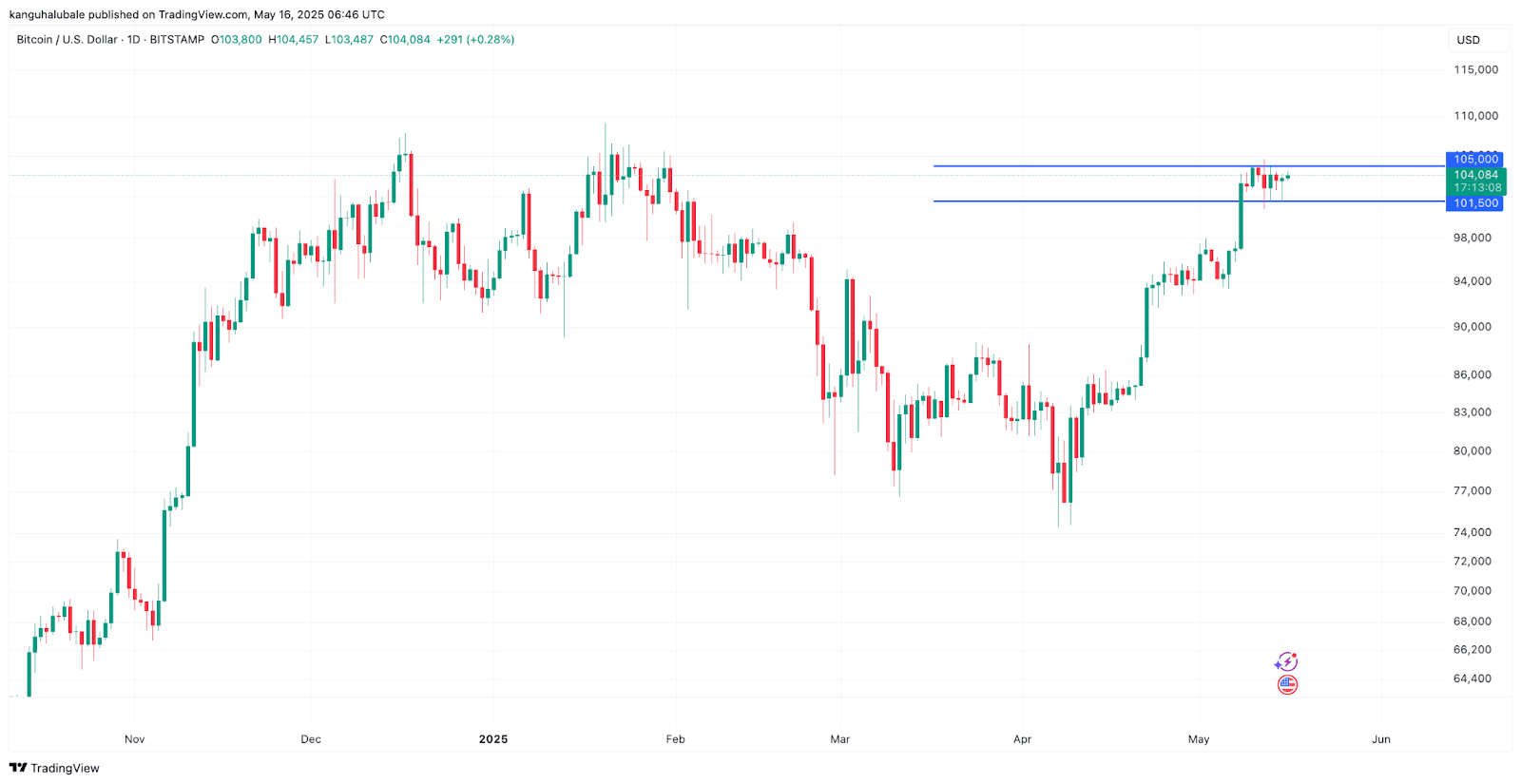

Bitcoin (BTC) has been consolidating for the past week, struggling to break through the $105,000 resistance level. This analysis explores the factors contributing to this price stagnation, examining market sentiment, key support levels, and potential catalysts for a breakout.

Key Takeaways:

- Bitcoin price is consolidating below $105,000 due to strong resistance.

- Market sentiment is mixed, with traders showing slight bearishness.

- A significant catalyst is needed for a sustainable breakout to new all-time highs.

Bitcoin’s Stalled Momentum at $105,000

Bitcoin’s price has been oscillating between $101,500 support and $105,000 resistance. Several analysts have pointed to this range-bound movement, highlighting the challenges BTC faces in overcoming this hurdle.

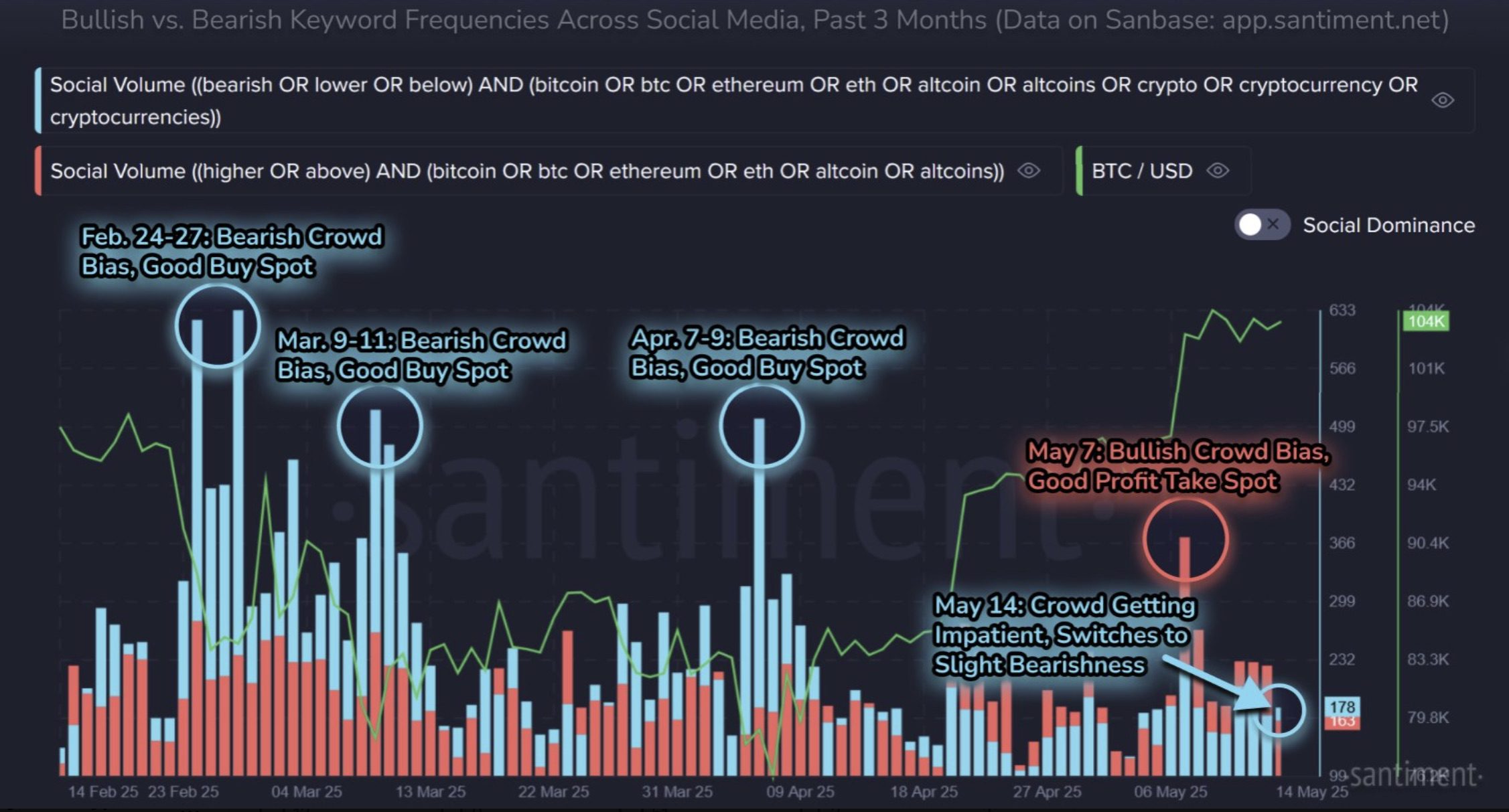

Market Sentiment and Trader Expectations

Despite Bitcoin managing to hold above $100,000, the failure to break $105,000 has led to some bearish sentiment among traders. However, it’s crucial to note that markets often move contrary to popular expectations. This potentially sets the stage for an unexpected bullish surge.

Santiment noted that retail traders are showing signs of impatience, which has historically been a bullish signal for Bitcoin prices.

The Need for a Catalyst

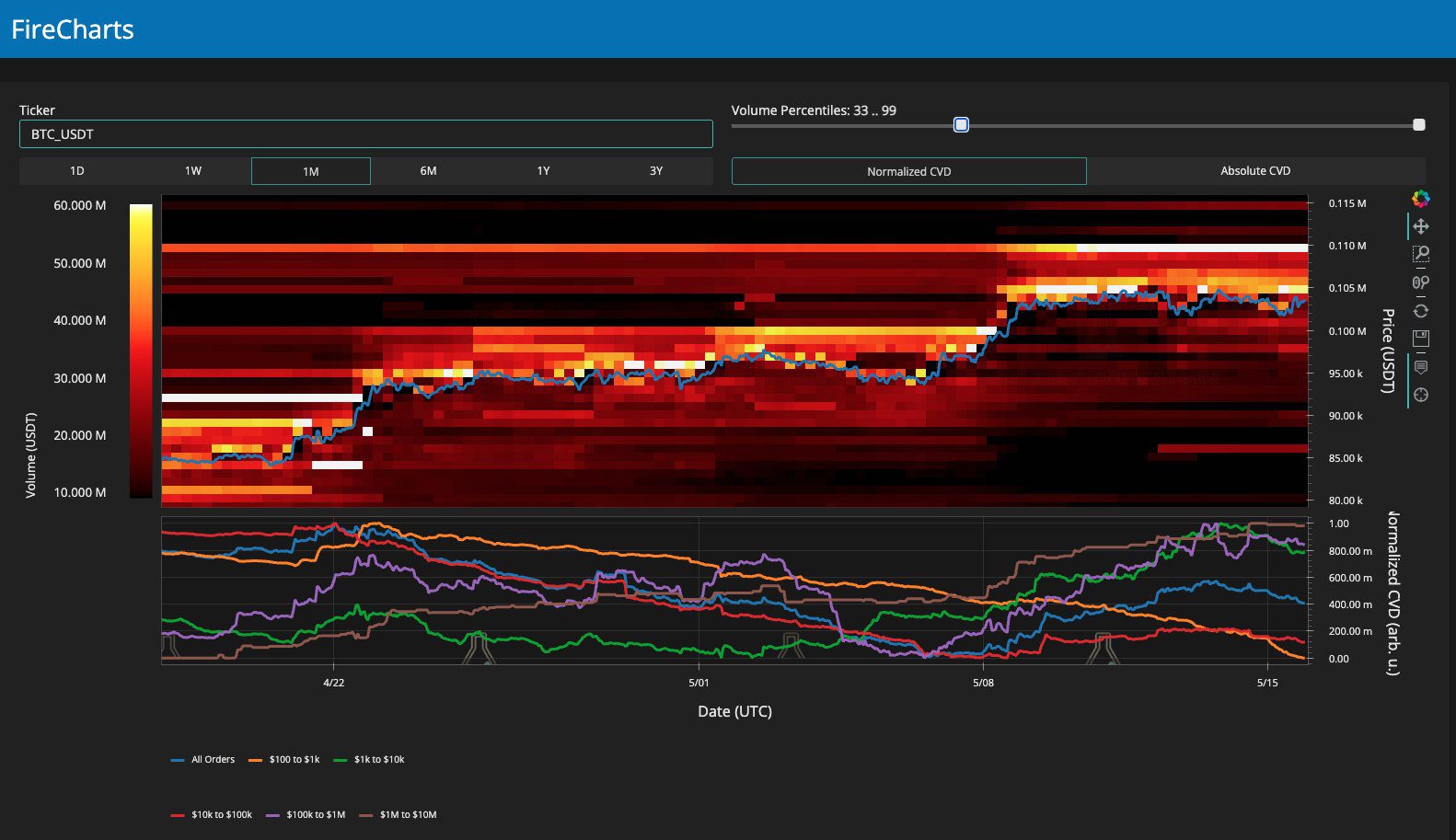

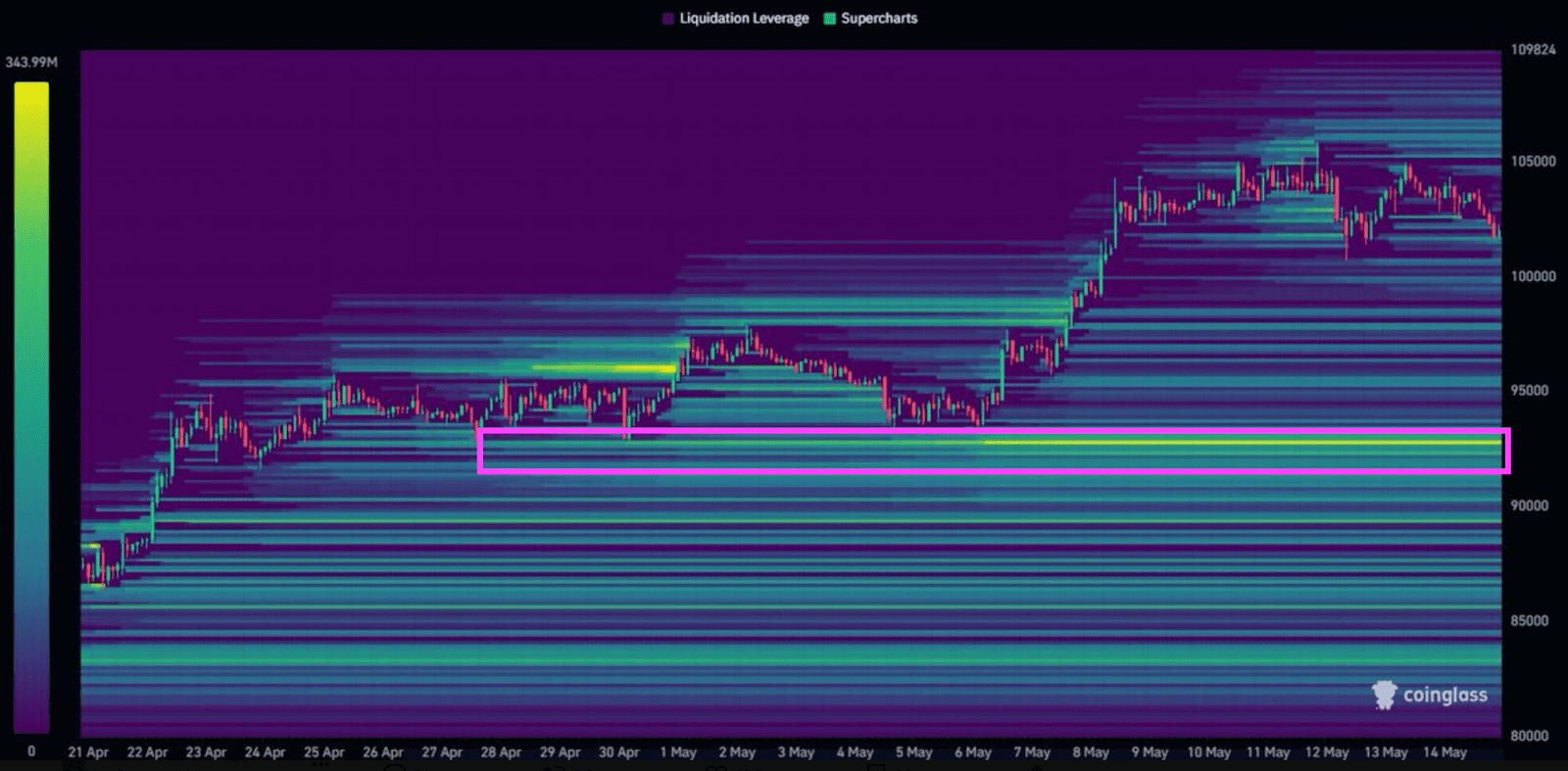

Bitcoin’s inability to break out suggests that a significant catalyst is needed. Material Indicators pointed out large sell orders between $105,000 and $110,000 on Binance exchange, hindering price appreciation. Without a strong upward force, a breakout seems unlikely.

Potential Catalysts:

- Unexpected positive regulatory developments.

- Increased institutional adoption.

- Significant macroeconomic shifts.

Key Support Levels to Watch

Analysts have identified crucial support levels to monitor. Material Indicators emphasized the $98,000-$100,000 range as a critical area to watch for a potential support test. A break below this range could lead to further downside.

Expert Opinions and Analysis

Daan Crypto Trades highlighted $93,000 as the “start of the recent move” and essential for traders. He noted that Bitcoin hasn’t traded long enough at current levels to establish significant support.

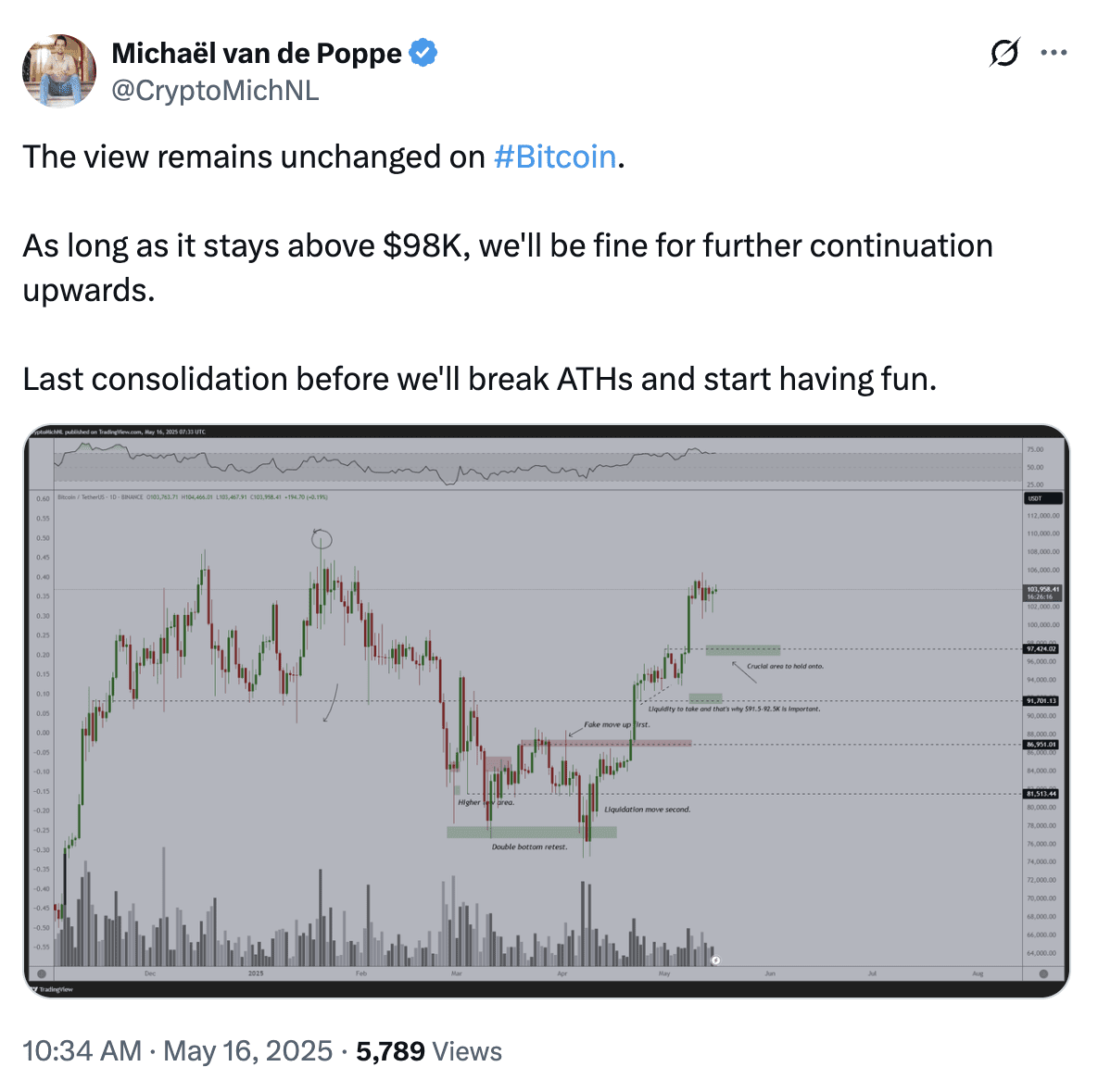

Michael van de Poppe considers $98,000 a crucial area to hold for continued upward movement.

Technical Indicators

Material Indicators also highlighted the bullish cross formed by the 50-day and 100-day simple moving averages (SMAs). This crossover suggests strong upward momentum in the long term, but the short-term resistance at $105,000 remains a critical obstacle.

Conclusion

Bitcoin’s current consolidation below $105,000 reflects a battle between buyers and sellers. Overcoming this resistance requires a catalyst, whether it be a shift in market sentiment, positive regulatory news, or increased institutional adoption. In the meantime, traders should closely monitor key support levels and be prepared for potential volatility.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Trading cryptocurrencies involves risk, and individuals should conduct thorough research before making any investment decisions.