Key Takeaways:

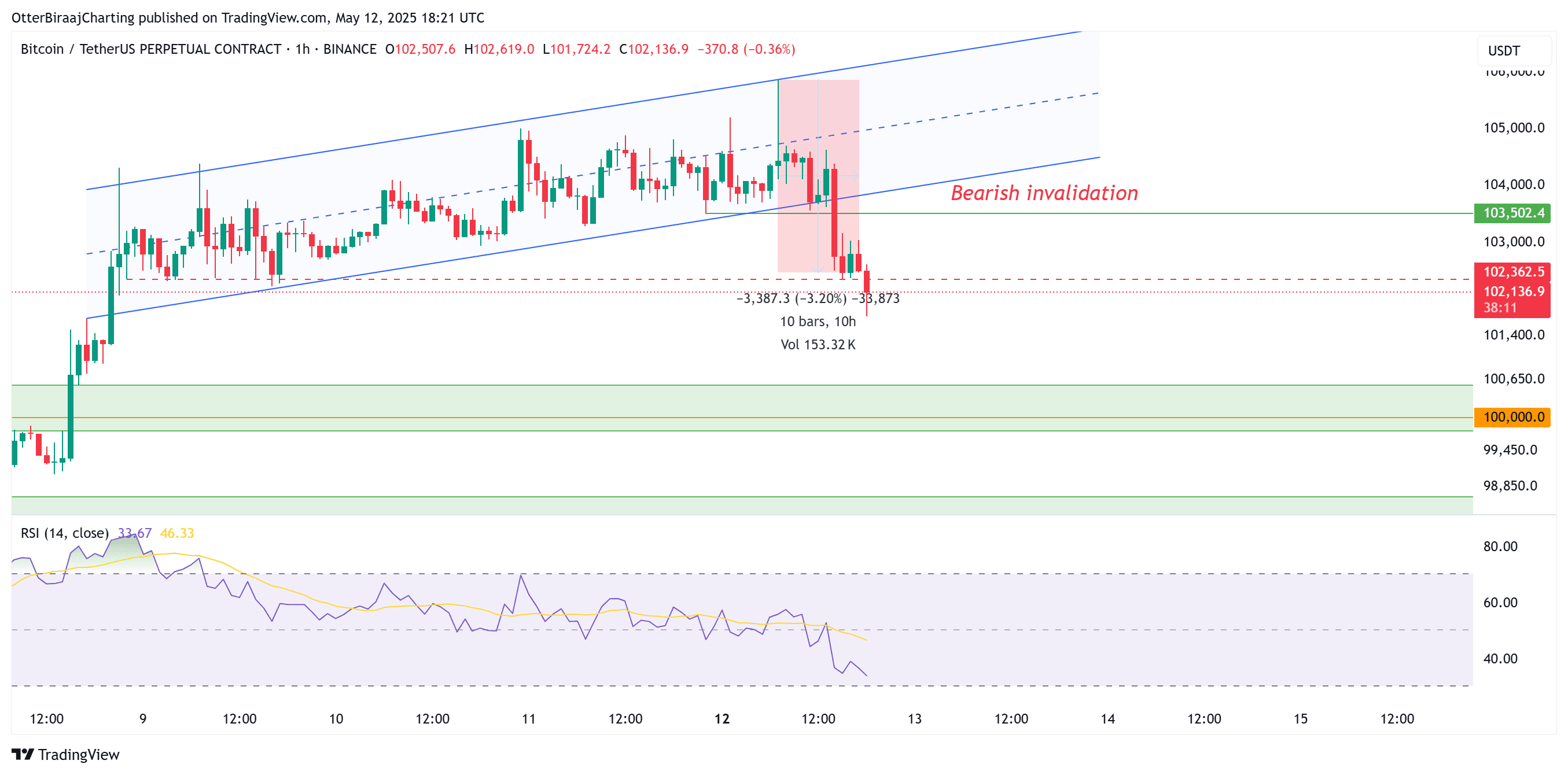

- Bitcoin experienced a bearish breakout from an ascending channel, increasing the risk of profit-taking around $106,000.

- US CPI data release is a crucial factor influencing Bitcoin’s price; a lower-than-expected CPI could boost Bitcoin, while a higher CPI may lead to a price drop below $100,000.

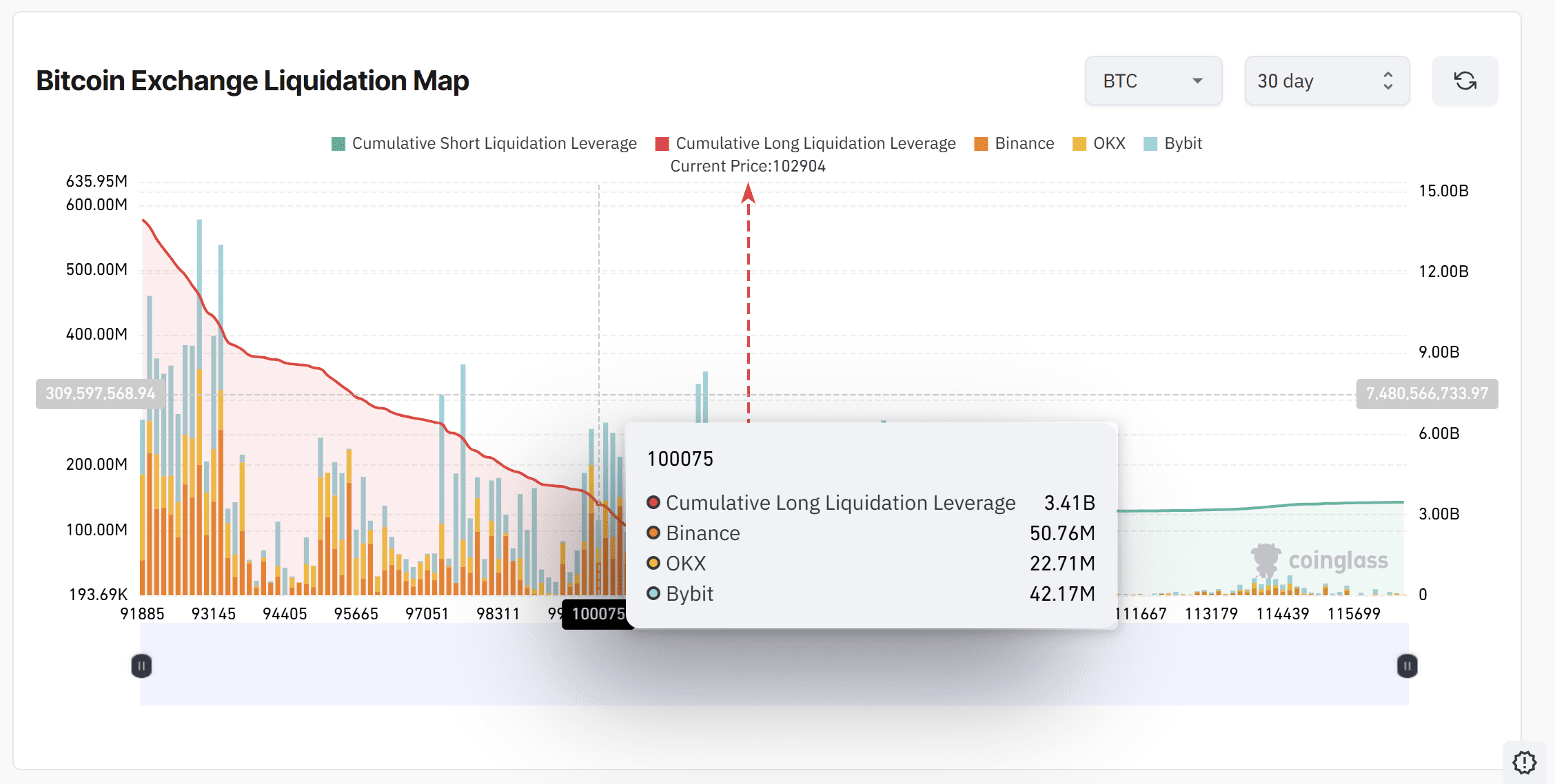

- Significant leveraged long positions are at risk, potentially causing a ‘long squeeze’ if Bitcoin’s price falls to $100,000.

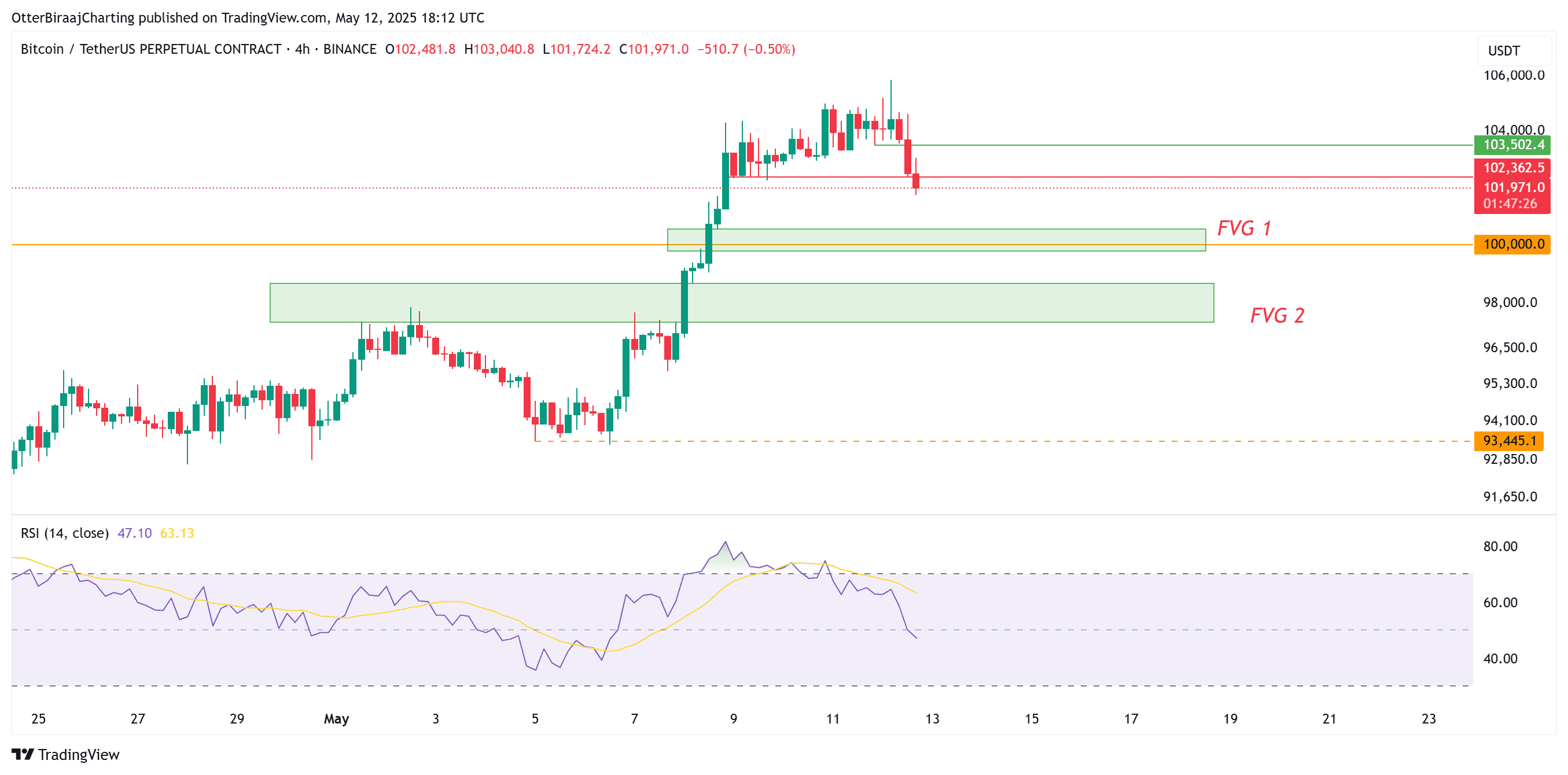

Bitcoin (BTC) reached an intraday high of $105,800 on May 12 before declining to $101,400. The price movement formed an ascending channel pattern on lower timeframes (LTF), followed by a bearish breakout. This breakout suggests a potential shift in market sentiment, with increased selling pressure.

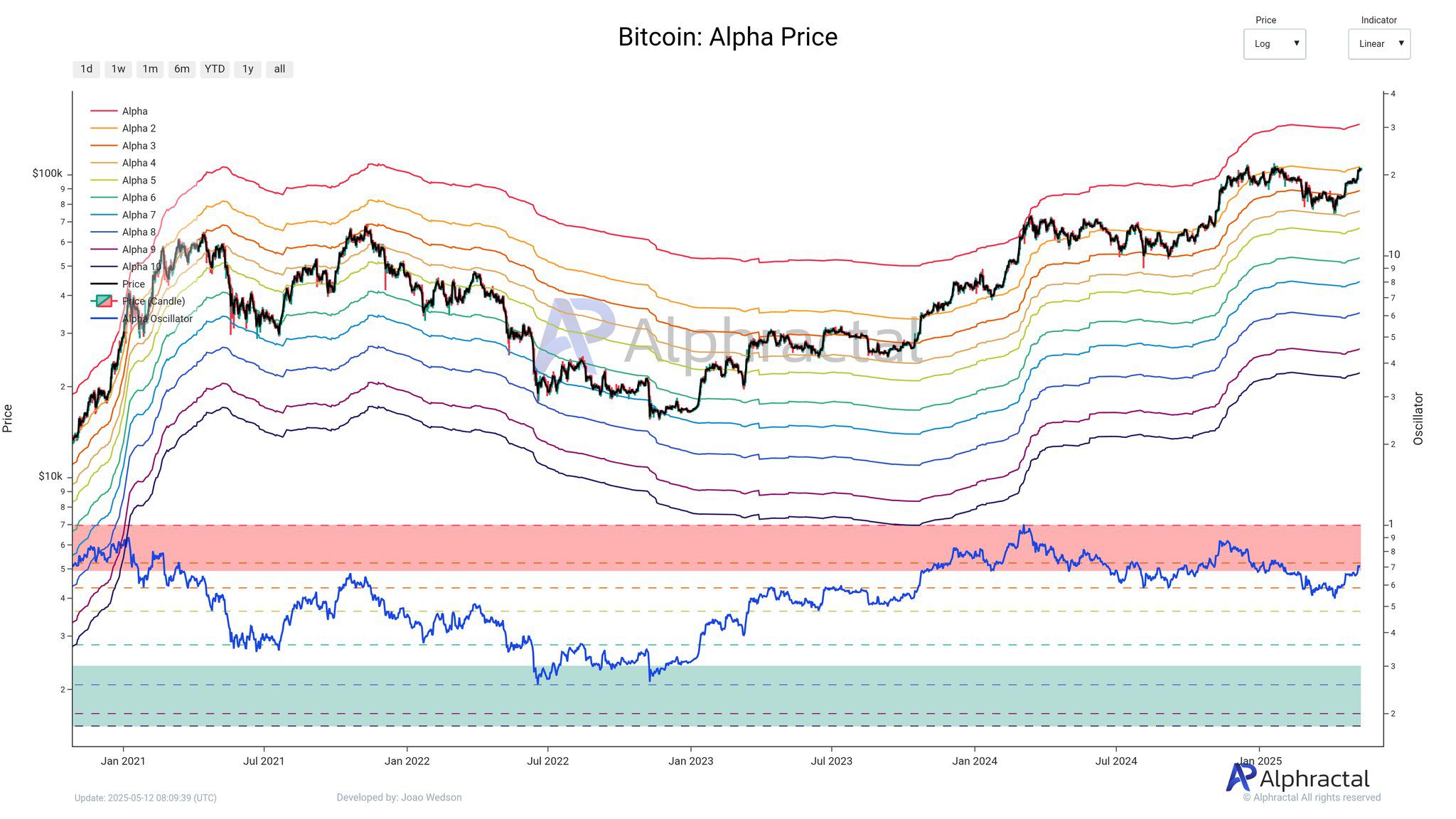

Alphractal suggests that Bitcoin’s retest of the $106,000 resistance level increases the likelihood of profit-taking. The ‘Alpha Price’ zone, where long-term holders might sell, is near current price levels.

Liquidation Risks: Over $3.4 billion in leveraged long positions are at risk of liquidation if Bitcoin’s price drops to $100,000. This creates a potential ‘long squeeze’ scenario, further driving down the price.

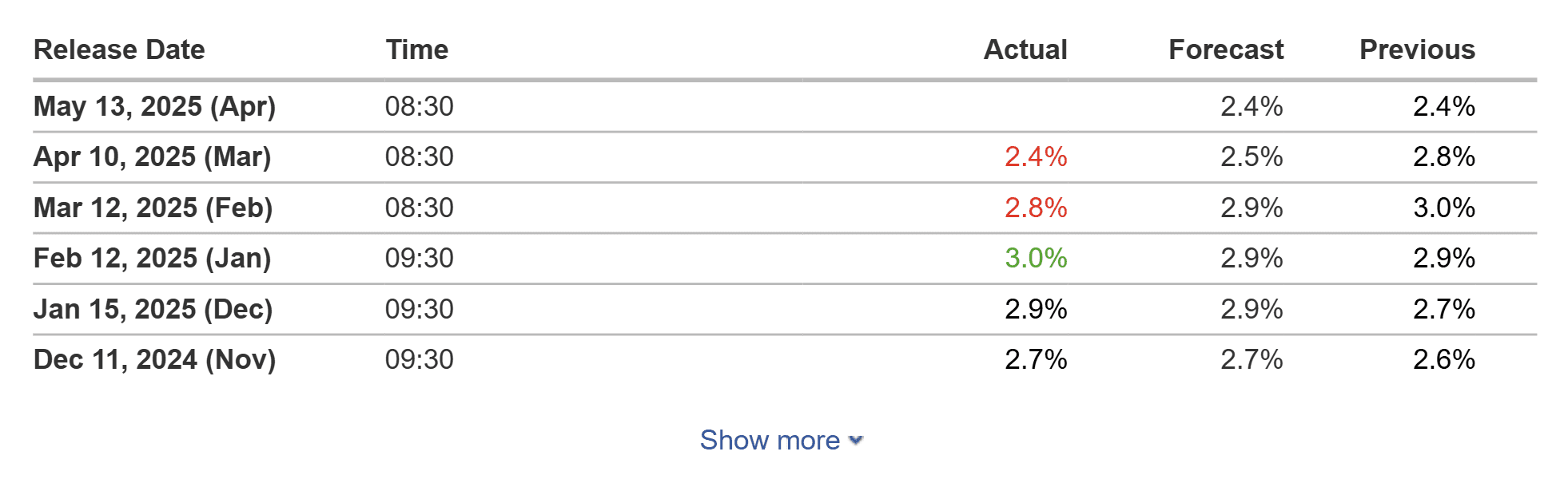

CPI Data’s Impact on Bitcoin

The upcoming US Consumer Price Index (CPI) release is a crucial event for Bitcoin. Traders are de-risking their positions, anticipating potential market volatility.

CPI Scenarios:

- Lower-than-Expected CPI: A lower CPI could signal potential Federal Reserve rate cuts in 2025, boosting risk assets like Bitcoin and equities.

- Higher-than-Expected CPI: A higher CPI could raise inflation fears, strengthening the dollar and pressuring Bitcoin’s price.

Key Support Levels: If Bitcoin faces bearish pressure post-CPI release, the $100,500 – $99,700 range (a fair value gap – FVG) on the four-hour chart is a critical area of interest. A further drop could lead to a retest of the $98,680 – $97,363 FVG, representing an 8% correction from recent highs.

Understanding Profit-Taking in Bitcoin

Profit-taking is a common occurrence in cryptocurrency markets, especially after significant price rallies. When Bitcoin reaches levels like $106,000, investors who bought at lower prices may choose to sell their holdings to realize gains. This increased selling pressure can cause a temporary pullback in price.

Several factors influence profit-taking behavior:

- Market Sentiment: Overall optimism or pessimism about Bitcoin’s future prospects.

- Price Levels: Significant resistance levels, like the $106,000 mark, can trigger profit-taking.

- Economic News: Events like CPI releases and Federal Reserve announcements impact market sentiment.

Additional Factors Affecting Bitcoin’s Price

Beyond technical analysis and CPI data, other factors can influence Bitcoin’s price:

- Regulatory Developments: Government regulations regarding cryptocurrencies can significantly impact market sentiment. Positive regulations can boost prices, while negative regulations can cause declines.

- Institutional Adoption: Increased adoption by institutional investors like hedge funds and corporations can drive up demand and prices.

- Technological Advancements: Improvements to Bitcoin’s underlying technology, such as the Lightning Network, can improve its usability and increase its appeal.

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile, and you could lose money. Always do your own research before investing.