Bitcoin Price Prediction: Will BTC Hit $155K? Key Factors to Watch This Week

Bitcoin (BTC) is showing resilience, bouncing back towards its all-time high after a dip. This week is crucial for risk-asset traders as they navigate a complex macroeconomic environment. Several factors could influence Bitcoin’s price, including inflation data, bond market movements, and large trader activity. Let’s delve into the details to understand where Bitcoin might be headed.

Key Takeaways:

- Price Action: Bitcoin rebounded above $110,000 after briefly dipping below $107,000.

- Macroeconomic Factors: US inflation data and bond market volatility are significant influences.

- Exchange Activity: Taker buy/sell ratios suggest a potential cooling of momentum.

- Whale Watching: The moves of large traders, like Hyperliquid’s James Wynn, are closely monitored.

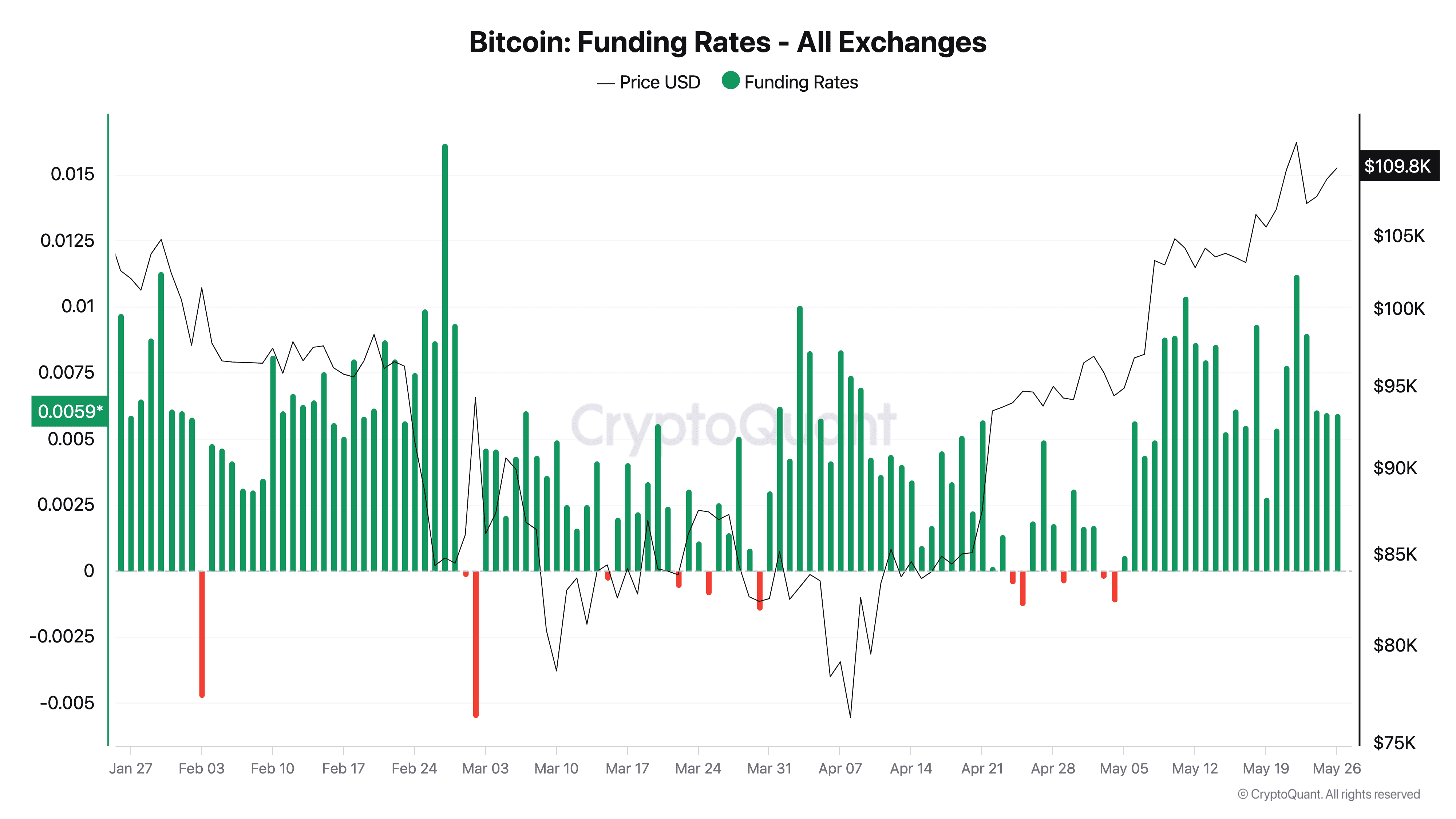

- Funding Rates: Neutral funding rates indicate a healthy breakout potential.

Bitcoin Price Discovery on the Radar After Rebound

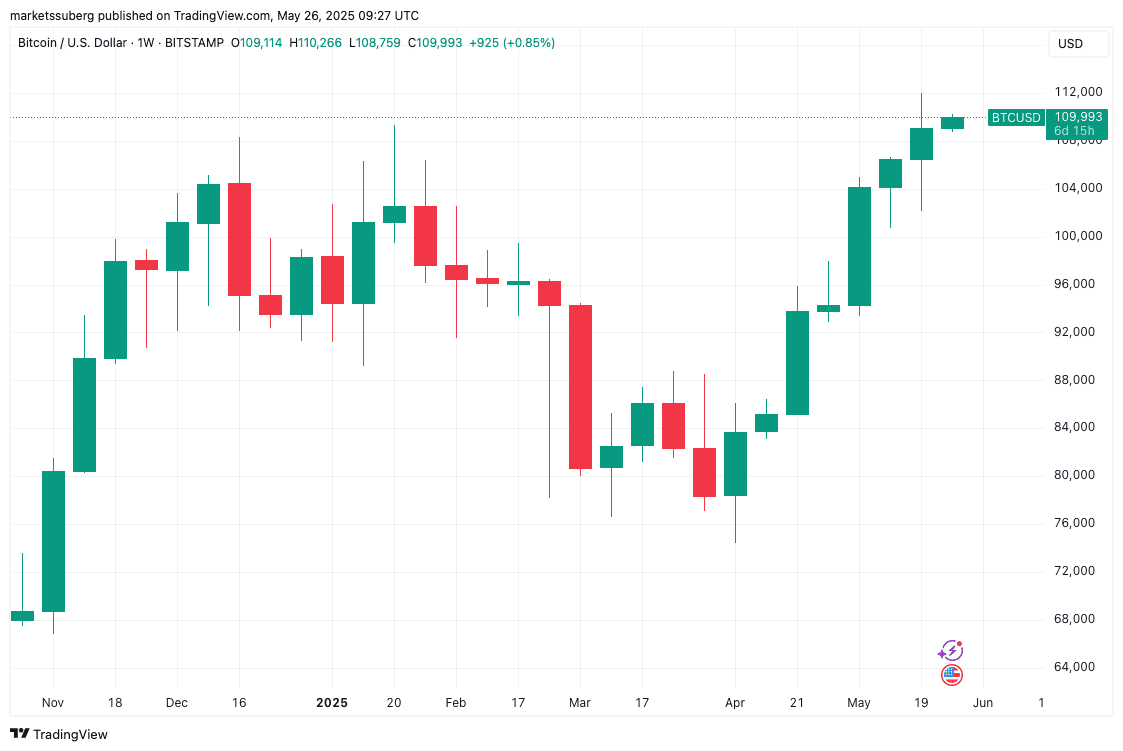

Bitcoin experienced a late-weekend recovery, pushing BTC/USD above the $110,000 mark. However, volatility persists, and the old all-time highs from January remain a key area of interest. Trader Daan Crypto Trades noted that a more convincing close is needed to confirm further gains. The weekly candle closed at $109,100, slightly below the January high.

Despite significant ETF inflows, the weekly candle’s appearance wasn’t ideal for an all-time high break. The market is looking for strong continuation signals.

$155K Target in Sight?

Fellow trader BitBull suggests that Bitcoin has completed a breakout and is undergoing a retest. If this structure holds, the next target zone is $155K. Momentum is building and only needs a trigger to push Bitcoin higher.

Bond Yields Meet PCE in Tough Macro Week

The Federal Reserve’s preferred inflation gauge, the Personal Consumption Expenditures (PCE) Index, is due on May 29. This data, along with initial jobless claims and the first revision of Q1 GDP, will be closely watched amid rising bond yields. Concerns are growing that rising interest rates could negatively impact the market.

The Kobeissi Letter highlighted the impact of delayed EU tariffs on bond yields, suggesting that trade deals are no longer containing the bond market. They described rising interest rates as a significant problem, warning of a combination of trade deals and high benchmark interest rates.

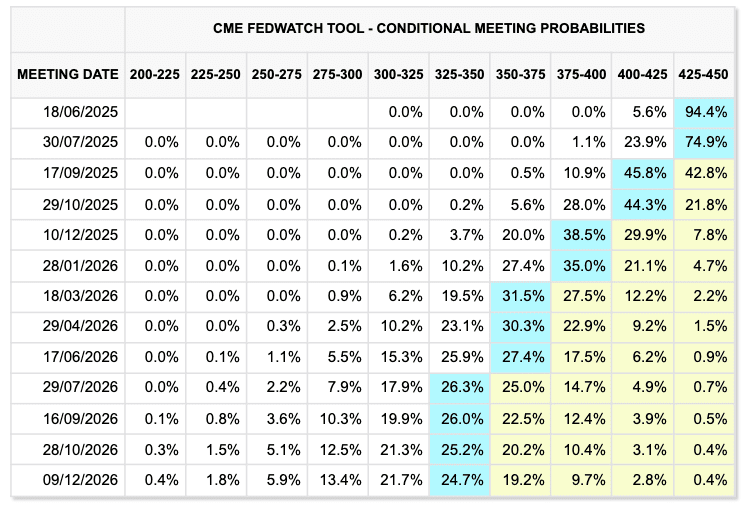

The minutes of the Fed’s May meeting will provide further insights into their decision to hold rates steady. Market expectations for a rate cut this year remain subdued, with no action anticipated before the September meeting.

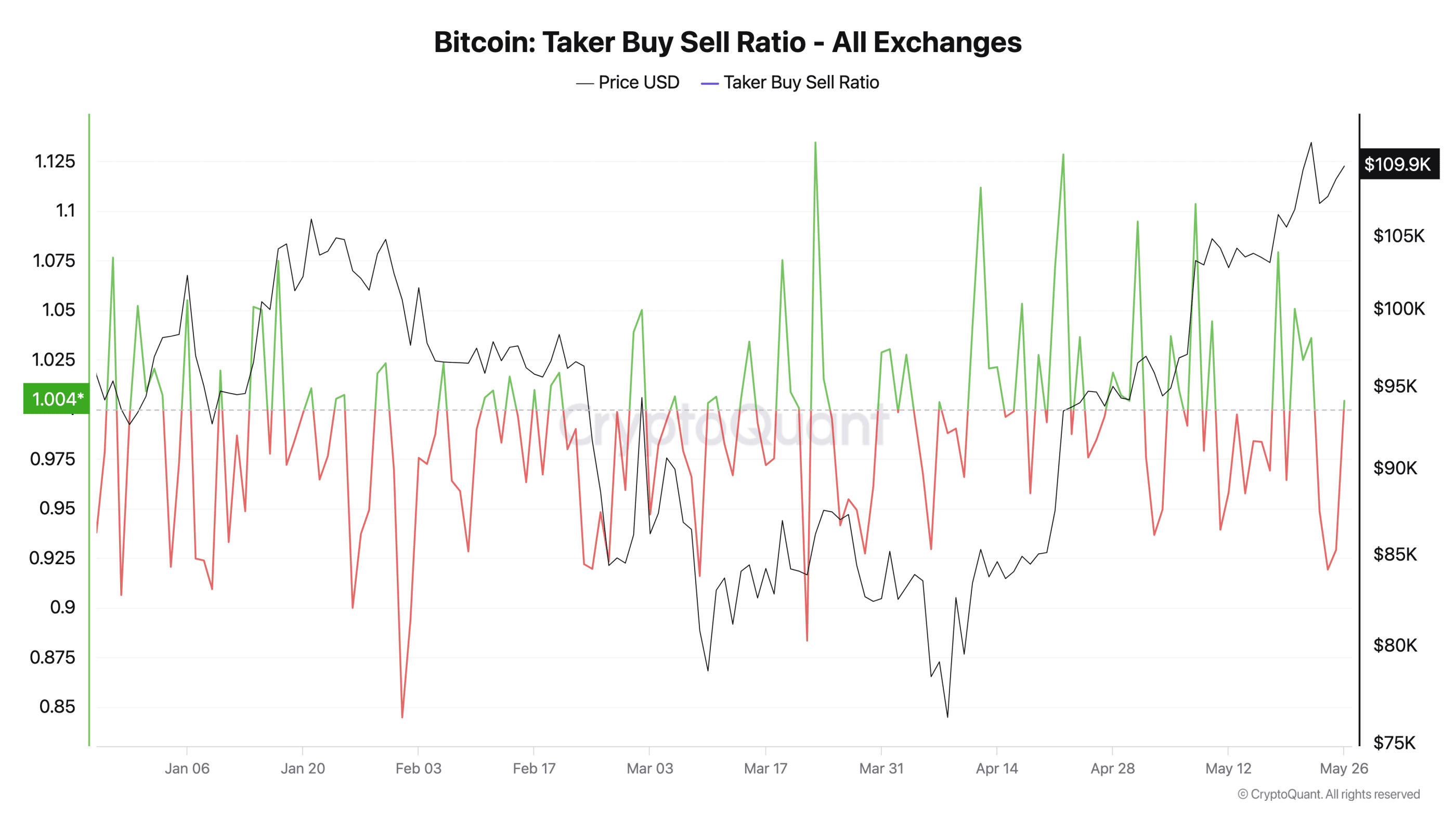

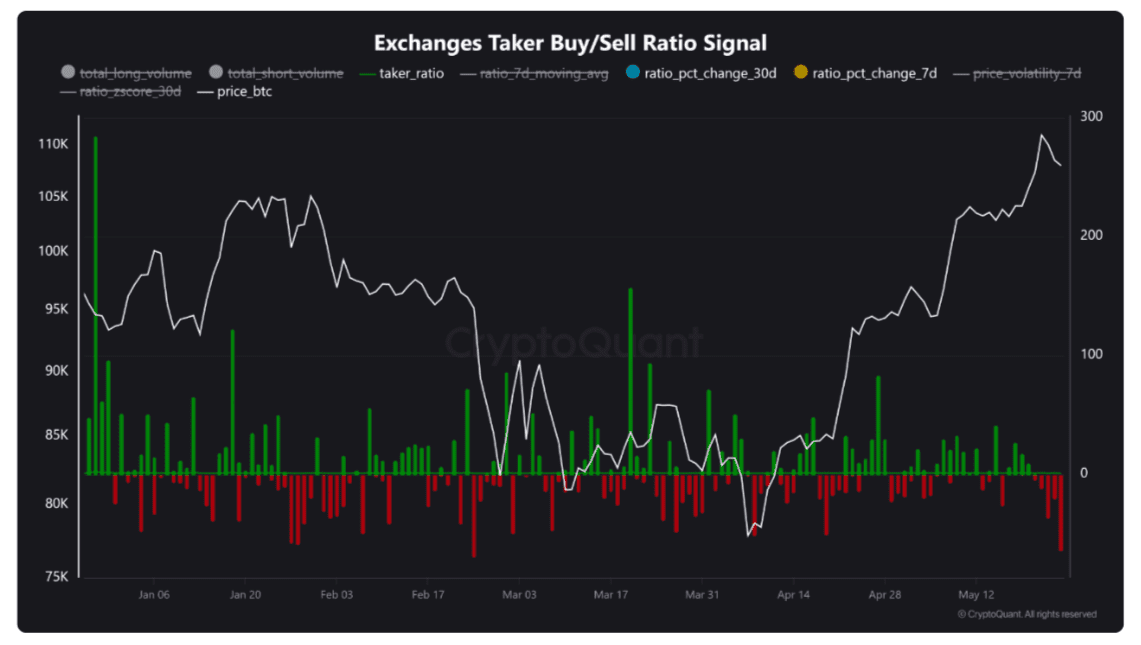

Exchanges Flash “Bearish” Momentum Signal

Exchange order books are signaling potential bearish momentum. CryptoQuant reported a “strong bearish” trajectory as both buyers and sellers reduced activity.

The taker buy/sell ratio, which tracks the ratio of buy-to-sell volume during perpetual swap trades, has fallen below 1 for the first time since early April, indicating that sellers are beginning to dominate. Simultaneously, 7-day price volatility is increasing, a typical sign of market inflection zones. This data suggests a potential short-term correction, with price action potentially testing support near the $105K level.

Hyperliquid’s Wynn Heads to Memecoins

Large-volume traders are closely watched for their influence on Bitcoin’s price. Hyperliquid’s James Wynn, in particular, has gained attention for his rapid shifts between long and short positions. After exiting a $125 million long position at a loss, Wynn briefly entered a short before reversing course with another leveraged long. He later announced his exit from perp trading with $25 million in profit and has since shifted focus to memecoins like Pepe (PEPE).

Funding Rates Boost Short-Squeeze Bets

Despite the recent volatility, funding rates across derivatives platforms remain fairly neutral. This is a similar picture to the run-up to previous all-time highs in late 2024. CryptoQuant data puts the cross-exchange Bitcoin funding rate at 0.006. This calm sentiment, without overleveraged longs, suggests a healthy breakout potential. Trader Jelle described it as one of the healthiest Bitcoin breakouts in a long time, ripe for further upward movement.

Quinten Francois described the funding rates as reflecting a perfect setup for a significant price increase. Trader Crypto Eagles added that the combination of low funding and increasing open interest (OI) should increase the likelihood of a short squeeze.

Conclusion: Will Bitcoin Reach $155K?

Bitcoin’s price action is currently influenced by a mix of macroeconomic factors, exchange activity, and large trader behavior. While the potential for a short-term correction exists, the neutral funding rates and positive momentum suggest that Bitcoin could continue its upward trajectory. Keep a close watch on the PCE data, bond yields, and key technical levels to determine whether BTC can reach the $155K target. Remember to conduct your own research before making any investment decisions.