Bitcoin (BTC) has experienced a significant rally, sparking excitement and speculation about its future price trajectory. This article delves into the factors influencing Bitcoin’s current surge and explores potential price targets for the near and long term.

Key Factors Driving Bitcoin’s Price Surge

Several factors are contributing to the renewed interest in Bitcoin:

- Increased Institutional Adoption: More institutions are adding Bitcoin to their portfolios, signaling growing confidence in its long-term value.

- Positive Regulatory Developments: Increased clarity in regulations surrounding cryptocurrencies is fostering a more stable investment environment.

- Bitcoin Halving: The recent Bitcoin halving event, which reduces the reward for mining new blocks, is expected to decrease the supply of new Bitcoin, potentially driving up the price.

- Marketwide Crypto Rally: The broader cryptocurrency market is experiencing a resurgence, driven by positive sentiment and increased investor interest.

- Devaluation of Fiat Currencies: Concerns about the devaluation of traditional currencies, such as the US dollar, are prompting investors to seek alternative stores of value like Bitcoin.

Potential Bitcoin Price Targets

Analysts and experts are offering various price predictions for Bitcoin, based on different analytical approaches:

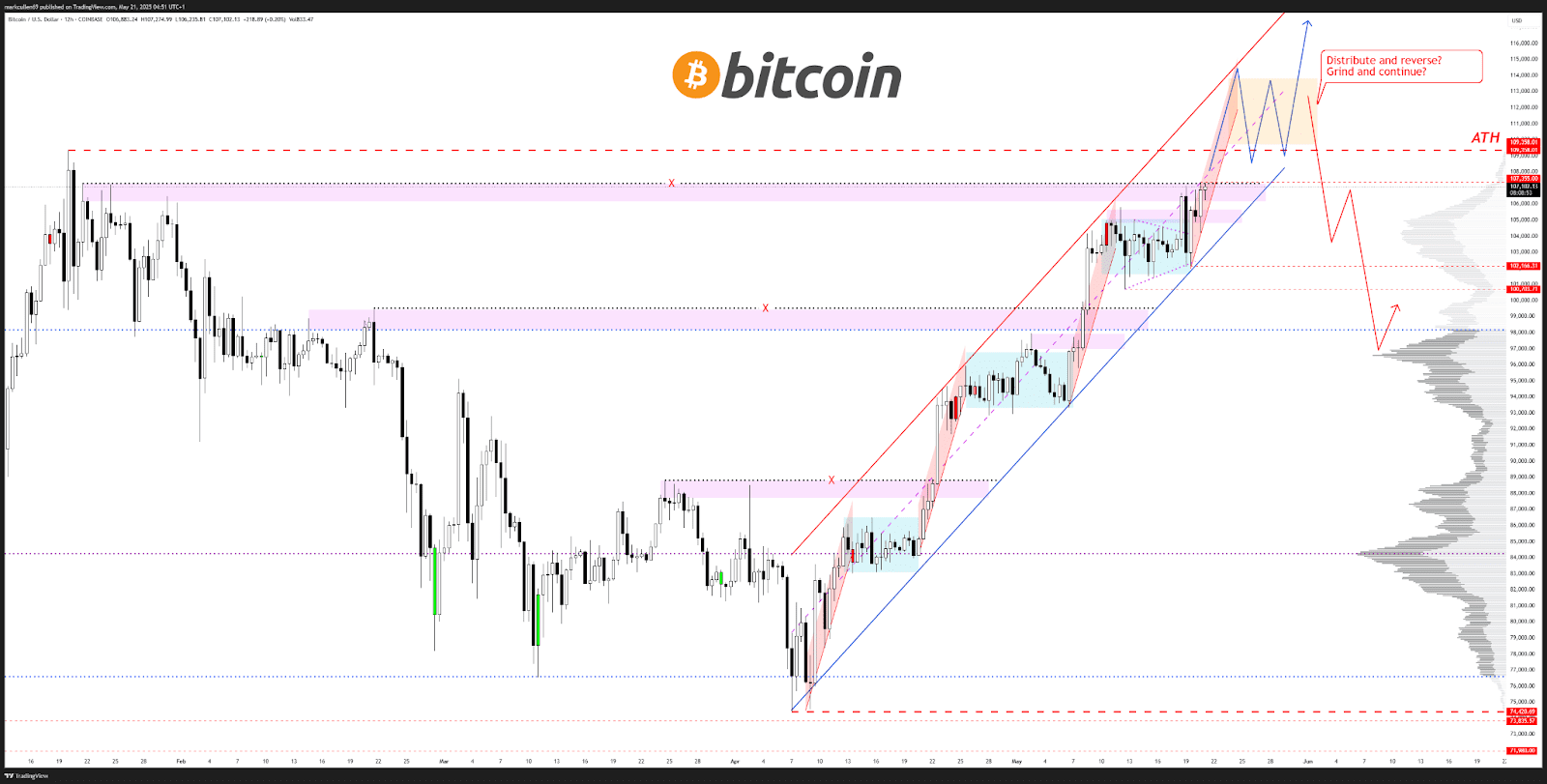

- Near-Term Targets (2024): Several analysts have suggested Bitcoin could reach new all-time highs in 2024. Predictions range from $115,000 to $130,000 by the end of June, with some projecting even higher targets if Bitcoin breaks through key resistance levels.

- Long-Term Targets (2025): Some analysts are extremely bullish on Bitcoin’s long-term potential, with predictions reaching as high as $200,000 or even $215,000 by 2025. These projections are often based on historical price patterns following previous Bitcoin halving events.

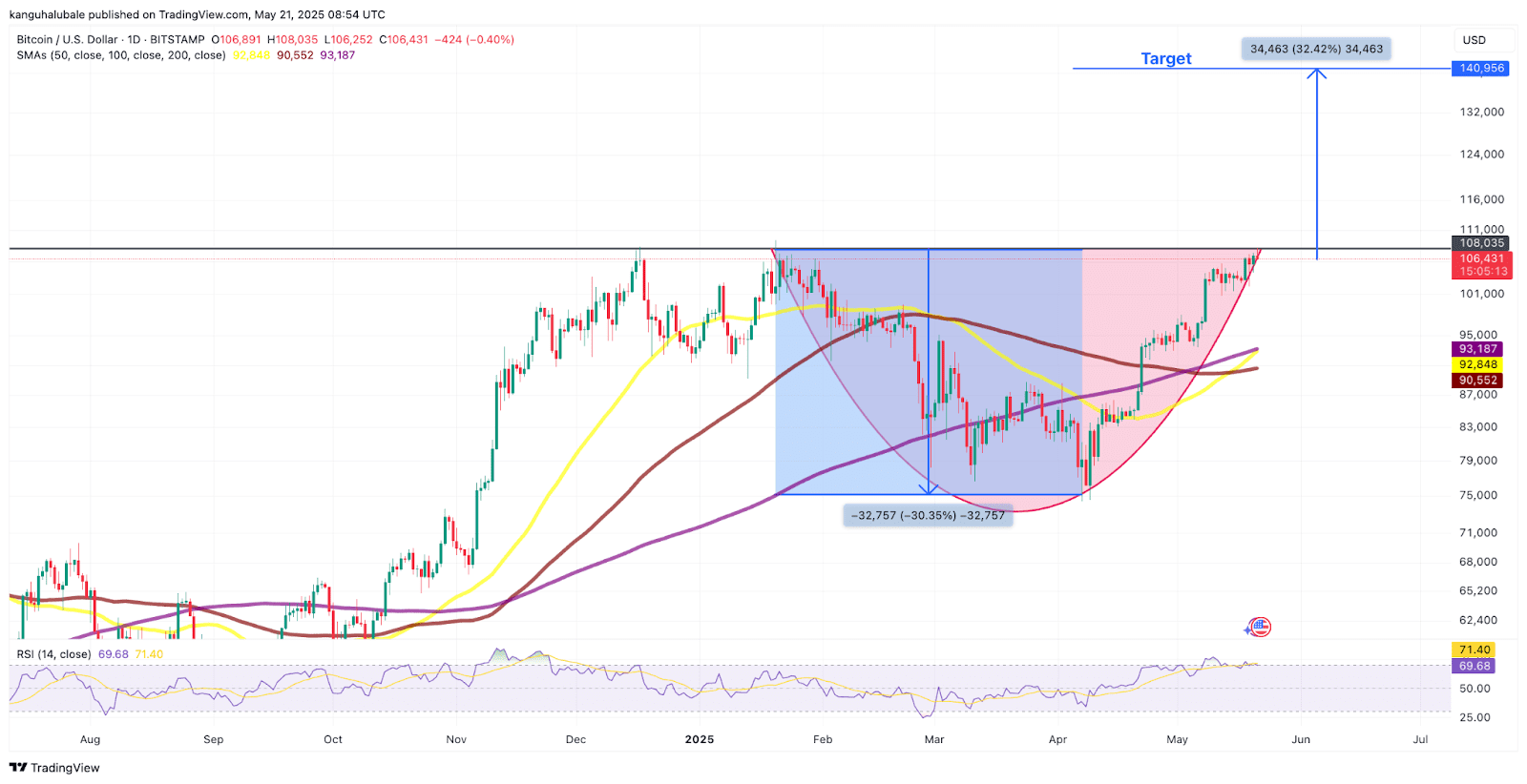

- Technical Analysis Targets: Technical analysis suggests that Bitcoin has formed a rounded bottom pattern on the daily chart. A breakout above the neckline of this pattern could trigger a significant price surge, with a technical target of around $140,000.

Expert Opinions and Analysis

Several prominent analysts have weighed in on Bitcoin’s potential:

- AlphaBTC: Anticipates Bitcoin will surpass its all-time high soon, driven by larger players capitalizing on short positions.

- Michael van de Poppe (MN Capital): Believes Bitcoin could reach $200,000 due to growing concerns about fiat currency devaluation.

- Mags: Projects a possible top around $215,000 based on Bitcoin’s four-year halving cycle.

- Timothy Peterson: Used statistical analysis to predict a potential top under $130,000 by the end of June.

Technical Indicators to Watch

Several technical indicators can provide insights into Bitcoin’s price momentum:

- Relative Strength Index (RSI): The RSI is currently around 69, suggesting that Bitcoin is not yet overbought and may have room to continue its upward trend.

- Golden Cross: An impending golden cross, where the 50-day moving average crosses above the 200-day moving average, is a bullish signal that could further fuel Bitcoin’s rally.

Conclusion

Bitcoin’s price is experiencing a resurgence, driven by factors such as increased institutional adoption, positive regulatory developments, and the recent halving event. Analysts are projecting significant price increases in the near and long term, with some predicting new all-time highs in 2024 and potential targets as high as $200,000 or more by 2025. While these predictions are optimistic, it’s important to remember that the cryptocurrency market is highly volatile and investments carry risk. Always conduct thorough research and consider your risk tolerance before investing in Bitcoin or any other cryptocurrency.