Key Takeaways:

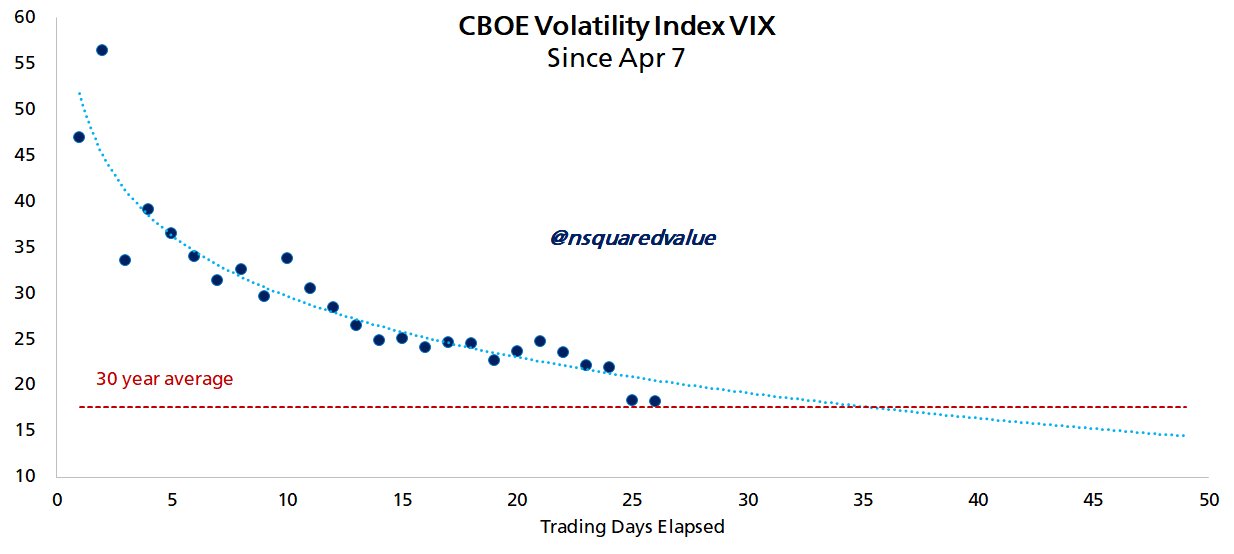

- Bitcoin price is consolidating above $100,000, buoyed by a “risk-on” market sentiment following a drop in the CBOE Volatility Index (VIX).

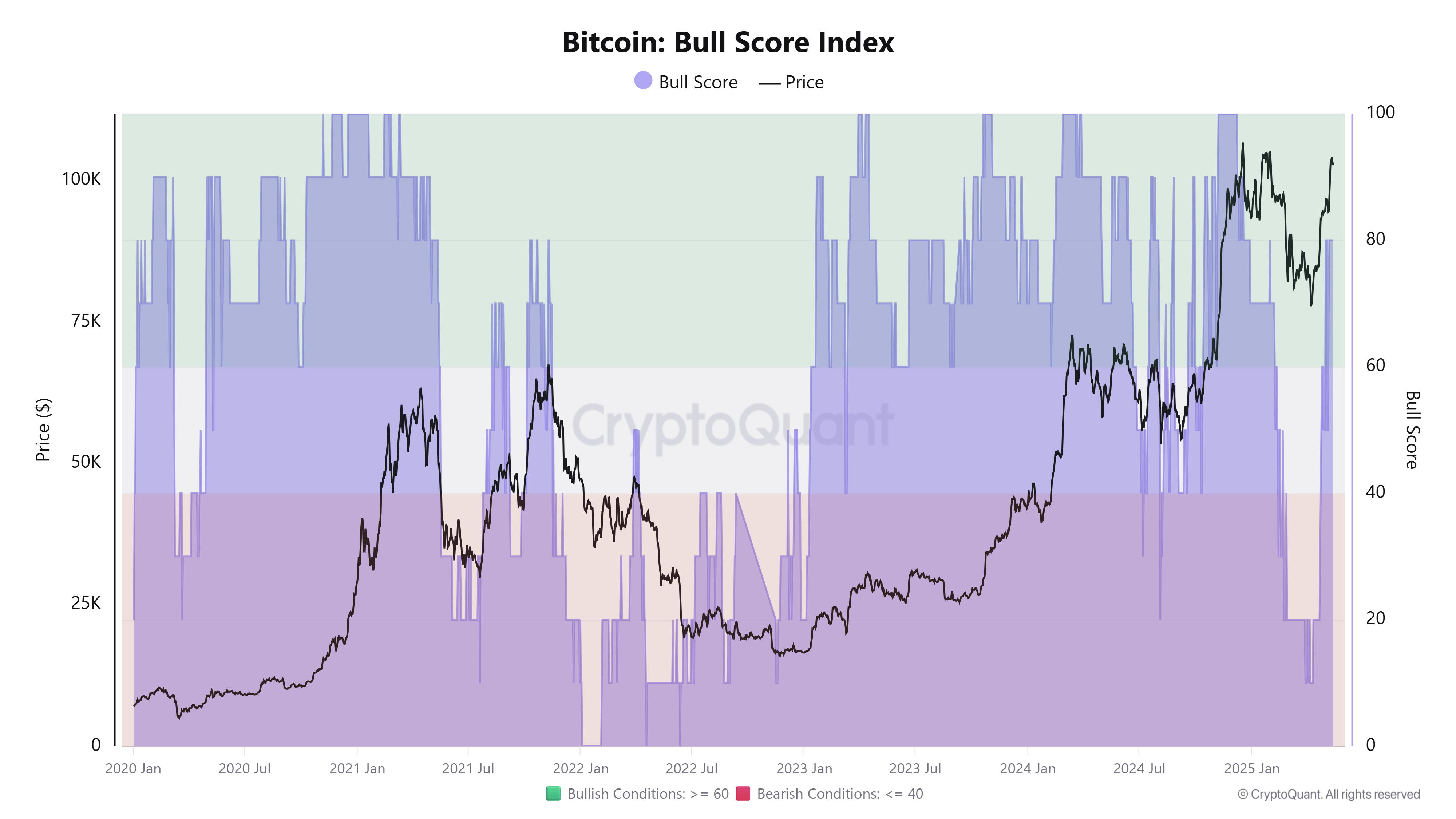

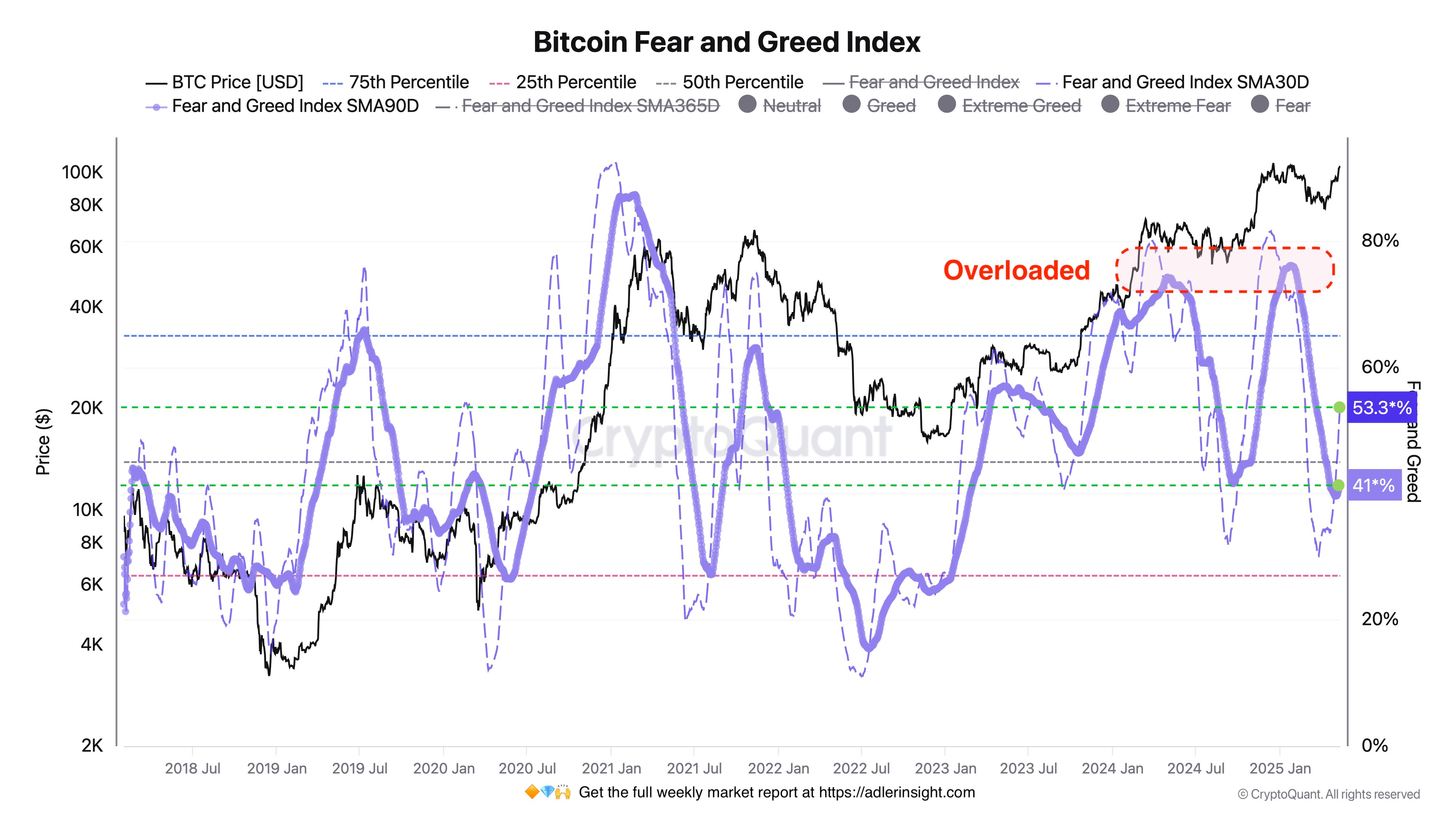

- The Bitcoin Bull Score Index has surged to 80, signaling strong bullish sentiment, while the Fear & Greed Index indicates growing optimism.

- Analyst Timothy Peterson projects a potential Bitcoin price of $135,000 within 100 days, contingent on continued low volatility and favorable macroeconomic conditions.

Bitcoin (BTC) is currently trading above $100,000, maintaining its position as a leading cryptocurrency. Several factors are contributing to the positive market sentiment surrounding Bitcoin, with analysts predicting further price increases in the near future. A key driver of this optimism is the recent drop in the CBOE Volatility Index (VIX), a measure of market volatility, which has fallen to its 30-year average of 20. This decline suggests a more stable and predictable market environment, encouraging investors to take on more risk.

The “Risk-On” Environment: The decrease in the VIX has created a “risk-on” environment, where investors are more willing to invest in assets perceived as riskier, such as Bitcoin and equities. This shift in sentiment is largely due to increased confidence in the market’s stability and reduced uncertainty about future economic conditions. The initial catalyst was the US-China trade deal which introduced a 90-day tariff pause and a 115% reduction on both sides.

Bitcoin network economist Timothy Peterson emphasized the significance of this development, stating that the lower VIX level signals a period of sustained investor confidence in higher-risk assets. This outlook aligns with the belief that reduced volatility provides a more conducive environment for investments like Bitcoin to thrive.

Easing Inflationary Pressures: Another factor supporting Bitcoin’s potential growth is the recent decline in the US Consumer Price Index (CPI) inflation rate. In April 2025, the CPI dropped to 2.3% year-over-year, the lowest level since February 2021. This decrease indicates easing inflationary pressures, which could prompt the Federal Reserve to consider interest rate cuts in 2025. Lower interest rates tend to make investments like Bitcoin more attractive, as they reduce the opportunity cost of holding non-yielding assets.

With macroeconomic dynamics aligning – lower volatility, cooling inflation, and a trade war truce – conditions are exceptionally favorable for Bitcoin’s upward trajectory. Peterson had earlier suggested that BTC could reach $135,000 within 100 days, based on the relationship between the VIX and investor confidence.

Bitcoin Bull Score and Fear & Greed Index: The Bitcoin Bull Score Index, which reflects overall market sentiment, has surged to 80, reaching its highest level in 2025. This significant increase suggests a dramatic shift in investor sentiment towards Bitcoin. The rise in the Bull Score Index is primarily attributed to spot demand outpacing supply, a dynamic that has historically led to significant price surges. This trend mirrors the patterns observed after the April 2024 halving, indicating that Bitcoin could be on the cusp of further gains. When the bull score is high, the market tends to be more bullish and open to high risk trades.

In addition to the Bull Score Index, the Bitcoin Fear & Greed Index is also indicating growing optimism. While the index is currently at 53.3%, it is still below the “overloaded” zone above 80%. Analyst Axel Adler Jr. suggests that this indicates the potential for further market upside, with the possibility of Bitcoin surpassing its all-time high near $110,000. The Fear & Greed index measures emotions and feelings from different sources and turns them into one simple number.

Factors Influencing the Prediction: Several factors support the prediction of Bitcoin reaching $135,000 within 100 days:

- Reduced Market Volatility: The decline in the VIX indicates a more stable and predictable market environment, encouraging investors to take on more risk.

- Easing Inflationary Pressures: The decrease in the US CPI inflation rate could prompt the Federal Reserve to consider interest rate cuts, making Bitcoin more attractive.

- Strong Bullish Sentiment: The surge in the Bitcoin Bull Score Index and the growing optimism reflected in the Fear & Greed Index suggest that investor sentiment is strongly positive.

Potential Challenges: While the factors discussed above point to a positive outlook for Bitcoin, it’s important to acknowledge potential challenges that could hinder its growth:

- Regulatory Uncertainty: Changes in regulations surrounding cryptocurrencies could negatively impact investor sentiment and demand.

- Market Corrections: Bitcoin is known for its volatility, and a sudden market correction could lead to a significant price drop.

- Unexpected Economic Events: Unforeseen economic events could disrupt the current positive market conditions and impact Bitcoin’s trajectory.

Conclusion: The confluence of reduced market volatility, easing inflationary pressures, and strong bullish sentiment suggests that Bitcoin has the potential to reach $135,000 within 100 days. However, investors should be aware of the potential challenges and conduct their own research before making any investment decisions. As always, past performance is not indicative of future results, and the cryptocurrency market remains inherently volatile. Investors should exercise caution and only invest what they can afford to lose.