Key Takeaways:

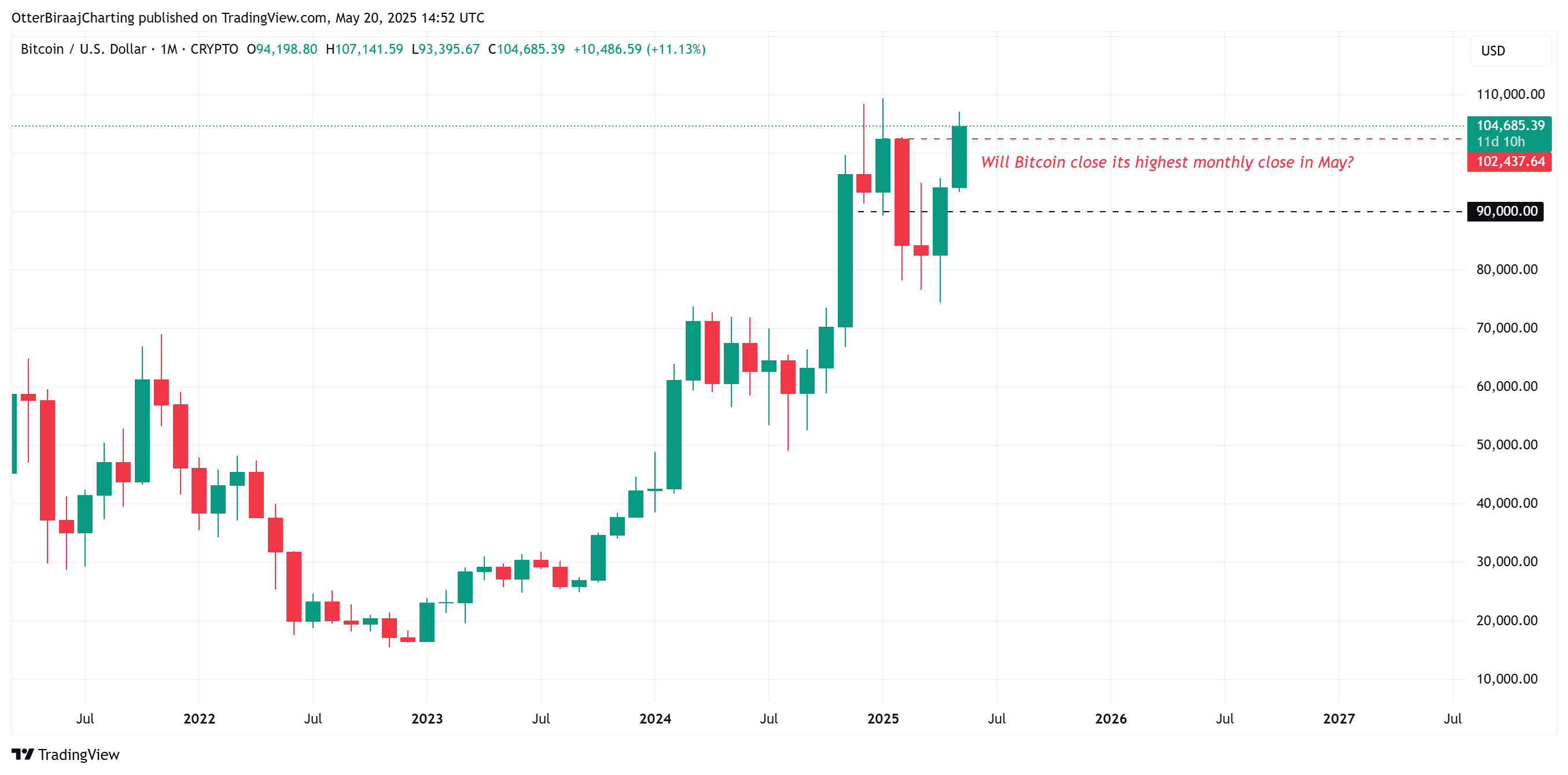

- Bitcoin is poised to potentially set a new all-time high monthly close, surpassing $102,400.

- A surge above $107,000 could trigger the liquidation of over $3 billion in Bitcoin short positions.

- Technical analysis suggests a ‘golden cross’ formation on Bitcoin’s daily chart, historically preceding significant price rallies.

- Price discovery above $110,000 could lead to uncharted territory for Bitcoin’s price.

Bitcoin (BTC) is currently positioned near a critical juncture. Market observers anticipate a potential ‘price discovery’ phase if BTC breaks above its all-time high of $110,000. This breakout could lead to a significant rally as Bitcoin enters an uncharted trading range.

Understanding Price Discovery

Price discovery refers to the process by which buyers and sellers interact to determine the market price of an asset in an undefined or non-traded range. For Bitcoin, surpassing $110,000 would initiate this phase, potentially driving the price to successive higher highs as market participants establish a new equilibrium.

Technical Indicators Point to Bullish Momentum

Bitcoin is nearing confirmation of a ‘golden cross’ on its daily chart. A golden cross occurs when the 50-day moving average crosses above the 200-day moving average, and is often interpreted as a bullish signal. Historically, this pattern has preceded significant price rallies, ranging from 45% to 60%.

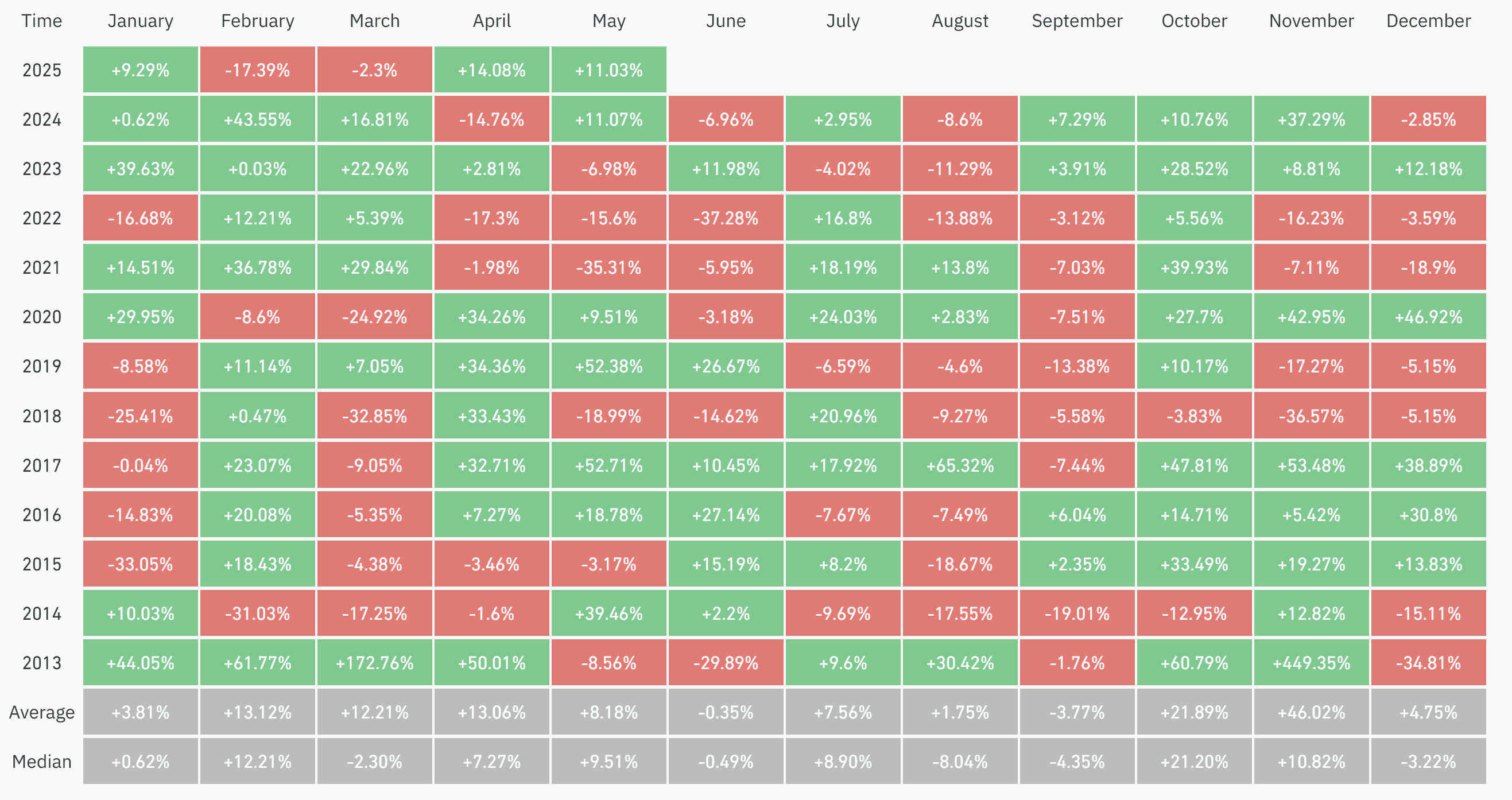

A strong monthly close near $110,000 would represent a substantial gain for Bitcoin in May, potentially marking its best performance for the month since 2019. This performance would significantly exceed the historical average monthly return of 8%.

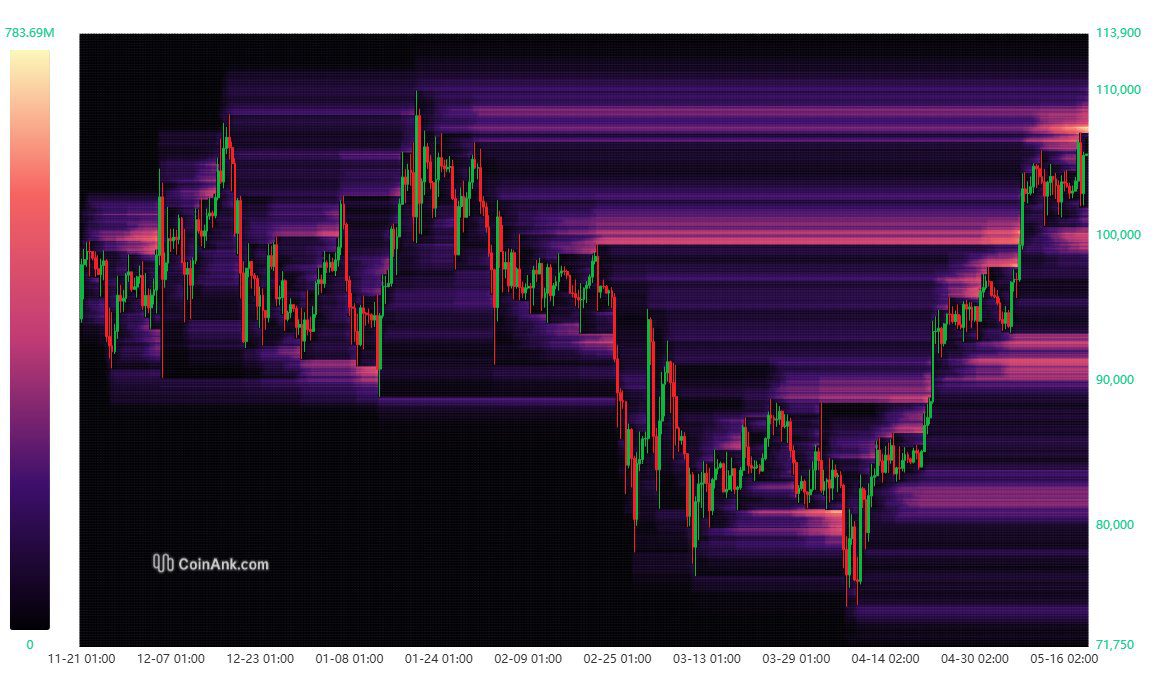

Liquidation Magnet Above $107,000

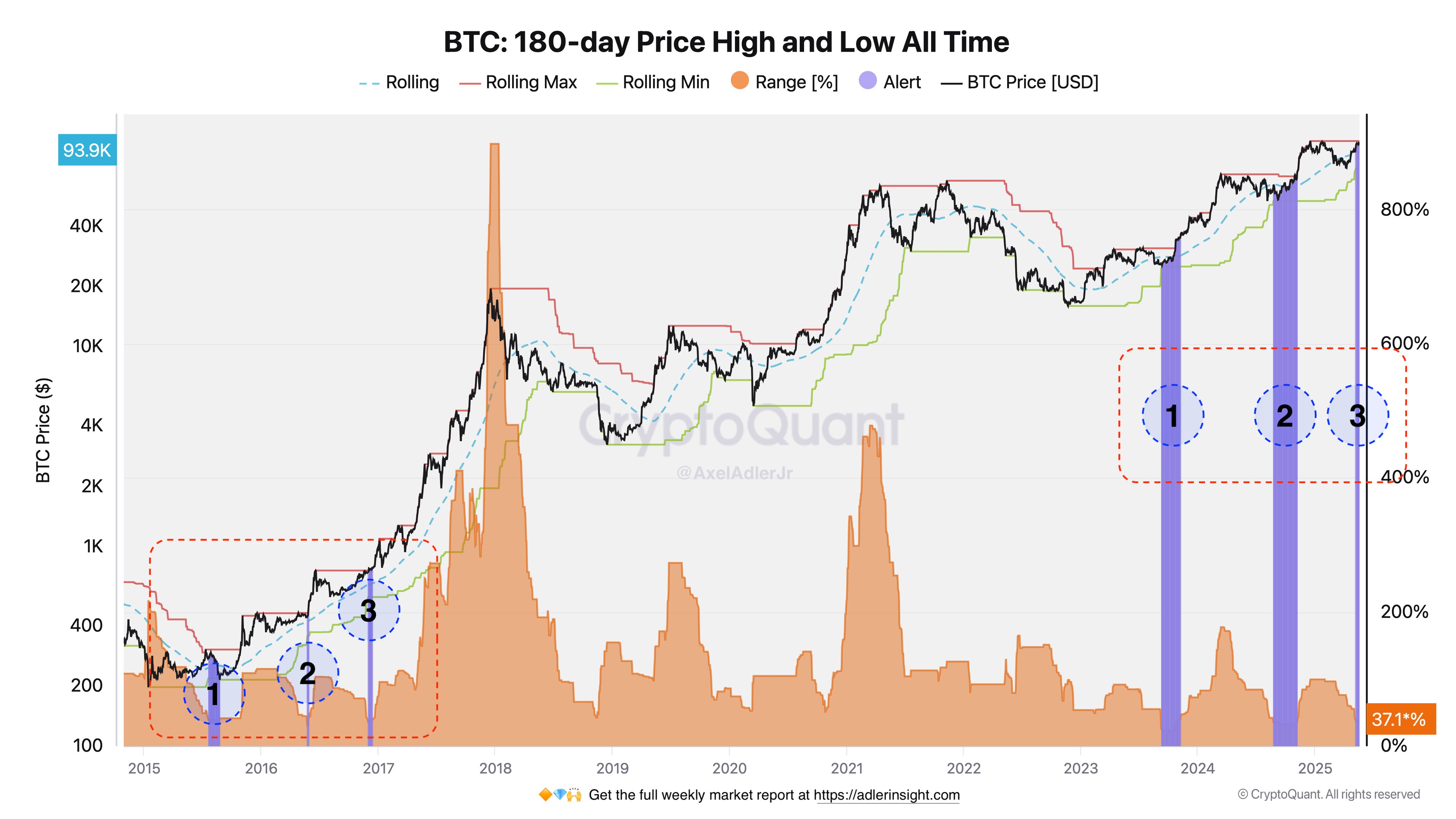

Analysis of Bitcoin’s current bull cycle highlights a pattern of ‘compression,’ characterized by tightening price ranges. This compression often precedes significant breakouts. The current cycle mirrors the 2017 rally, where Bitcoin surged from $1,000 to $20,000 following halving events and supply shocks.

Currently, over $3 billion in short leveraged positions are at risk of liquidation if Bitcoin’s price reaches $110,000. This creates a ‘liquidation magnet,’ incentivizing upward price movement to capitalize on these liquidations. Conversely, a drop to $94,612 would be required to trigger a similar amount in long liquidations, suggesting a higher probability of an upward surge.

Expert Opinions

Technical analysts note the significant liquidation levels above $107,000, suggesting that Bitcoin’s next move could be driven by the liquidation of short positions. The convergence of technical indicators, market dynamics, and historical patterns supports a potentially bullish outlook for Bitcoin.

Factors Driving Potential Growth:

- Halving Events: Bitcoin halvings reduce the rate at which new Bitcoins are created, decreasing supply and potentially increasing demand.

- Institutional Adoption: Increased investment from institutional investors adds legitimacy and capital to the Bitcoin market.

- Regulatory Clarity: Clearer regulatory frameworks can encourage wider adoption by both retail and institutional investors.

- Macroeconomic Factors: Economic uncertainty and inflation can drive investors to Bitcoin as a store of value.

- Technological Advancements: Improvements to the Bitcoin network, such as the Lightning Network, can enhance its usability and scalability.

Conclusion:

Bitcoin’s current market position suggests a potential for significant price appreciation. A breakout above $110,000 could trigger a substantial rally, driven by the liquidation of short positions and supported by favorable technical indicators and historical patterns. While market conditions remain dynamic, the confluence of factors suggests a bullish outlook for Bitcoin in the near term. It is important for investors to conduct their own research and carefully consider their risk tolerance before making any investment decisions.