Bitcoin (BTC) price rallies, while often attributed to inflation worries or strong economic data, can be predicted by identifying specific patterns. Historically, Bitcoin has demonstrated significant surges, often exceeding 50%, when three key factors align: low crypto market leverage, stronger-than-expected retail sales data, and hawkish signals from the U.S. Federal Reserve.

Decoding Bitcoin Rally Patterns

These patterns aren’t just coincidences; they offer valuable insights into market dynamics. Let’s break down each element:

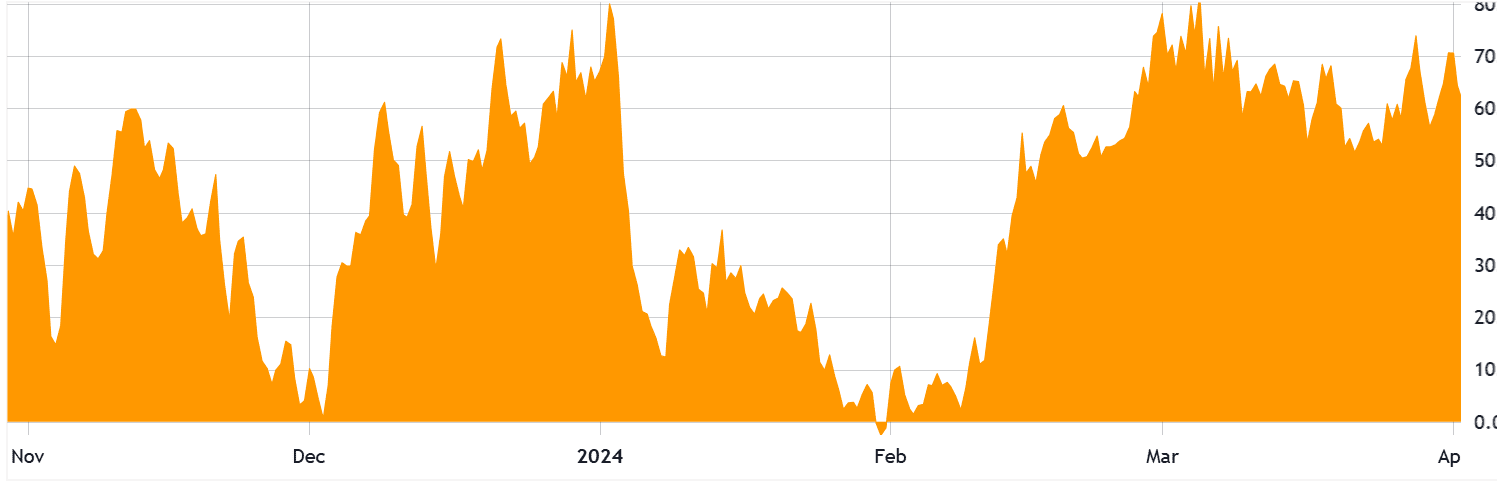

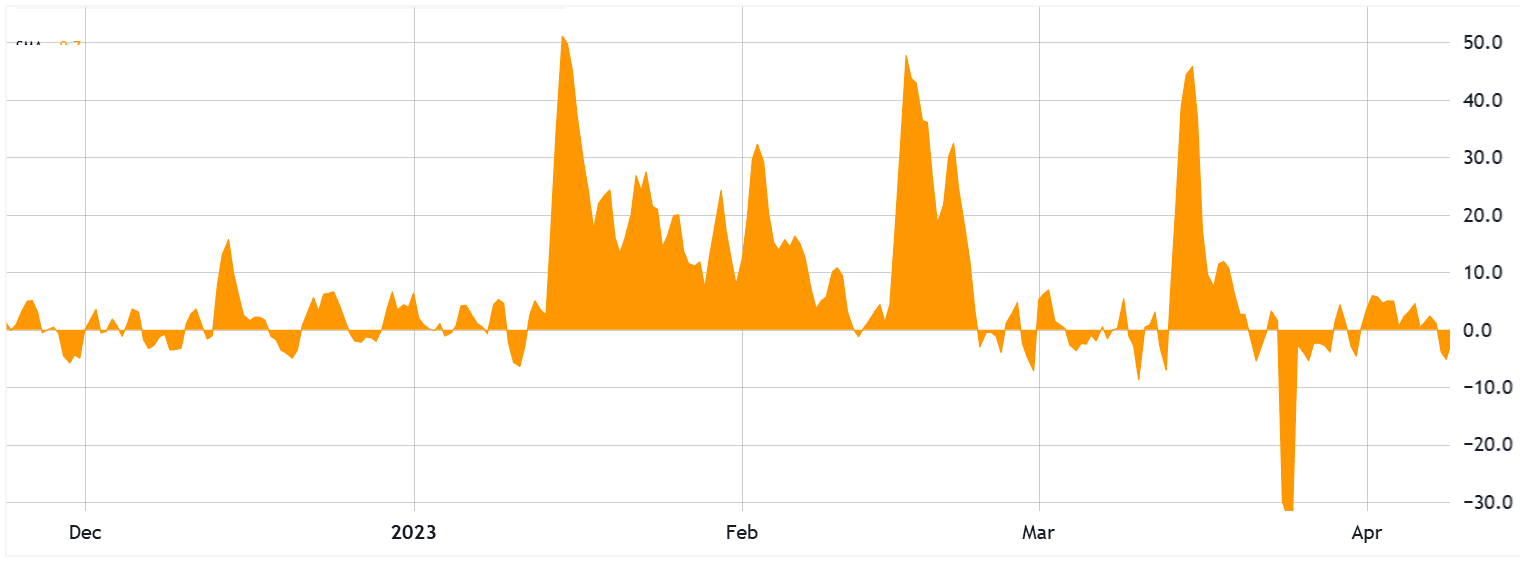

- Low Crypto Market Leverage: A low perpetual futures funding rate indicates minimal demand for leveraged long positions. This suggests that traders are cautious and less likely to be overextended, creating a stable base for potential price increases.

- Strong Retail Sales Data: Better-than-expected retail sales figures signal a healthy economy and consumer confidence. This positive sentiment can spill over into the crypto market, driving demand for Bitcoin.

- Hawkish Federal Reserve Signals: When the Federal Reserve signals a tighter monetary stance (e.g., indicating no immediate interest rate cuts or a reduction in asset purchases), it can paradoxically benefit Bitcoin. This is often because investors view Bitcoin as a hedge against potential economic uncertainty and inflation.

When these three conditions converge, they create a fertile ground for a Bitcoin bull run. Traders, initially cautious, are then spurred into action, driving up prices.

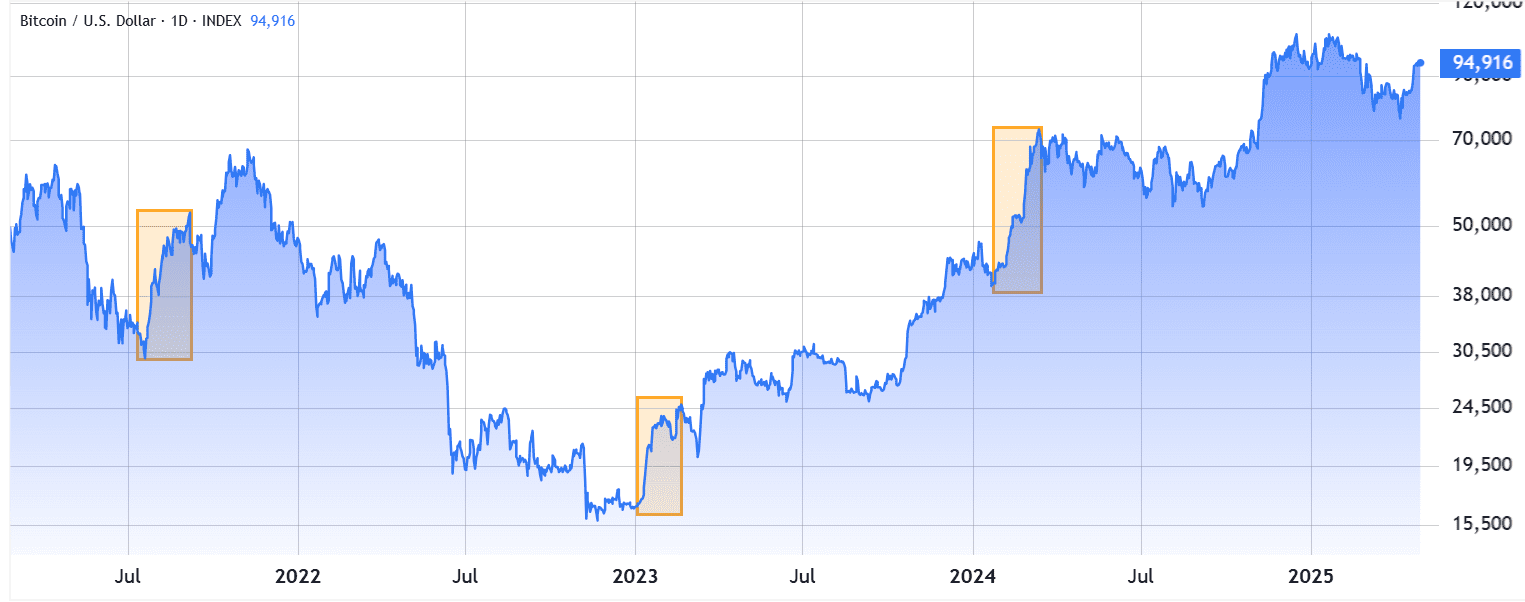

Historical Examples of Bitcoin Rallies Following This Pattern

Let’s examine three specific instances where these patterns emerged, leading to substantial Bitcoin price increases:

- January 25, 2024 – March 13, 2024 (84% Gain): Bitcoin’s price rebounded from a dip in late January 2024. The perpetual futures funding rate was exceptionally low (4% per year). Retail sales data for December 2023 exceeded expectations. Fed Chair Jerome Powell signaled a tighter monetary stance.

- January 3, 2023 – February 20, 2023 (50% Gain): After consolidating below $18,000, Bitcoin saw minimal demand for leveraged long positions. The funding rate on Binance surged. Stronger-than-expected retail sales data for January 2023 was released. Fed Chair Powell suggested a tighter monetary policy.

- July 20, 2021 – September 7, 2021 (76% Gain): Bitcoin’s price had declined in the preceding month. The annualized Bitcoin funding rate jumped. US retail sales data for June 2021 surprised economists by increasing. Powell’s remarks at the Jackson Hole Economic Symposium indicated a potential reduction in central bank asset purchases.

Analyzing the Contributing Factors

- Low Leverage and Funding Rates: When funding rates are low or negative, it suggests that fewer traders are taking highly leveraged positions. This reduces the risk of cascading liquidations during price drops, making the market more stable and attractive to larger investors.

- Retail Sales Data This indicator provides insights into the strength of consumer spending. When retail sales exceed expectations, it boosts confidence among investors.

- Federal Reserve Policies and Communications: The Federal Reserve’s monetary policies play a crucial role in the broader economic landscape. Investors carefully scrutinize the Fed’s announcements and decisions, especially regarding interest rates and asset purchases. A hawkish stance, signaling a commitment to controlling inflation, often leads investors to seek alternative assets like Bitcoin.

Identifying Potential Future Bitcoin Upswings

To anticipate future Bitcoin rallies, closely monitor these indicators:

- Federal Reserve Communications: Pay attention to speeches and announcements from Fed Chair Jerome Powell and other Federal Reserve officials. Look for clues about future interest rate decisions and monetary policy.

- U.S. Retail Sales Data: Track monthly retail sales data releases. Higher-than-expected figures can signal a potential Bitcoin rally.

- Crypto Market Leverage: Monitor perpetual futures funding rates on major exchanges. Low or negative rates suggest a reduced risk of liquidation cascades and a more stable market.

Specifically, watch for Fed Chair Powell’s speeches, Beige Book releases, and the Jackson Hole Economic Symposium. Monitoring US retail sales data for May and June will also be crucial.

Conclusion

By understanding the interplay of low leverage, robust retail sales, and Federal Reserve signals, investors can gain a strategic edge in predicting potential Bitcoin price rallies. While past performance is not indicative of future results, these patterns provide a valuable framework for assessing market conditions and making informed investment decisions. Keep a close watch on these key indicators to potentially capitalize on the next Bitcoin upswing.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Bitcoin and other cryptocurrencies are highly volatile assets, and you could lose your entire investment. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.