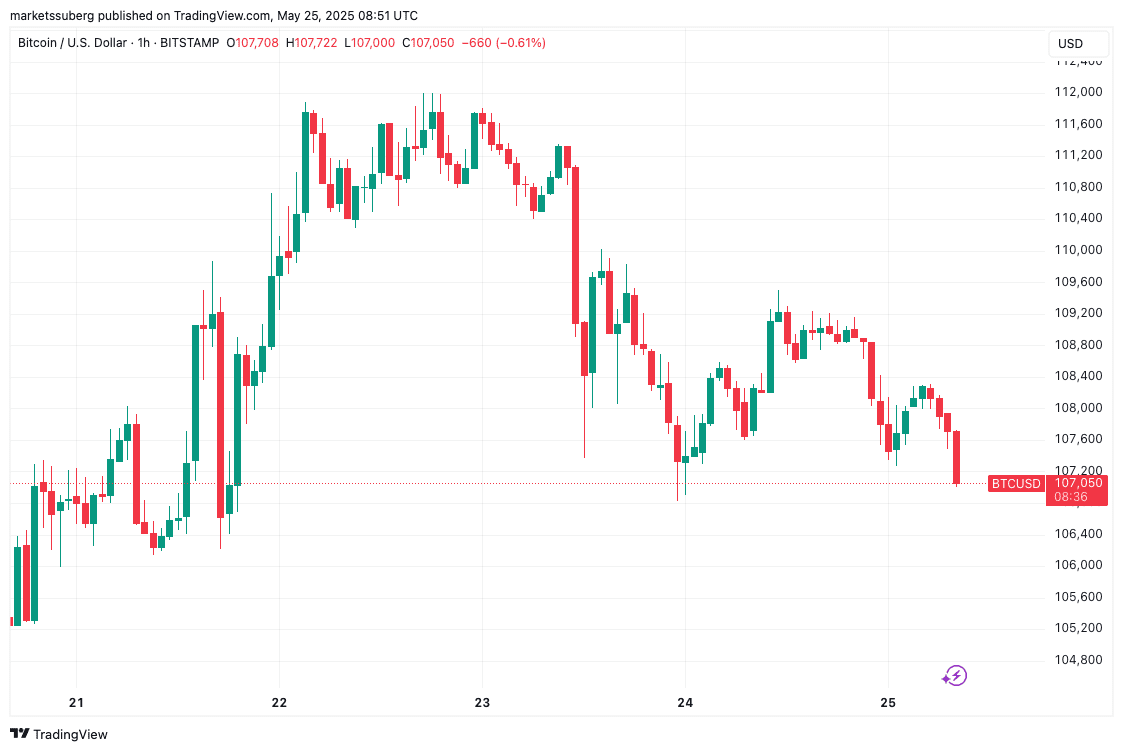

Bitcoin Price Slides Under $108K: Trade War Fears and a Major Trader’s Shift

Bitcoin (BTC) is experiencing downward pressure, failing to hold above $108,000 as market sentiment is impacted by renewed US trade war concerns. This article dives into the factors contributing to this price movement, including the influence of US trade tariffs and a significant shift in position by a prominent Bitcoin trader.

Key Takeaways:

- Trade War Impact: US trade tariffs are contributing to increased market volatility and negatively affecting Bitcoin’s price.

- Trader Sentiment: Despite the price dip, some analysts believe Bitcoin’s bull run remains intact, with potential for retesting lower support levels.

- Major Position Flip: Hyperliquid trader James Wynn closed a substantial $1.25 billion long position and initiated a short position on Bitcoin, signaling a change in outlook.

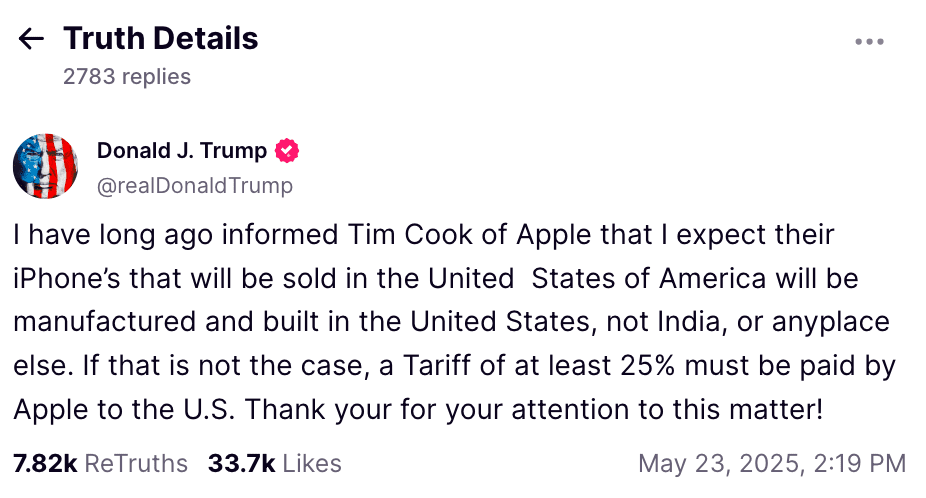

Trump’s Trade Rhetoric and Bitcoin’s Reaction

Bitcoin’s recent struggles can be partly attributed to comments made by former US President Donald Trump regarding potential 50% tariffs on goods from the EU. These announcements triggered immediate sell-offs in the crypto market, preventing Bitcoin from establishing a new all-time high above $112,000.

Market participants have expressed concerns about the significant influence of political rhetoric on market volatility. Keith Alan from Material Indicators described the situation as “More hot air from the Manipulator in Chief.” However, Alan also suggested that Bitcoin has room to retest support levels without jeopardizing the overall bull trend.

Key Support Levels and Bullish Outlook

According to Keith Alan, the MACRO trend line and key Moving Averages on the Bitcoin Daily chart align with the Yearly Open price (around $93,500). As long as Bitcoin remains above this zone, the bullish trend is expected to continue. This suggests a potential floor for further price corrections.

Similarly, trader Crypto Tony believes that a weekly close above $104,000 would be acceptable, indicating that the resistance zone has been cleared. These analysts highlight the importance of monitoring these levels to gauge the strength of the ongoing bull market.

CME Gap as a Potential Price Magnet

Another factor influencing Bitcoin’s price is the presence of a CME gap at $107,230. Trader Merlijn pointed out that these gaps tend to attract price action, suggesting that Bitcoin may return to fill the gap in the short term. Traders often use CME gaps as potential entry or exit points.

James Wynn’s Bold Move: From Long to Short

One of the most notable events this weekend was the decision by Hyperliquid trader James Wynn to close his $1.25 billion long position and open a new short position worth approximately $110 million. This significant shift in position caught the attention of market participants and signaled a potential change in sentiment.

Wynn’s initial long position suffered losses due to the volatility triggered by Trump’s trade-related comments. This led him to reverse his stance and bet against Bitcoin. Lookonchain reported that Wynn’s short position was opened at $107,711.1, with a liquidation price of $149,100.

Market Reaction and Further Analysis

Trader Daan Crypto Trades described Wynn’s move as “a lot of trading for an illiquid choppy weekend,” highlighting the impact of this large-volume trade on market conditions.

The current market dynamics suggest a confluence of factors influencing Bitcoin’s price, including trade war tensions, technical analysis indicators, and the actions of major traders. Monitoring these factors will be crucial for understanding Bitcoin’s future price trajectory.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Trading cryptocurrencies involves significant risks, and readers should conduct thorough research before making any investment decisions.