Key Takeaways:

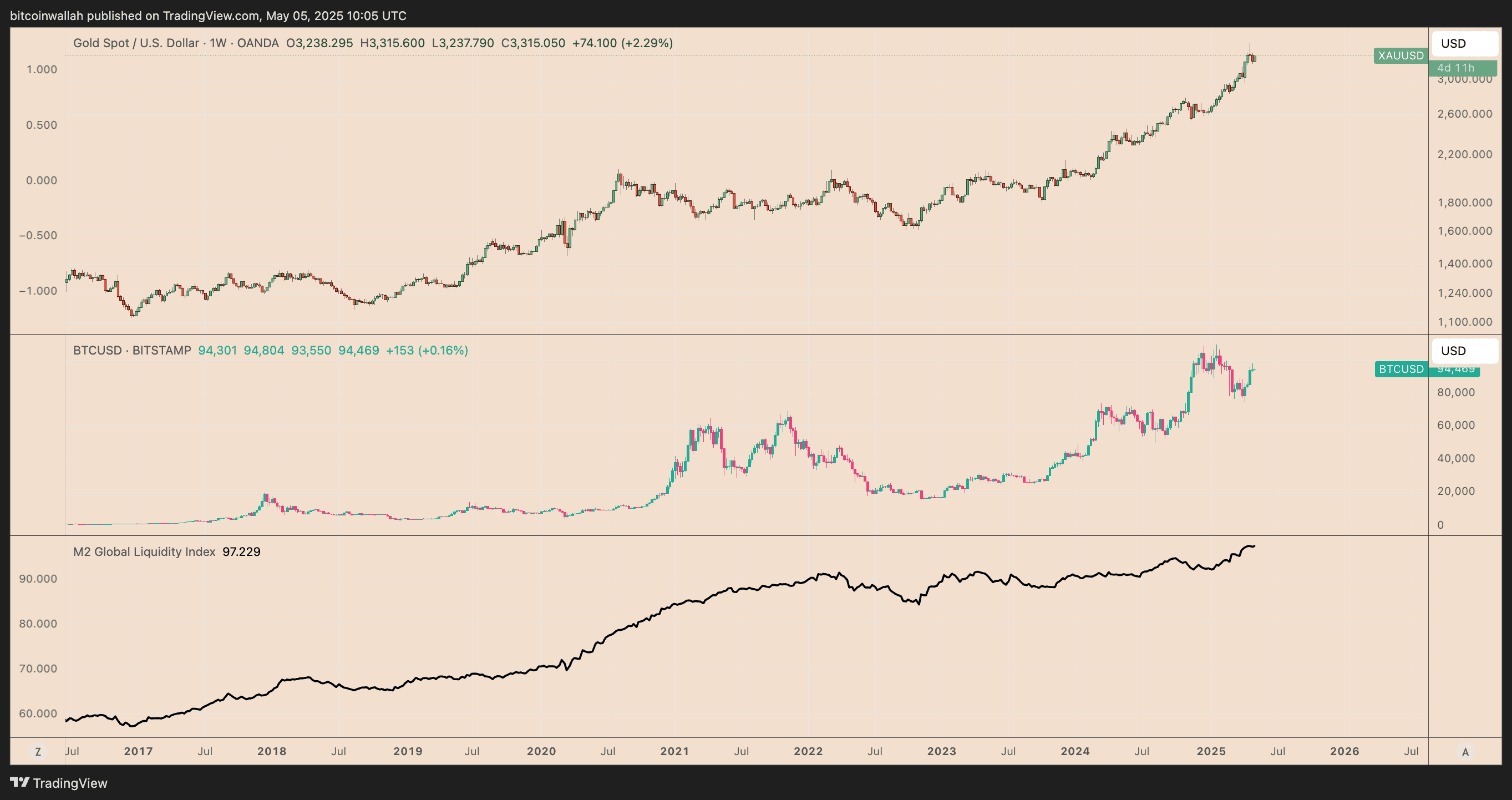

- Bitcoin has historically outperformed gold, especially during periods of increased global liquidity.

- Analysts predict significant Bitcoin gains if gold reaches $5,000-$6,000, potentially pushing BTC to $155,000-$285,000.

- Factors like a weakening US dollar, rising global money supply, and increased institutional adoption could drive both gold and Bitcoin prices higher.

The prospect of gold hitting $5,000 per ounce has ignited discussions about the potential impact on Bitcoin (BTC), often referred to as ‘digital gold.’ Given their intertwined narratives and occasional correlation, understanding how gold’s rise might affect Bitcoin is crucial for investors.

Historical Performance: Bitcoin vs. Gold

Historically, Bitcoin has demonstrated the potential for more substantial gains than gold during concurrent market rallies. For example:

- March 2020 – March 2022: During the Federal Reserve’s loose monetary policies, Bitcoin surged by approximately 1,110%, while gold increased by only 35.5%.

- November 2022 – November 2023: As global money (M2) supply increased, gold gained about 25%, but Bitcoin jumped by 150%, nearly 6x outperformance.

Expert Predictions and Analysis

Several analysts have weighed in on the potential impact of a gold rally on Bitcoin’s price:

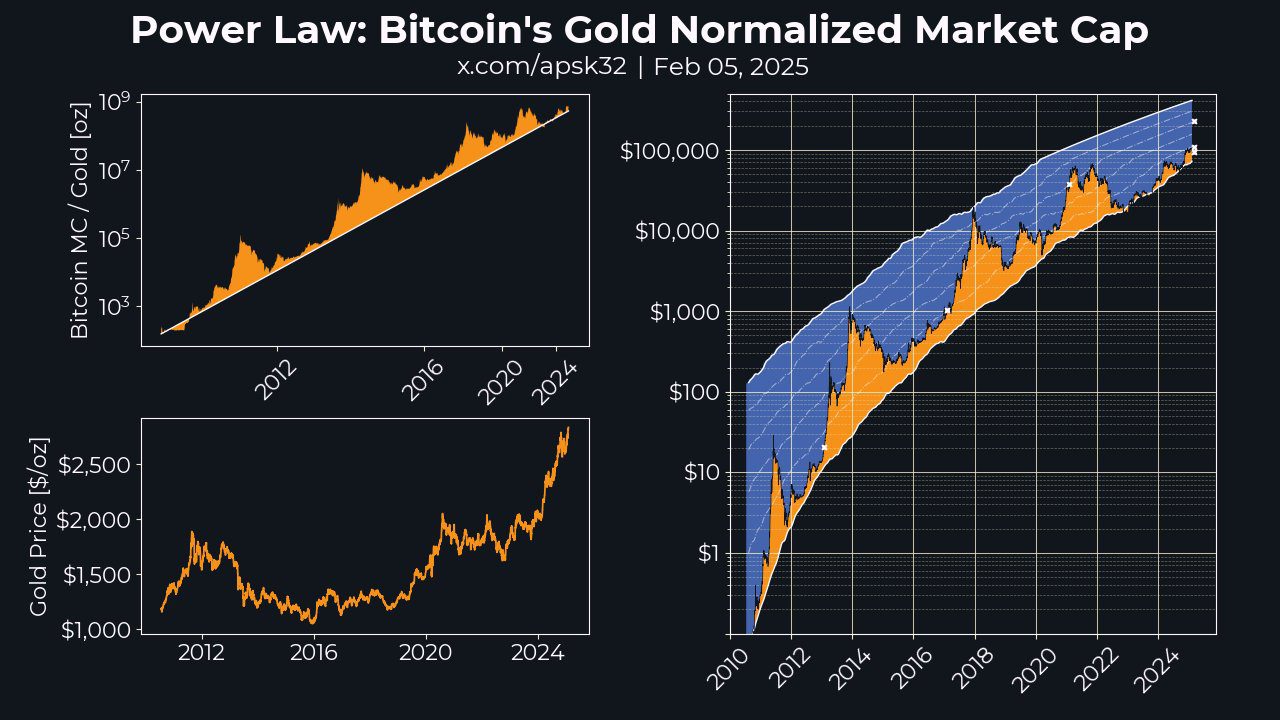

- Analyst apsk32: Projects a Bitcoin price target based on a power law model normalized against gold’s market cap, aligning with a $270,000-$300,000 valuation.

- Frank Holmes (US Global Investors): Sees gold heading to $6,000 during Trump’s presidential term and anticipates Bitcoin potentially reaching $250,000 as adoption accelerates. He believes Trump’s tariff policies could weaken the US dollar, boosting gold and subsequently Bitcoin.

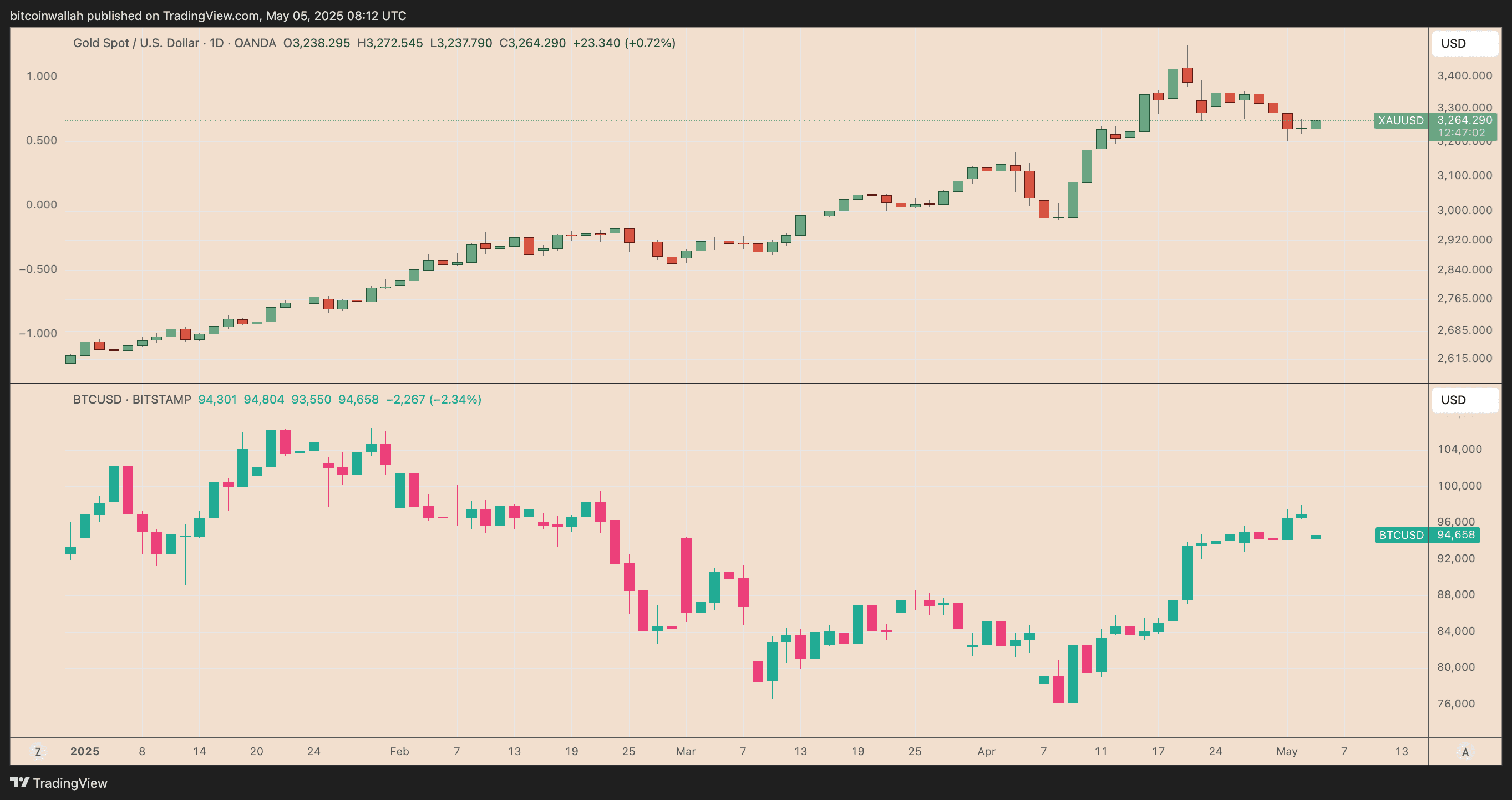

- Cryptollica: Points to Bitcoin’s past behavior of following gold after a lag, suggesting a possible move toward the $155,000 level if it breaks out of its prevailing consolidation range.

Potential Bitcoin Price Scenarios

Based on historical trends and expert analysis, here are a few potential Bitcoin price scenarios if gold reaches $5,000:

- 300% Growth Scenario: If history repeats itself and Bitcoin mimics its past outperformance, a 50% gain in gold (from $3,265 to $5,000) could translate to a 300% increase in Bitcoin, potentially reaching $285,000 per BTC.

- Lagging Correlation Scenario: If Bitcoin follows gold with a lag, as suggested by Cryptollica, it could potentially reach the $155,000 level.

Factors Driving Both Gold and Bitcoin

Several factors contribute to the potential rise of both gold and Bitcoin:

- Weakening US Dollar: A weaker dollar makes gold more attractive to international investors.

- Rising Global Liquidity (M2 Money Supply): Increased money supply can devalue fiat currencies, driving investors to seek alternative assets like gold and Bitcoin.

- Institutional Adoption: Increased institutional investment in both gold and Bitcoin can drive up demand and prices.

- Geopolitical Uncertainty: Economic and political instability often lead investors to safe-haven assets like gold and Bitcoin.

Conclusion

While predicting the future price of any asset is inherently uncertain, the historical correlation between gold and Bitcoin, combined with expert analysis and favorable macroeconomic conditions, suggests that Bitcoin could experience significant gains if gold reaches $5,000. Investors should carefully consider these factors and conduct thorough research before making any investment decisions.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Investing in cryptocurrencies and precious metals involves risk, and you could lose money. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.