Key Takeaways:

- Rising bond yields signal growing concerns about fiscal stability and inflation, challenging the US Treasury’s safe-haven status.

- Bitcoin defies conventional risk models, potentially benefiting from worsening macroeconomic conditions.

- Institutional investment in Bitcoin ETFs is surging, suggesting a shift toward Bitcoin as a politically neutral store of value.

Bitcoin (BTC) has recently reached new heights, driven by an increasingly fragile global macroeconomic environment. The surge in bond yields in the US and Japan, coupled with stalling global growth and low consumer confidence in the US, has created a unique backdrop for Bitcoin’s rise.

Traditionally, unfavorable macro conditions would negatively impact Bitcoin’s price. However, the current situation is fueling its growth, reflecting a shift in how investors perceive risk and seek refuge. The US debt crisis and rising Treasury yields are central to this realignment.

The Significance of US Treasury Yields

Rising US bond yields increase the cost of servicing the national debt, which has surpassed $36.8 trillion. Interest payments are projected to reach $952 billion in 2025. To lower yields, the US Federal Reserve could lower interest rates or implement quantitative easing (QE), buying large amounts of bonds. However, the Fed is hesitant to reignite inflation.

Political intervention in the economy can erode investor confidence, leading them away from Treasurys and towards alternative assets like Bitcoin. The recent loss of the US government’s AAA credit rating further underscores this shift.

Yield Surges in the US and Japan

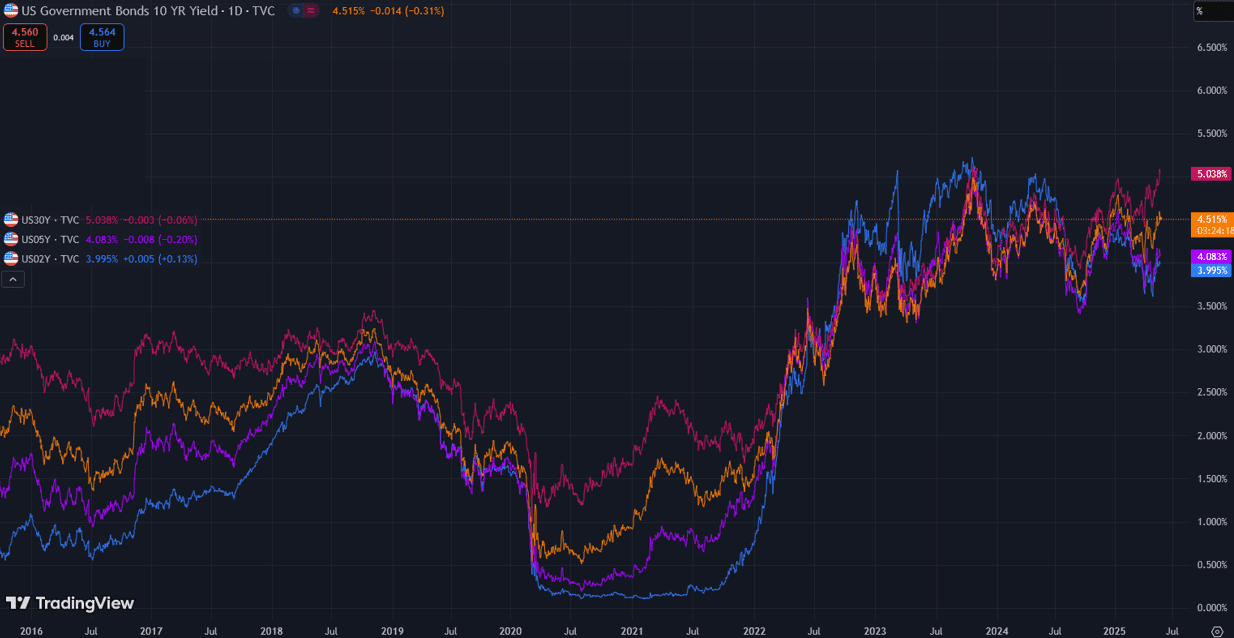

On May 22, the US 30-year bond yield hit 5.15%, its highest since October 2023. The 10-year yield stands at 4.48%, the 5-year yield at 4%, and the 2-year yield at 3.92%. The US 5-Year to 30-Year bond spread has steepened, indicating expectations of stronger growth, persistent inflation, and a “higher for longer” rate environment.

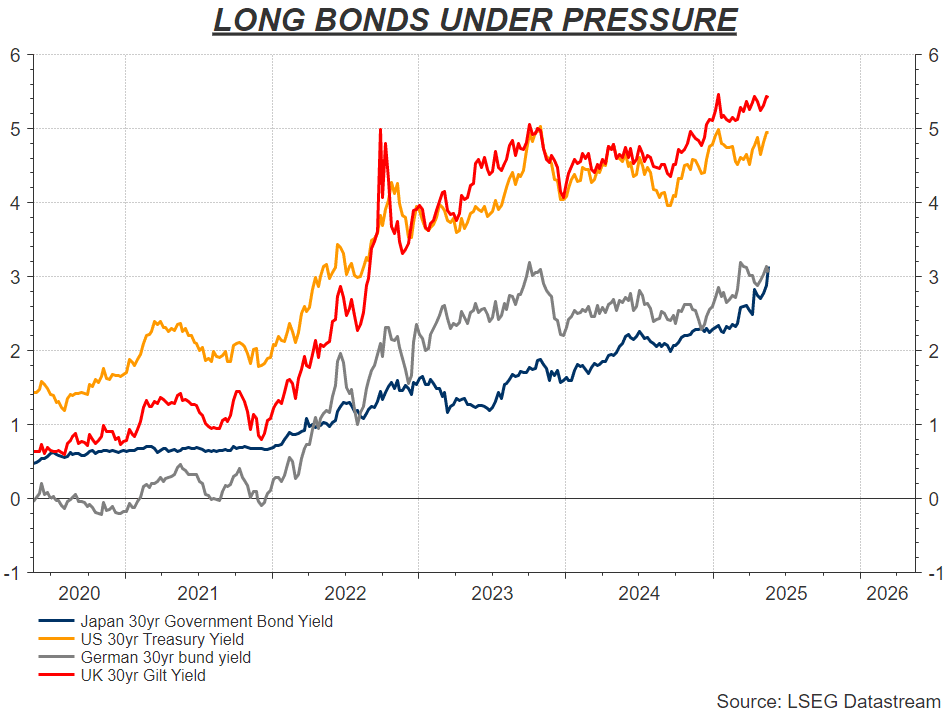

Japan, a major holder of US Treasurys with $1.13 trillion in holdings, is also experiencing yield surges. The Bank of Japan has started raising interest rates, causing the Japanese 30-year bond yield to reach an all-time high of 3.1%. This strategic shift by Japanese institutions, reassessing duration risk and foreign bond exposure, could impact US Treasurys.

Prime Minister Shigeru Ishiba even warned that the country’s financial position was “worse than Greece”

Bitcoin’s Response to Bond Volatility

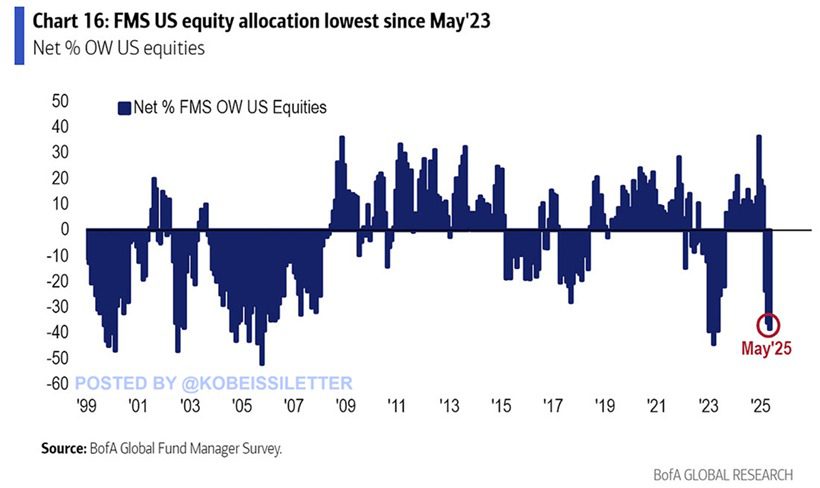

Despite rising bond yields typically dragging down risk assets, both stocks and Bitcoin continue to climb. This divergence suggests a shift in investor behavior, with assets outside the traditional financial system gaining appeal. Institutional investors are increasingly choosing Bitcoin over US equities. Data from BofA indicated that net 38% of institutional investors were underweight US equities in early May, the lowest since May 2023.

Spot Bitcoin ETFs are experiencing significant inflows, with assets under management exceeding $104 billion. This surge reflects recognition of Bitcoin as a politically neutral store of value, similar to gold. In an era of instability in fiat debt-based economies, Bitcoin offers a predictable and decentralized monetary system.

Bitcoin’s current position supports both its high-yield risk asset and safe-haven store of value narratives. Its dual role may become the norm as traditional financial frameworks falter.

Expanding on Bitcoin’s Appeal

To further understand Bitcoin’s potential, it’s crucial to consider the following:

- Decentralization and Security: Bitcoin’s decentralized nature eliminates the need for intermediaries, making it resistant to censorship and single points of failure. Its blockchain technology provides a secure and transparent record of transactions.

- Limited Supply: Unlike fiat currencies, Bitcoin has a fixed supply of 21 million coins. This scarcity can drive up its value as demand increases.

- Global Accessibility: Bitcoin can be sent and received anywhere in the world without needing traditional banking infrastructure. This makes it valuable for cross-border transactions and in regions with limited financial access.

- Potential for Inflation Hedge: As governments around the world print more money, leading to inflation, Bitcoin’s limited supply and decentralized nature can make it a hedge against the declining value of fiat currencies.

Risks to Consider

While Bitcoin offers potential benefits, it’s essential to acknowledge the risks involved:

- Volatility: Bitcoin’s price is known for its volatility, which can lead to significant gains and losses.

- Regulatory Uncertainty: The regulatory landscape for Bitcoin is still evolving, and governments may impose stricter regulations in the future.

- Security Risks: Bitcoin holdings can be vulnerable to hacking and theft. It’s important to secure your Bitcoin in a hardware wallet or other secure storage method.

In conclusion, Bitcoin’s rise amid global bond market turmoil reflects a growing demand for alternative assets that offer security, decentralization, and a hedge against inflation. While risks remain, Bitcoin’s potential as a store of value and a medium of exchange is increasingly recognized by both institutional and individual investors. As the global financial landscape continues to evolve, Bitcoin is poised to play a more prominent role in the future of finance.

Disclaimer: This article does not provide investment advice. Investing in Bitcoin carries inherent risks, and you should conduct thorough research before making any investment decisions.