Bitcoin (BTC) faced volatility on May 23rd as news of potential US tariffs on the European Union (EU) emerged, triggering a market reaction. Former US President Donald Trump’s comments regarding tariffs sent ripples through both traditional financial markets and the cryptocurrency space.

Key Takeaways:

- Price Drop: Bitcoin’s price initially declined by up to 4% in response to Trump’s tariff announcement.

- EU Tariff Threat: Trump proposed a 50% tariff on the EU starting June 1, 2025, citing stalled discussions.

- Market Reaction: US stock markets also reacted negatively, with the S&P 500 and Nasdaq Composite Index experiencing declines.

- Liquidation: The price movement resulted in significant liquidations in the crypto market.

- Key Levels: Traders are closely monitoring key BTC price levels to maintain bullish momentum.

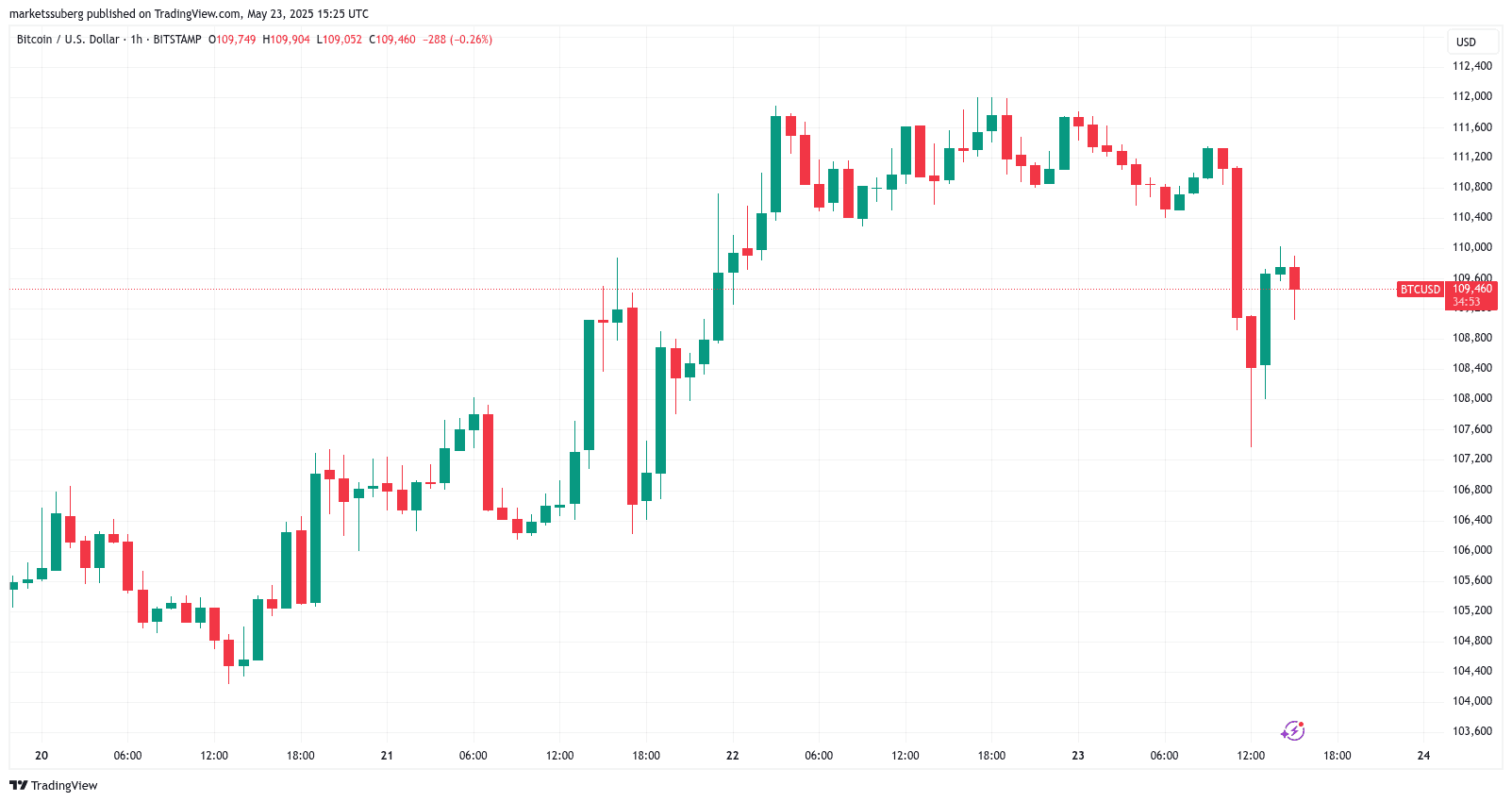

The Initial Dip and Recovery

Bitcoin’s price briefly dipped to lows of $107,367 on Bitstamp before showing signs of recovery. The initial drop reflected a broader market concern over potential trade wars and their impact on the global economy.

Trump’s Tariff Announcement

Trump’s announcement, made on Truth Social, stated, “Our discussions with them are going nowhere! Therefore, I am recommending a straight 50% Tariff on the European Union, starting on June 1, 2025.” This statement immediately impacted financial markets.

Broader Market Impact

The traditional financial markets mirrored the crypto market’s unease. The S&P 500 and Nasdaq Composite Index both declined, reflecting investor concerns about the potential economic ramifications of the proposed tariffs. The interconnectedness of crypto and traditional markets is becoming increasingly apparent, with events in one sector often influencing the other.

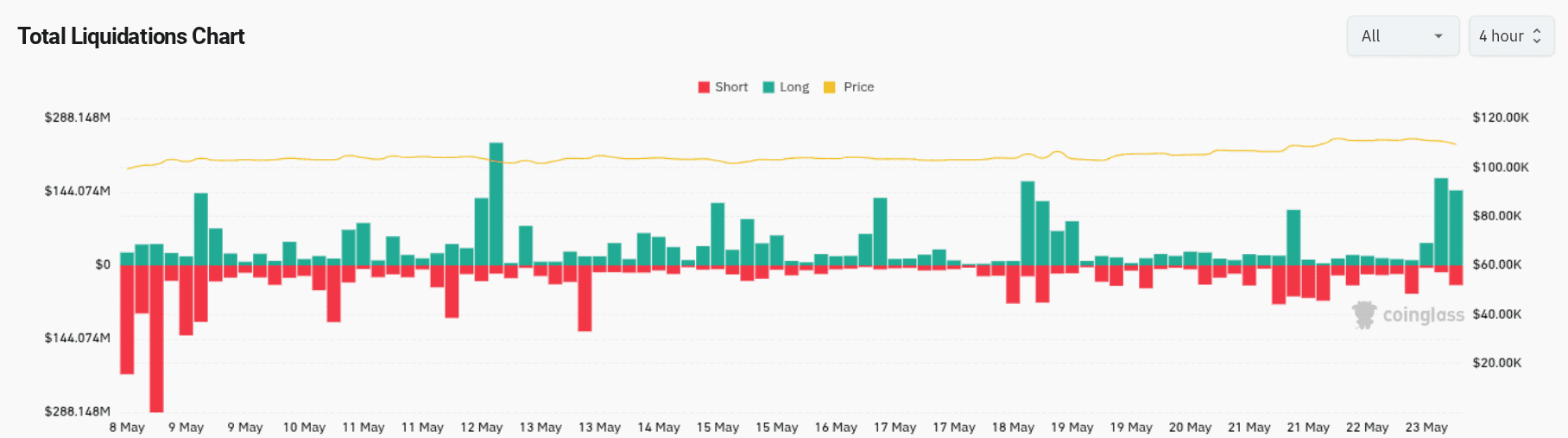

Crypto Market Analysis and Liquidations

The market reaction led to a significant amount of liquidations. Data from CoinGlass indicated that 4-hour liquidations reached nearly $350 million, while the 24-hour tally exceeded $500 million. This demonstrates the high leverage often used in cryptocurrency trading and the potential for rapid losses during periods of volatility.

Trader Perspectives

Various traders offered insights into the market’s movements. Skew noted the “aggregate flush of long leverage & de-risk selling from spot,” attributing the volatility to the news headlines.

Daan Crypto Trades commented on the market’s break from compression, driven by Trump’s announcement, and emphasized the need to observe how Bitcoin performs relative to equities given the renewed trade uncertainty.

Macroeconomic Considerations

The Kobeissi Letter highlighted the challenges facing the Trump administration regarding tariffs, noting that excessive tariff pressure could unwind the basis trade, while insufficient pressure could lead to rising inflation expectations. This creates a delicate balancing act for policymakers.

Key Price Levels to Watch

Traders are closely monitoring key BTC price levels. Crypto Caesar highlighted the importance of holding the “green zone” (an area immediately below $110,000) to maintain bullish momentum.

Poseidon pointed out the lack of significant resistance above the current spot price, suggesting potential for upward movement if key levels are maintained.

Conclusion

The Bitcoin market reacted swiftly to news of potential US tariffs on the EU, demonstrating the sensitivity of cryptocurrencies to geopolitical events. The initial price drop, followed by a partial recovery, highlights the ongoing volatility in the crypto market. Traders and investors should closely monitor key price levels and macroeconomic developments to navigate this dynamic environment. The interplay between trade policies, market sentiment, and technical analysis will continue to shape Bitcoin’s price action in the coming days and weeks.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Trading cryptocurrencies involves significant risk, and you should conduct your own research before making any investment decisions.