Key Takeaways:

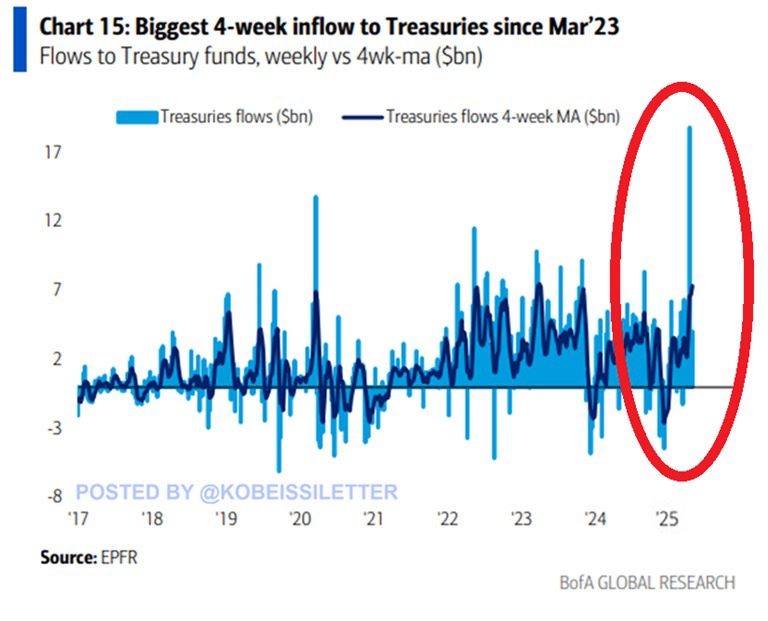

- US Treasury funds experienced a significant inflow of $19 billion, the largest since March 2023, coinciding with a 30 basis point drop in the 30-year yield.

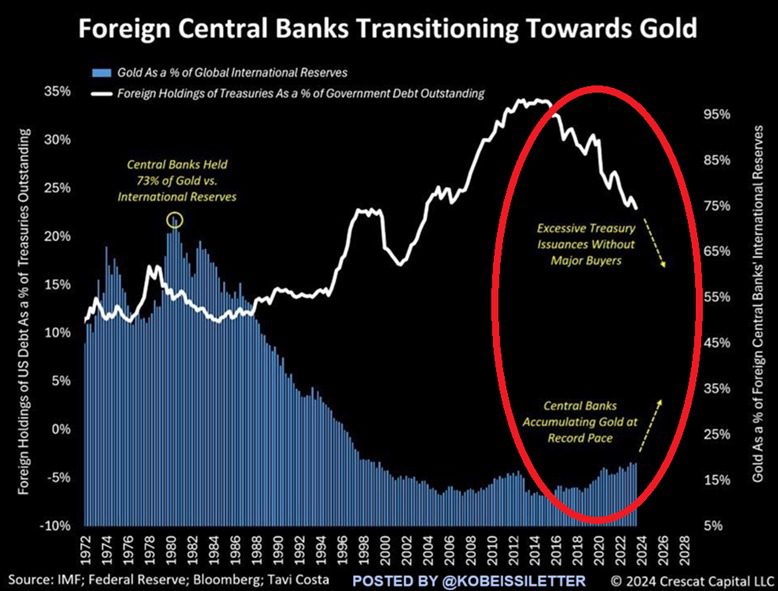

- Foreign central banks have decreased their US Treasury holdings to a 22-year low of 23%, while simultaneously increasing gold reserves to 18%.

- A similar pattern in 2020 saw Bitcoin skyrocket from $9,000 to $60,000, suggesting a potential parallel surge in 2025.

The global financial landscape is undergoing a seismic shift, potentially setting the stage for a significant Bitcoin (BTC) price rally. Recent data reveals a surge in inflows into US Treasury funds, reaching $19 billion last week, surpassing even the peak during the 2020 pandemic. This influx signifies heightened investor demand for the safety and stability offered by US government bonds.

De-Dollarization and the Rise of Gold

However, while private investors are bolstering US Treasury holdings, foreign central banks are taking a different course. These banks have reduced their Treasury holdings to just 23% of US government debt, a 22-year low. This strategic pivot appears to be fueled by a desire to diversify away from the US dollar and potentially mitigate risks associated with ongoing trade disputes and geopolitical uncertainties.

Complementing this reduction in US Treasury holdings is a significant increase in gold reserves. Gold’s share of global reserves has climbed to 18%, a 26-year high, marking an 8% increase since 2015. China, in particular, has aggressively expanded its gold reserves, doubling them to 7.1% since 2023. This global “de-dollarization” trend, where nations seek alternatives to the US dollar, is a crucial factor influencing the cryptocurrency market.

Bitcoin’s Potential as a Safe Haven Asset

This current environment closely mirrors the conditions preceding Bitcoin’s explosive growth in 2020. During the pandemic, similar to the current situation, US Treasury inflows surged amidst economic uncertainty. Consequently, Bitcoin witnessed a monumental rise, soaring from $9,000 to nearly $60,000 by early 2021. Simultaneously, gold’s share of global reserves rose by 14.5% within 18 months.

The combination of a stabilizing bond market and central banks’ increasing preference for gold suggests a similar catalyst for Bitcoin’s next significant upward movement. In 2023, when US Treasury yields increased due to recession fears, Bitcoin outperformed traditional assets, gaining 47% in a month while the Nasdaq dropped 8.7%. With yields now easing and central banks expressing less confidence in the US dollar, Bitcoin’s appeal as a global store of value is further enhanced.

Factors that could impact bitcoin’s price:

- Global Economic Recession: A significant global recession could prompt investors to prioritize liquidity and traditional safe-haven assets like cash or US Treasurys over speculative assets like Bitcoin.

- Regulatory changes: Regulatory uncertainty or unfavorable regulatory actions could negatively impact market sentiment and investor confidence in Bitcoin.

- Technological advancements: Advancements in blockchain technology and the broader cryptocurrency ecosystem could lead to increased adoption and innovation, potentially driving up the price of Bitcoin.

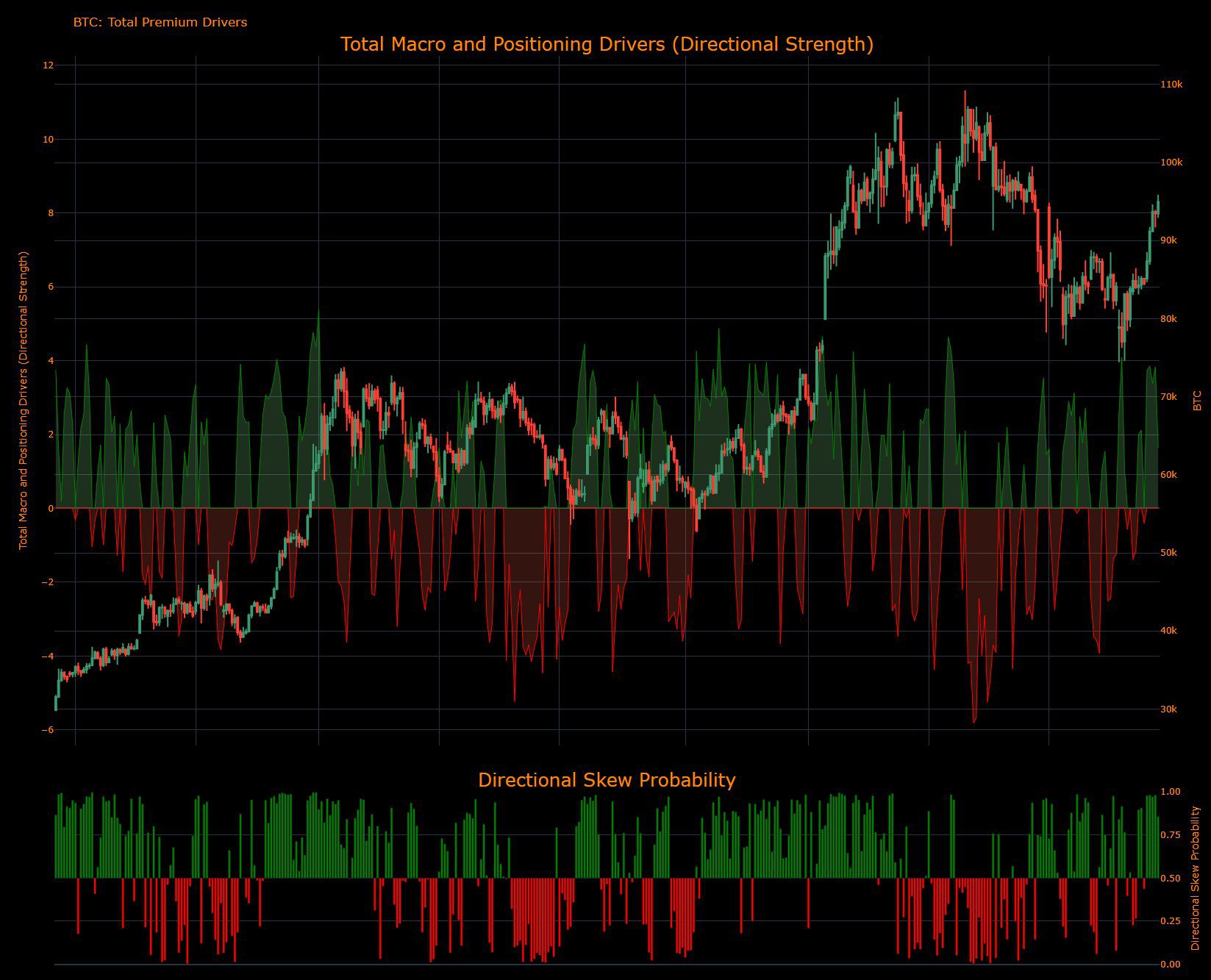

Institutional Interest Drives Bitcoin Rally

Anonymous global markets researcher Capital Flows highlights the impact of macroeconomic liquidity and positioning factors on Bitcoin’s bullish trajectory. Their analysis suggests that Bitcoin is primed for further upward movement.

Bitwise CEO Hunter Horsley’s observation that Google searches for “Bitcoin” are near long-term lows supports this view. This lack of retail interest suggests that the current rally is primarily driven by institutional investors, advisors, corporations, and even nations.

This contrasts with previous cycles where Bitcoin’s price was closely correlated with retail search volume. The current market dynamic signifies a shift towards institutional adoption as the primary driver of demand.

In Conclusion: Is Bitcoin Poised for a New All-Time High?

The confluence of factors – central bank gold accumulation, de-dollarization, rising institutional interest, and favorable macroeconomic conditions – suggests that Bitcoin could be on the cusp of a significant price surge. While potential risks such as a global recession remain, the current landscape appears highly conducive to Bitcoin reaching new all-time highs.