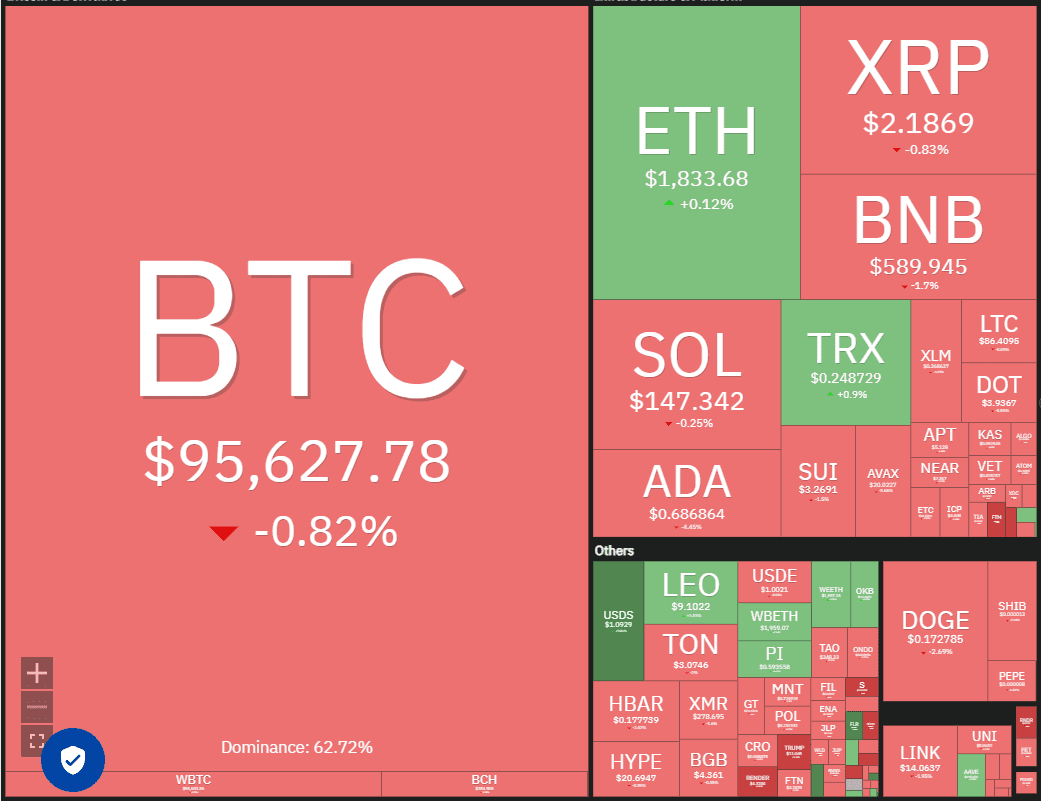

The cryptocurrency market is bracing for potential volatility as the Federal Reserve’s upcoming interest rate decision looms. Bitcoin (BTC) is currently retesting the $95,000 level, and its ability to hold this support will be crucial in determining the near-term market direction. Meanwhile, several altcoins, including Hyperliquid (HYPE), Aave (AAVE), Render (RNDR), and Fetch.ai (FET), are displaying bullish patterns that could lead to significant gains if Bitcoin’s positive momentum remains intact.

Bitcoin Price Analysis: Key Levels to Watch

Bitcoin is at a critical juncture, testing the $95,000 breakout level. Here’s a breakdown of potential scenarios:

- Bullish Scenario: If BTC holds above $95,000 and the 20-day EMA (around $92,000), a retest of $100,000 becomes likely.

- Bearish Scenario: A break below the 20-day EMA could signal a bull trap and lead to a decline towards the 50-day SMA ($86,682).

Bitcoin network economist Timothy Peterson suggests that certain macroeconomic conditions, such as a drop in the CBOE Volatility Index below 18 and favorable performance in June and July, could propel Bitcoin to a new all-time high of $135,000 within 100 days.

Altcoin Analysis: Bullish Opportunities in HYPE, AAVE, RNDR, and FET

Beyond Bitcoin, several altcoins are exhibiting promising technical setups:

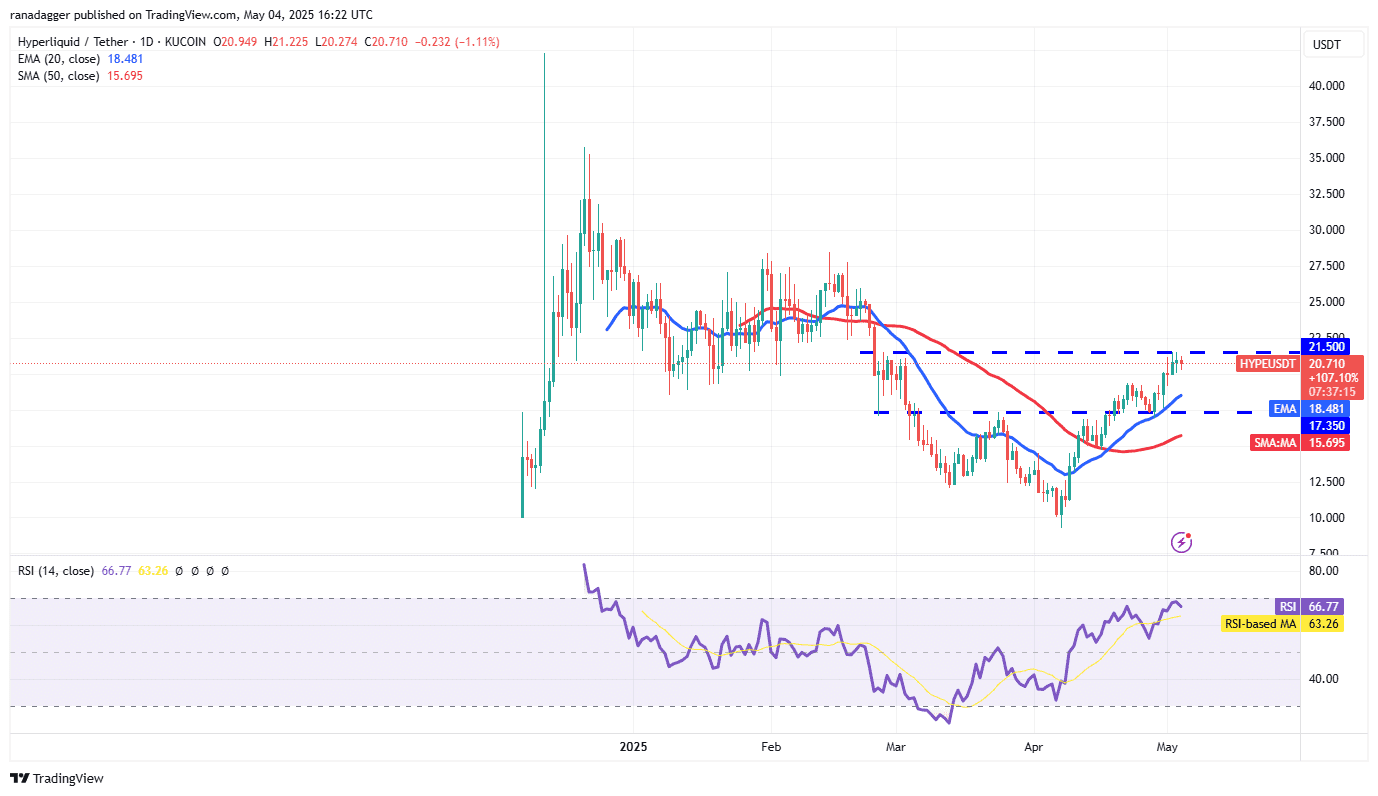

Hyperliquid (HYPE)

HYPE is facing resistance at $21.50. A sustained break above this level could trigger a rally towards $25 and $27.50. Failure to break through could lead to a pullback towards the 20-day EMA ($18.48) and potentially $17.35.

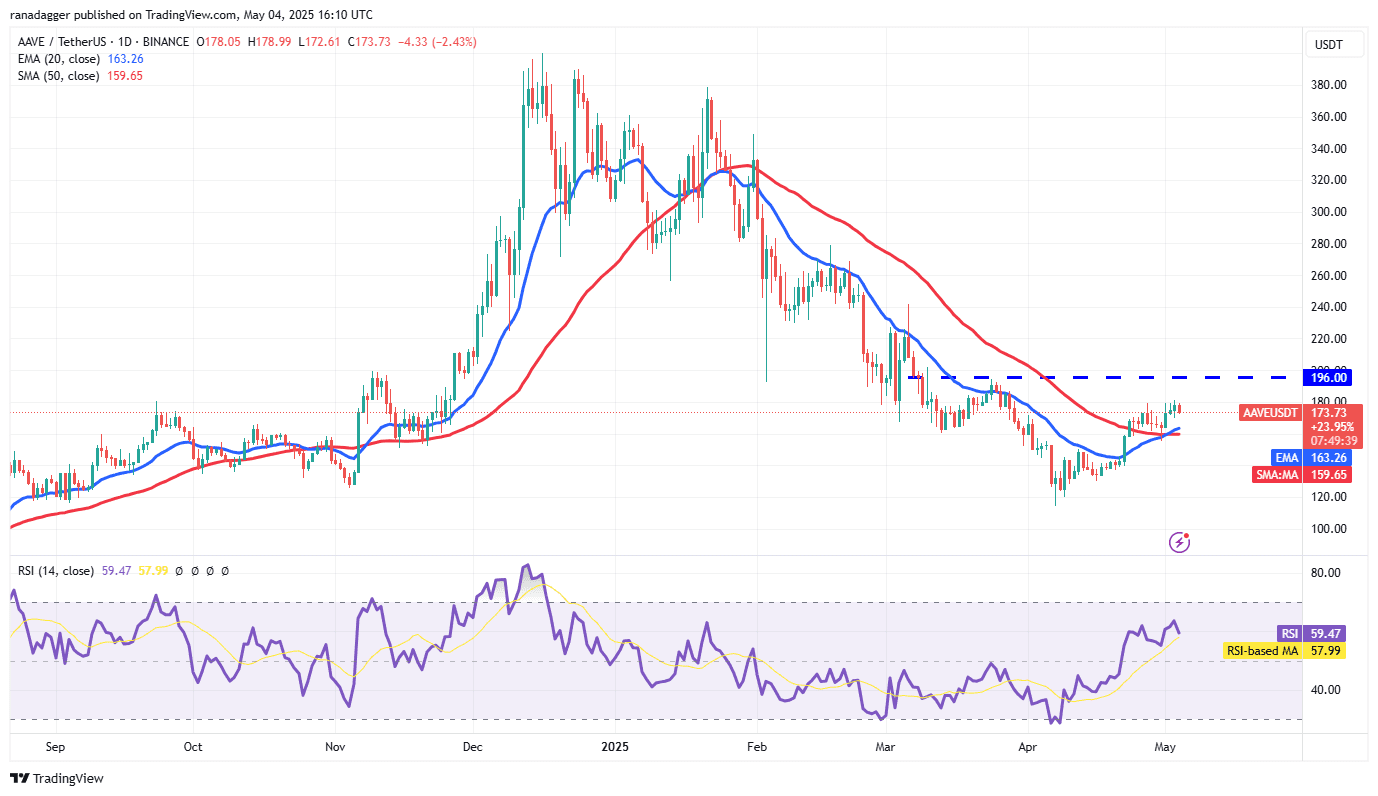

Aave (AAVE)

AAVE has rebounded from its moving averages, signaling renewed bullish sentiment. The next target is $196, where strong selling pressure is anticipated. A successful break above $196 could propel AAVE towards $220 and $240. Conversely, a drop below the moving averages could lead to a decline to $130.

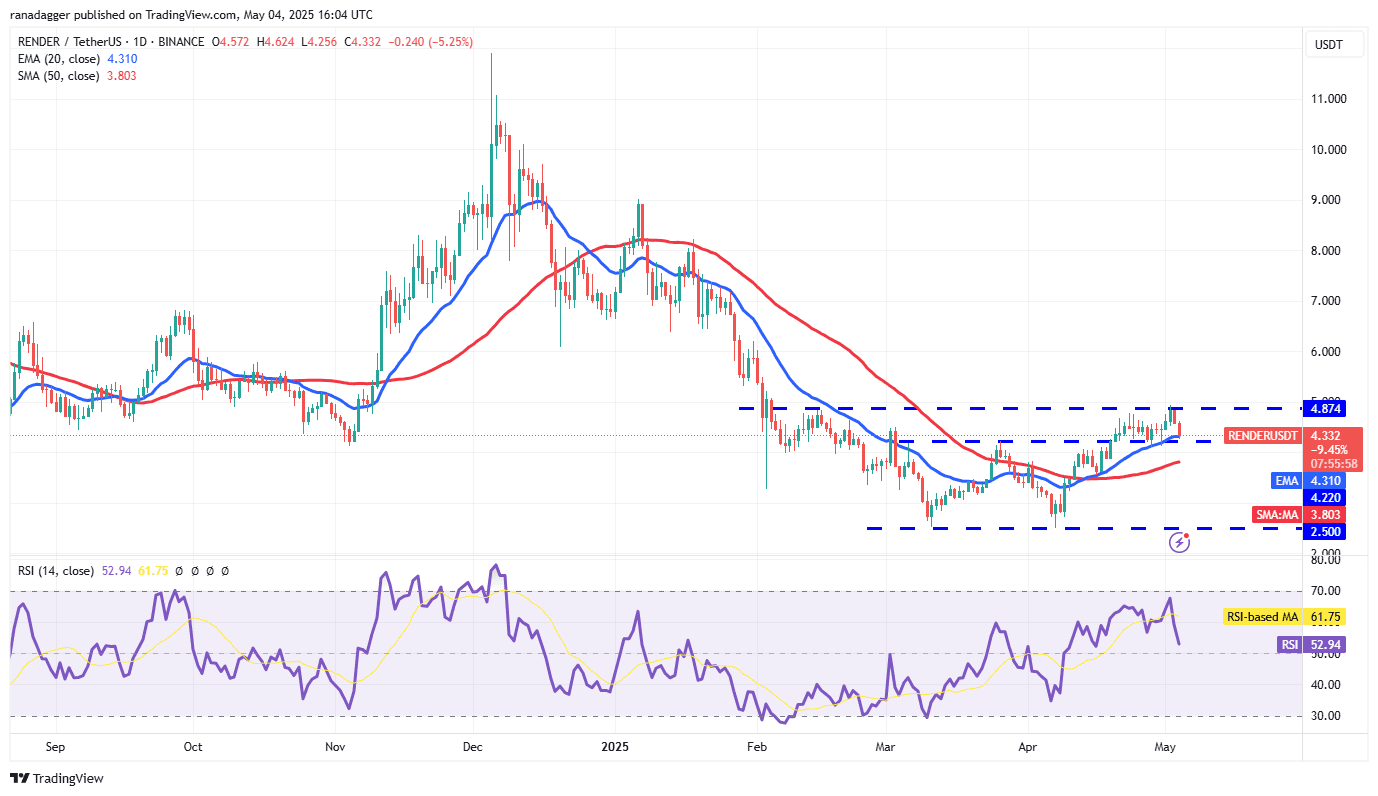

Render (RNDR)

RNDR encountered resistance at $4.87 and is currently testing the 20-day EMA ($4.31). A bounce from this level increases the likelihood of breaking above $4.87 and reaching $6.20. A break below $4.22 could trigger a deeper correction towards the 50-day SMA ($3.80).

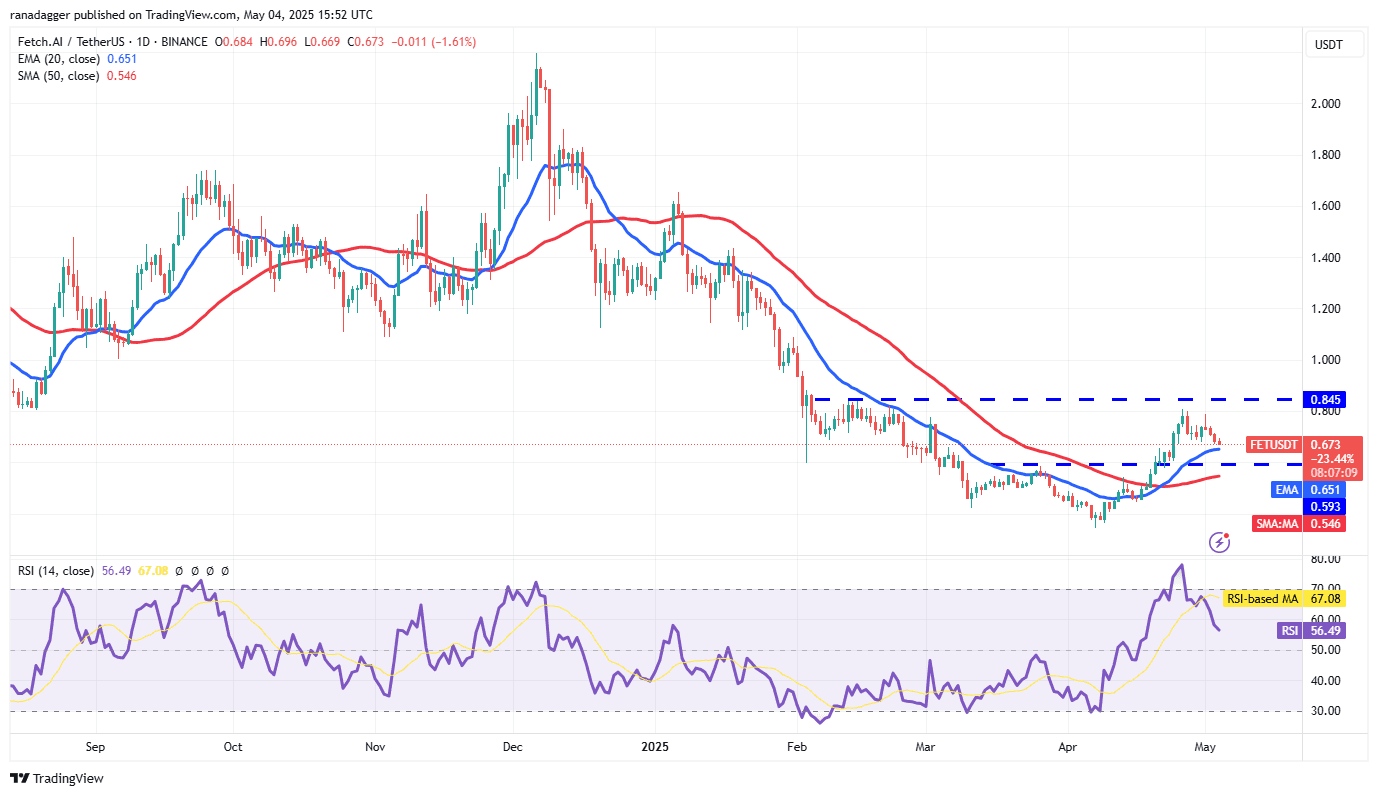

Fetch.ai (FET)

FET has pulled back from the $0.84 resistance and is currently at the 20-day EMA ($0.65). A strong bounce from this level could lead to a retest of $0.84 and potentially a move towards $1.09. A break below the 20-day EMA could result in a decline towards the 50-day SMA ($0.54).

Federal Reserve Rate Hike Decision: A Key Catalyst

The Federal Reserve’s upcoming interest rate decision is expected to significantly impact the cryptocurrency market. While a rate cut is considered unlikely at the May 7 meeting, any surprises or hawkish statements could trigger volatility. Traders should closely monitor the Fed’s announcement and adjust their strategies accordingly.

Conclusion: Navigating the Cryptocurrency Market

Bitcoin’s ability to hold the $95,000 level is crucial for maintaining bullish momentum. Altcoins like HYPE, AAVE, RNDR, and FET present potential opportunities, but traders should carefully assess the risks and rewards before investing. The Federal Reserve’s interest rate decision will be a key catalyst in the coming week, and its impact should not be underestimated.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Cryptocurrency investments are highly volatile and can result in significant losses. Conduct thorough research and consult with a qualified financial advisor before making any investment decisions.