Key Takeaways:

- Bitcoin’s resilience in both risk-on and risk-off markets positions it as a unique asset.

- Its high Sharpe ratio, second only to gold, demonstrates its maturity and superior risk-adjusted returns.

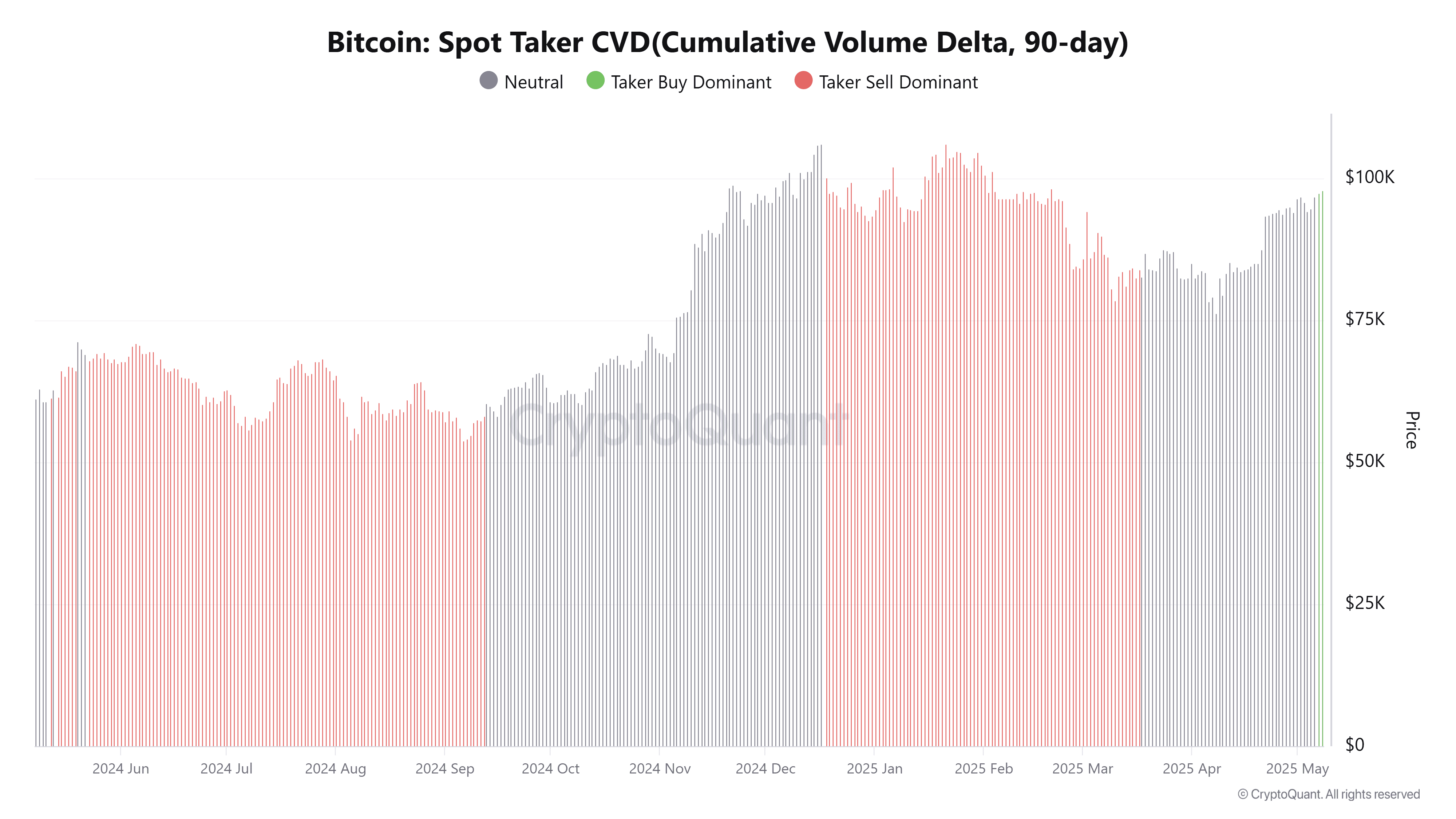

- Increased buyer dominance signals robust institutional and retail demand, potentially triggering a supply squeeze and pushing prices to new highs in May.

Bitcoin (BTC) is showing strong potential to surpass its previous all-time high and potentially exceed $110,000 in May. This bullish outlook is supported by several factors, including its ability to perform well in varying economic climates and increasing institutional interest.

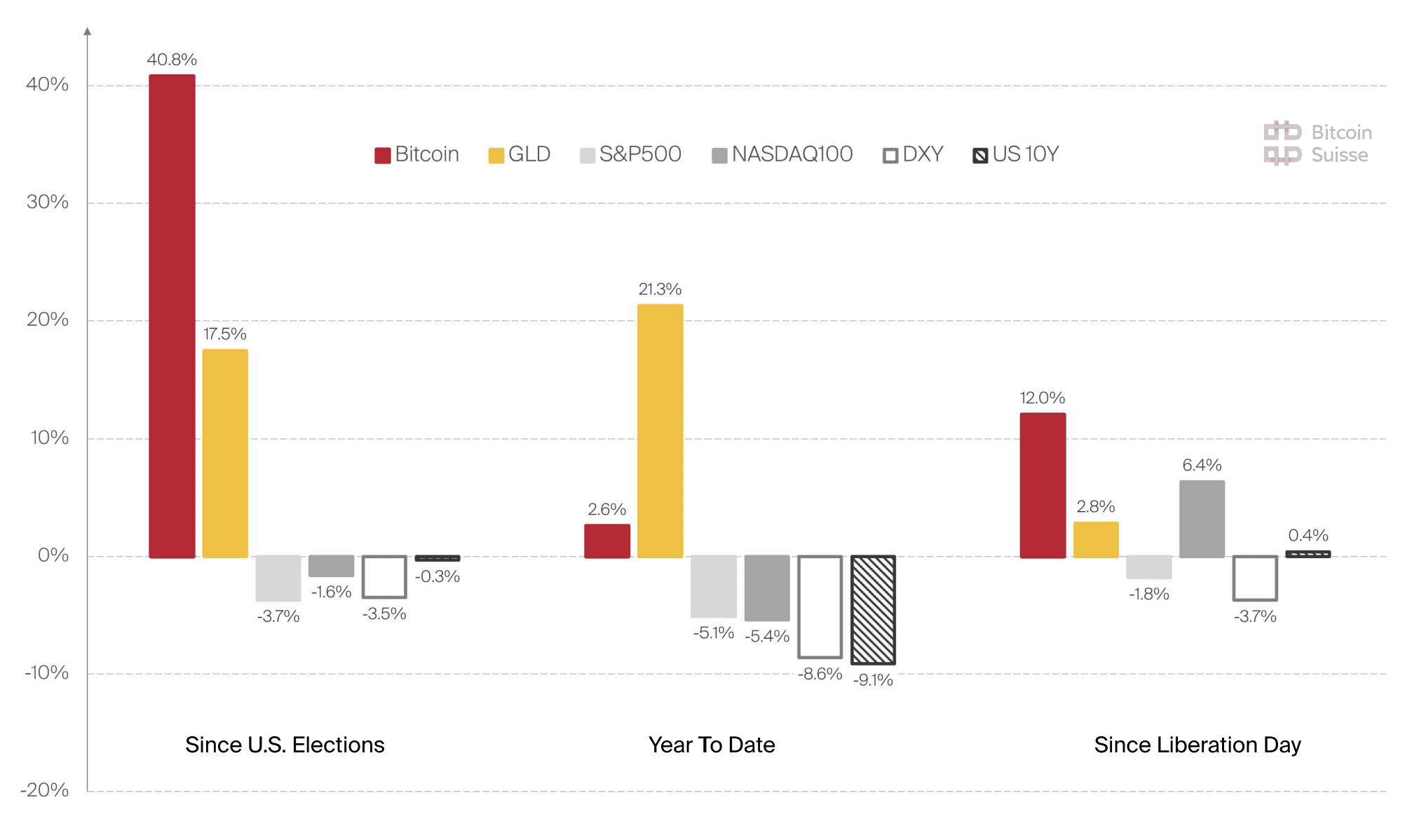

Bitcoin Suisse, a crypto custody service provider, highlights Bitcoin’s ability to thrive in both risk-on and risk-off environments. This dual functionality stems from its role as a macro hedge during geopolitical instability and de-dollarization concerns, alongside its performance as a high-conviction growth asset. The “Industry Rollup” report indicates a high Sharpe ratio of 1.72, surpassed only by gold, which emphasizes Bitcoin’s robust risk-adjusted returns and growing maturity.

Why Bitcoin Could Reach $110,000 in May:

- Resilience in Diverse Environments: Bitcoin acts as a hedge against economic uncertainty (risk-off) and performs as a growth asset during periods of economic expansion (risk-on). This adaptability makes it attractive to investors seeking stability and growth potential.

- Strong Risk-Adjusted Returns: The Sharpe ratio indicates that Bitcoin offers significant returns relative to the risk involved, making it an appealing investment compared to other asset classes.

- Institutional Interest and ETF Inflows: Increasing participation from institutions and substantial inflows into spot Bitcoin ETFs demonstrate growing confidence in Bitcoin’s long-term value.

- Buyer Dominance: The shift to buyer-dominant conditions suggests strong demand, which can lead to a supply squeeze and drive prices higher.

Sharpe Ratio Explained:

The Sharpe ratio is a critical metric for evaluating investment performance. It measures the excess return (return above the risk-free rate) per unit of total risk. A higher Sharpe ratio signifies better risk-adjusted performance. Bitcoin’s high Sharpe ratio indicates that it has historically delivered substantial returns relative to the risk taken, making it an attractive option for investors seeking to optimize their risk-return profile.

The Role of Bitcoin Spot ETFs:

The introduction of Bitcoin spot ETFs has significantly impacted the market. These ETFs provide a more accessible and regulated way for investors to gain exposure to Bitcoin without directly holding the asset. The resulting inflows into these ETFs have increased demand for Bitcoin, contributing to its price appreciation. Since April 1, spot inflows has reached over $4.5 billion

Analyzing Bitcoin’s Supply and Demand:

Bitcoin’s supply is limited to 21 million coins, creating scarcity that can drive up its price as demand increases. The recent shift to buyer dominance, as evidenced by the 90-day spot taker cumulative volume delta (CVD), suggests that demand is currently outpacing supply. This imbalance can lead to a supply squeeze, where buyers are willing to pay higher prices to acquire Bitcoin, further fueling price increases.

Potential Risks and Considerations:

While the outlook for Bitcoin in May appears promising, it’s essential to consider potential risks. The cryptocurrency market is known for its volatility, and prices can fluctuate rapidly. Regulatory changes, macroeconomic factors, and unforeseen events can all impact Bitcoin’s price. Investors should conduct thorough research and assess their risk tolerance before making any investment decisions.

Conclusion:

Based on current market dynamics, Bitcoin has the potential to reach new highs above $110,000 in May. Its unique ability to perform well in diverse economic environments, coupled with strong institutional interest and a growing supply squeeze, supports this bullish outlook. However, investors should remain aware of the inherent risks in the cryptocurrency market and exercise caution when making investment decisions. Bitcoin’s current market position is strong, but continued monitoring of market trends and risk assessment is crucial for making informed investment decisions.

The convergence of these factors positions Bitcoin as a compelling investment opportunity for May 2025. However, potential investors should remain vigilant and prepared for the inherent volatility of the cryptocurrency market.