Key Takeaways:

- De-risking before the May 13 CPI (Consumer Price Index) report might be influencing Bitcoin’s price correction.

- Bitcoin’s overall market structure and fundamental factors remain positive, suggesting the correction might be temporary.

Bitcoin (BTC) briefly dipped to $102,388 on May 12th after reaching an intraday high of $105,819. This correction occurred despite generally positive news, including progress in US-China trade talks and positive announcements from companies involved in Bitcoin.

Positive Developments Preceding the Correction:

- US-China Trade Talks: Positive developments in trade negotiations between the US and China were reported, initially boosting equity markets.

- MicroStrategy’s Bitcoin Purchase: Strategy, led by Michael Saylor, acquired 13,390 Bitcoin, increasing their total holdings to 568,840 BTC. This signaled continued institutional investment in Bitcoin.

- KindlyMD Merger: Shares of healthcare company KindlyMD surged after announcing a merger with Nakamoto Holdings, a Bitcoin investment firm advised by David Bailey.

What Caused the Bitcoin Price Correction?

Despite these positive catalysts, several factors contributed to the price pullback:

- Profit-Taking: After recent gains, some investors likely decided to secure profits, contributing to selling pressure.

- CPI Uncertainty: Investors may have de-risked their positions ahead of the May 13 CPI report, a key indicator of inflation. Uncertainty surrounding the report’s outcome can lead to increased volatility.

- Technical Resistance: Bitcoin struggled to maintain levels above $104,000, indicating potential resistance at this price point. Failure to break through this resistance may have triggered further selling.

Glassnode data suggested potential consolidation due to weakening momentum buyers and rising profit-taking, even with strong new demand.

Derisking Ahead of CPI: From a trader’s perspective, profit booking ahead of the release of the CPI report on May 13, coupled with the view that the Trump trade deal with China is now priced in after BTC failed to rally and hold above $104,000 on such momentous news.

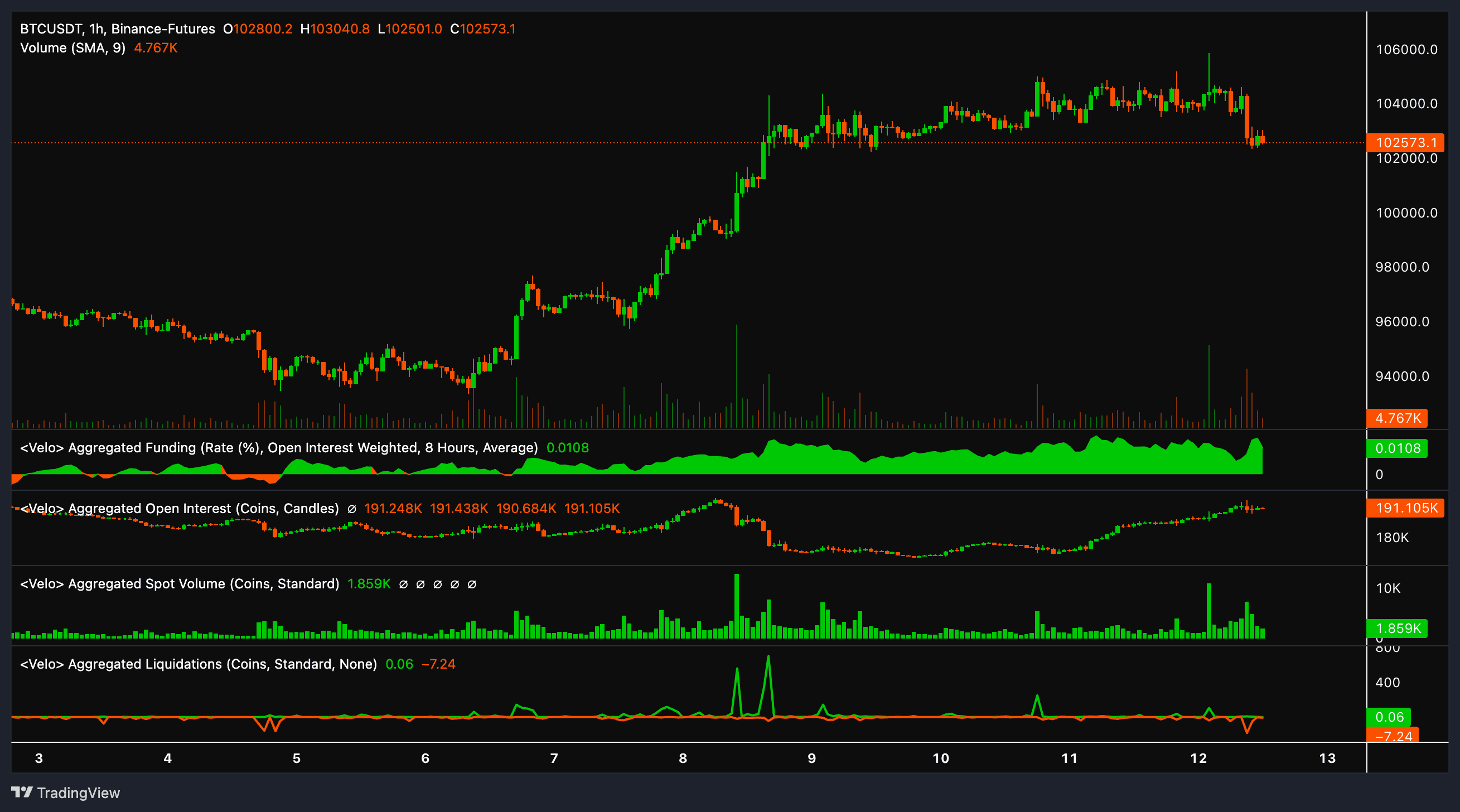

Before the trade war news, the US Dollar Index (DXY) rallied and stock indexes soared. Seeing Bitcoin failing to break and hold $104,000 to $105,000 prior to stock futures opening and then BTC being unable to follow equities opening bell gains in the NY session suggests some traders elected to close profitable longs ahead of tomorrow’s CPI or before the current bid appetite shifts to lower price levels.

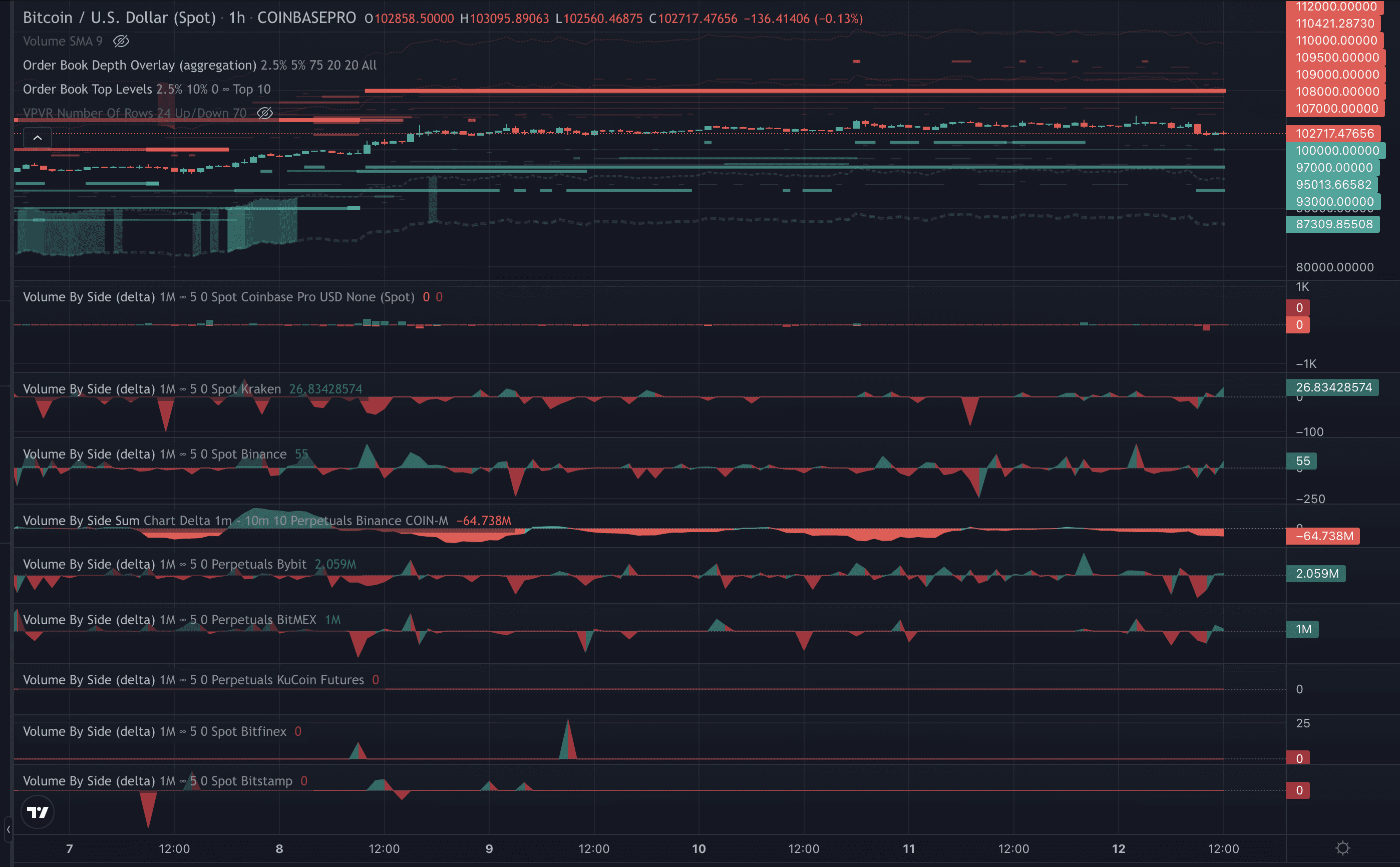

This view can be interpreted by the chart above, showing open interest rising hour-over-hour, along with an abrupt spike in the funding rate as short positions opened and longs were liquidated.

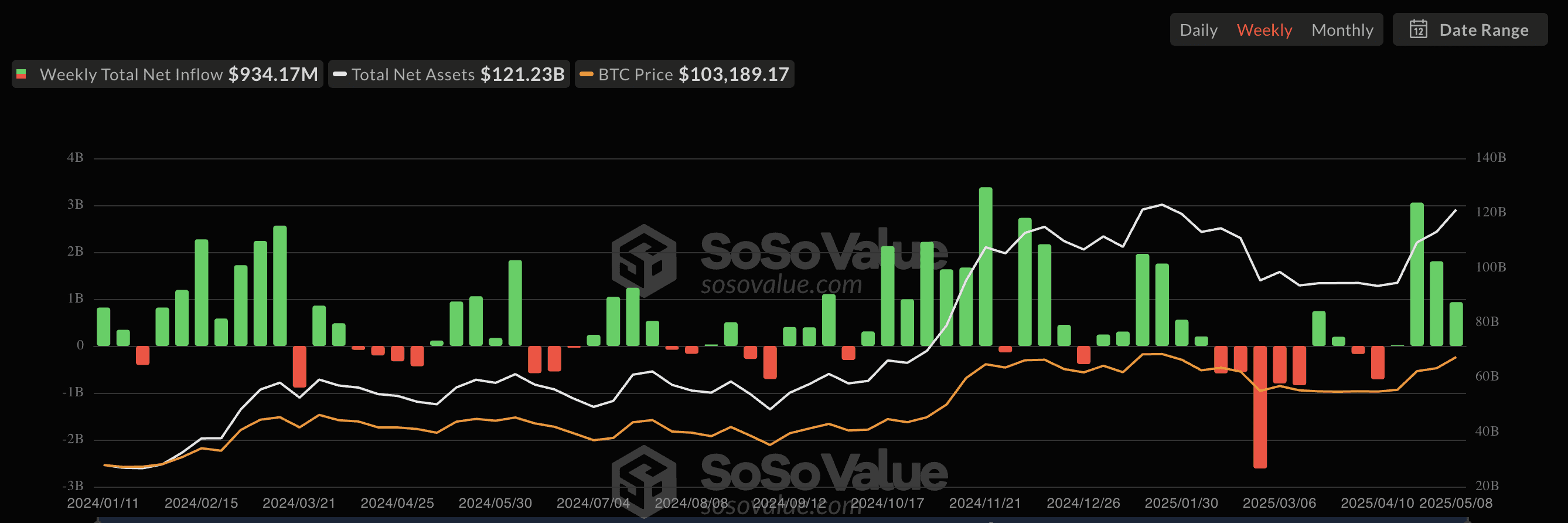

Spot Market Impact: Last week’s Bitcoin price rally was fueled by spot purchasing, including MicroStrategy’s acquisition and inflows into spot BTC ETFs. Concerns arose about whether this buying pressure would continue.

Is the Correction a Sign of a Larger Downtrend?

While the correction caused some concern, the underlying factors suggest it may be a short-term technical adjustment. The accelerating adoption of Bitcoin within traditional finance and the evolving regulatory landscape remain positive.

Factors Supporting Continued Growth:

- Institutional Adoption: Increasing investment from companies like MicroStrategy and inflows into Bitcoin ETFs demonstrate growing institutional interest.

- Regulatory Clarity: Improvements in the crypto regulatory environment are fostering greater confidence in the market.

Looking Ahead: The market’s reaction to the May 13 CPI report will likely influence Bitcoin’s near-term price action. A favorable report could encourage renewed buying interest and a return to higher price levels.

In Conclusion: Although Bitcoin experienced a price correction, the underlying bullish fundamentals remain intact. Profit-taking and uncertainty surrounding the CPI report contributed to the pullback, but growing adoption and a more favorable regulatory environment suggest a potential rebound in the near future. Investors should carefully monitor the CPI report and broader market trends before making investment decisions.