Key Takeaways:

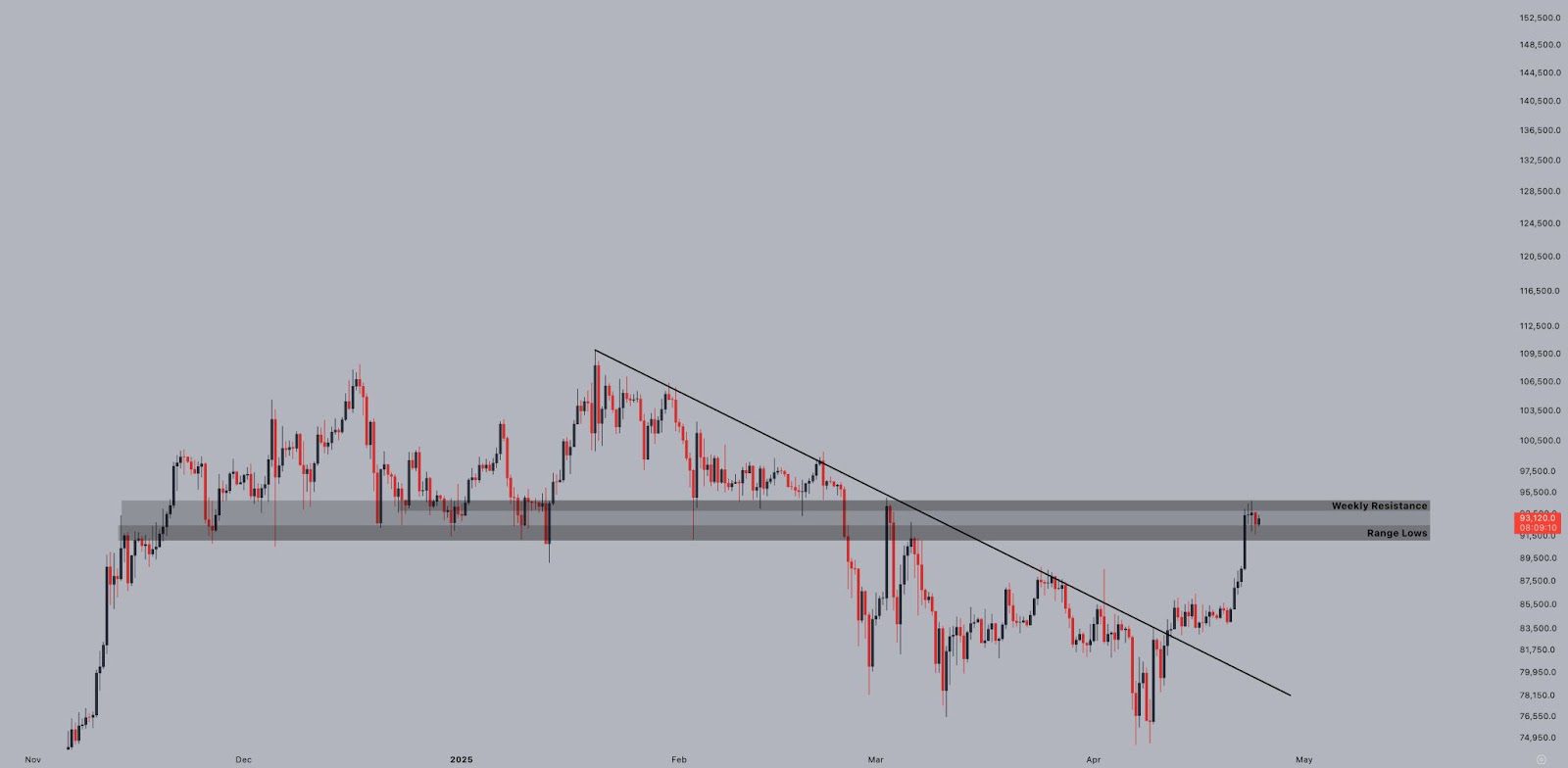

- Bitcoin has been trading within a narrow range of $91,000-$94,500, indicating a period of consolidation.

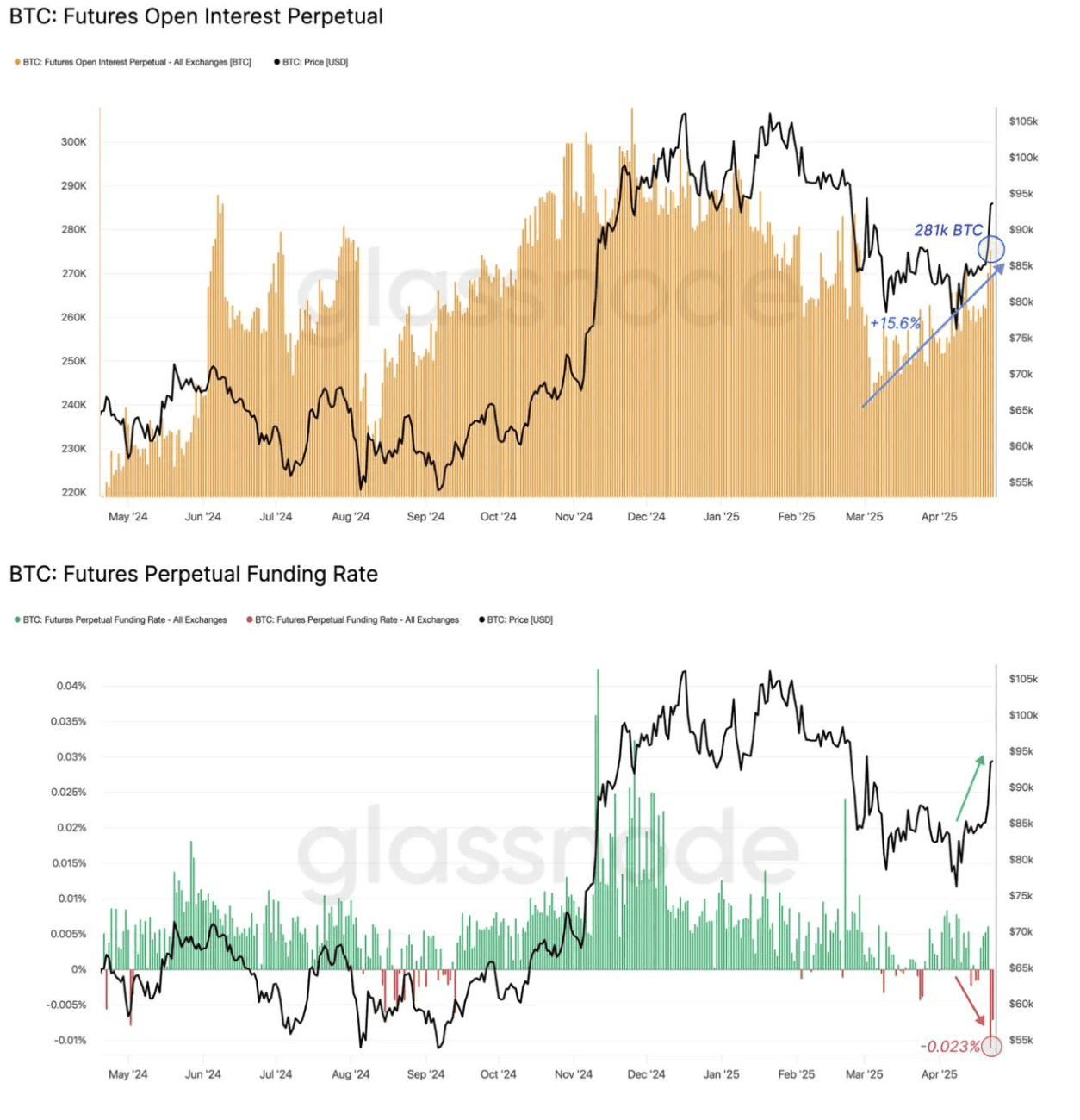

- A divergence between rising open interest and negative funding rates suggests a potential short squeeze.

- Breaking the $95,000 resistance level is crucial for Bitcoin to resume its upward trend.

Bitcoin (BTC) has been experiencing a period of price consolidation since April 22nd, fluctuating between $91,700 and $94,490. This period of sideways movement has left investors wondering when the consolidation will end and what the next major price movement will be. Several factors are contributing to this consolidation, and expert opinions offer insights into the potential outcomes.

Funding Rates and the Potential for a Short Squeeze

One of the most compelling indicators suggesting a potential end to the consolidation is the presence of negative funding rates in Bitcoin’s futures markets. This unusual scenario occurs when open interest rises while funding rates decline. In the recent recovery, Bitcoin’s price saw a 15% increase in open interest, but the average funding rates decreased, signaling a rise in short positions. As the price reached $94,700, funding rates dropped as low as -0.023%, revealing a strong bias toward traders betting against the uptrend.

Glassnode’s Week Onchain report highlights that this divergence could lead to a short squeeze if the upward momentum continues. A short squeeze happens when prices rise rapidly, forcing traders who have shorted the asset to buy back contracts to cover their losses. This buying pressure can then further accelerate the price increase.

Analysts at Jlabs Digital echoed this sentiment, stating that a rally combined with negative funding and rising open interest is a rare and bullish occurrence. They suggest that the momentum has room to run, despite other potential warning signals.

The $95K Hurdle: A Crucial Resistance Level

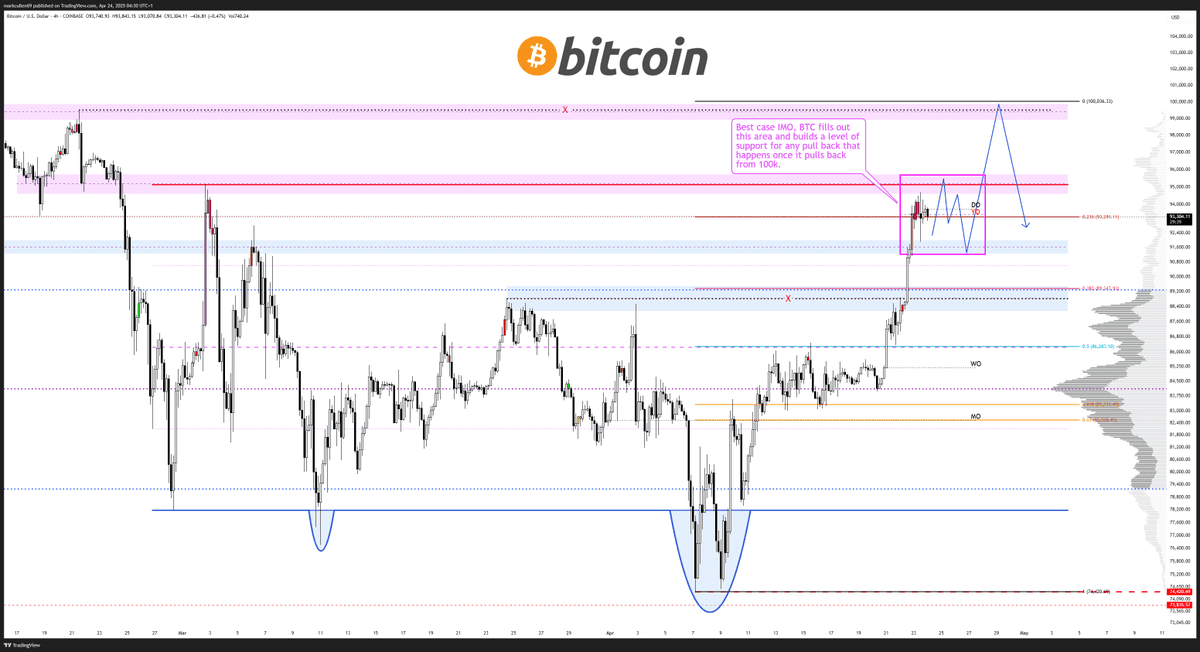

A critical factor determining whether Bitcoin breaks out of its consolidation phase is its ability to surpass the $95,000 resistance level. Market analyst AlphaBTC pointed out that Bitcoin is currently consolidating under this resistance. Until Bitcoin reclaims this level as support, it is likely to continue trading within the $93,000-$95,000 range.

AlphaBTC suggests that the best-case scenario involves Bitcoin consolidating and building a base before pushing higher to take liquidity above the $100,000 mark.

Similarly, analyst Jelle believes that the current consolidation cycle could persist until Bitcoin breaks above $94,000. Jelle noted the impressive strength Bitcoin has demonstrated while approaching the weekly resistance around $95,000 and stated that a break above $94,000 could propel the price significantly higher.

Potential Catalysts and Future Outlook

QCP Capital suggests that the breakout could occur in the coming days as April comes to a close. The firm highlights significant activity in call options at $95,000 strikes for end-April and end-May expirations, which indicates a tactical expectation for further upside potential. In a note to investors, QCP Capital stated that with macro risks temporarily subdued and trade tensions easing, Bitcoin is likely to consolidate within a narrow $90,000–$94,500 range while awaiting a catalyst for a decisive push toward the elusive $100,000 mark.

Factors Influencing Bitcoin’s Price

Several factors can influence Bitcoin’s price in the short and long term. These include:

- Market Sentiment: Positive or negative news and social media trends can significantly impact investor behavior.

- Regulatory Developments: Government regulations and policies concerning cryptocurrencies can affect their adoption and price.

- Macroeconomic Factors: Economic indicators like inflation, interest rates, and global economic growth can influence Bitcoin’s appeal as an alternative asset.

- Technological Advancements: Improvements in blockchain technology and the development of new applications can drive interest and investment in Bitcoin.

Conclusion

Bitcoin’s current consolidation phase presents both challenges and opportunities for investors. While the short-term outlook remains uncertain, the potential for a short squeeze and the anticipation of a breakout above $95,000 suggest that significant price movement is on the horizon. By closely monitoring key indicators and market sentiment, investors can better navigate this period and position themselves for potential gains.