Bitcoin Price Analysis: Crash or Breakout?

Bitcoin (BTC) has experienced a significant 36% rebound from its recent low of $74,500. However, the cryptocurrency now faces a crucial test at the $106,000 resistance level. Failure to surpass this point could trigger a sharp correction, while a successful breakout could lead to further gains. This analysis delves into key factors influencing Bitcoin’s price, including on-chain data, open interest, and technical indicators.

Key Takeaways:

- Bitcoin’s rebound faces resistance at $106,000, a level that previously triggered a 27% drop.

- Strong bid-side liquidity around $93,000 suggests potential support during a downturn.

- Over 97% of Bitcoin holders are currently in profit, which historically precedes price corrections.

- High open interest in Bitcoin derivatives markets indicates potential for volatility.

Bitcoin Holder Profitability: A Double-Edged Sword

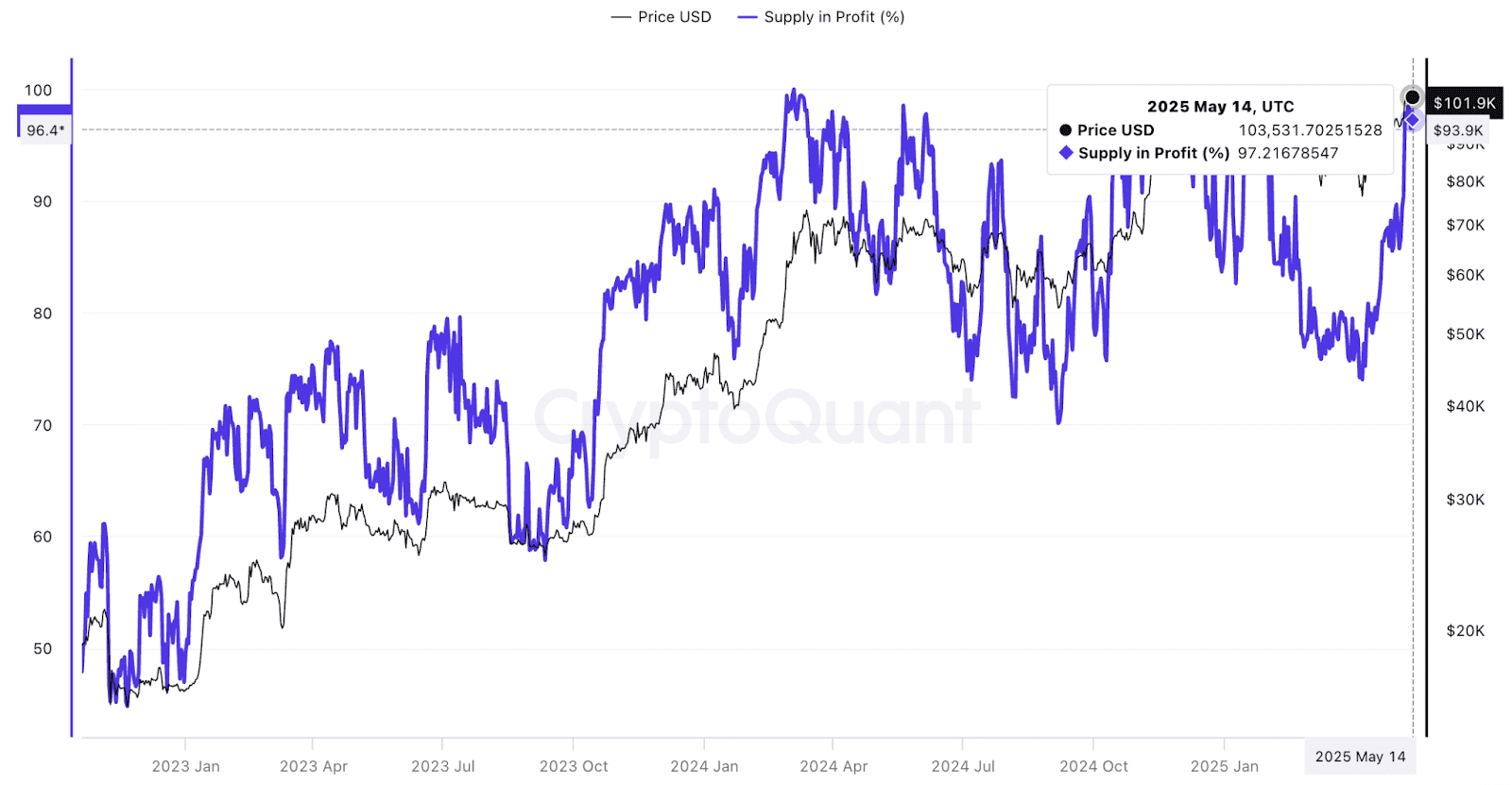

A significant portion of Bitcoin investors are currently in profit. Data from CryptoQuant indicates that less than 2.8% of Bitcoin investors were at a loss when the price reached $102,000 on May 15, meaning over 97% were in profit. This could be seen as a positive indicator of market strength. However, historically, a large percentage of holders in profit often precedes a price correction as investors take profits.

The percentage supply in profit is calculated by comparing the price when unspent transaction outputs (UTXO) were last moved with the current price. As Bitcoin’s price continues to climb, more investors enter a profitable position, increasing the likelihood of profit-taking and potential downward pressure on the price.

Bitcoin Open Interest: A Volatility Indicator

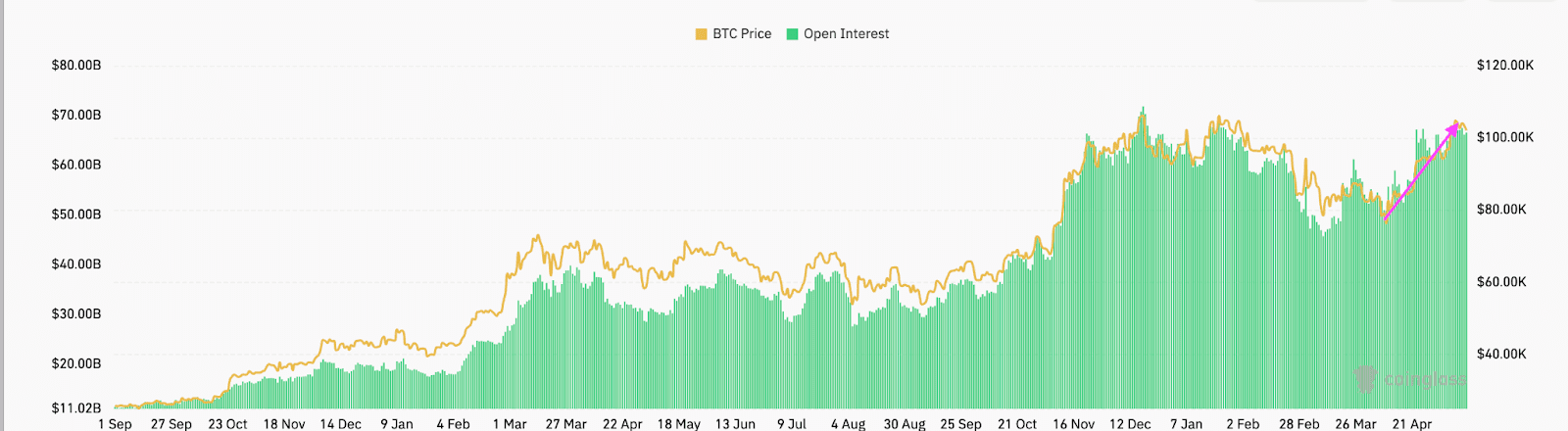

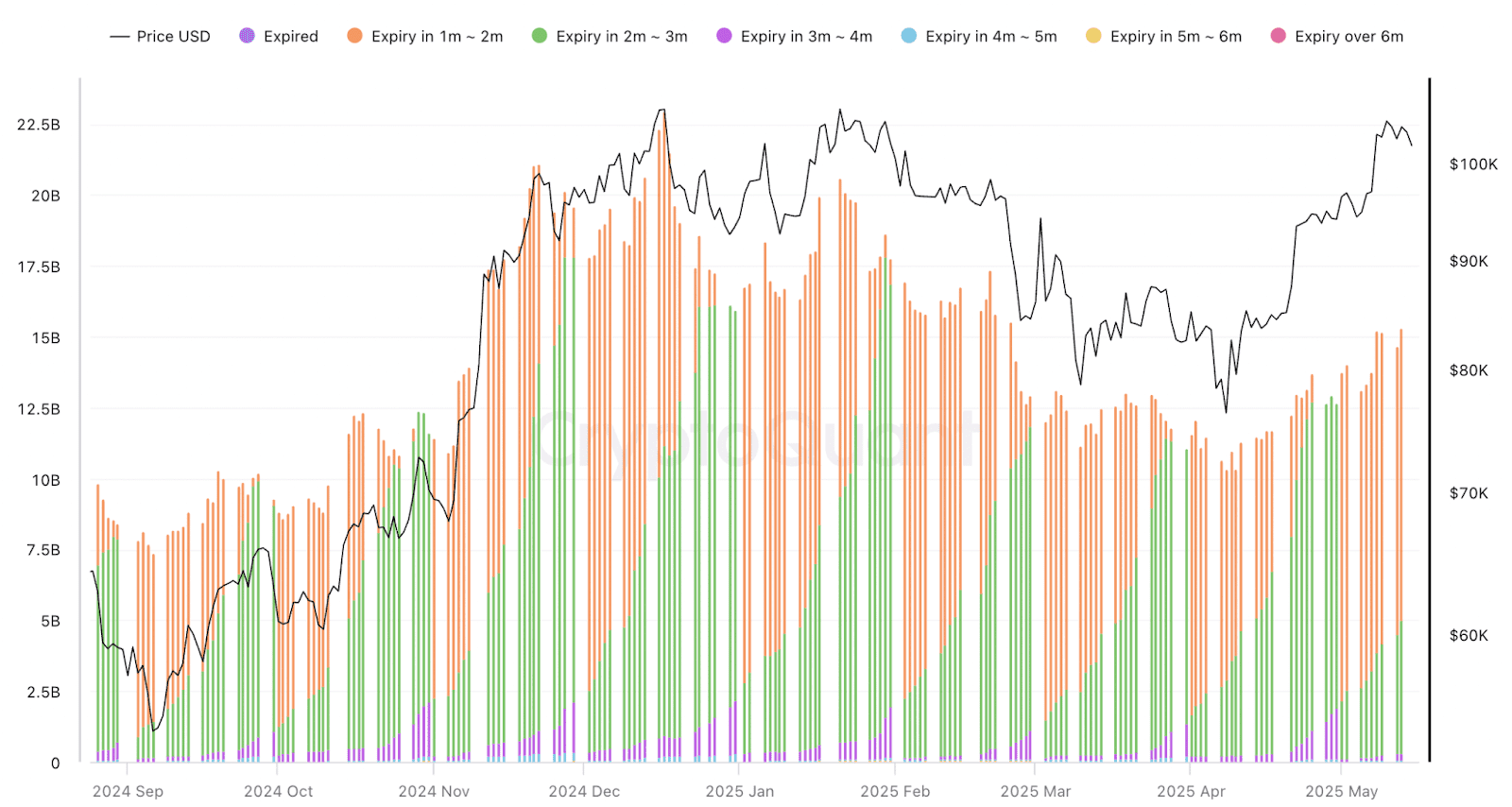

Open interest (OI) in Bitcoin derivatives markets has surged, nearing record highs of $67.5 billion. High OI suggests significant speculation and leverage in the market, increasing the potential for amplified price swings. Pseudonymous trader Adam noted that the open interest levels were similar to prior all-time highs, suggesting the market might be “exhausted”.

Bitcoin CME futures OI has also reached a 90-day high, indicating strong institutional interest. CME holds the largest share of open interest, followed by Binance and Bybit. The high demand for Bitcoin futures contracts raises concerns about a potential pullback similar to the one in late January, where BTC prices fell nearly 16%.

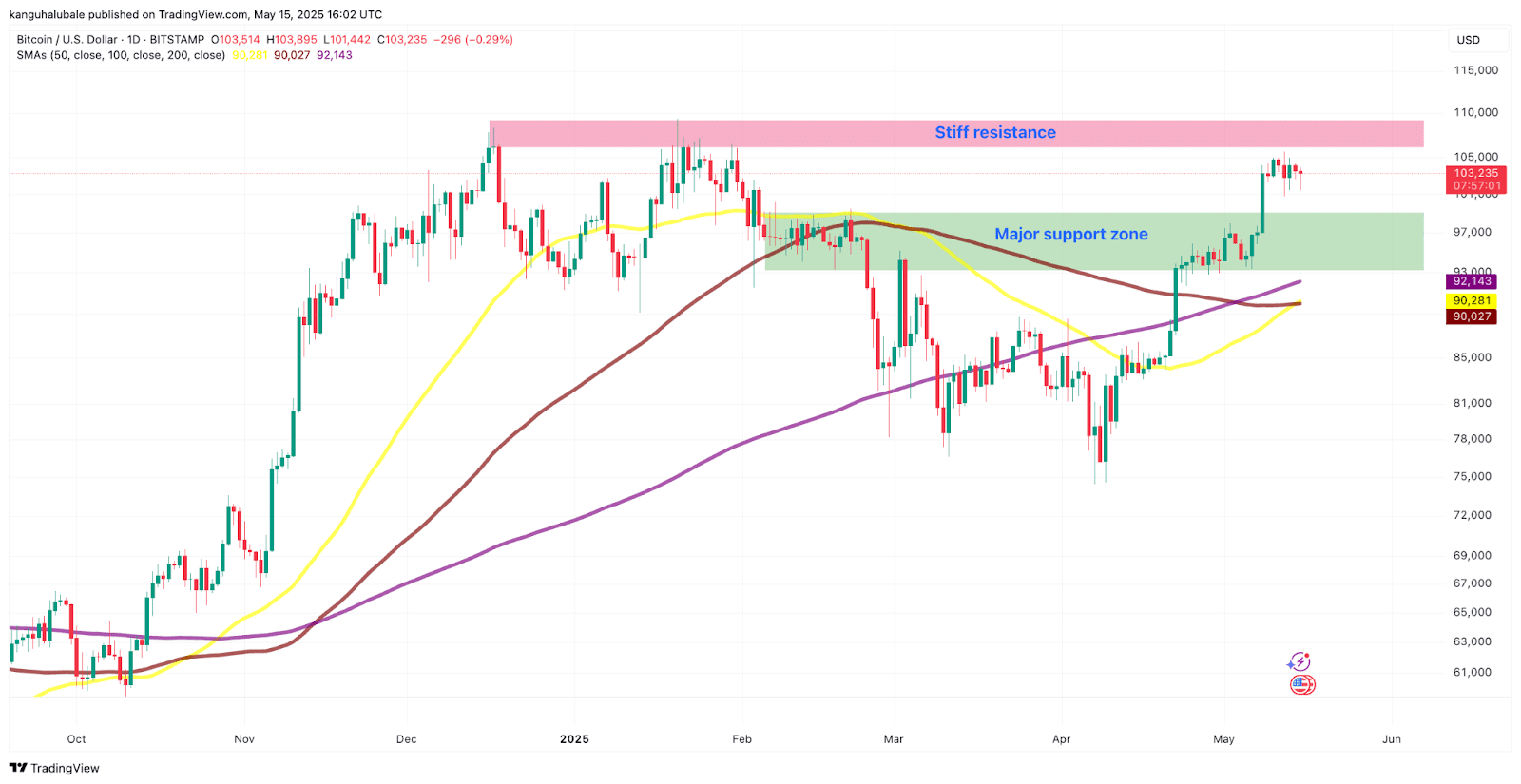

Technical Analysis: $106,000 as a Key Level

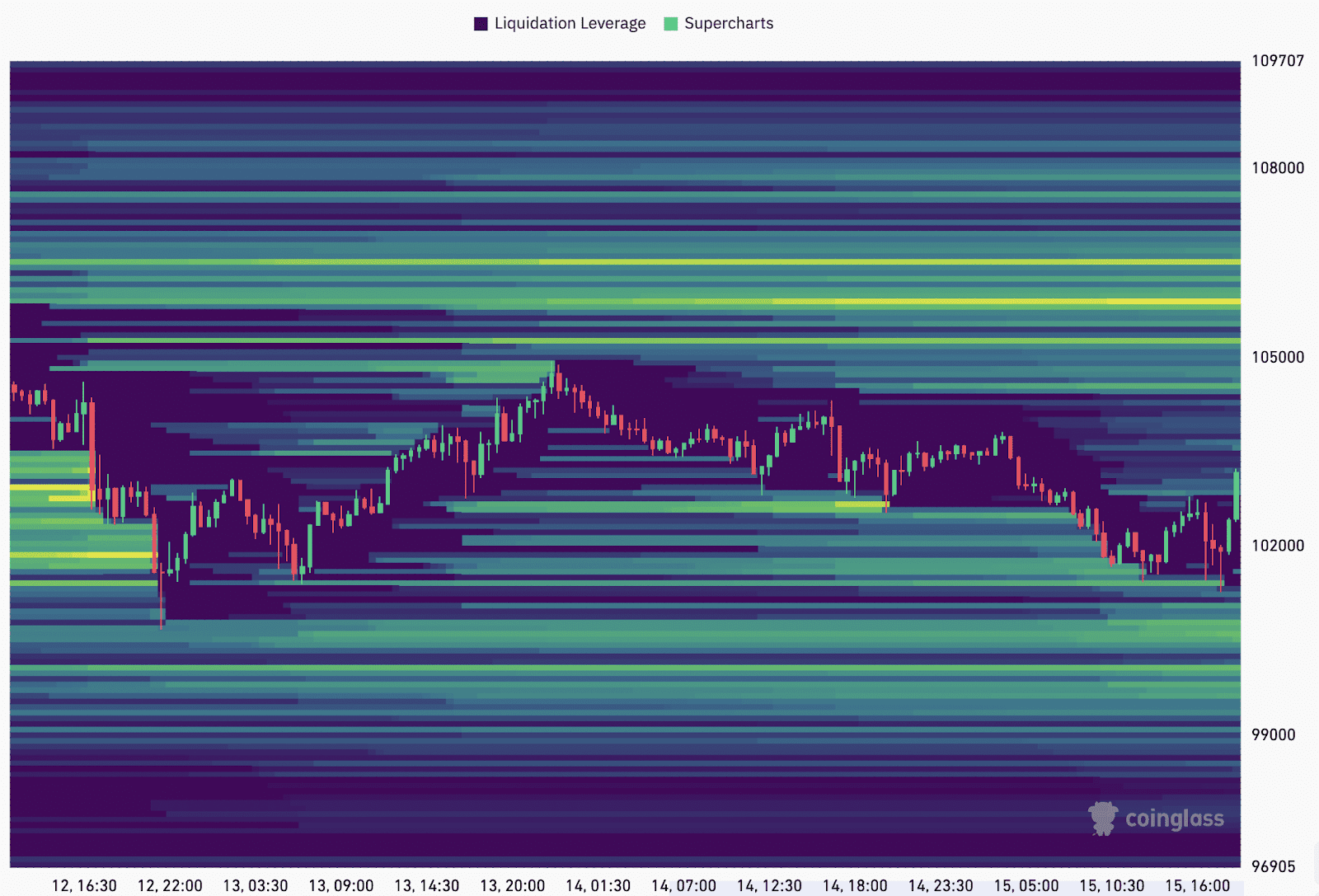

From a technical standpoint, Bitcoin’s recent rally has been stifled by a supply congestion zone between $106,000 and its all-time high of $109,000. A previous rejection at this level resulted in a 27% price drop, indicating strong resistance from sellers. Bitcoin bulls need a decisive daily candlestick close above $106,000 to sustain the recovery.

Failure to convert $106,000 into support could trigger a price decline toward the year’s opening level of $93,000. Liquidation data shows significant ask orders building up above $106,000, highlighting the importance of this resistance area.

Conclusion: Bitcoin’s Uncertain Path

Bitcoin’s current price action suggests a period of uncertainty. The cryptocurrency faces strong resistance at $106,000, and failure to break through could lead to a correction. Conversely, a successful breakout could pave the way for further gains. Traders and investors should closely monitor on-chain data, open interest, and technical indicators to assess the potential for a crash or breakout.

Several factors could influence Bitcoin’s trajectory in the coming days:

- Macroeconomic factors: Changes in interest rates, inflation, and global economic conditions can significantly impact Bitcoin’s price.

- Regulatory developments: New regulations regarding cryptocurrencies could introduce volatility.

- Market sentiment: Overall investor sentiment toward Bitcoin and the broader cryptocurrency market can affect buying and selling pressure.

Staying informed about these factors and conducting thorough research is crucial for making informed investment decisions in the volatile cryptocurrency market.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.