Bitcoin’s price movements are often correlated with global liquidity, a measure of the availability of money and credit in the global financial system. Analysts like Raoul Pal have noted that global liquidity can explain a significant portion (up to 90%) of Bitcoin’s price fluctuations. Understanding this relationship is crucial for investors looking to navigate the cryptocurrency market.

Key Takeaways:

- Bitcoin’s price is strongly correlated with global liquidity growth.

- Global liquidity is influenced by factors like central bank policies and debt levels.

- The current liquidity cycle is projected to peak around mid-2026, potentially impacting Bitcoin’s price.

The Correlation Between Bitcoin and Global Liquidity

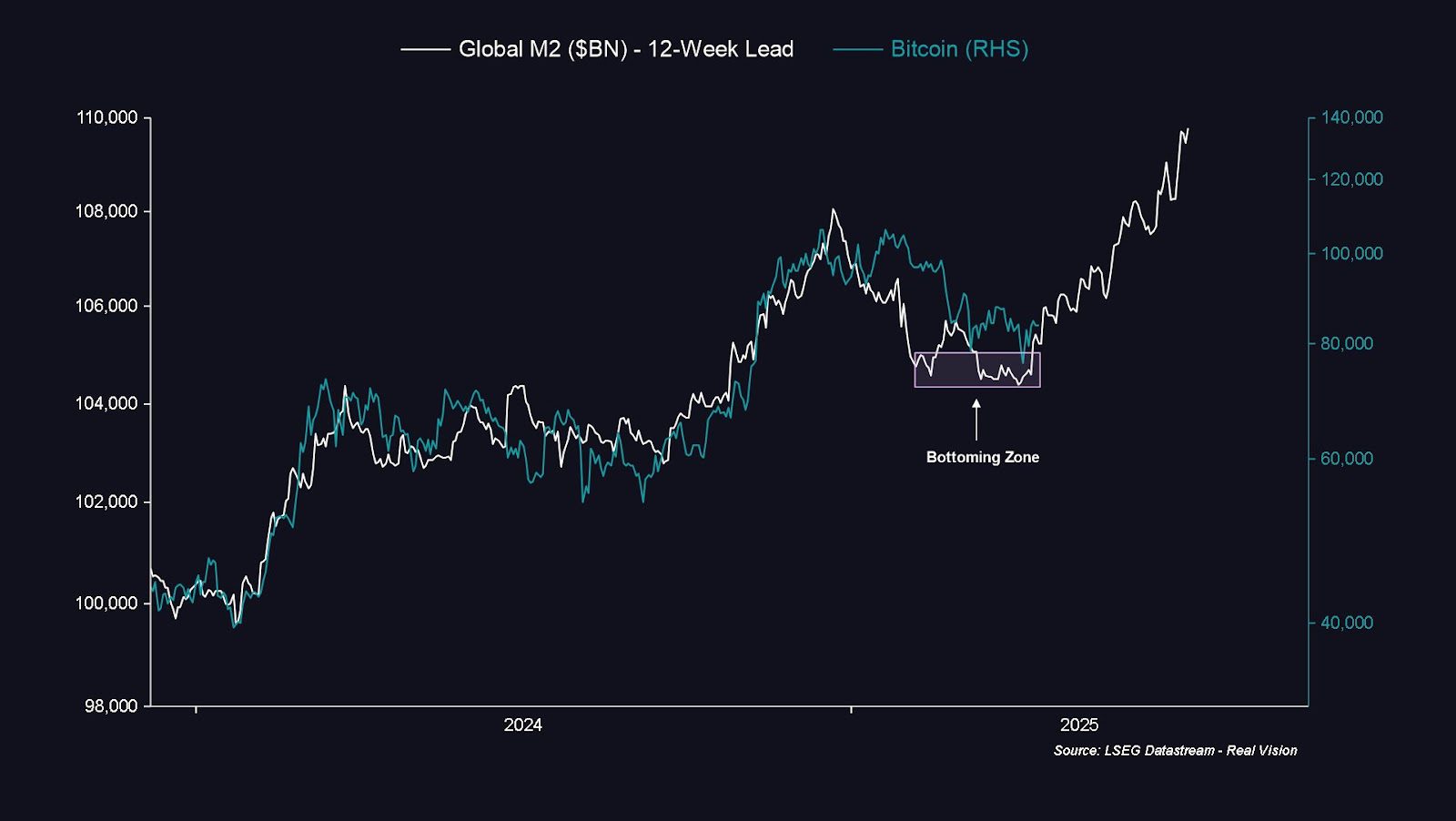

The price of Bitcoin (BTC) is known for its volatility, but some analysts argue that its movements are not entirely random. Instead, they suggest that Bitcoin’s price closely tracks global liquidity, with a lag of a few months. This means that when global liquidity increases, Bitcoin’s price tends to rise, and vice versa.

Raoul Pal, the founder of Global Macro Investor, emphasizes the strong correlation between Bitcoin and global M2 liquidity. He points out that rising liquidity can explain a significant portion of Bitcoin’s price action, even in the face of other economic concerns. Pal argues that expanding liquidity acts as a primary driver for asset prices, including Bitcoin.

Pal also highlights the concept of a “hidden tax” due to currency debasement and global inflation. He suggests that individuals need to earn more than 11% per year to avoid losing purchasing power. Bitcoin, with its historically high annual returns, can serve as a hedge against this debasement.

What Drives Global Liquidity?

Global liquidity is primarily driven by the expansion of the money supply. Fiat currency systems rely on increasing debt levels, leading to continuous growth in the money supply across countries. This long-term expansion of liquidity is a structural aspect of modern economies.

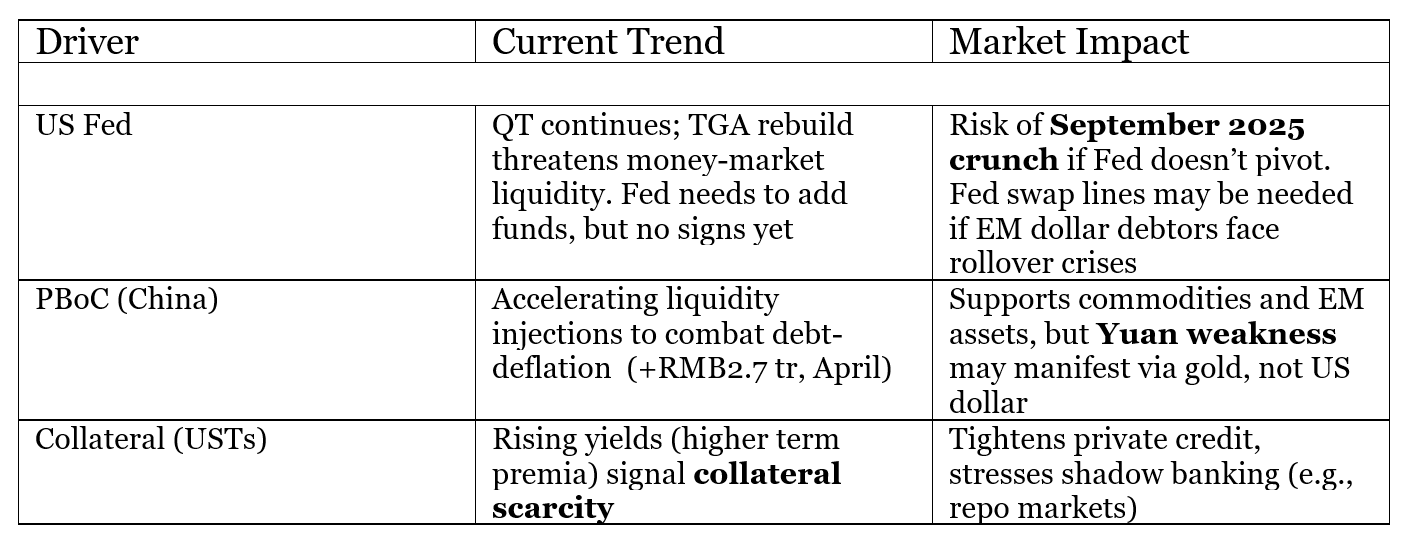

However, short-term fluctuations in global liquidity are influenced by specific factors. Michael Howell, author of “Capital Wars,” identifies three main drivers:

- The US Federal Reserve (Fed): The Fed’s monetary policy decisions, such as interest rate changes and quantitative easing, have a significant impact on global liquidity.

- The People’s Bank of China (PBoC): The PBoC’s actions, including reserve requirement adjustments and lending policies, also affect global liquidity.

- Banks Lending Through Collateral Markets: The availability of collateral and the willingness of banks to lend influence the overall liquidity in the financial system.

Indirect factors like the global business cycle, oil prices, dollar strength, and bond market volatility also play a role. A weak global economy and a softening dollar tend to boost liquidity, while rising bond volatility can tighten credit conditions and reduce liquidity.

Future Outlook for Global Liquidity

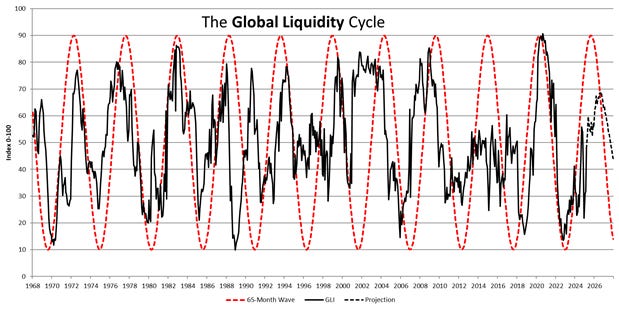

Michael Howell believes that global liquidity moves in cycles of roughly five years and that the current cycle is approaching its peak. He projects that the current cycle will mature by mid-2026, after which a downturn is likely. This cyclical pattern could have implications for Bitcoin’s price.

The recent growth in global liquidity is partly driven by a weakening global economy, which may prompt central banks to implement further easing measures. The PBoC has already started injecting liquidity into the system. The Fed faces a dilemma: whether to continue fighting inflation or to support the fragile financial system.

Economic uncertainty is also driving up US Treasury yields and increasing bond market volatility, which can tighten credit conditions. These pressures could eventually hinder liquidity expansion. Additionally, an anticipated recession could weaken investor risk appetite and reduce liquidity in the system.

Implications for Bitcoin

Even with a potential downturn in 2026, global liquidity is expected to continue growing through 2025, which could be beneficial for Bitcoin. Howell suggests that the likely policy response of “more liquidity” will create an upward path of monetary inflation, supporting assets like gold, equities, real estate, and Bitcoin.

Interestingly, Howell’s liquidity cycle aligns with Bitcoin’s four-year halving cycle. The former is expected to peak in late 2025, while the latter is expected to peak in early 2026. If these cycles continue to align, it could set the stage for a significant price movement for Bitcoin.

Conclusion

Understanding the relationship between Bitcoin’s price and global liquidity is essential for investors. By monitoring the factors that drive global liquidity, such as central bank policies and economic conditions, investors can gain insights into potential future price movements of Bitcoin. While the future is uncertain, the correlation between Bitcoin and global liquidity remains a crucial aspect of the cryptocurrency market to watch.