Bitcoin (BTC) is navigating a week filled with significant U.S. macro data releases, leading crypto market observers to anticipate heightened volatility. Here’s a breakdown of the key factors influencing Bitcoin’s price and potential movements this week.

Bitcoin Price Action and Key Support Levels

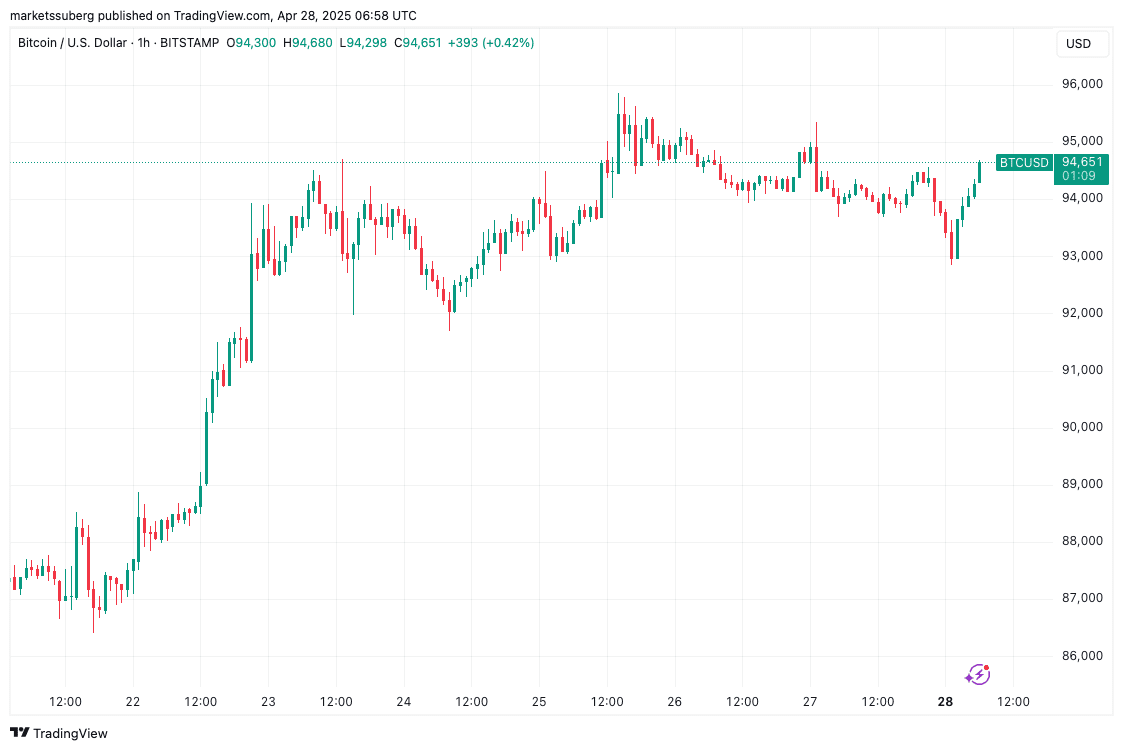

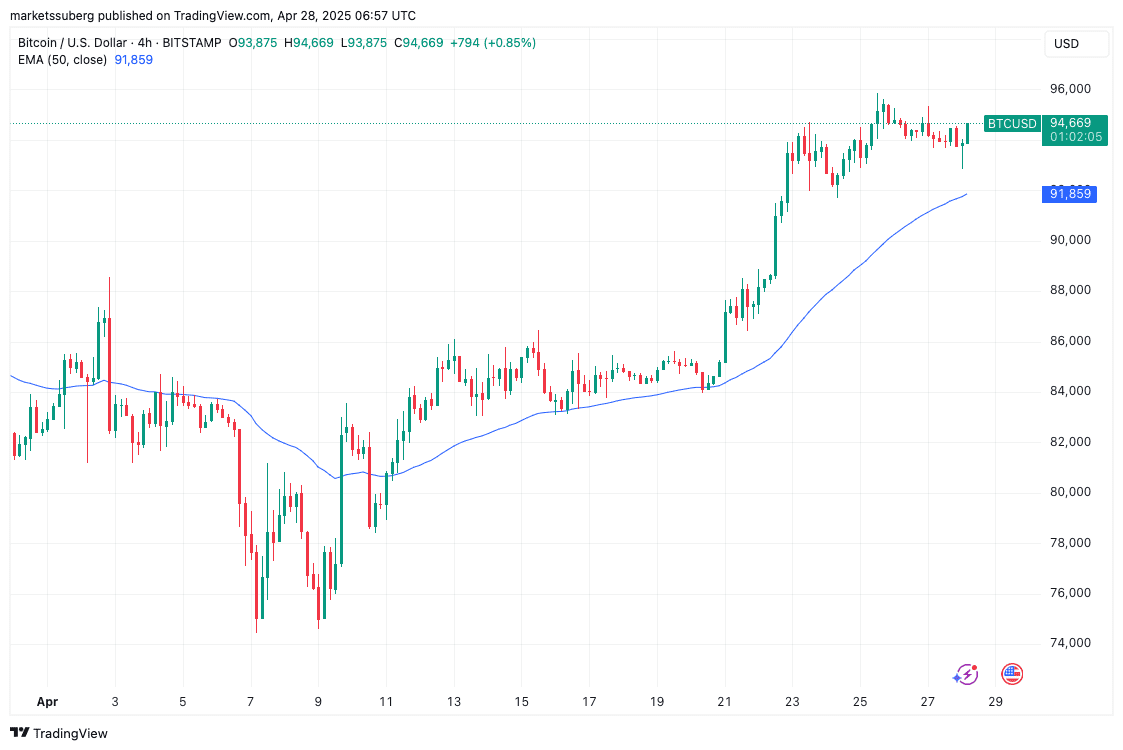

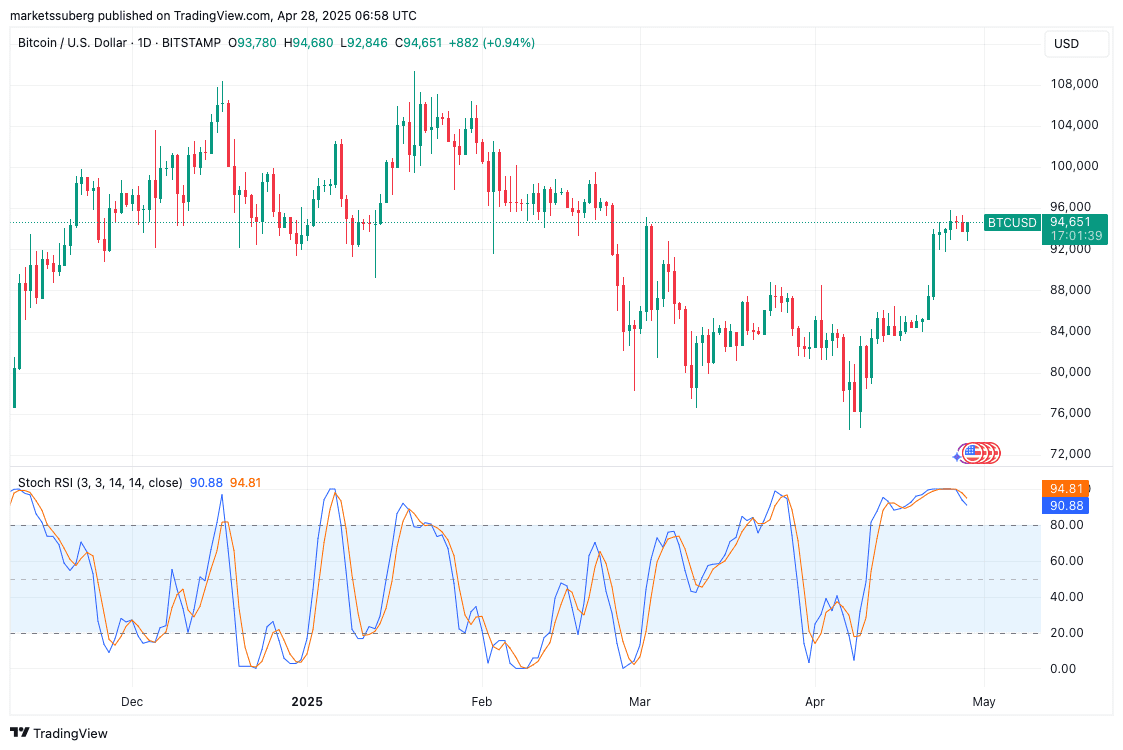

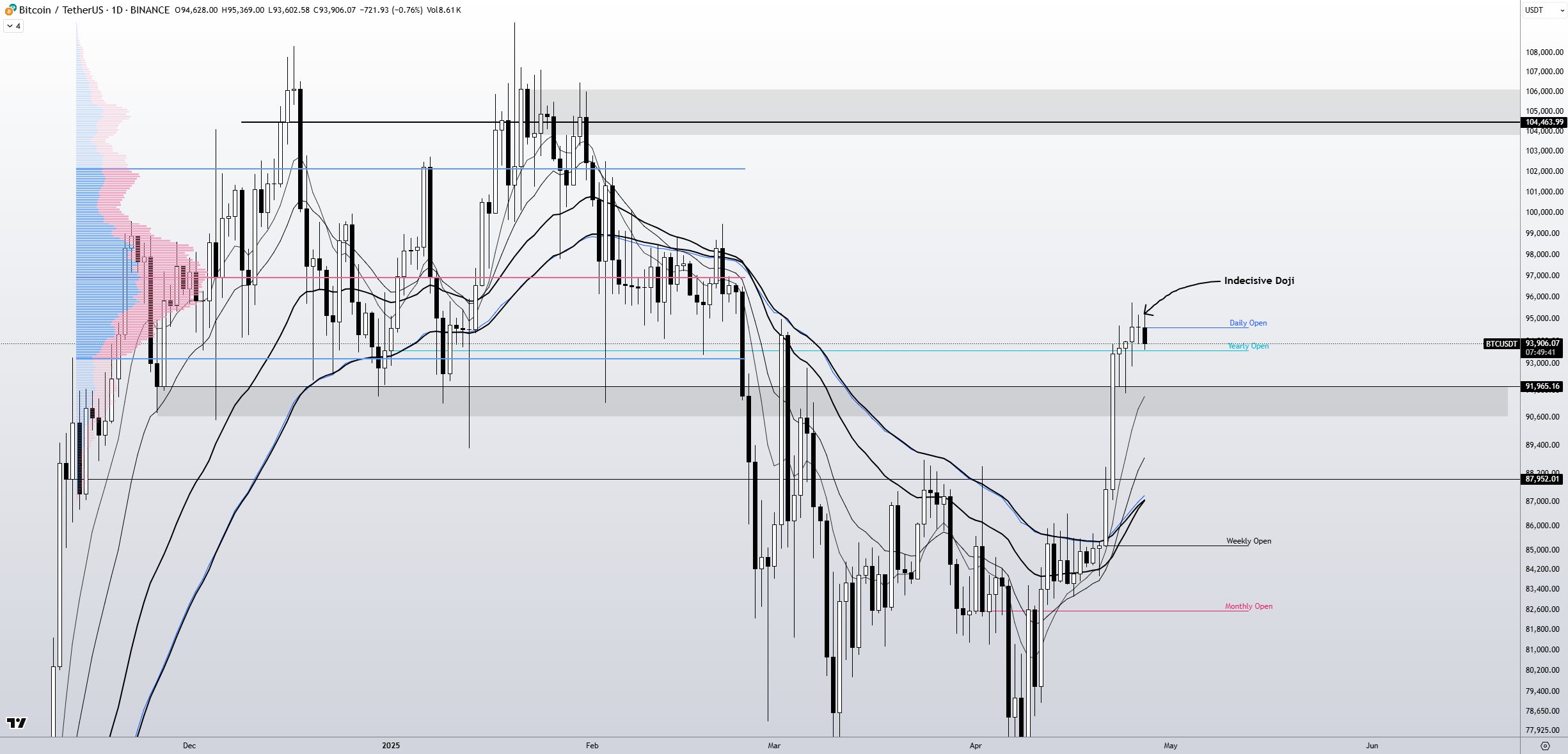

- Retesting Key Levels: Bitcoin is retesting the $92,000 level as support following a promising weekly close.

- Analyst Predictions: While some traders anticipate further upward movement, others foresee a deeper price correction.

- Support to Watch: Traders are closely watching the $88,000 level as a potential support zone.

Popular trader CrypNuevo suggests the possibility of Bitcoin reaching $97,000, citing ongoing momentum. However, he also notes the potential for a retest of the 4-hour 50 EMA (Exponential Moving Average), currently around $91,850, as a support level.

Macroeconomic Data and Federal Reserve Policy

- Key Data Releases: The week features crucial U.S. macro data releases, including Q1 GDP, nonfarm payrolls, and tech earnings.

- Inflation Focus: The Personal Consumption Expenditures (PCE) index, the Federal Reserve’s preferred inflation gauge, will be a key focus.

- Potential Volatility: These data releases are expected to inject volatility into crypto and risk assets.

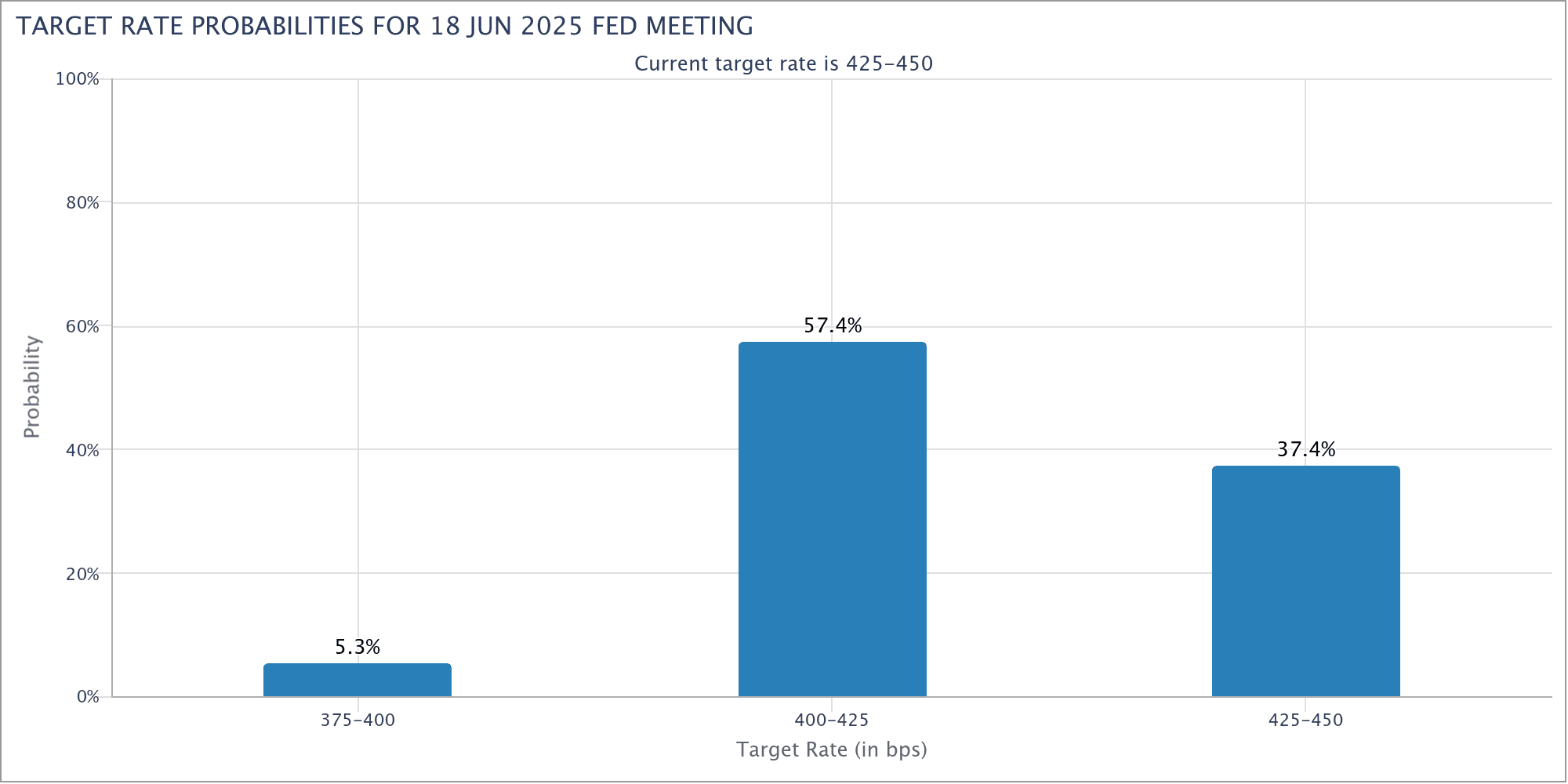

The Federal Reserve’s policy decisions remain a critical factor. While markets anticipate interest rate cuts beginning in June, the Fed remains hawkish. Discrepancies in opinions regarding the June FOMC (Federal Open Market Committee) meeting highlight the uncertainty surrounding future monetary policy.

Long-Term Price Predictions and Market Liquidity

- $180,000 Target: Hedge fund founder Dan Tapiero predicts Bitcoin reaching $180,000 before summer 2026.

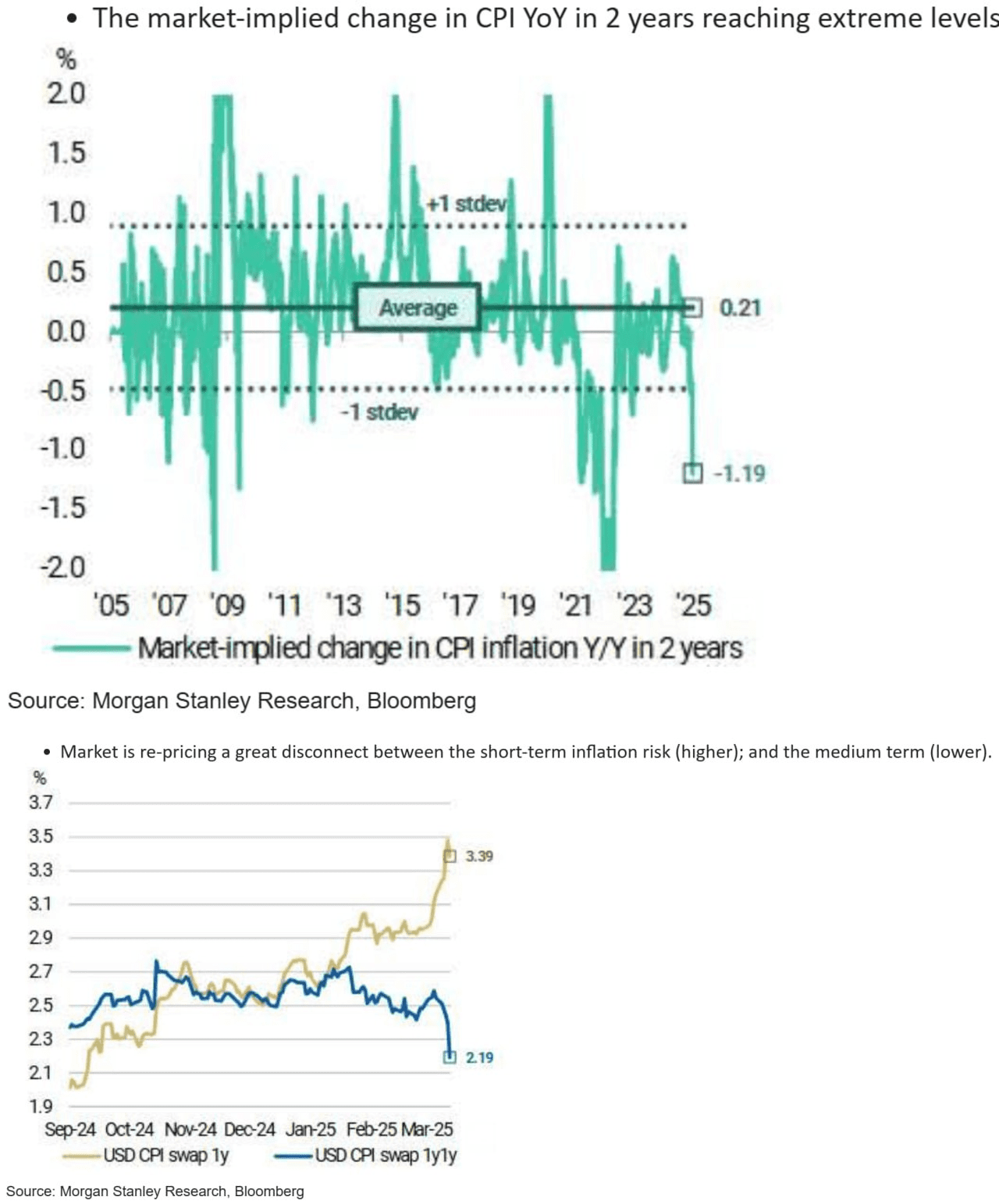

- Factors Influencing Price: Tapiero cites deteriorating manufacturing expectations and collapsing forward market inflation indicators.

- Liquidity Boost: He believes increasing market liquidity will benefit Bitcoin and risk assets.

Tapiero argues that the Fed’s survey showing deteriorating manufacturing expectations will be difficult for them to ignore, leading to increased liquidity that will drive Bitcoin’s price higher.

Short-Term Holder Analysis and Market Sentiment

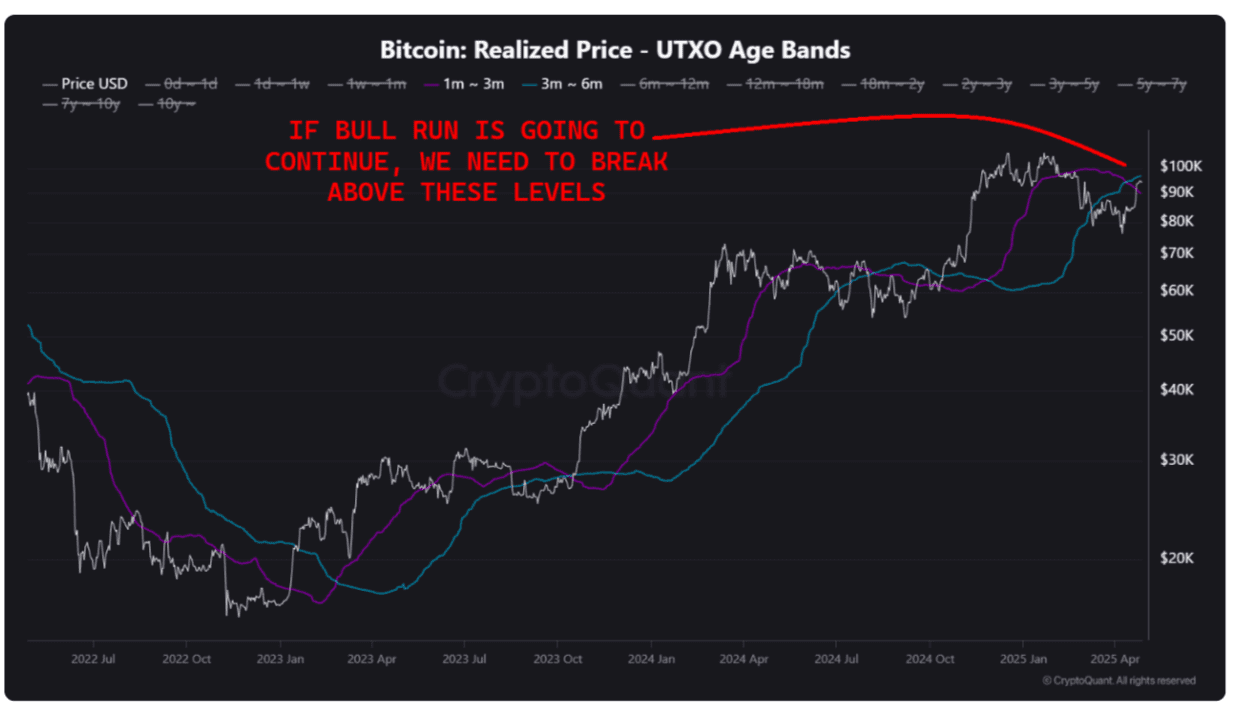

- STH Cost Basis: Bitcoin’s price reaching the short-term holder (STH) realized price is a key factor.

- Bull Run Indicator: Maintaining the price above the STH realized price (around $92,000) is crucial for a continued bull run.

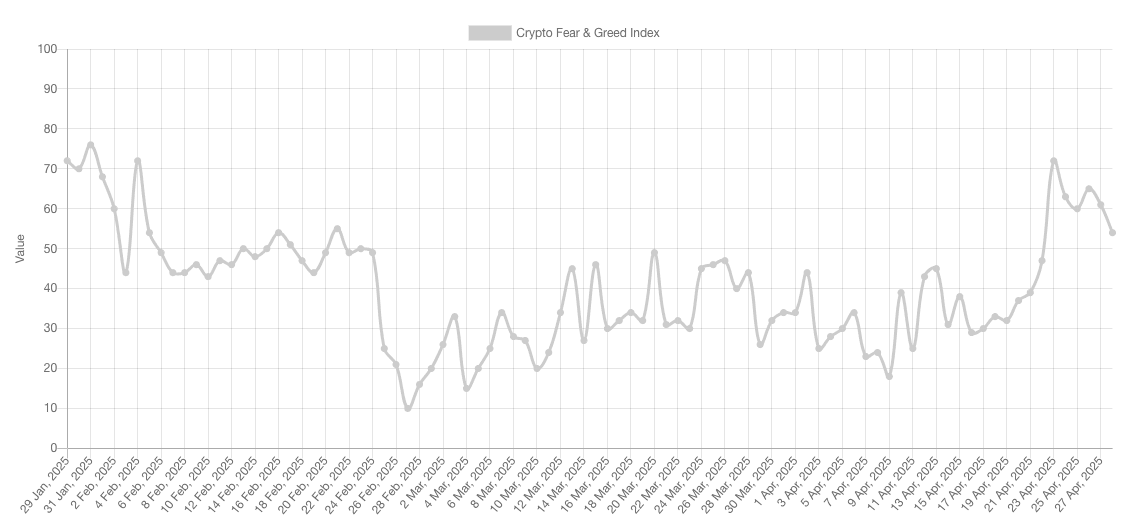

- Greed Factor: The Crypto Fear & Greed Index suggests a potential local price top due to increased greed in the market.

CryptoQuant data shows that the combined STH cost basis currently sits at around $92,000, making this level crucial for Bitcoin to hold as support. A break below this level could signal a weakening of the bullish trend.

Volatility and S&P 500 Correlation

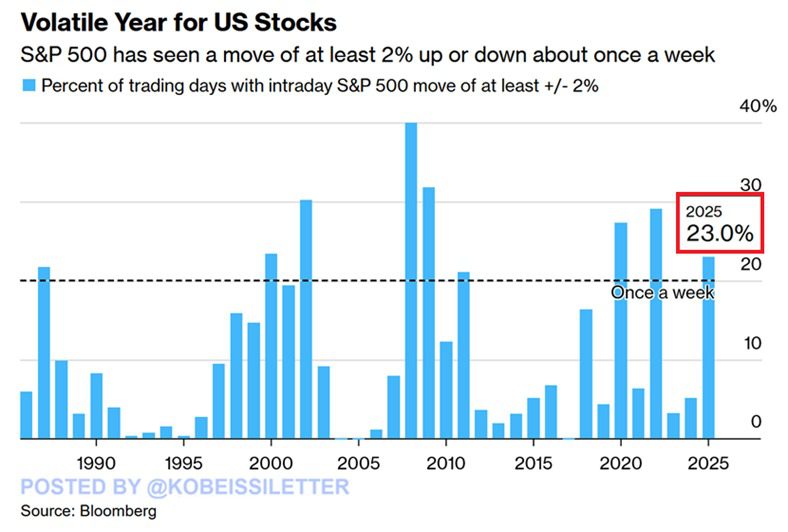

- Increased Volatility: The S&P 500 has experienced a 2% move in either direction on 23% of trading days this year, indicating high volatility.

- Impact of Tariffs: U.S. trade tariffs have resulted in wild swings in crypto, stocks, and commodities.

- Potential Decoupling: Market sentiment will influence whether Bitcoin can decouple from the S&P 500.

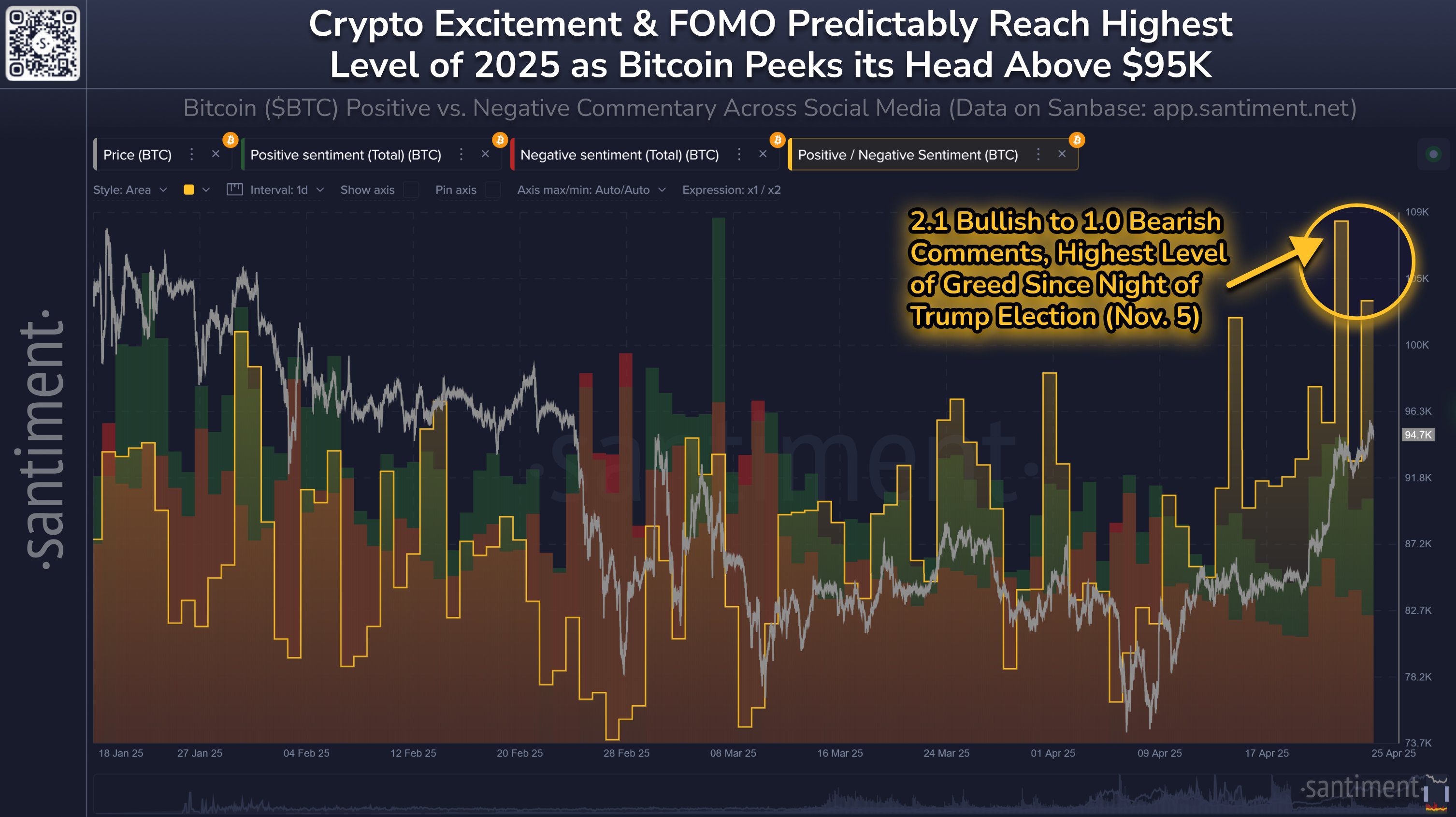

The level of excitement and FOMO (Fear of Missing Out) within the market will likely influence whether a local top forms, or if crypto can continue to perform independently of traditional markets.

Conclusion

Bitcoin’s price action is currently influenced by a complex interplay of factors, including technical levels, macroeconomic data releases, Federal Reserve policy, and market sentiment. Monitoring these elements will be crucial for understanding Bitcoin’s trajectory in the coming week.