Bitcoin (BTC) is currently trading around $95,000 on April 30th, exhibiting a period of consolidation before an anticipated volatility spike. Traders are closely watching for a potential upside breakout, targeting liquidity around the $96,000 level. This analysis comes as the market braces for key US macro data releases and the end of the monthly trading candle.

Key Takeaways:

- Consolidation Before Potential Breakout: Bitcoin is consolidating, indicating a possible move higher or lower in the near term.

- $96K Liquidity Target: Traders are eyeing the $96,000 level as a potential area of liquidity, suggesting a possible upward price target.

- Macro Data Impact: US Q1 GDP and Personal Consumption Expenditures (PCE) data are expected to introduce volatility into the market.

- Bullish Sentiment Prevails: Despite potential risks, many traders are leaning towards an upside breakout for Bitcoin.

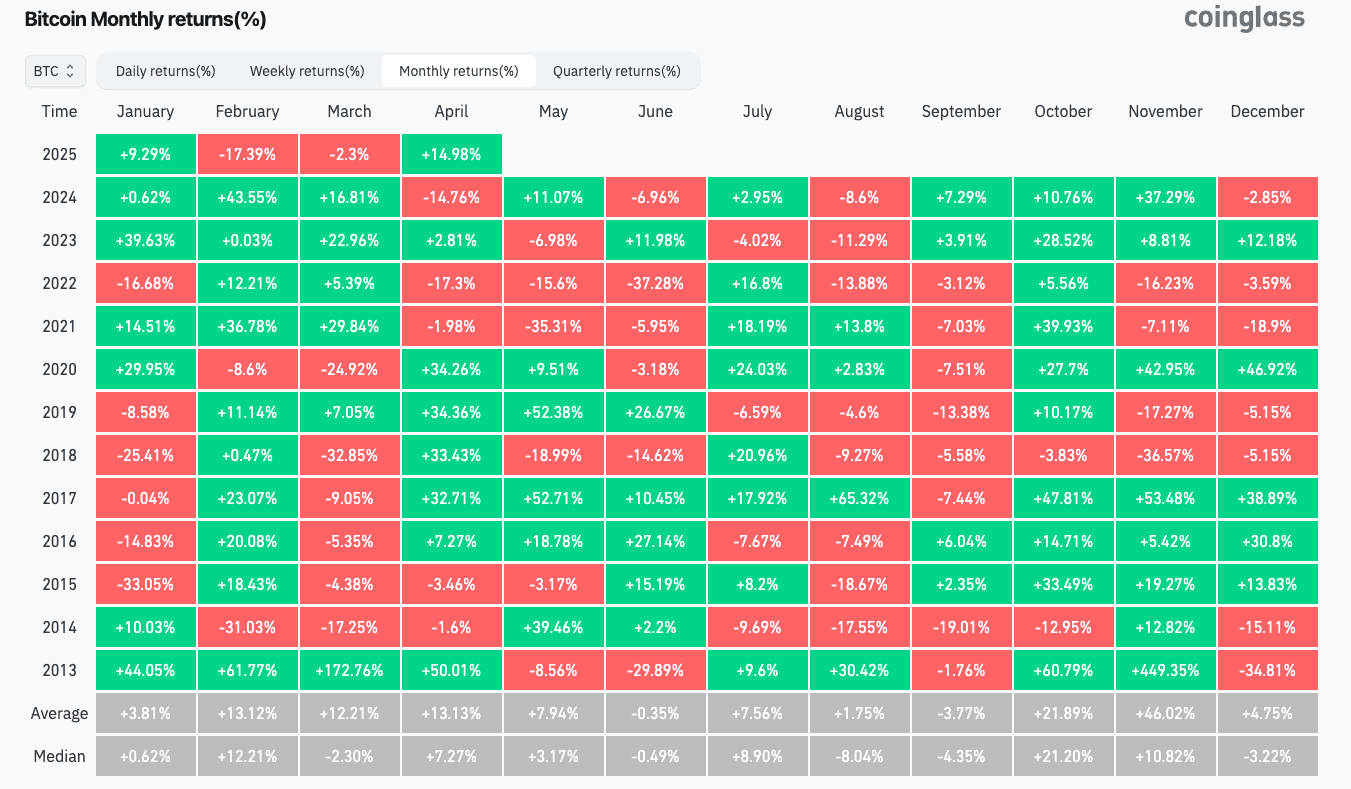

- Best April Since 2020: Bitcoin’s April performance is currently on track to be the strongest in four years.

US Macro Data and Potential Volatility

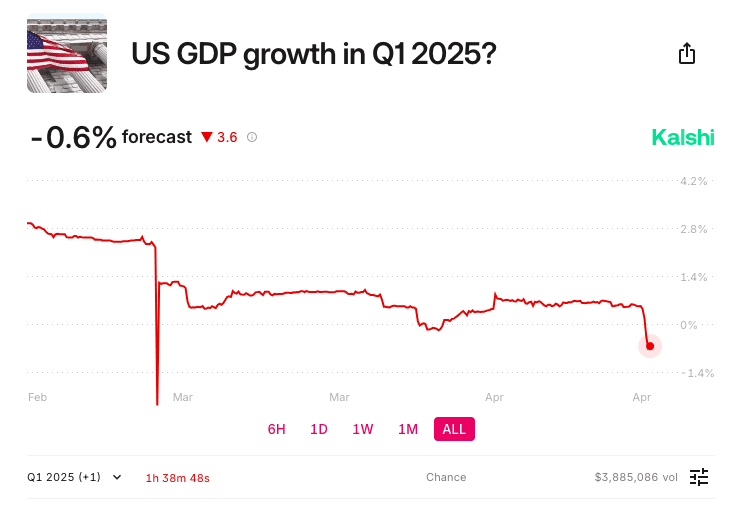

The upcoming release of US Q1 GDP and the March PCE index are crucial factors influencing Bitcoin’s short-term price action. The PCE index, the Federal Reserve’s preferred inflation gauge, will provide insights into the current inflationary pressures within the US economy. Any surprises in these data releases could trigger significant volatility across all risk assets, including Bitcoin. Some analysts are predicting a negative GDP result, which could further impact market sentiment.

Trader Sentiment and Price Predictions

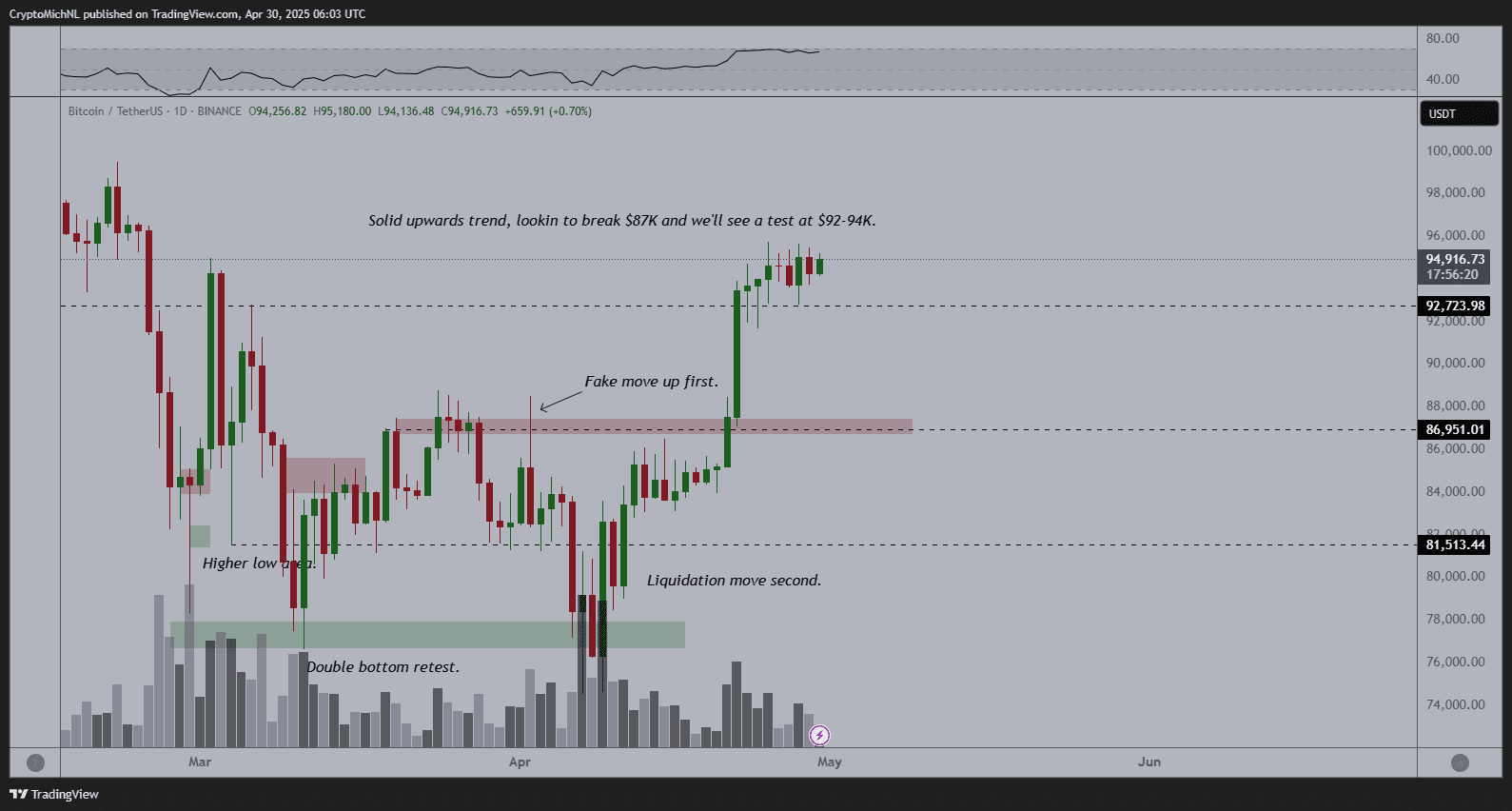

Despite the looming macro data and potential for downside risk, many prominent crypto traders remain optimistic about Bitcoin’s near-term prospects. Cold Blooded Shiller noted that Bitcoin and the S&P 500 are at a decision point, suggesting that a significant move is imminent. They favor an upward breakout, anticipating new highs. Michaël van de Poppe echoed this sentiment, stating that Bitcoin is consolidating nicely before its next leg upwards. Jelle and others have identified a potential upside liquidity grab near $96,000, suggesting that this level is a key target for bullish traders.

Bitcoin’s April Performance

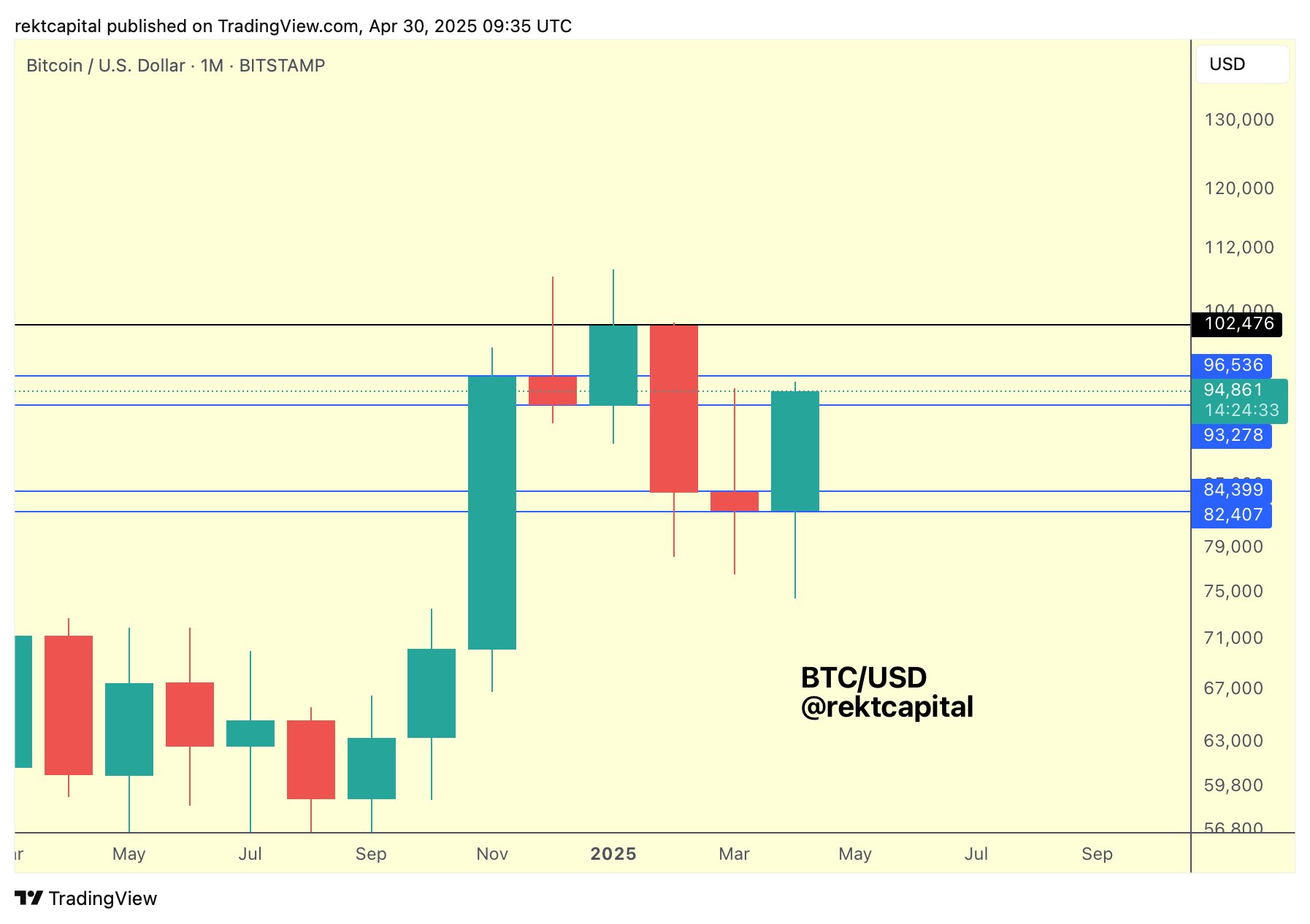

Despite a somewhat stagnant Q1, Bitcoin’s April performance is showing promise. Currently, BTC/USD is up 15% month-to-date, making it the best April since 2020. This positive trend is contributing to the overall bullish sentiment in the market. Rekt Capital noted that a monthly close within the $93,300-$96,500 range would solidify Bitcoin’s position at these highs.

Disclaimer:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.