Key Takeaways:

- Bitcoin (BTC) faces a critical juncture around $93,000, potentially triggering a short squeeze if broken.

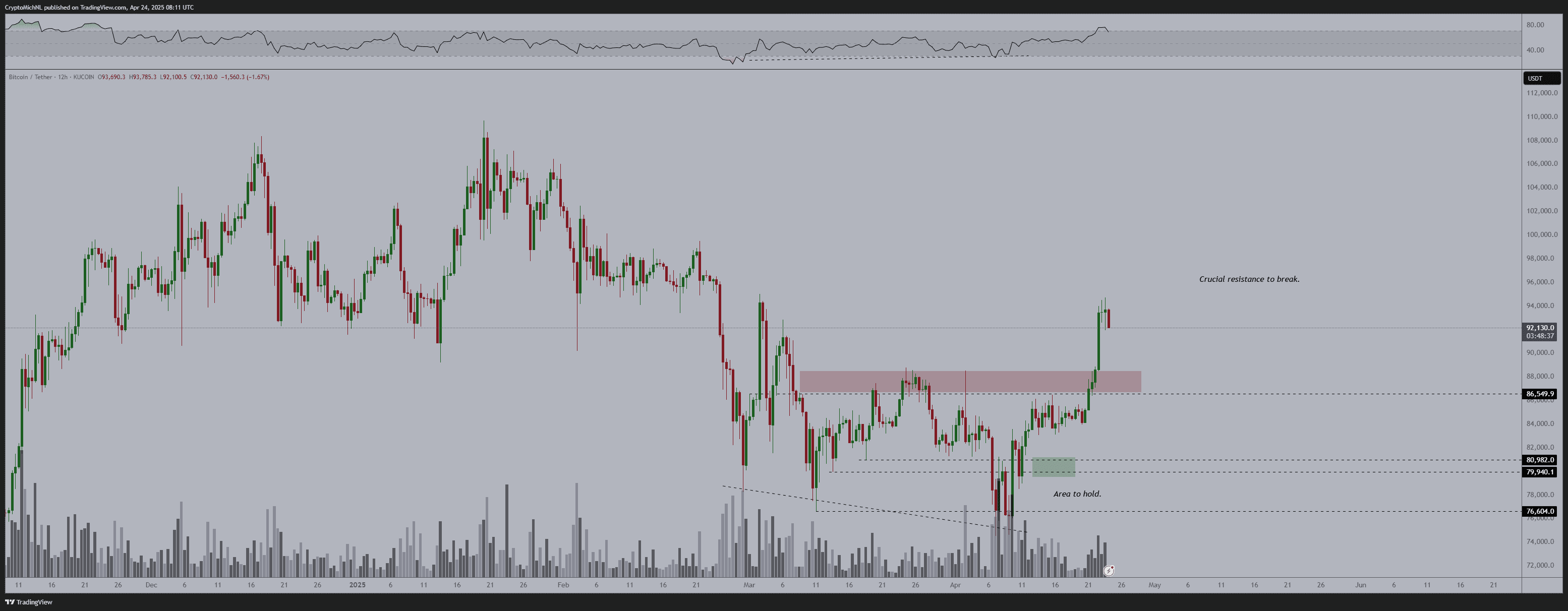

- Analysts suggest a possible retest of support levels, potentially down to $87,000, before a continued upward trend.

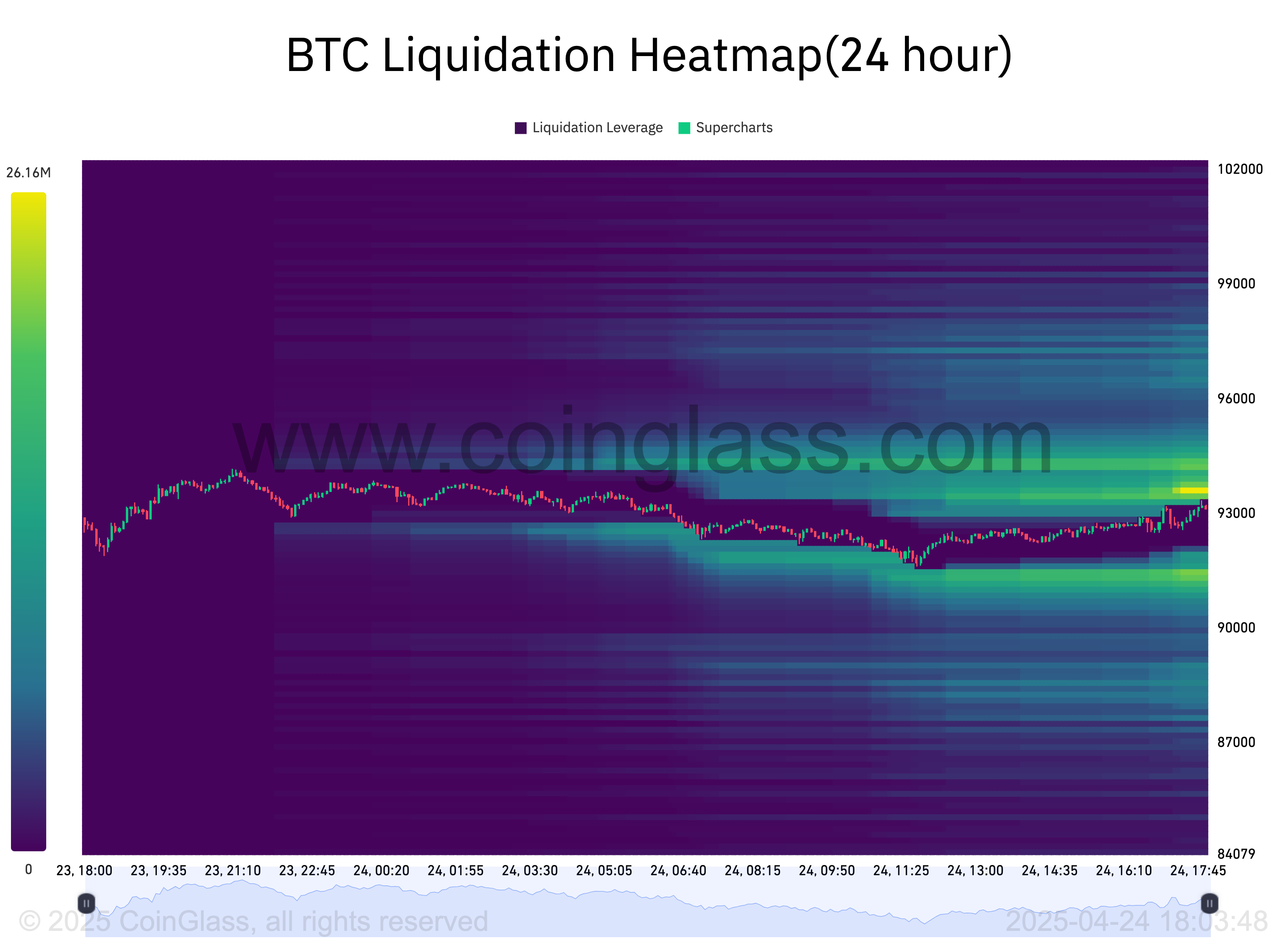

- Leveraged shorts are accumulating near the $93,500-$94,500 range, making a short squeeze scenario plausible.

Bitcoin’s recent price action has sparked a flurry of speculation, with traders and analysts weighing the likelihood of a “short squeeze” versus a deeper correction. After consolidating below the key resistance level of $93,000 on April 24th, the digital asset’s next move remains uncertain. This article delves into the factors influencing Bitcoin’s price, exploring both bullish and bearish scenarios.

Analyst Perspectives: Correction or Continuation?

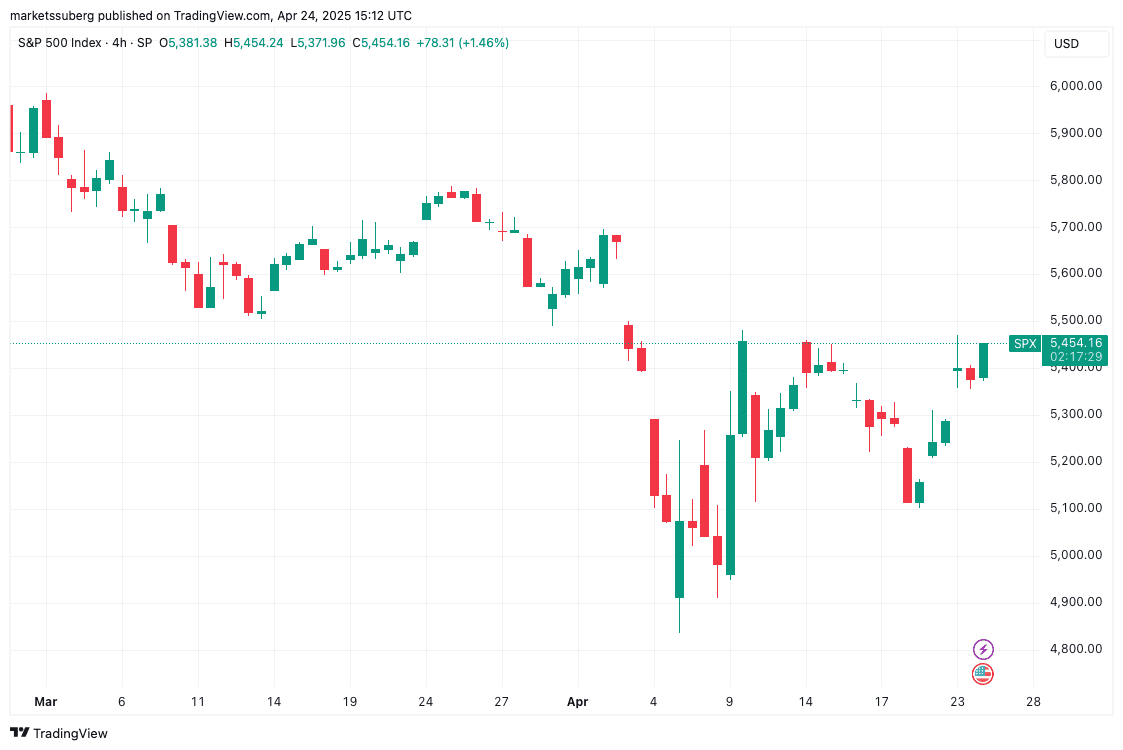

The Kobeissi Letter noted the market’s unexplained 1% rise, hinting at potential bullish news on the horizon. This sentiment suggests underlying strength in Bitcoin, even amidst market uncertainty. This may indicate some bigger players preparing for bigger moves.

Michaël van de Poppe considers a slight correction as “fairly normal” after Bitcoin’s recent breakout. He anticipates buyers stepping in to continue the ascent towards new all-time highs. He suggests we may see an ATH soon

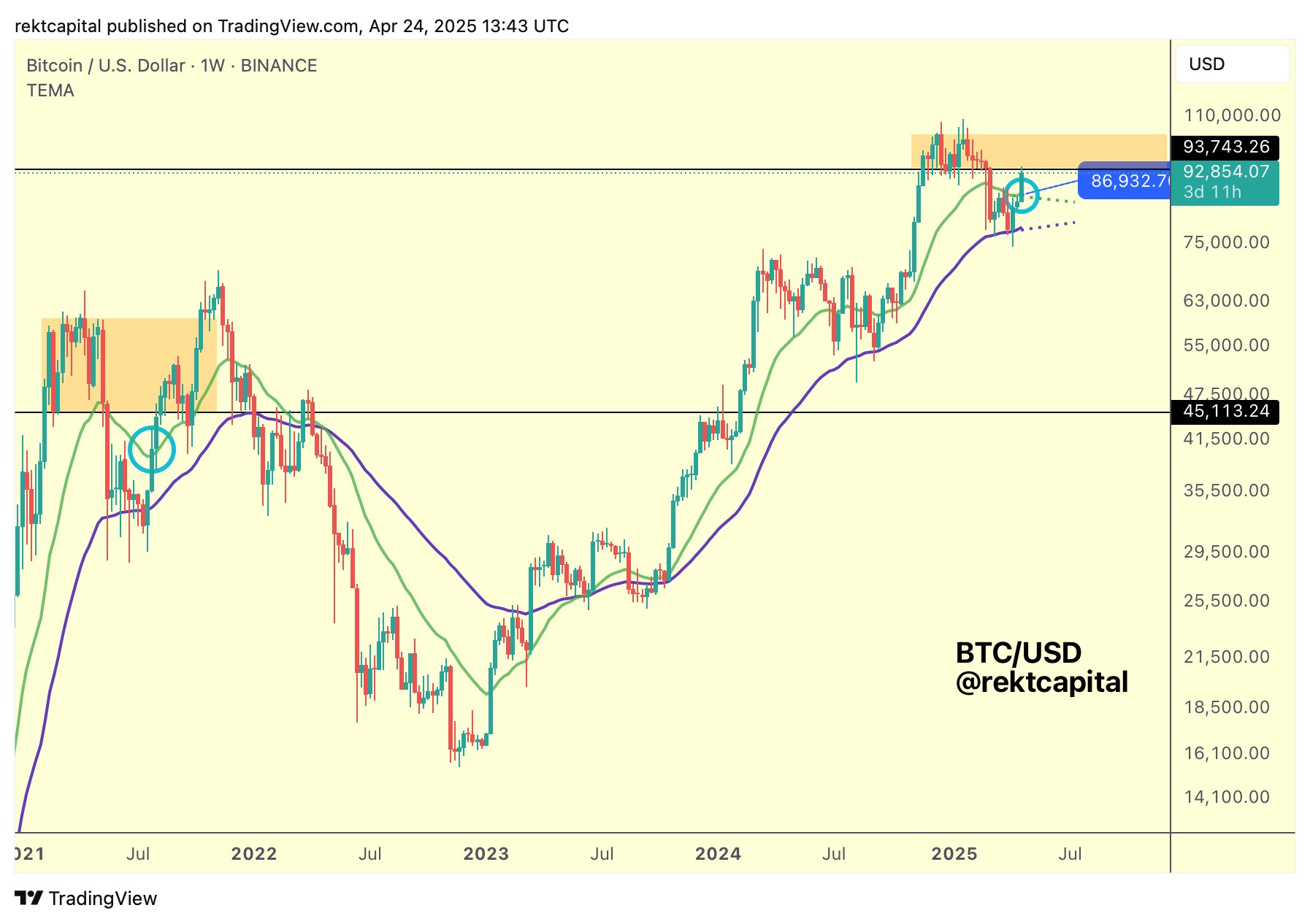

In contrast, Inmortal anticipates a dip to $88,000, presenting potential buying opportunities. Rekt Capital draws parallels to Bitcoin’s mid-2021 bull market behavior, suggesting a potential retest of the $87,000 level (green EMA) as support. These insights highlight the divergent viewpoints within the market, creating uncertainty for traders.

The Short Squeeze Scenario

The potential for a short squeeze arises from the concentration of leveraged short positions around the $93,500-$94,500 range. A short squeeze occurs when a rapid price increase forces short sellers to buy back the asset to cover their positions, further driving up the price. This phenomenon can lead to explosive upward movement, benefiting those holding long positions.

Chad Ventures has pointed out that the liquidity of leveraged positions is building on both sides, with leveraged longs near $91,400 and leveraged shorts around $93,500-$94,500. A move above $93,500 could trigger significant liquidations and propel Bitcoin higher.

Key Price Levels and Factors to Watch

- $93,000-$93,500: A break above this resistance zone could trigger a short squeeze and further price appreciation.

- $91,400: The area of leveraged longs.

- $87,000-$88,000: Potential support levels for a deeper correction.

Other factors influencing Bitcoin’s price include overall market sentiment, macroeconomic conditions, and regulatory developments. Keep in mind market sentiments and movements.

Whale Activity and Market Manipulation

Cointelegraph reported on a large trading entity, “Spoofy the Whale,” removing a wall of asks at $90,000. This suggests potential market manipulation, highlighting the influence of large players on Bitcoin’s price. This could indicate a planned move from some major market movers.

Conclusion: Navigating the Uncertainty

Bitcoin’s current price action presents a complex picture, with potential for both upward and downward movement. Traders should carefully monitor key price levels, analyst opinions, and market sentiment to make informed decisions. The possibility of a short squeeze adds an element of excitement, while the risk of a deeper correction underscores the need for caution. Ultimately, Bitcoin’s trajectory will depend on a confluence of factors, requiring constant analysis and adaptation.