Bitcoin (BTC) is showing signs of a potential upside breakout, leading traders to speculate about a move towards all-time highs. Several factors contribute to this bullish sentiment, including a converging triangle pattern, solid demand from US buyers, and positive market structure interpretations. However, some analysts remain cautious, pointing to outstanding resistance levels that need to be overcome before a sustained rally can occur.

Key Takeaways:

- Bullish Momentum: Many traders believe Bitcoin is poised for a breakout, targeting $116,000 as an initial goal.

- Converging Triangle Pattern: A common indicator of a potential breakout, characterized by decreasing volume.

- Strong Demand: Consistent Coinbase spot premium suggests solid demand from US buyers.

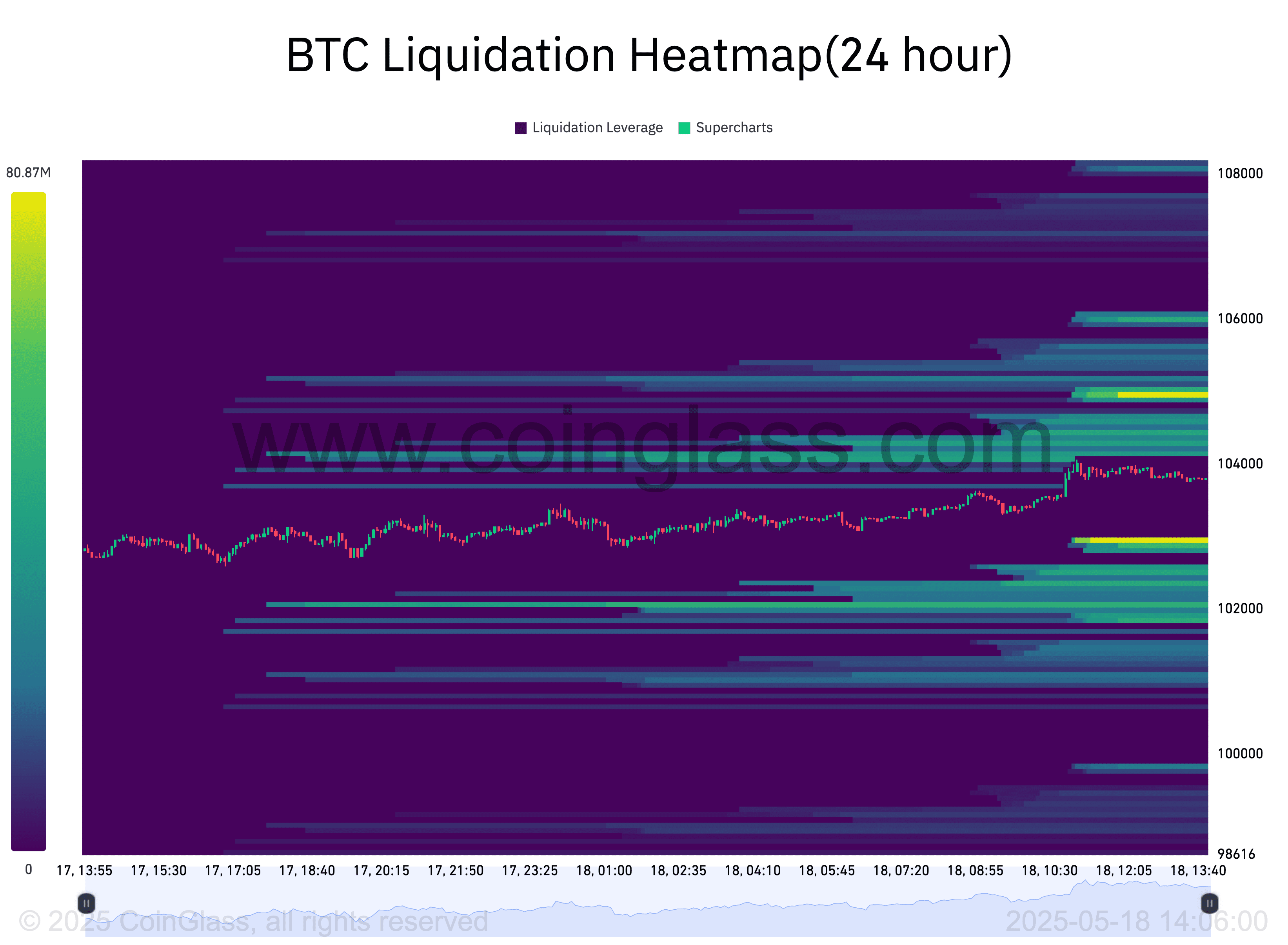

- Resistance Levels: Some analysts caution about outstanding resistance that Bitcoin needs to overcome.

- Potential Pullback: A temporary pullback before resuming the upside is also considered a possibility.

Technical Analysis and Market Structure

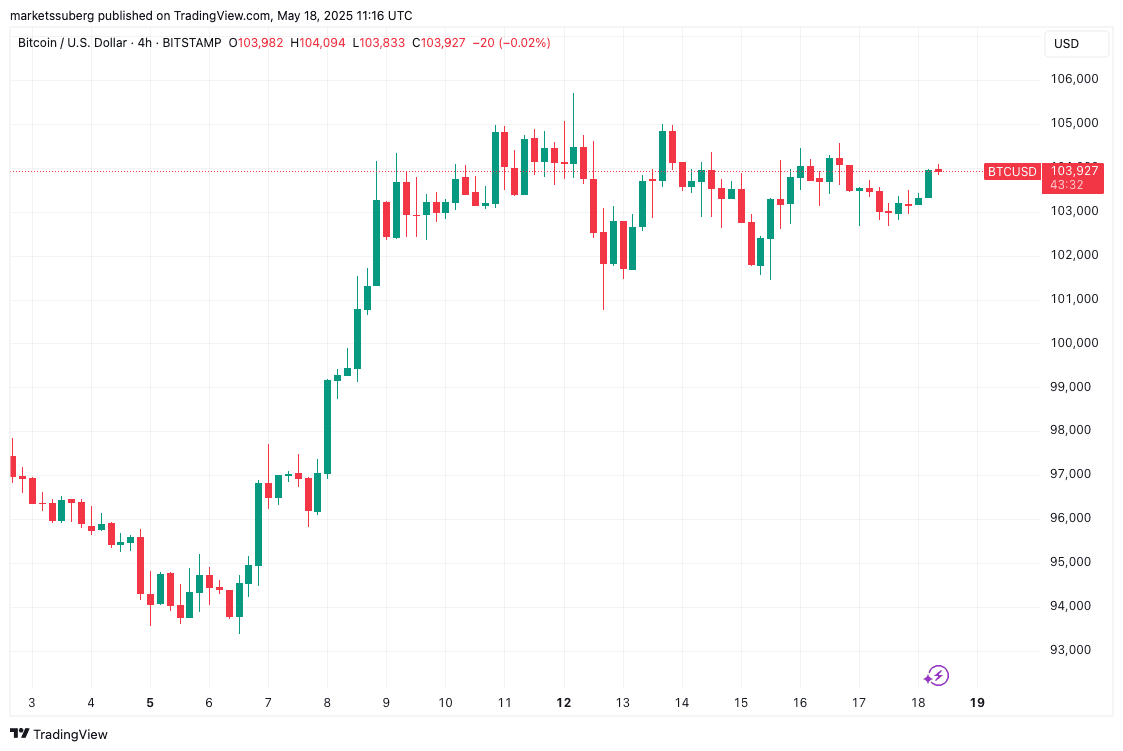

The recent price action of Bitcoin has formed a converging triangle pattern, which is often seen as a precursor to a significant breakout. This pattern is characterized by decreasing volume as the price consolidates within a tightening range. Trader Alan summarized in his latest short-term prediction on X that the next early week Bitcoin target is $116,000.

Mikybull Crypto described the market structure as an “intraday diamond pattern breakout.” This pattern also suggests a potential for upward movement.

Demand and Buyer Support

Trader Daan Crypto Trades highlighted a consistent Coinbase spot premium, indicating solid demand from US buyers. This is a positive sign for Bitcoin, as it suggests strong buying pressure fueling its potential return to six figures. This demand is crucial for sustaining any upward momentum and overcoming resistance levels.

Potential Resistance and Pullbacks

Despite the bullish sentiment, some analysts remain cautious, pointing to outstanding resistance levels that Bitcoin needs to overcome. CrypNuevo suggested that a slow week and Bitcoin’s inability to break resistance so far makes him think that a temporary pullback might be possible.

Daan Crypto Trades also added that against stocks, Bitcoin has yet to beat out final resistance.

Overall Outlook

The Bitcoin market is currently exhibiting a mix of bullish and cautious signals. While many traders are optimistic about a potential breakout towards $116,000 and new all-time highs, it’s essential to consider the outstanding resistance levels and the possibility of a temporary pullback. Monitoring key indicators like the Coinbase spot premium, volume within the converging triangle pattern, and the performance of Bitcoin against stocks can provide valuable insights into the future direction of the market.

As Cointelegraph reported, longer-term concerns include a full retrace of the relief bounce, which rescued BTC/USD from multimonth lows near $75,000 in April.

A sweep of levels closer to $90,000 is also on the radar.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.