Key Takeaways:

- Historically, weak labor and consumer data have preceded Bitcoin rallies, suggesting potential economic stimulus impact.

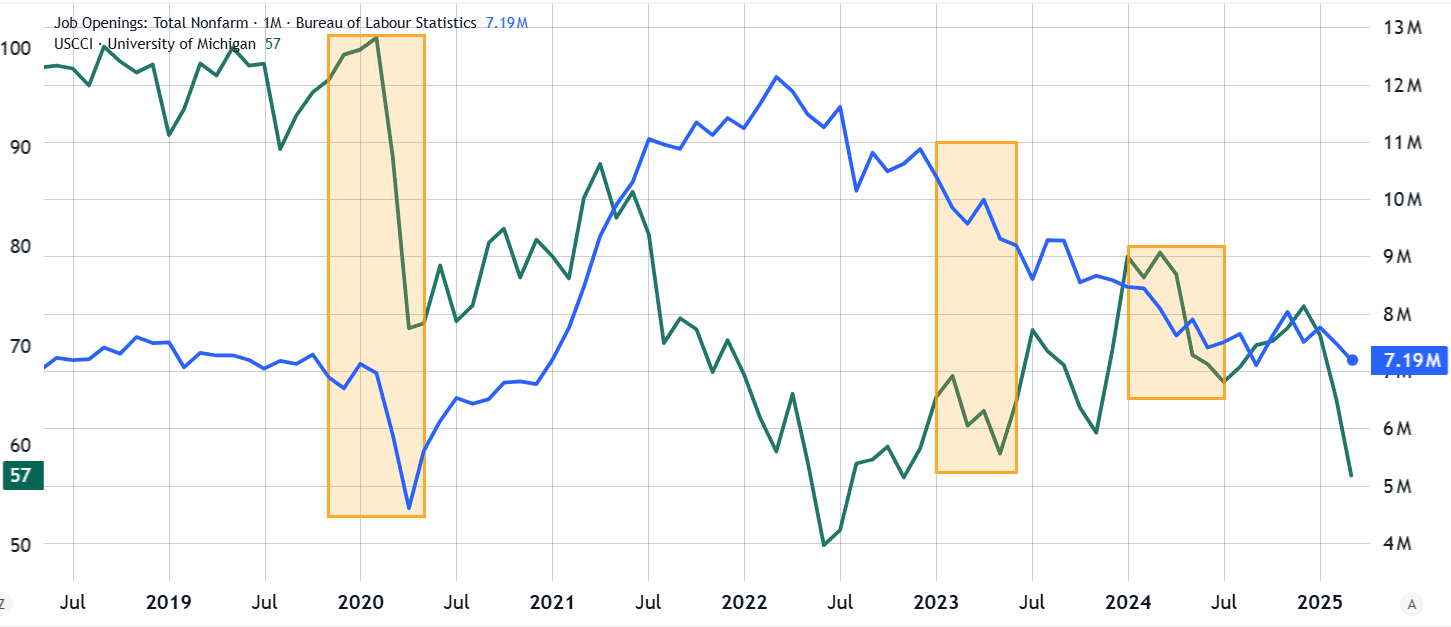

- March saw job openings fall to 7.2 million, below the 7.5 million forecast, and consumer confidence hit its lowest since January 2021.

- Based on past patterns, Bitcoin could rally by mid-July, potentially reaching $140,000 by October 2025.

Macroeconomic conditions significantly influence cryptocurrency prices. Bitcoin (BTC) and altcoins often struggle when investors perceive weakness in employment and consumer data. Recent US Labor Department JOLTS report data indicates that job openings are at their lowest levels in four years, with 7.2 million vacancies in March, falling short of the expected 7.5 million. Concurrently, US consumer confidence has declined for five consecutive months, hitting its lowest point since January 2021.

Understanding the Correlation:

Deteriorating economic conditions often lead central banks to consider economic stimulus measures. This injection of liquidity can encourage investment in risk-on assets like Bitcoin, as more capital enters the economy. The anticipation of future economic growth plays a vital role in financial markets, often overshadowing current weak data.

Historical Trends and Bitcoin Performance

Examining past instances reveals potential patterns:

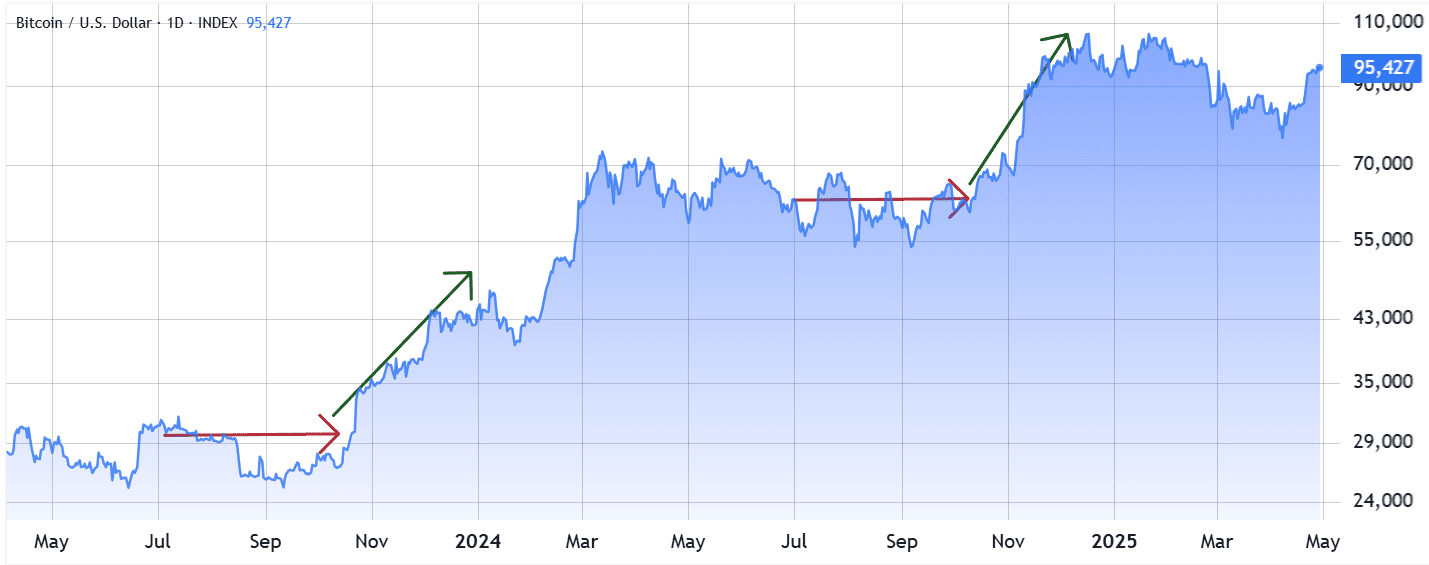

- January to June 2024: Similar drops in job openings and consumer confidence were followed by a Bitcoin price movement between $53,000 and $66,000, culminating in a 60% rally by mid-October, pushing BTC above $100,000.

- January to June 2023: Similar declines led to an initial 18% price drop to $25,000, followed by a recovery to $30,500 by late October and a subsequent 45% gain to $43,900 in the following two months.

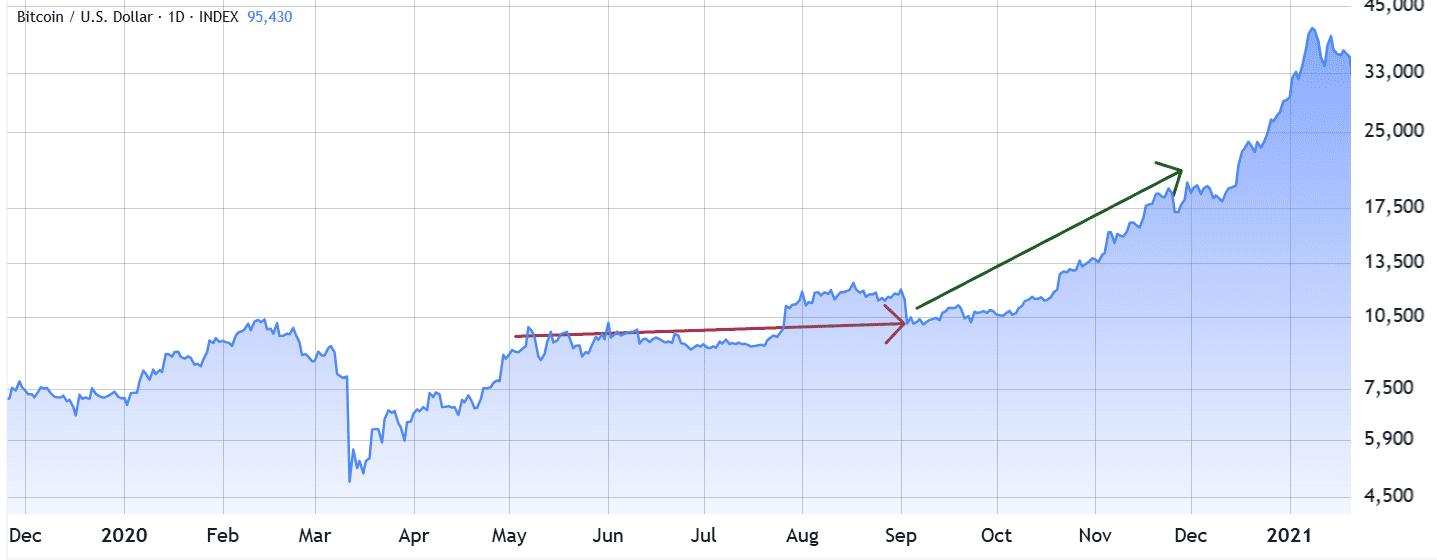

- February to May 2020 (COVID-19 Lockdowns): Bitcoin briefly dropped below $4,000 in March, followed by a period of consolidation.

The delay between weak economic data and a potential Bitcoin rally is crucial. Improved sentiment among crypto investors typically follows confirmation of better macroeconomic conditions, explaining the observed lag of 105 to 130 days.

The $140,000 Target: A Realistic Possibility?

Analyzing data from May to September 2020, Bitcoin’s price increased from $8,900 to $10,600 (a 20% gain). The subsequent 60 days saw an 85% rally to $19,700. This historical data suggests a pattern: weaker economic sentiment preceding Bitcoin price increases.

Forecasting the Future:

If US job openings and consumer confidence show improvement from April 2025, Bitcoin’s price could begin to rise by mid-July. Following historical trends, a target of $140,000 by October 2025 is plausible, pending further positive macroeconomic confirmations.

Factors Influencing Bitcoin’s Price:

- Economic Stimulus: Government or central bank actions to boost the economy.

- Investor Sentiment: How investors feel about the market and the future.

- Global Events: Major events like economic crises or regulatory changes.

- Adoption Rate: How quickly people start using Bitcoin and other cryptocurrencies.

- Technological Advancements: Improvements in blockchain technology and cryptocurrency infrastructure.

Potential Risks to the Rally:

- Regulatory Crackdowns: Increased regulation can negatively impact cryptocurrency prices.

- Unexpected Economic Downturn: A sudden economic downturn could reverse the trend.

- Black Swan Events: Unpredictable events can significantly impact the market.

In conclusion, while historical data suggests a potential Bitcoin rally based on weak economic indicators, various factors can influence the outcome. Investors should exercise caution and conduct thorough research before making investment decisions. The information provided here is for general informational purposes only and should not be considered financial advice.