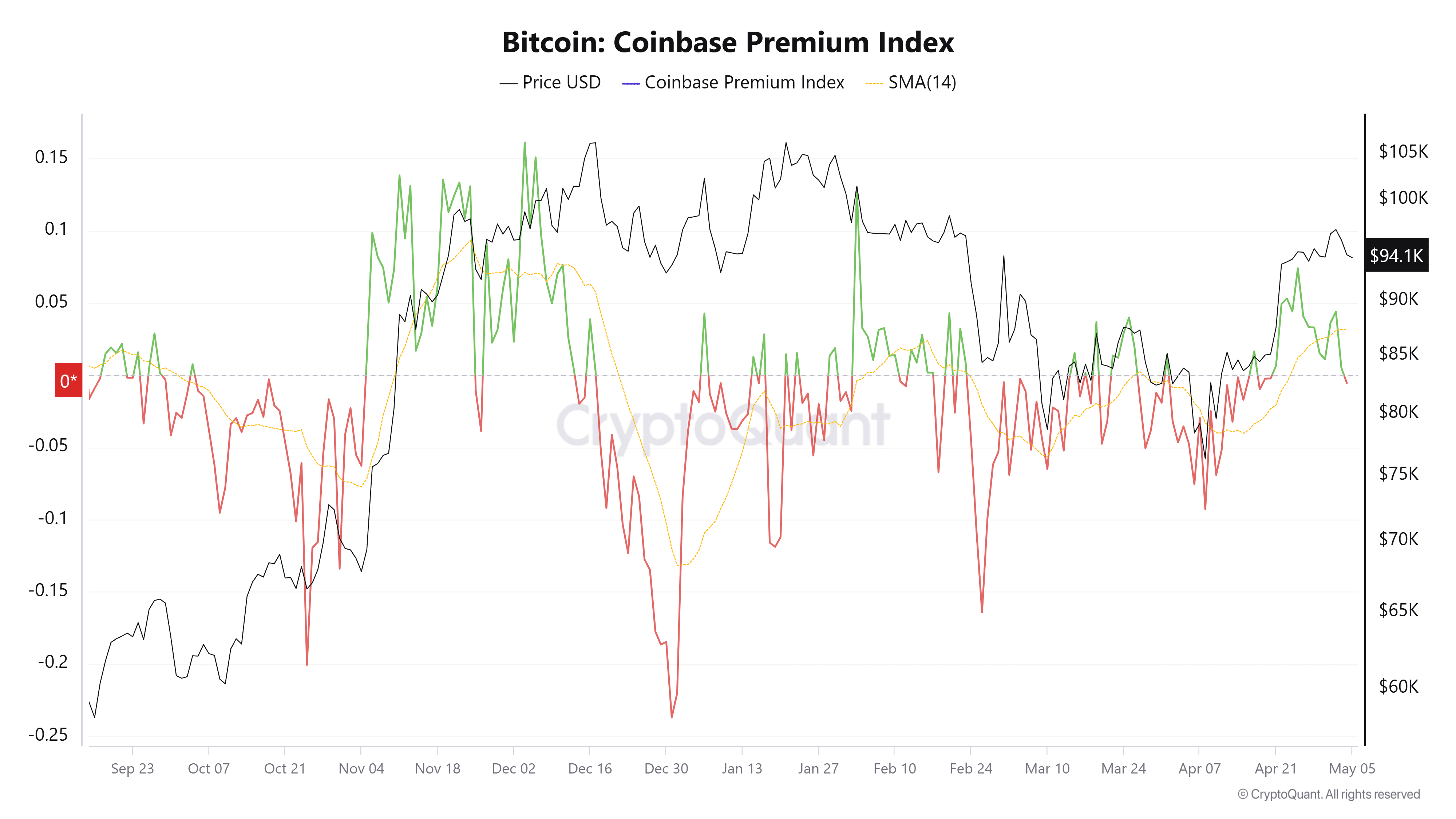

- Coinbase premium index turned negative, indicating potential short-term bearish sentiment among US investors.

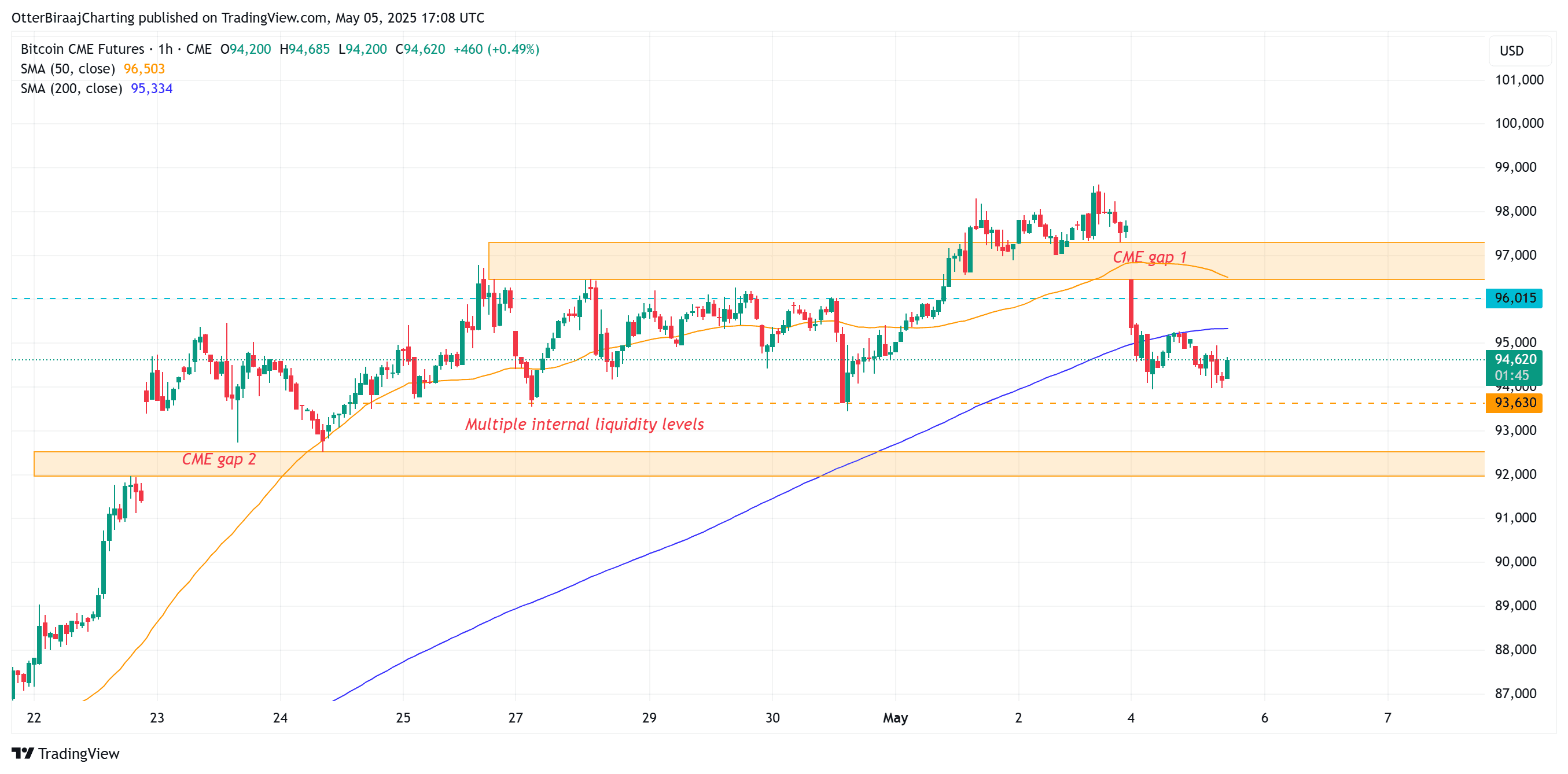

- Bitcoin CME futures gaps between $92,000-$92,500 and $96,400-$97,400 suggest a period of range-bound trading.

- Analysis of key support and resistance levels provides insights into potential future price movements.

Bitcoin’s price is currently navigating a complex landscape, influenced by factors ranging from Coinbase premium fluctuations to the presence of CME futures gaps. This analysis delves into these key elements to provide a clearer understanding of potential future price movements.

The Coinbase premium index, which measures the price difference between Bitcoin on Coinbase Pro and other exchanges like Binance, recently turned negative after a 15-day positive trend. This shift signals a possible decrease in buying pressure from US investors, who often use Coinbase as a primary platform. The negative premium often reflects a reduction in institutional and retail demand. When the premium is positive, it suggests strong buying activity, while a negative premium indicates selling pressure.

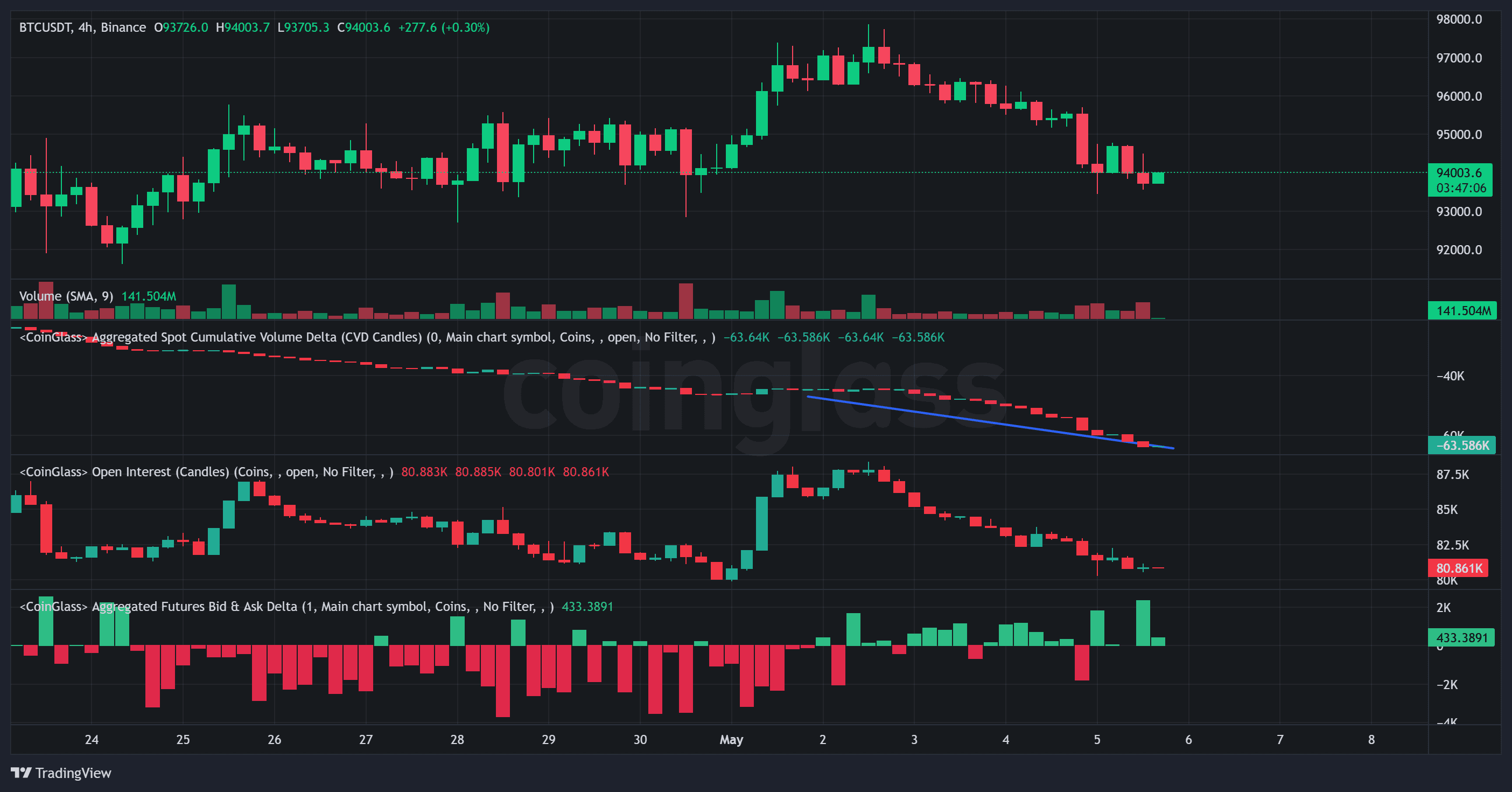

This coincides with Bitcoin’s dip below $94,000, further emphasizing the potential for a short-term bearish trend. Analyzing the spot cumulative volume delta (CVD) from late April revealed over $300 million in negative figures, indicating sustained selling activity.

Adding to the complexity, Bitcoin is currently trading between two CME (Chicago Mercantile Exchange) futures gaps. These gaps, located between $92,000-$92,500 and $96,400-$97,400, often act as magnets, with price tending to move towards and fill them. The lower gap represents potential support, while the upper gap indicates potential resistance.

CME Futures Gaps: What They Mean for Bitcoin

CME futures gaps occur when the price of Bitcoin futures on the CME exchange opens significantly higher or lower than the previous day’s close, creating a gap in the price chart. These gaps often act as areas of price attraction, with traders expecting the price to eventually move to fill the gap.

The presence of these gaps suggests that Bitcoin could test the $92,000 level in the near future. The failure to maintain a position above the 200-day simple moving average (SMA) further strengthens this possibility. A break below this key moving average can often signal a shift in trend.

Key Levels and Potential Scenarios

Several key levels are important to watch in the coming days:

- Support: $92,000-$92,500 (lower CME gap), $93,000 (liquidity level)

- Resistance: $96,400-$97,400 (upper CME gap), $97,000-$98,000 (overhead resistance)

A break below the $93,000 support could trigger a further decline towards the lower CME gap around $92,000. Conversely, a sustained move above the $97,400 resistance could signal a bullish reversal and a potential move towards $100,000.

Analyzing Market Sentiment

Overall market sentiment appears cautious, with the negative Coinbase premium and reduced leverage in futures markets suggesting a degree of risk aversion. However, recent data indicates increasing buying interest in derivatives markets, providing a potential counter-signal.

In conclusion, Bitcoin’s price action is currently influenced by a combination of factors, including Coinbase premium, CME futures gaps, and key support and resistance levels. Monitoring these elements will be crucial for understanding potential future price movements. Range-bound trading is likely in the short term, with potential tests of both the upper and lower CME gaps.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.