Bitcoin (BTC) experienced a recent price pullback, dipping to around $93,500 after approaching $97,900. While some traders express concern, underlying data points toward a continuation of the bullish trend, with potential for new all-time highs in 2025. This article examines the key factors supporting this outlook.

Key Factors Supporting a Bullish Outlook for Bitcoin:

- Rising Bitcoin Dominance: Bitcoin’s dominance in the cryptocurrency market is currently at 70%, the highest since January 2021. This indicates a flight to safety amid the launch of numerous new altcoins.

- Strong Institutional Inflows: Spot Bitcoin ETFs saw significant net inflows of $4.5 billion between April 22 and May 2, demonstrating continued institutional appetite.

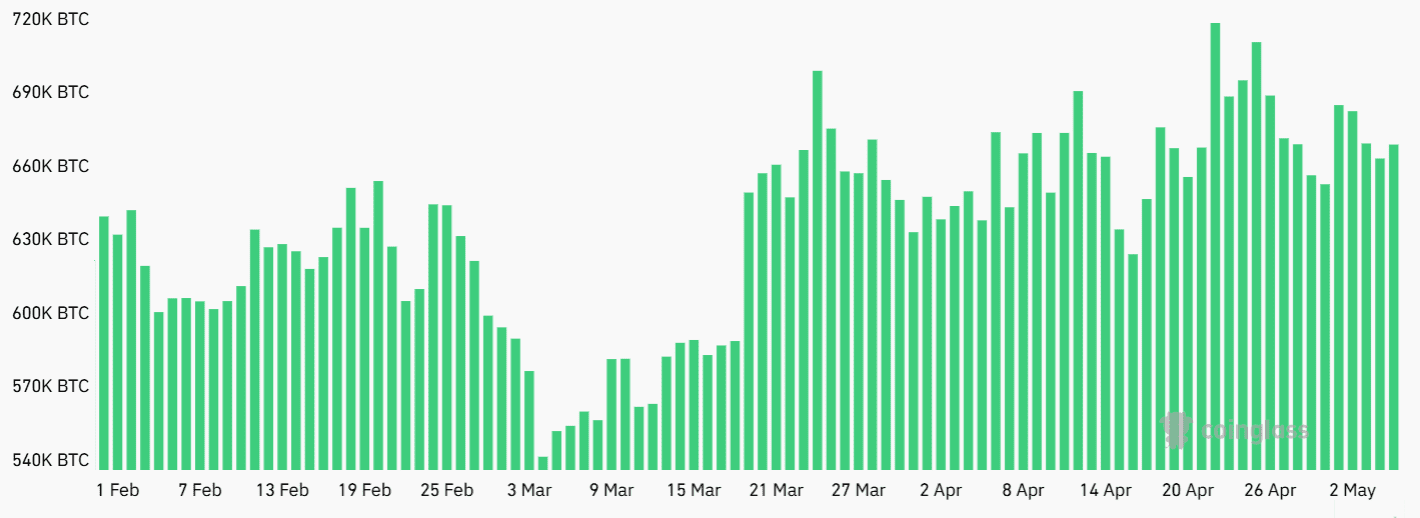

- Robust Futures Market Activity: Open interest in Bitcoin futures markets has reached 669,090 BTC, a 21% increase since March 5. Strong demand for leveraged positions, even after price dips, signals confidence.

- Strategic Investments: Companies like Strategy continue to invest heavily in Bitcoin, indicating a long-term belief in its value.

Bitcoin Dominance Explained

Bitcoin’s dominance refers to its market capitalization relative to the rest of the cryptocurrency market. A high dominance percentage signifies that Bitcoin holds a larger share of the total crypto market value. This is often seen as a sign of stability and investor confidence, as Bitcoin is generally considered less risky than smaller altcoins.

The Role of Bitcoin ETFs

Bitcoin ETFs (Exchange Traded Funds) provide a way for investors to gain exposure to Bitcoin without directly owning the cryptocurrency. These ETFs track the price of Bitcoin and are traded on traditional stock exchanges, making them accessible to a wider range of investors, including institutions. The inflows into Bitcoin ETFs are a strong indicator of institutional demand.

Bitcoin Futures and Open Interest

Bitcoin futures are contracts that allow investors to speculate on the future price of Bitcoin. Open interest refers to the total number of outstanding futures contracts that have not been settled. A high open interest suggests that there is significant trading activity and investor interest in Bitcoin futures. It can be an indicator of market sentiment and potential price volatility.

Why Has Bitcoin Struggled to Break $100,000?

Several factors have contributed to Bitcoin’s inability to surpass the $100,000 mark:

- Uncertainty surrounding government BTC holdings: Hopes surrounding a US Strategic Bitcoin Reserve have been tempered by a lack of disclosure regarding government holdings and purchase plans.

- Failed state-level Bitcoin bills: Setbacks in state-level Bitcoin initiatives, such as in Arizona, have created some disappointment.

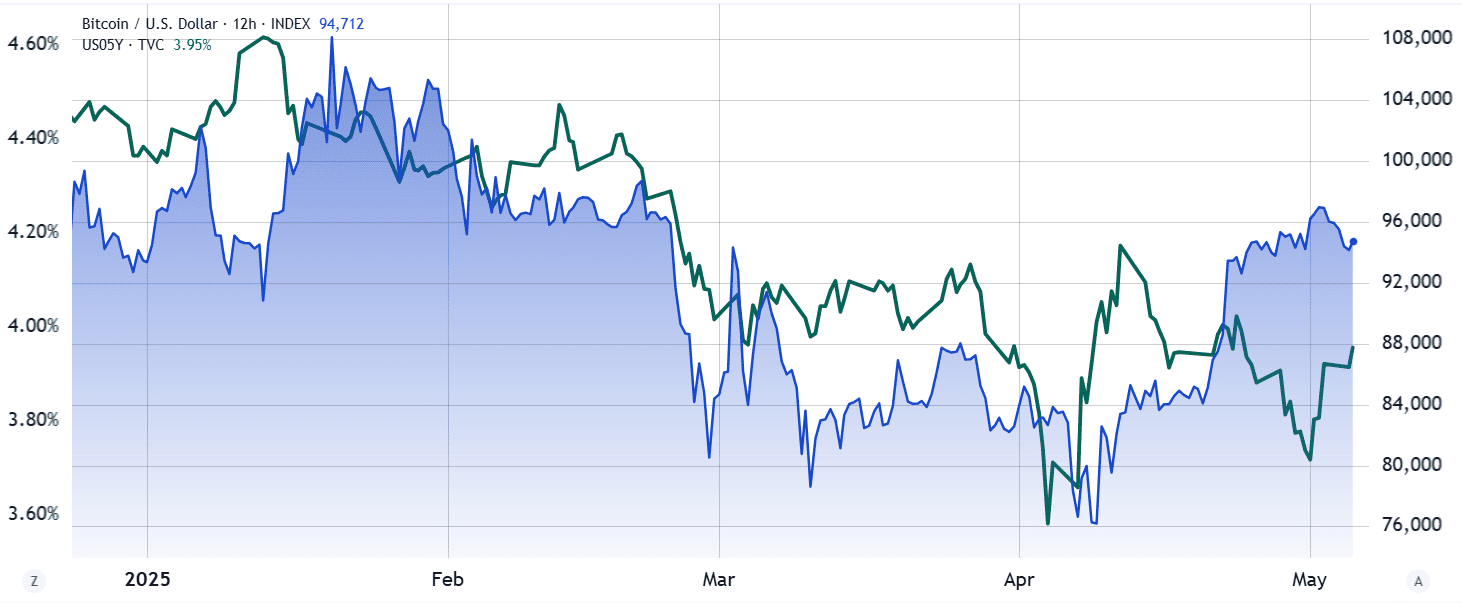

- Macroeconomic Concerns: Concerns about the global trade war have driven investors towards safer assets like fixed income and cash.

The Impact of Macroeconomic Factors

Bitcoin, like other assets, is influenced by broader macroeconomic trends. Factors like interest rates, inflation, and geopolitical events can affect investor sentiment and impact Bitcoin’s price. For example, rising interest rates can make bonds more attractive, potentially diverting funds away from riskier assets like Bitcoin.

Strategy’s Continued Investment in Bitcoin

Strategy, led by Michael Saylor, remains a significant Bitcoin investor. The company’s recent acquisition of additional BTC, funded by capital increases, demonstrates a continued commitment to the cryptocurrency. This provides a strong signal to the market and reinforces the belief in Bitcoin’s long-term potential.

Will Bitcoin Reach a New All-Time High in 2025?

While market conditions are constantly evolving, the key elements for a potential Bitcoin bull run remain in place. Continued institutional adoption, strong market dominance, and favorable macroeconomic conditions could pave the way for new all-time highs in 2025.

In conclusion, while the recent price dip to $93.5K may have caused concern, the underlying data suggests that the long-term outlook for Bitcoin remains positive. Factors such as rising dominance, strong institutional inflows, and robust futures market activity indicate continued investor confidence and the potential for new all-time highs in 2025. Keep a close eye on macroeconomic developments and regulatory changes, as these could significantly impact the future of Bitcoin.