Key Points:

- Bitcoin’s price is showing strong upward momentum, with analysts predicting a potential surge to $200,000 by Q4 2025.

- The prediction is based on the ‘power law’ model, which considers Bitcoin’s network growth in relation to its value.

- Bitcoin’s price movements often mirror gold’s, with a lag of 100-150 days, suggesting further upside potential.

Bitcoin’s Power Law and Price Predictions

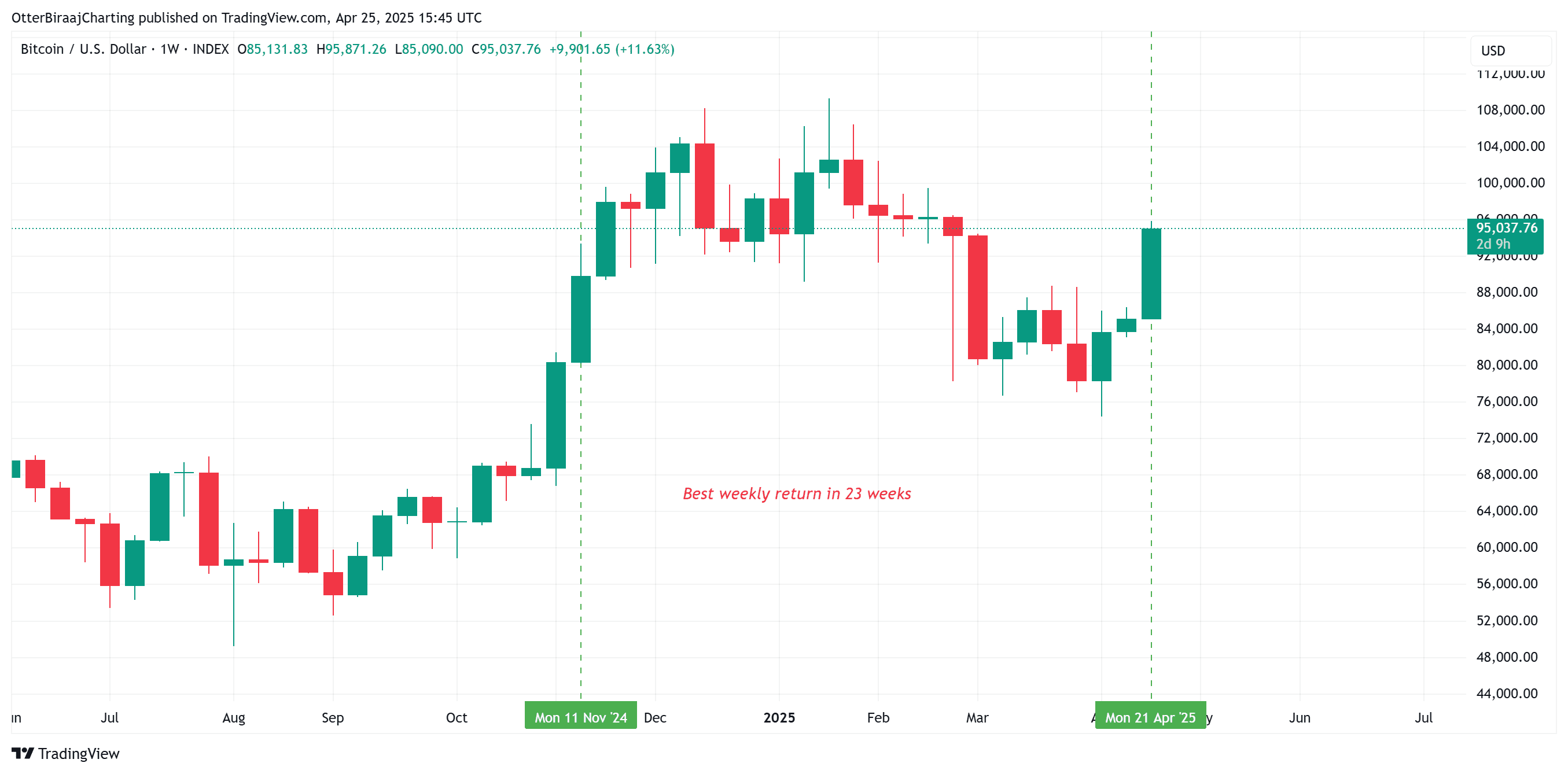

Bitcoin (BTC) has experienced a significant rally, achieving its best weekly return in 2025 and reaching levels not seen since February 2024. This resurgence has reignited discussions about its future price trajectory, with some analysts forecasting substantial gains.

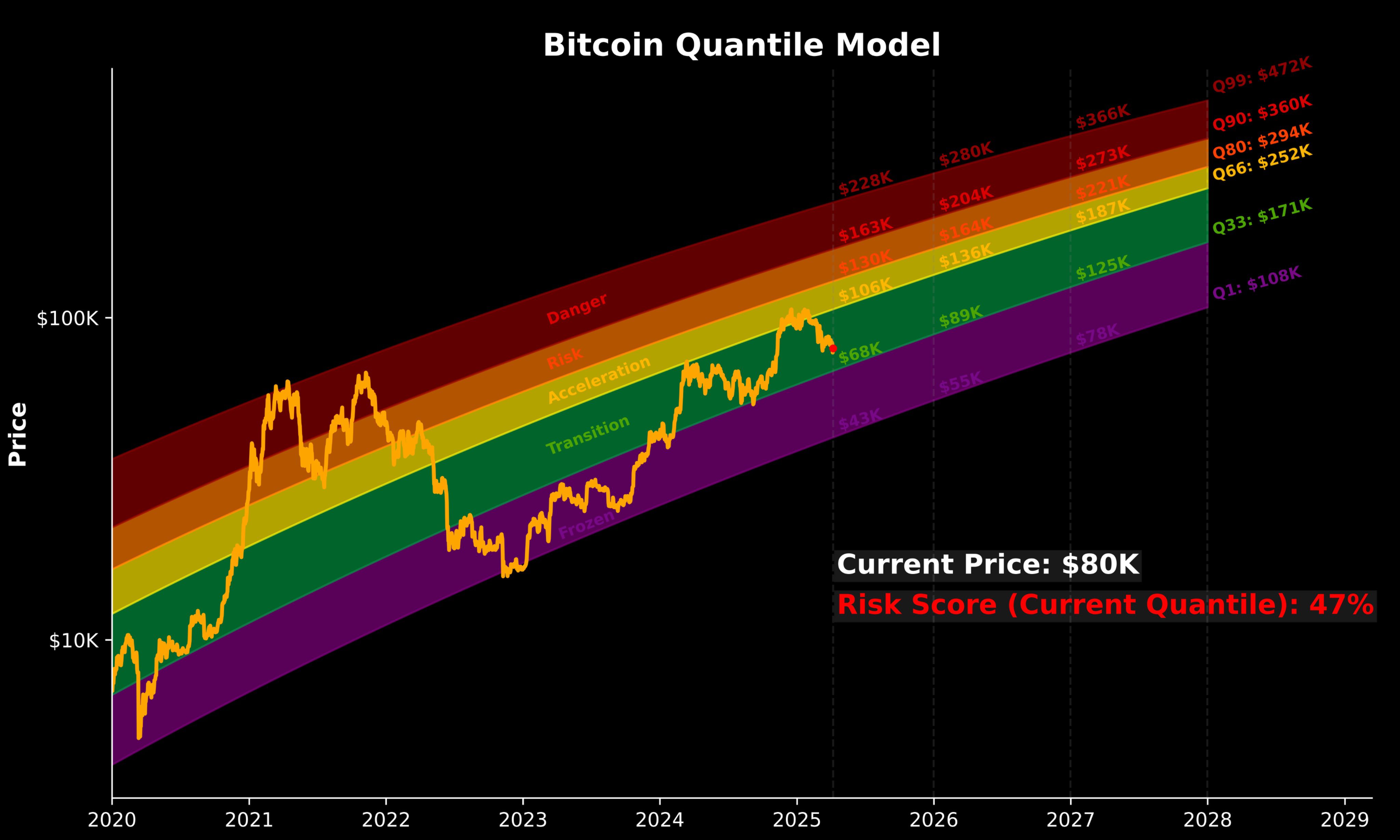

One prominent model used to predict Bitcoin’s price is the ‘power law.’ This model posits that Bitcoin’s value scales with the square of its users, following Metcalfe’s Law. According to Sina, co-founder of 21st Capital, reclaiming the power-law price keeps BTC on track to hit price targets of $130,000 and $163,000 before the end of 2025.

Another analyst, apsk32, predicts an even more optimistic scenario, suggesting that Bitcoin could reach $200,000 in 2025. This prediction is based on ‘Bitcoin power curve time contours,’ which analyze Bitcoin’s price movements across four-year cycles. The chart indicates strong performance in Q3 and Q4 of 2025, with historical trends suggesting further growth.

Bitcoin vs. Gold: A Historical Comparison

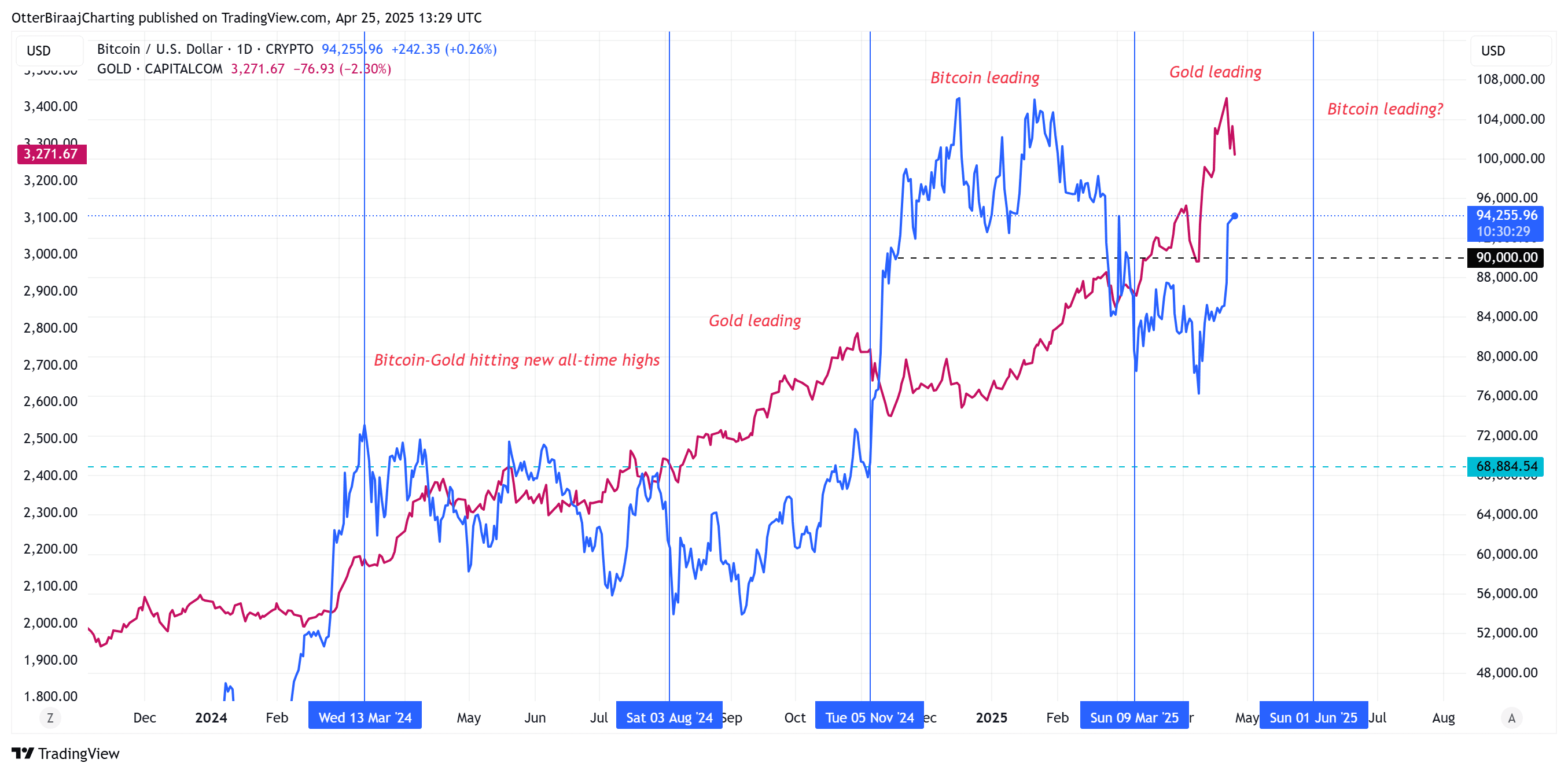

An interesting aspect of Bitcoin’s price movements is its correlation with gold. Historically, Bitcoin’s price has followed gold’s directional bias with a lag of 100-150 days. This pattern suggests that if gold continues to perform well, Bitcoin could potentially follow suit. The US Dollar Index (DXY) dropped to a new three-year low on April 21, which further fueled the likelihood of a rally for risk assets. Multi-year DXY lows have been historically bullish for Bitcoin.

Since the beginning of 2024, Bitcoin and gold have posted new highs in the market, with each asset outperforming the other during specific periods. In Q3 2024, gold spearheaded the rally, surpassing Bitcoin’s performance. By Q4, Bitcoin regained momentum, outpacing the precious metal and maintaining its lead until March 2025, when gold again took the lead.

Factors Influencing Bitcoin’s Price

Several factors could contribute to Bitcoin’s potential rally:

- Increasing Institutional Adoption: As more institutions invest in Bitcoin, demand increases, driving up the price.

- Halving Events: Bitcoin’s halving events, which reduce the reward for mining new blocks, historically lead to price increases due to reduced supply.

- Growing Acceptance as a Store of Value: Bitcoin is increasingly being viewed as a hedge against inflation and a safe haven asset.

- US Dollar Weakness: DXY going down is very bullish for $BTC.

Conclusion

The ‘power law’ model, coupled with Bitcoin’s historical correlation with gold and increased market interest, paints a potentially bullish picture for Bitcoin’s price in 2025. Whether Bitcoin reaches $200,000 remains to be seen, but the factors outlined above suggest a potential for substantial growth. However, it’s important to note that cryptocurrency investments carry significant risk, and investors should conduct thorough research before making any decisions.