Key Takeaways:

- Bitcoin experienced a correction, dropping to $93,500, mirroring declines in US Treasury yields, indicating a flight to safer assets.

- Strategy’s significant Bitcoin purchases and stock market strength have provided support, keeping BTC above $90,000.

- Achieving a breakout towards $100,000 requires Bitcoin to demonstrate independence from stock market trends and improved liquidity signals.

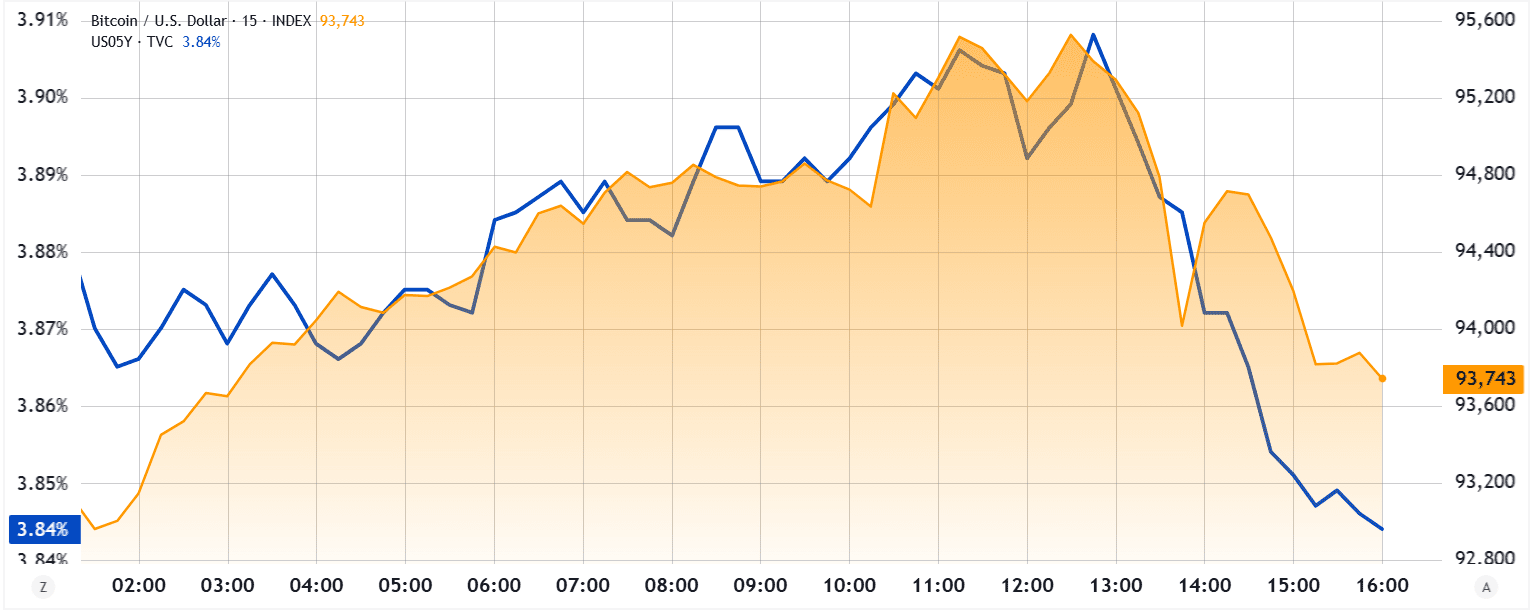

Bitcoin (BTC) faced a correction, retreating to $93,500 on April 28th. This price dip coincided with a decrease in US Treasury yields, suggesting that investors were shifting towards less risky investments.

While Bitcoin has seen gains, the inability to consistently stay above $95,000 raises questions about its near-term potential.

Macroeconomic Factors Influencing Bitcoin

The recent price correction followed a pattern observed in US Treasury yields, where falling yields reflect a preference for safer investments. This trend suggests a broader reduction in risk appetite across financial markets.

Impact of Trade Tensions and Optimism

Initial market optimism was fueled by reports of China reducing tariffs on certain US semiconductor imports. However, this sentiment shifted following US Treasury Secretary Scott Bessent’s comments regarding trade agreement responsibilities.

Earnings Season vs. Macroeconomic Concerns

Despite strong first-quarter earnings reported by many US companies, Bitcoin’s price is being affected by broader macroeconomic uncertainties. Investors remain unconvinced of Bitcoin’s ability to act as a hedge during potential economic downturns.

Sustainability of Bullish Momentum

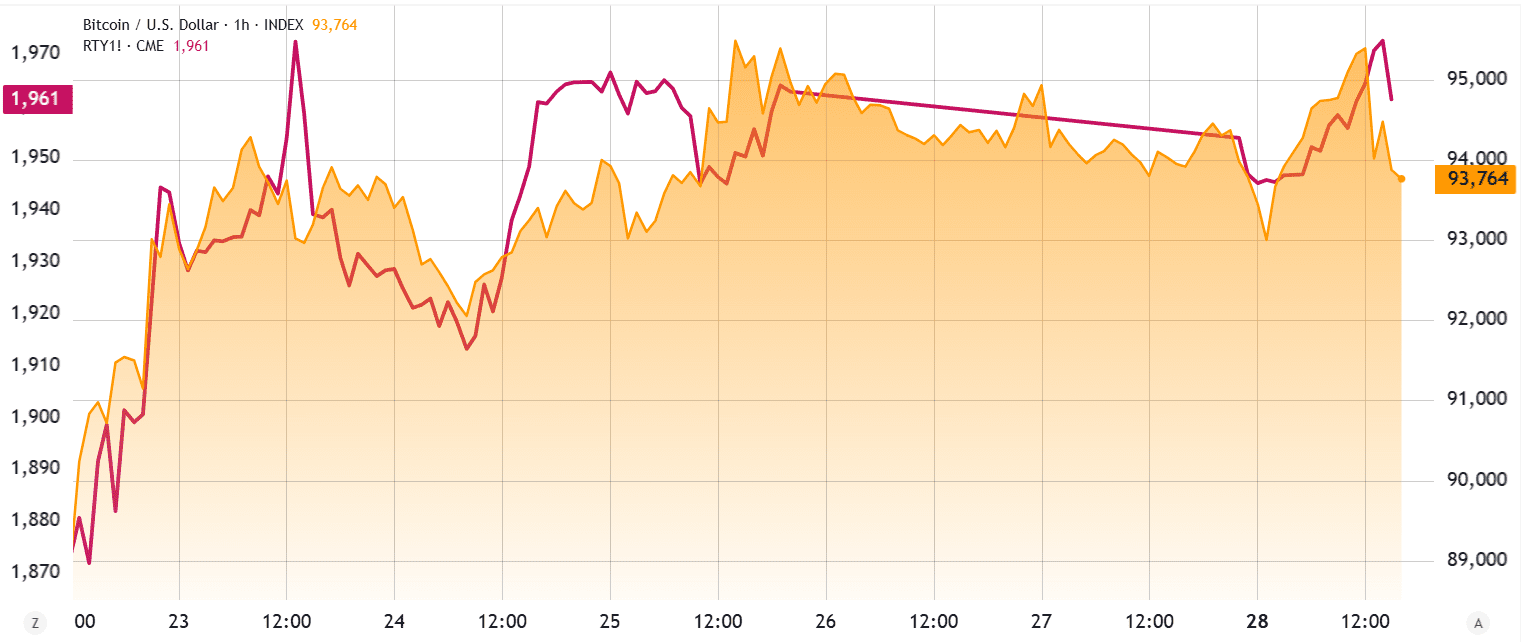

Concerns exist regarding the sustainability of recent bullish momentum, largely driven by Strategy’s significant Bitcoin acquisitions. The near-exhaustion of previously approved common share issuance also raises questions.

Divergence from Stock Market Needed

For Bitcoin to experience a sustained rally above $100,000 and reach new all-time highs in 2025, it must demonstrate a clearer separation from US stock market trends. Evidence of central banks injecting liquidity to prevent a crisis is also crucial.

US Interest Rate Trajectory

Traders are closely watching the trajectory of US interest rates and the potential for a reversal in the Federal Reserve’s balance sheet, which could signal the end of monetary tightening.

Additional Factors to Consider:

- Inflation: Persistently high inflation could lead to more aggressive interest rate hikes, negatively impacting risk assets like Bitcoin.

- Regulation: Increased regulatory scrutiny and potential crackdowns on the crypto industry could dampen investor sentiment.

- Geopolitical Risk: Escalating geopolitical tensions could trigger a flight to safety, potentially benefiting Bitcoin as a store of value but also introducing volatility.

- Technological Developments: Breakthroughs in blockchain technology or the emergence of competing cryptocurrencies could influence Bitcoin’s dominance.

- Adoption by Institutions: Continued institutional adoption of Bitcoin could provide a more stable foundation for price appreciation.

Analyzing the Price Correction: A Deeper Dive

The initial drop of $2,000 may appear insignificant when considering Bitcoin’s volatility. However, it is a symptom of underlying market anxiety. The parallel movement between Bitcoin and Treasury yields is telling. Investors are keenly aware of the potential for economic instability. This anxiety makes them reduce their holdings in riskier assets.

The fact that China’s tariff cuts did little to boost Bitcoin is notable. This suggests investors were more concerned about the US Treasury Secretary’s comments on trade than the optimism surrounding the cuts.

The Role of Strategy’s Bitcoin Purchases

Strategy’s BTC purchases are playing a significant role in supporting the price of Bitcoin. This strategy is working for them and for the broader Bitcoin community. However, it introduces a risk. If they slow down or stop buying, the resulting impact on the market could be severe.

In conclusion, the short term direction of bitcoin is uncertain. It depends on a complex interaction of macro economic factors and market sentiment. To see a truly bullish trend, Bitcoin needs to demonstrate independence from those external market factors.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice.